Commodities super cycles

Published 21-MAY-2022 09:07 A.M.

|

17 minute read

The broader market still looks pretty choppy at the moment with up days and down days.

On certain days the market does feel like it could be crashing... but there isn’t that overt and sustained “panic” that came with the 2000 dot-com crash, the 2008 GFC or the 2020 Covid crash.

In our view, the current market situation is not so much a crash, but a repositioning by most global fund managers to set up their portfolios for a new world of:

- Rising inflation (and interest rates)

- Less consumer spending on non-essentials (goodbye consumer growth stocks)

- De-globalisation of supply chains caused by Covid and the Ukraine war

- Global switch to clean energy

Over the last few years of near zero interest rates, money was aggressively pushed into growth and consumer stocks (especially big tech) that benefit from an economy awash with easy money - pushing up those share prices to record highs.

Over the last couple of months, the start of what could be a long interest rate hiking cycle has triggered fund managers to rethink the best place to park their collective trillions of dollars - and share prices have been dropping accordingly as money is pulled out to find a new home.

Hence why our view is that the current conditions are less of a crash, but more of a repositioning of funds in response to changing global conditions.

No matter what the global macro-economic conditions are like, humans are always going to need energy, food and the basic materials used to create other “non-negotiable” goods.

Let's say your monthly home loan repayment increases significantly, and you are feeling less rich because your stock portfolio value is down over the last few months.

You’ll probably rethink whether you really need a monthly subscription to four different TV streaming services (bye bye B Netflix?), reconsider that extra holiday and think twice before that impulse purchase from Amazon.

But you are always going to buy food, electricity, heating and transport - and the more modern “necessities” like your smart phone and internet.

We believe that the best place to be invested during a high inflation environment is in the commodities sector.

Commodities are the very beginning of nearly every supply chain for basic human needs, where prices are set rather than taken.

Commodities are widely regarded as a hedge against inflation.

Covid made the world realise that relying on other countries for supply of critical commodities is a risk, encouraging many governments to try and discover and develop local supply.

This “security of local supply” theme was turbo-charged after the Ukraine war took all sorts of commodity supply off the market, especially food (Ukraine wheat) and energy (Russian gas).

And commodity stocks is where we think a lot of funds are cycling into - and this shift represents the start of a new commodities supercycle.

The history of commodities supercycles...

- US industrialisation: Late 1890s through to a peak in 1917 - the US was rapidly industrialising and the supercycle peak coincided with the entry of the US into World War 1 - it continued until the early 1930s.

- World War and the rebuild: The next supercycle began in the lead up to the Second World War. The war itself and rebuilding in the aftermath required lots of materials - it peaked in 1951, and this demand continued through to the early 60s

- Cold war and Nationalisation: The early 1970s marked the start of the third cycle as commodity supply was disrupted as the Cold War saw countries nationalise industries and foreign investors pulled out. In the mid 1980s producers managed to shore up supply and the cycle faded.

- China Industrialisation: The most recent supercycle started in 2000 when China joined the World Trade Organisation (WTO) and started to modernise. The raw materials China needed to do this sparked a long bull run for commodities. The 2008 GFC put a spanner in the works but Chinese stimulus made the cycle continue through to 2014 when oil cratered on oversupply.

Source: Forbes: Are We About To Enter A Commodity Supercycle?

So are we entering a 5th commodities supercycle?

We have been saying for a while now that a new commodities super cycle may be upon us.

Supply shocks from Covid triggered de-globalisation combined with surging demand for new energy materials, is now accelerating due geopolitical tensions and the need for energy security.

After many years of underinvestment in favour of growth and consumer stocks, energy and commodities prices are still looking very strong in the current market climate.

Most relevant to us: the need to discover and develop new deposits of critical commodities (security of local supply) has created a nice sentiment around early stage exploration stocks - which is where our Portfolio is heavily weighted.

Even in the current down market, it appears major re-rates in small-cap exploration stocks can still happen in the right stock that delivers a significant result.

Our early stage explorer Galileo Mining (ASX:GAL) has delivered a 500% share price rise (in shocking market conditions) over the last two weeks after hitting a significant Palladium discovery with further potential for PGEs and Rhodium.

GAL finished the week at $1.15 hitting as high as $1.33. We first initiated coverage of GAL on 3 March 2020 when it was 15 cents.

Over the last two years, we’ve followed the GAL story closely as it pursued two projects at Norseman and the Fraser Range in WA.

Our Catalyst Hunter Investment Latin Resources (ASX:LRS) is another standout performer in a rough market after an exploration success, with its Brazilian lithium discovery a few weeks ago, taking it from a base of ~3 cents to a high of ~21 cents, now trading at ~14c.

