COP26, Battery Metals, Green Energy

Published 06-NOV-2021 09:03 A.M.

|

10 minute read

This week the VUL short attack came and went, world leaders commenced meeting at COP26 to secure national promises to cut greenhouse gas emissions, and green hydrogen continues to be all over the news.

The market has been generally running hot for well over a year now, and many seasoned market veterans we speak with are wondering when it will correct or crash, will it be in a few months? Or will it be in a couple of years?

Or is this just the start of a multi year “green commodities super cycle” as world leaders commit to going green, and countries start buying up all the raw materials required to build green projects and electrify their economies to cut emissions?

Will the equities market be further fuelled by an entire new generation of investors being priced out of the property market and turning to the share market as their preferred pathway to wealth creation?

Compared to saving for a house deposit, young investors are able to enter the share market with as little as $500 using one of many new trading apps, and most importantly start learning what does and DOESN’T work in the share market, allowing them to start seeing more success as their financial literacy and earning capacity grows.

Forbes predicts $30 trillion will be passed from boomers to young people over the coming decades - we think climate change will be high on young people's agenda and the share market is increasingly the place they are investing and becoming comfortable with.

The COP26 conference is entering its second week, where world leaders are meeting to make binding commitments to reduce emissions and coordinate their actions to deliver these commitments.

Young people have joined in by staging mass protests at the COP26 conference demanding more and faster action.

We expect that commitments made by our leaders at COP26 will soon turn to emissions reducing policy and actions like electrification of vehicles, building solar and wind farms, green hydrogen projects, improved electricity storage and even nuclear power.

All of which will require raw materials such lithium, nickel, copper, manganese, cobalt, graphite, rare earths and platinum group metals to name a few.

Australia has always been deeply involved in the resources sector, so Australian investors have generally been looking at the climate discussion from a lens of “what raw materials will be needed to deliver these climate goals” and have identified this coming supply shortage.

In our view the continuation of this green commodities bull market will be helped along as global investors who are inexperienced in resources, but want to invest in green projects, begin to understand the risk posed to green goals by limited raw materials supply.

While it seems like the perfect storm for a continued bull market, we simply don’t know if this hot market cycle is nearing the end, in the middle or just getting started - for all we know it could end in a month OR roll on for another few years. We are certainly in unprecedented times following the pandemic and the new global push to go green.

To allow for any future market situation (boom or bust), we always make sure to create an investment strategy and stick to it. We hold long term positions in all our investments and make sure to take some money off the table after an investment has delivered key milestones in case there is a crash or correction. This strategy has worked well for us in the past.

For the reasons we listed above, we are optimistic that the strong market will continue on in the near to mid term. Below are all our current investments leveraged to the “green commodities supercycle”, click on any link to read all our past commentary and see our investment strategy for each investment:

Battery metals - As the world switches to green energy and battery powered transport, battery metals supply is going to need to catch up and fast. After COVID, countries also realised how fickle global supply chains are, and battery metal demand will further increase as each country rushes to secure their own supply:

- Vulcan Energy (ASX:VUL) - development stage Zero Carbon Lithium in Europe (Germany)

- Euro Manganese (ASX:EMN) - development stage High purity manganese in Europe (Czech Republic)

- Kunico (ASX:KNI) - early stage exploration Zero Carbon Copper, nickel and cobalt in Europe (Norway)

- Galileo Mining (ASX:GAL) - early stage exploration nickel in WA, also with a palladium project (Western Australia)

- Pursuit Minerals (ASX:PUR) - early stage exploration platinum group elements, nickel and copper (Western Australia)

Green Energy - Clean energy and green hydrogen have been increasingly popping up in 2021, we think it’s still early in this theme and it has a while to play out yet:

- Province Resources (ASX:PRL) - early stage green hydrogen and clean energy project (Western Australia) - our 2021 small cap pick of the year

- GTi Resources (ASX:GTR) - early stage exploration for uranium (USA). We have been invested for over a year now, waiting for the market to cotton on to uranium — it looks like it finally has over the last two weeks...

- Minbos Resources (ASX:MNB) - main game is food security but quietly announced a clean energy powered green ammonia project a few months ago

- Elixir Energy (ASX:EXR) - main game is natural gas exploration but announced green energy and hydrogen projects a few months ago

Upcoming investments across our portfolios:

So far this year we have made just five new investments on Next Investors, and 13 across our three other portfolios, here’s what we have coming up next:

We are still working on a new traditional energy investment (these things take time) - we are heavily invested in the green shift but still believe there is an urgent place for natural gas during the transition to green energy.

We have another battery materials focused company in Kazakhstan - hopefully to be announced in the next few months.

Gold is currently a bit unloved, so we are looking at a new gold story, so we are ready for when sentiment turns (inflation is coming).

Our next biotech investment should also be announced before Christmas.

Evolution Energy Minerals (ASX: EV1) is an ESG focused graphite company that recently closed its IPO. EV1 is set to list on the ASX on November 16th.

📰 This week on Next Investors

Earlier this week Pantera Minerals (ASX:PFE) announced that three drill holes have been completed encountering broad widths of up to 14m in Hematite sandstone - the cores have been sent to the assay lab and grades are expected to be announced in December.

In mid December we expect to get the assay results - this is the next big piece of PFE news, and will give us the best indication of the hematite grades at depth and geological information to plan the next drill targets.

📰 Read More: PFE intersects 14m of Hematite sandstone on first drill campaign.

