What are we Investing in?

Published 01-OCT-2022 10:00 A.M.

|

11 minute read

The market is rough right now - here is what we are looking to Invest in over the next 18 months.

Please send us an email if you know of any companies that fit these criteria.

2022 has been a choppy year for the overall global markets, with a positive start, a rough May and June, positive July and April and now a few pretty bad weeks in a row.

At least compared to the 2020 crash the market now is only gradually limping downwards instead of an all out, aggressive crash.

Long term readers will have now sat through a few crashes and corrections with us.

Because we only Invest in a select number of companies that we believe in long term, during down markets we hold on to our positions. For example, we didn’t do any selling during the March 2020 crash or during the May-June weakness this year.

Our view is that there is no point Top Slicing, Taking Profit or selling down losers when market sentiment is low.

Rather, we think it is the time for us to build some carefully selected new positions and add to existing, quality positions that have taken a beating - then wait for positive sentiment to return.

Note: this is our strategy based on what we have experienced and what works for us, and may not work for everyone. We are not traders and are comfortable patiently sitting on pretty harsh paper losses until the market turns back positive.

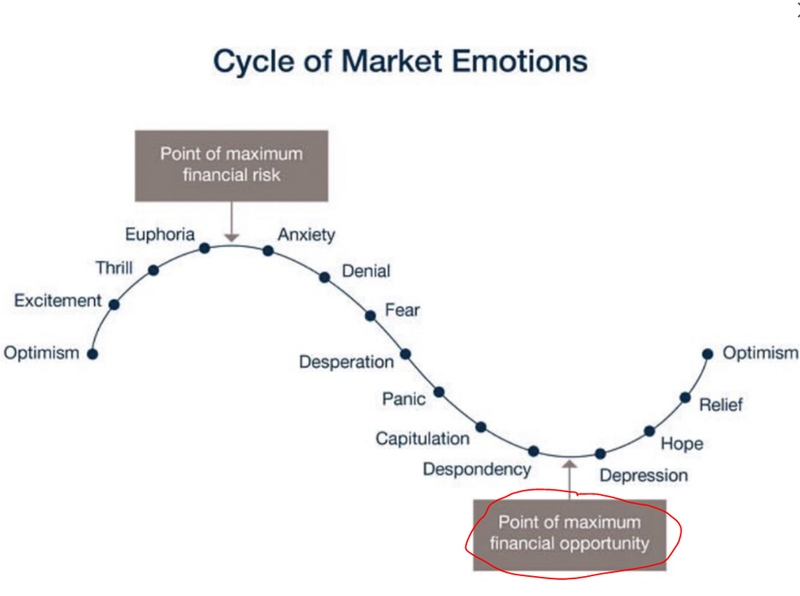

The market broadly cycles between positive and negative sentiment based on the collective sum of the emotions of all the market participants, this image summarises the ever repeating market cycle:

During the raging bull market of 2021 the market was sitting between “excitement” and “euphoria”.

Right now the market could be sitting anywhere between “denial” all the way to “depression” on this cycle - it could be about to turn back positive or there could be a lot more pain ahead - no one knows.

New Investments we made as the market was recovering from the March 2020 crash performed exceptionally well, helped by the roaring bull market during 2021.

As a more compressed example of this cycle, medium term traders who bought quality small cap stocks being sold down during June tax loss selling likely saw a decent return when the market bounced back in July and August - it’s just a shortened version of this cycle.

So while taking money off the table and waiting to see what happens can emotionally feel like the right thing to do when the market is capitulating, our plan is to do the opposite by increasing our holdings in some of our beaten up positions and increase the velocity of adding new Investments.

We have no idea how long this rough phase in the market will last. For all we know it could still get a LOT worse... or get better faster than everyone expects.

So based on our past experience, we will slowly but progressively add new positions, NOT trying to pick any market bottom at once, but adding over time to try and average in a few new positions across the period of market weakness.

Investments we will be making fall into the following four categories:

1 - New Investments in macro themes that are popular, but are now trading at lower levels due to broader market sentiment.