In a tough market, it’s not always going to work out like it did with GAL and LRS. In fact, more often than not we’ll likely be underwater with our exploration Investments while waiting for them to hopefully deliver that rare, important share price catalyst.

Our goal is to derive returns from a few major, outsized winners. To do this we need to have a few “bets” placed across our Portfolio. Remember, Investing in small-caps is and always will be a risky endeavour.

In this current market environment, over the last few weeks we’ve been closely tracking upcoming catalysts coming up in our Portfolio, focused mainly on commodities explorers:

Results delivered since we launched the “upcoming catalyst” list:

- LCL drilling results from its large central gold target (we named it “Jabba the blob”) to significantly expand its multi-million ounce known deposit (memo)

- RESULT: mixed

- This week we provided our analysis on LCLs results

- Share price: (-25%)

- Next: LCL has already started drilling to test the extensions to its Miraflores deposit at depth, at the same time the company is targeting new discoveries all across its wider project area.

- GAL nickel and palladium drilling results (memo)

- RESULT: Excellent

- What happened: Last week assays confirmed a new major palladium/platinum discovery at the company's Norseman project. This week Mark Creasy put out a change in substantial holding notice showing he had purchased ~$1.7M in shares on market after the discovery.

- Share price:+475%

- Next: GAL are waiting on more assay results around the new discovery hole whilst at the same time have started planning a new RC drilling program to test for extensions to the North/East of the discovery.

Upcoming catalysts: Results still to come in the next ~8 weeks:

- GGE drilling its maiden helium well in Utah where it’s aiming to make a commercial helium discovery (memo)

- IN PROGRESS: Earlier in the week, GGE announced that it had detected helium concentrations ~37x higher than the background levels right above the primary helium target GGE is drilling towards (17x was announced the week before).

- Drilling is currently completed to a depth of ~8,070 feet. The primary “Leadville Formation” helium target is at an anticipated depth of ~8,300 feet and so GGE should be close to drilling into this zone very soon.

- The Sasanof companies’ (PRM & GLV) high impact gas drilling event: one of the biggest oil and gas wells drilled in Australia by an ASX junior in decades (memo).

- IN PROGRESS: PRM and GLV both confirmed that the drill rig is on the way to well site - drilling to commence at some point next week:

- You can track the progress of the vessel carrying the drill rig on Vessel Finder.

- PRL signing a Joint Development Agreement with its partner, Total Eren to materially derisk its WA Green Hydrogen Project (memo)

- IN PROGRESS: No news from PRL this week.

- IVZ about to drill its giant gas prospect in Zimbabwe - we have been waiting 2 years for this event (memo)

- IN PROGRESS: Drilling is scheduled for July and IVZ recently updated the market saying it had three separate farm in offers that were being considered.

- We also noticed that this week IVZ went into a trading halt “pending a capital raise”, it will be interesting to see what comes of this raise with the company scheduled to come out of the halt on Monday.

- KNI about to drill its cobalt targets in Norway (memo)

- IN PROGRESS: 7 hole drilling program in progress since 3 May. Drilling is expected to be completed in June with results available shortly after. Usually, explorers will release drill core photos if they get some good visuals, so we may see some news before then.

- BPM about to drill its lead zinc prospect in the Earaheedy basin close to Rumble Resources recent discovery (memo)

- IN PROGRESS: Last week BPM announced that its ~7,500m AC/RC drilling program had commenced at the Hawkins project (Along strike from Rumble’s discovery). This is a drill campaign we have been waiting for since May last year and we should start to see some of the first results from this over the coming weeks.

- FNT commencing drilling for rare earths (memo)

- IN PROGRESS: FNT is still in the process of getting approvals, so we are not sure exactly when the actual drilling will occur - this may be later than most of the above list but we are keeping an eye on progress.

We will provide weekly updates on the “in progress” potential share price catalysts as they move to a “result” - we would be delighted if one of them hit another GAL style result.