Galileo Mining (ASX:GAL) started drilling for palladium and nickel in Norseman, WA on Monday - running a 10,000m, aircore drilling programme on 5 targets that will run for the next 6 weeks.

GAL’s next drill programme starts in a few weeks - this is the big one for us, in December GAL will be diamond drilling its highest priority Fraser Range nickel targets - this is the main project that we are invested in GAL for.

📰 Read More: GAL Started Drilling this Morning - More Planned in December

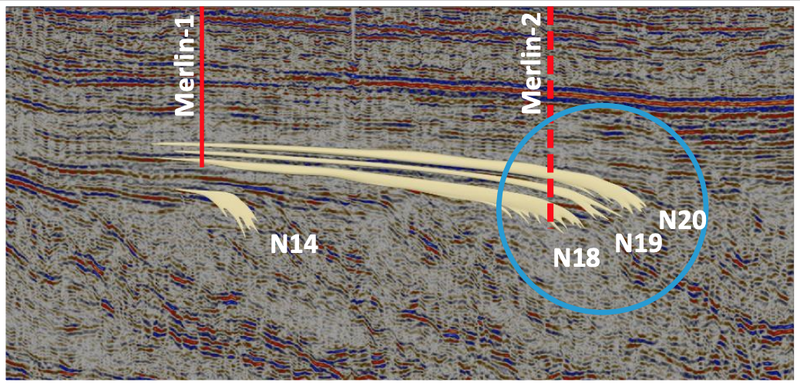

We also put out an update this week on 88 Energy (ASX:88E) leading up to the drilling programme at the Merlin-2 Well in northern Alaska. Merlin-2 is an “appraisal” well which follows up on the valuable learnings from the Merlin-1 well.

Armed with all the precious data gathered at Merlin-1, 88E is going to drill through those three reservoir intervals hit on Merlin-1, but this time 88E is going to move the drilling location to the east - where the formation is proven to thicken and be of a better quality - so hopefully it can intersect greater net pay.

With the rig now contracted, 88E is currently going through the process of planning and permitting its Merlin-2 well.

📰 Read More: 88E Drill Rig Contracted - The Merlin-2 drilling event awaits...

🗣️ Quick takes on key portfolio company events this week:

Los Cerros (LCL)

LCL MD Jason Stirbinskis recently caught up for Coffee with Samso, providing a good reservoir of knowledge of the story to date, as well as what is ahead for the Colombian-focused gold junior. We found Jason’s comments quite insightful, especially at around the 18 minute mark detailing the potential of the new porphyry targets uncovered by the drone mag and deep IP. We’re quite excited to see what the 2 rigs find that have been sent there. Watch the full interview here: A Colombian High-Grade Gold Porphyry Story - Los Cerros Limited (ASX: LCL) - Episode 116

The analysts at leading global gold fund Sprott also provided their take on the new porphyry targets news in this research note - Giant ‘bullseye’ Au porphyry target outlined by geophysics between Miraflores - Tesorito - Sprott noted that this is a ‘vindicated thesis’ anomaly, given LCL had predicted the results of what the geophysical surveys would unveil between their Miraflores and Tesorito prospects.

Invictus Energy (ASX:IVZ)

This week IVZ completed their 2021 seismic survey. Seismic data will help IVZ to identify the drill targets with the best chance of a successful discovery.

It has been a while since we have provided a full update on IVZ, we will be speaking to management this week and provide a full update on their operations soon.

Advanced Human Imaging (ASX:AHI)

AHI is looking to raise US$15M and complete their NASDAQ listing. We will be monitoring announcements closely for any updates, and we are still awaiting news on the initial revenues from the Tinjoy deal.

In our other portfolios 🧬 🦉 🏹

🏹 Catalyst Hunter

Techgen Metals (ASX:TG1) is exploring for copper in the Ashburton Basin in WA. TG1 has spent the past few months refining its copper drill targets using modern electromagnetic surveys, plus mapping and geochemistry work. After picking up some extremely high grade rock chip assays of 49.9% copper along the way, drilling has started.

TG1 is drill testing two of its copper targets across an eight hole, 2,000m programme. With the copper price hitting all time highs of late, and its use as a key metal in the EV boom - it's a pretty good time to be drilling for it.

📰 Read the full story:TG1 Drilling for Copper Right Now - Tiny Market Cap Means Leverage to a Discovery

🌎 Mainstream Media:

Covid Treatment (DXB)

First pill to treat Covid gets approval in UK (BBC)

Cannabis (CPH)

Switzerland will be the next country to legalise recreational cannabis (Pondering Pot)

Uranium (GTR)

China’s Climate Goals Hinge on a $440 Billion Nuclear Buildout (Bloomberg)

IAEA at COP26: How Nuclear Power and Technologies Can Help Tackle Climate Change (IAEA)

Gold Ecuador (TTM)

Meet the Metals Hunter Who Wants to Make It Big in Ecuador (Bloomberg)

Oil (88E, IVZ)

COP26: oil price soars even as the world turns against fossil fuel (Financial Times)

Lithium (VUL)

China mining, battery companies sweep up lithium supplies in acquisition blitz (S&P Global)

Australian Hydrogen (PRL)

Billions more in spending to come on PM’s road to net zero (Sydney Morning Herald)

Why hydrogen needs to take centre stage at COP26 (Woodmac)

Also we noticed this on the front page of The Australian:

Have a great weekend,

Next Investors

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.