No surprises on the currently popular macro themes - battery materials, energy security and food - here is what we are specifically looking for:

Battery materials for the global shift to electrification has been one of our favourite and best performing themes, and we think still has a long way to run. We invest in explorers all the way up to companies about to develop a mine.

Battery materials/energy transition materials:

Lithium, Graphite, Manganese, Cobalt, Copper, Nickel, Neodymium, Praseodymium, Silver, Zinc, Aluminium, Steel, Uranium.

Battery metals stocks had a very strong run over the last 18 months but have taken a beating like most other small cap stocks lately. Here is specifically what we are looking for in new battery materials investments:

- Exploration companies with projects in the USA

- Australian exploration projects

- Overseas projects, in frontier locations but with potentially big deposits - early to late stage

- Advanced projects moving into development (any location)

Energy security has been a popular theme — we include new green energy like hydrogen OR traditional energy like oil & gas.

Specifically:

- Oil & gas exploration - preferably high impact, frontier drilling

- Green hydrogen plays with long standing in-country relationships and potential to partner with energy majors

- Hydrogen technology

Food and food security - very important in times of geo-political uncertainty, include:

- Fertiliser (potash, ammonia, phosphate)

- Non-animal based replacements for food

- Food or nutrition technology

2 - New Investments in macro themes we believe in, but that are currently hated by the market, AND are even further beaten up by current market sentiment.

Gold and silver - we are long term believers in precious metals and after a strong run in 2020 precious metals explorers are now very unloved, providing what we see as opportunities to pick up some good value, assuming precious metals come back into favour in 2023.

Tech stocks - tech stocks have been savagely beaten up as the market shifts away from companies with profitability projected well in the future, often regardless of the companies underlying merit. If rate rises start to ease there could be some good value in this sector. We are looking at tech stocks in the following fields:

- Health tech

- Early stage food or agtech

- Extremely beaten up SaaS, undervalued relative to SaaS metrics multiples

Biotech - biotechs are much like tech stocks, just with emphasis on the life sciences. As biotechs are extremely risky and the market is in a thoroughly “risk off” phase, even companies with good progress are struggling to get traction. We are looking for companies with exposure to the following themes:

- Various stages of clinical or preclinical trials - treating serious diseases

- Medicinal cannabis

- Other “recreational” drugs with therapeutic benefits for mental health (Psychedelics, MDMA, Ketamine)

3 - Increase position in companies that we are already Invested in and know well, but have taken a beating in the rough market.

Averaging down is a risky strategy, but we are very familiar with our Portfolio companies and have formed a firm view on how well each has been executing on their plans, specifically around how management handles situations that are in their control (as opposed to just bad exploration luck or market crashes which they can’t control).

Unfortunately, some of our companies have done or will need to do capital raisings during this market correction, and they will likely be at a heavy discount to the already much lower share prices and will probably come with free options to encourage uptake.

Given the need to offer “attractive terms” we hope that companies will offer a rights issue to existing holders as part of any cap raise during the down market (CAY is still in our bad books for not doing this in their last raise).

If we think one of our current Investments has been doing a good job and have good trust levels with management, we will look to participate if they do a placement. Otherwise we will have to accept the dilution if we sit out, which is annoying when the market bounces back and share prices recover.

Placements in existing Portfolio companies we participated in over the last 3 months include TMR, EV1, GAL, KNI, LNR, 88E and BOD.

4 - New Investments in companies we have been watching from the side lines for a while that have now become good value.

There have been a few companies where we ran due diligence and really liked over the last 18 months but we felt were at high valuations. We think some have now become good value (obviously this is subjective to our view of the company and value).

Do you have any suggestions for our Next Investment?

If you have been following any stocks that fit into any of the above categories or if you know of a private company that is looking to list on the ASX (can be located anywhere in the world) please email [email protected].