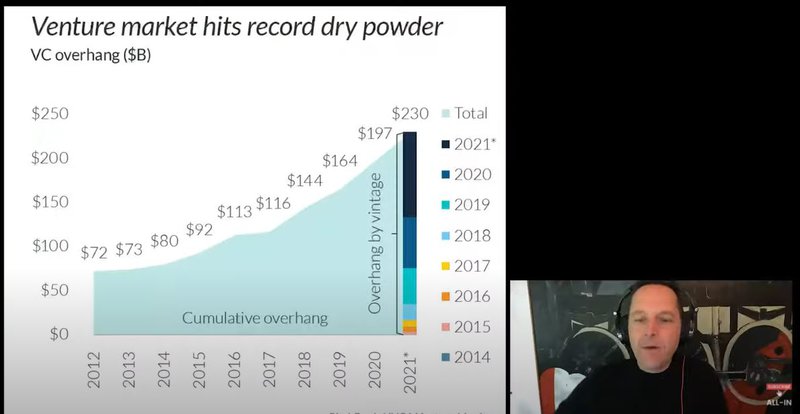

Holding multiple small cap exploration stocks is a Venture Capital (VC) style approach to investing, a similar strategy to investing in early stage tech.

A strategy where you have many risky bets placed in the hope of hitting one or two outsized winners to offset the losers.

And in a down market, money will flow to quality companies delivering progress and success.

In this current down market, we’ve observed this dynamic play out. Namely, the upwards momentum of companies that have major discoveries or significant positive news may actually amplified.

Investors seem to be latching onto these big moves as a source of relative safety, while big chunks of the market fade down the charts.

Our favourite investing podcast, the All-In podcast, has a good look at Venture Capital (VC) psychology in a down market (specifically in the tech space, but applies to all sectors) and it touches on this very phenomenon (click the image below to watch on YouTube):

Key takeaways:

- Point: still plenty of undeployed money in the market

- Counterpoint: VC funds have been hurt badly after doing big raises

- It’s reflexive - poor performance of funds means that funds have to be more and more conservative with their allocations

- 2008 GFC laid foundations for current market polarisation where winners become even bigger winners and losers become even bigger losers

The team behind this podcast are primarily tech investors so naturally they are sounding a bit “doom and gloom” in recent episodes, but we note that Chamath has already gone on record in his annual investor letter about the switch from big tech to commodities and energy.

The concept of money flowing to quality during tough market conditions translates to exploration stocks too, which contributes to our theory that the right exploration stocks that deliver a result can still do well in a rough market.

We take inspiration from the way the All-In contributors think, and it's certainly worth a listen if you want to start thinking more deeply about investing.

As always, we’ll share our insights and analysis as our Investment journey continues.

🗣️ Quick Takes

Here are this week's Quick Takes:

EMN: Demo plant modules en route to Europe

EMN: First samples from demo plant expected in Q4 2022

EMN: Where to catch the EMN conference call tomorrow

EMN: New details emerge from Half Year Report

EV1: Tanzanian Gov discussions, improved DFS coming by September

EV1: Auramet appointed to advance project financing

GAL: Mark Creasy purchases $1.74M in shares on market

GGE: Helium concentrations 37x above background levels

GTR: 100,000 foot Uranium drilling program detailed

GTR: Acquisition of additional project area progressing

IVZ: African gas to replace Russian gas supplies to Europe?

KNI: EVs overtake phones as top source of cobalt demand

LRS: Drilling at newly acquired lithium prospects commenced

LRS: More spodumene bearing pegmatites intercepted

MNB: War in Ukraine - is it creating a global food crisis?

MNB: India bans wheat exports, food security now a global issue

TG1: Directors purchasing shares on market

TTM: Managing Director purchases more shares on market

TTM: Directors buying shares on market

Gas macro: UK to label gas a “green investment” to replace coal

Lithium macro: Lithium industry needs US$42 billion in investment

📰 This week on Next Investors

Assays reveal Miraflores extends significantly deeper

Earlier this week we put out an update on our gold exploration Investment Los Cerros (ASX:LCL) which just last week completed its first drillhole into the giant geophysics target between two of its deposits which we called “jabba the blob”.

LCL were basically testing a theory where the source for the two of its deposits could be connected to form one giant gold system at depth.

Last week, LCL announced the results from that drillhole, and whilst the assays didn't confirm the thesis that the two systems were connected it DID reveal that one of the deposits (Miraflores) actually extends significantly deeper than first thought.

Exploration is a game of try, test and learn, and while the original thesis for this drill was not supported with the result, they may be connected, but deeper or to the side.

A new thesis has been developed around Miraflores being significantly deeper, showing potential to DOUBLE the depth of the existing mineral reserve at Miraflores. So we consider the result to be quite good and provides precious information for creating a new drill campaign to test this new thesis.

LCL now has multiple high impact targets; they are drilling with five rigs and importantly, has $17.5M in the bank - which we think is especially important in times of negative market sentiment.

This means LCL can continue aggressively drilling its project with the aim of making new discoveries without having to tap the markets for cash at a time where investors are unwilling to invest.