🗣️ This week’s Quick Takes

BOD - Entitlement offer at 8c closes today

EMN - MoU for long-term carbon-free renewable energy

EV1 - Flake graphite market in deficit - EV1’s strategy

EV1 - Flake graphite market in deficit - EV1’s strategy

EXR - Gas pilot production program update

GAL: Billionaire Mark Creasy purchases $2.86M in shares on market

KNI: Significant multi-element anomaly clusters along strikes

LCL: Drilling completed at Quinchia, focus now squarely on PEA

NHE: NHE's All-Important 3D Seismic Commences

RAS: More pegmatites mapped - drilling to start next week

TG1: First copper project drilled, second drilling program underway

TMR: More visible gold at No. 9 Vein; Blue Vein gets bigger

TMZ - Old drilling data to find new zones of mineralisation?

Macro: Lithium supply shortage to continue

This week in our Portfolios 🧬 🦉 🏹

Arovella Therapeutics (ASX:ALA)

Biotech junior Arovella Therapeutics (ASX:ALA) this week announced that it has partnered with the $1.1BN capped clinical stage immune-oncology company, Imugene Ltd, to combine their technologies and fight solid tumours.

Previously, ALA’s technology — which uses the body’s own immune system to locate and kill cancer cells in a patient — was only being used to attack blood cancers. However, as solid tumours account for 90% of all cancers, this partnership with imugene dramatically increases the potential market for ALA’s for emerging technology.

This news significantly advances our Big Bet that “ALA achieves a major breakthrough in cancer immunotherapy, and is acquired by a major pharmaceutical company for multiples of our Initial Entry Price”.

📰 $23M capped ALA partners with $1.1BN Imugene - Now Targeting 90% of Cancers

Evolution Energy Minerals (ASX:EV1)

Our late stage graphite development Investment, Evolution Energy Minerals (ASX:EV1), has signed a binding term sheet with its existing offtake partner YXGC to pursue a downstream processing facility – potentially in Europe or the Middle East.

The ownership structure will be 60% EV1 and 40% YXGC and the pair envision a processing facility that will process 25,000 tonnes per year of coarse flake concentrate into high-value graphite products including graphite foil, bi-polar plates, and seals for electric vehicles.

EV1’s downstream strategy is important as these high value products can fetch up to US$30,000/tonne — many multiples of the graphite prices that are usually quoted.

📰 EV1 Locks in Binding Terms for Downstream Graphite JV

Bod Australia (ASX:BOD)

While our Investment in Bod Australia (ASX:BOD) has been a rough ride to date, we’ve decided to participate in its upcoming rights issue.

The rights issue is part of an acquisition by BOD of a company which has technology that could dramatically increase the bioavailability of CBD in the human body – so it’s more potent, and more effective.

This opens up the prospect of improving BOD’s product suite, a “moonshot” move into the child epilepsy treatment market and the rapidly growing cannabis drinks market.

📰 BOD’s big bet – will it pay off?

⏲️ Upcoming potential share price catalysts

Results expected in the near term:

- LNR is commencing drilling for rare earths along strike from Hastings Technology Metals. (memo)

- Update: After a brief pause, drilling at LNR’s Lyons prospect has recommenced, focussing on the Lyons 12 and 13 prospects.

- GAL is undertaking a second round of drilling at its Callisto PGE discovery in WA.

- Update: No update on drilling this week, but Mark Creasy purchased $2.86M in shares on-market at ~$1.18/share, bringing his total holding to 27.43%.

- GGE is drilling its maiden helium well in Utah, USA (memo).

- Update: GGE produced both water and gas to surface; it couldn't isolate the gas, so no actual helium flow rate was able to be obtained. A disappointing result, but GGE has more targets to drill.

- IVZ to drill its giant gas prospect in Zimbabwe - we have been waiting two years for this event (memo).

- Update: On Monday IVZ commenced drilling at the Mukuyu-1 exploration well.

- KNI is drilling its cobalt targets in Norway (memo).

- Update: No material news this week.

- PRL Joint development agreement with Total Eren(memo)

- No material news this week.

- BPM has completed drilling at its lead/zinc prospect in the Earaheedy Basin, close to Rumble Resources’ recent discovery (memo)

- Update: No material news this week.

- PFE is drilling its polymetallic (Hellcat) project (memo)

- Update: No material news this week.

Company Progress Trackers

[New] ALA Progress Tracker

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.