📰 Read the full breakdown: Assays reveal Miraflores extends significantly deeper

In our other portfolios 🧬 🦉 🏹

🦉 Wise-Owl

Tiny Medical Cannabis Stock BOD Has Started Two Clinical Trials – We are Hoping for a Re-rate on Results

On Friday we covered our medical cannabis investment BOD Australia (ASX:BOD), which is currently doing two clinical trials.

BOD dosed the first patients for the following trials in the last month:

- Insomnia (Phase IIb)

- Long-COVID (Open label, “Proof of Concept”)

Cannabis use spiked during the pandemic and consumer demand hasn’t waned.

The problem is getting quality products with proven benefits into the hands of these consumers - something BOD is aiming to do with these two trials.

With the share price now sitting at 14 cents, and a ~$14M market cap, BOD trades at around twice last year’s revenues ($7.43M), and has over $4M cash in the bank as of 31 March 2022.

If market sentiment returns to the cannabis sector, our conviction is that BOD is well placed in the market to capitalise on renewed investor appetite.

Part of our reasoning here is that another ASX company (Incannex Healthcare) is generating zero revenue but doing a number of cannabis clinical trials — it is capped at more than $600M.

BOD’s increased focus on R&D (via these two clinical trials) is important to their future success.

For one, we’re looking for a marketing coup created by clinical success. In effect, we think successful clinical trials would be the calling card BOD needs to grow sales enough for the market to notice it again.

Alternatively, the clinical trials could give BOD the intellectual property it needs to justify a higher valuation relative to its existing strong revenues.

📰 Read the full breakdown: Tiny Medical Cannabis Stock BOD Has Started Two Clinical Trials – We are Hoping for a Re-rate on Results

🏹 Catalyst Hunter

Anchors lifted, drill rig on the move - GLV & PRM Days Away from Binary Drilling Event

This week our gas exploration Investments Prominence Energy (ASX: PRM) and Global Oil and Gas (ASX: GLV) announced that the anchors to the drill rigs and support vessels had been lifted and the transit towards the Sasanof-1 well location had commenced.

For those wanting to follow the rig's movements, we found this link that is live tracking the movements of the rig: https://www.vesselfinder.com/?imo=8770314

With the transit time anticipated to take ~four days, our Investments are now only a few days away from drilling the giant Sasanof Prospect on the North West Shelf of WA - globally this ranks as one of the Top 20 Most High Impact wells of 2022.

The big drilling event at the Sasanof-1 well is targeting a 2U (unrisked mean) prospective resource of 7.2 trillion cubic feet (Tcf) gas and 176 million barrel condensate.

This makes it one of the biggest oil and gas drilling events done by any ASX junior in recent decades.

Together, our Investments have a 37.5% interest in the Sasanof Prospect - PRM holds 12.5% interest and GLV a 25% interest.

With the rig due to arrive at the drilling location in four days, PRM and GLV both confirmed that the drilling program would commence the week starting 23rd May.

📰 Read the full breakdown: Anchors lifted, drill rig on the move - GLV & PRM Days Away from Binary Drilling Event

New acquisition - Rich history but never been drilled

This week Our early stage exploration investment TechGen Metals (ASX:TG1) added a “walk-up, fully permitted” drill ready gold project into its portfolio of exploration projects, by acquiring a 90% interest in the “Jackadgery” gold project located in northern New South wales.

The newly acquired project was last explored between 1983 and 1985. At this time, the previous owners Kennecott and Southern Goldfields Ltd dug a 220m long trench and returned 160m of gold mineralisation at grades of ~1.2g/t.

Inside that 160m of mineralisation, there were two higher grade intervals measuring 5m at 18g/t of gold and 5m at 7.1g/t of gold.

At the same time, rock chip sampling to the northwest of the trenching returned grades averaging ~5.6g/t gold across 6 different samples.

For some context, an open pit intercept with grades of ~2g/t gold is considered high grade, so these grades measuring as high as 18g/t from surface could mean TG1 are targeting a high grade gold structure which forms from surface.

With the last round of exploration done in the early 1980’s, the biggest takeaway is that the project has never been drill tested. This is where the discovery potential for TG1 comes into play.

With drill permits in place and drilling targets already identified, TG1 plans to start drilling over this project next quarter.

At the same time, TG1 will be busy drilling out its WA copper/gold prospects in the Ashburton basin, where it recently picked up samples during geochemical surveying works with copper grades higher than 50%.

Capped at just $7.3M at the time of writing our note and with $2.6M in cash on hand, the company was trading with a tiny enterprise value of $4.7M, making it highly leveraged to any exploration success.

📰 Read the full breakdown: New acquisition - Rich history but never been drilled

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.