Here’s what we found at Africa’s biggest mining event

Published 14-FEB-2023 18:22 P.M.

|

11 minute read

Africa has always been a favourite destination of ours for Investing in small cap resource companies.

Two of us are in Africa right now for Mining Indaba, the premier global mining conference located in Cape Town, South Africa.

We met up with a few of our Africa based Investments and will provide a quick update today, before we head off to visit one of the projects we are Invested in.

The conference was attended by more than 7,500 delegates, 800 investors, 70 government officials & ministers and 500 mining companies - all gathered in one place to talk about Africa's mining potential and do some deals:

Unsurprisingly, the hot topic for the conference was “battery metals” and how Africa and its communities could benefit from increased investment to extract the critical materials for the global energy transition.

In the last few years there has been a palpable interest in the African region from both the East and West for opportunities for critical resources.

According to the UN Environment Programme, the African continent is home to 30% of the world’s mineral reserves.

For some context, the largest reserves of cobalt, diamonds, platinum and uranium are located in Africa.

There’s also an abundance of gold, and new lithium and graphite deposits are attracting investment.

... this is just the deposits that have already been found.

Imagine what else lies undiscovered...

The continent also holds ~65% of the world’s arable land and 10% of the planet’s internal renewable fresh water source.

So it’s clear that the continent has what is needed from a resource perspective.

The only thing missing has been a willingness to invest capital into unlocking the geological potential of the region.

At the conference the message was clear - most African countries, governments, and organisations are open for business, and the rest of the world is starting to take notice.

In nearly all the presentations we heard “energy transition materials” or “battery metals” mentioned at least a few times.

We moved through the conference exhibition where various companies and organisations, big or small, were showcasing their products and projects.

Many countries had their own conference booths – a general rule we observed was that the bigger the booth, the stronger the signal that that country was seeking foreign investment, new exploration and mine development.

For example, here is a photo of the Angolan booth, which was by far the biggest showcase, right in the middle of the conference – it was literally a two-storey, multi booth structure:

Ministers from each country presented to the conference, inviting investment into their country.

What was clear from listening to several panels is the desire for investment in Africa, but it needs to be underpinned by a framework for investment that is mutually beneficial to all stakeholders.

This means benefits for the countries and communities combined with certainty and stability for companies and their financiers.

The pace and scale required to meet global emissions targets has created a sense of urgency around the Western world for governments and investors to be “risk on” when it comes to sourcing critical minerals.

The Global Director of Mining and Extractions at the World Bank said that financing for clean energy projects is much easier, and there are significant amounts of capital and funds available to companies that can support the global energy transition.

What is clear however is that mining is about a partnership, and the companies investing in Africa will need to make a genuine and lasting positive impact on the communities where they operate.

The global energy transition is an opportunity for Africa to both support the transition, but more importantly, grow and develop its local economies and prosperity.

Altogether, the conference was a great insight into Africa’s place on the global stage – and the opportunity for investment in the region.

From investments in small projects, to big government licences deals, Cape Town was the place for mining industry players to negotiate the differing interests in the region.

Small cap stocks were out in force at the “little brother” of the main conference, Mining 121 - which was effectively “speed dating” for high net worth/institutional investors and small cap mining companies with projects in Africa.

With around 700 investors to 100 companies, it was an opportunity for companies to pack in lots of valuable face-to-face time with potential investors and project financiers.

We always say how important it is to put in face time with management, and the 121 conference was the perfect place to do this.

We caught up with four of our investments in Cape Town, here is a quick summary:

Noble Helium (ASX:NHE)

Country: Tanzania

What does NHE do? NHE is a helium exploration company working to define a helium resource in the East African Rift System. If proven, this resource has the potential to be the world’s third largest helium reserve behind the nations USA and Qatar, and the largest ever reserve held by a single company.

NHE is going to be a big one in 2023 - the next frontier basin opening well on our drilling calendar.

As always, we expect a share price run up in the lead up to NHE drilling in Q3 this year.

We have seen before with IVZ what happens to a company when there is a major drilling event on the horizon, and we expect interest to grow in the story now that NHE is closer to drilling and with the size and scale of the target that NHE is hoping to discover.

NHE’s 121 meeting booth - while we wait for our turn

We met up with NHE CEO Justyn Wood at Mining 121 for and he was enthusiastic about NHE’s exploration progress so far.

Read more in our NHE Investment Memo.

Evolution Energy Minerals (ASX:EV1)

Country: Tanzania

What does EV1 do? EV1 is a sustainable, ESG friendly, advanced stage graphite developer.

This week we caught up with Managing Director Phil Hoskins and Technical Executive Director Michael Bourguignon from EV1.

We got the update on the project Definitive Feasibility study (DFS) and Tanzanian government framework agreement which EV1 has publicly stated that they are expecting to be completed soon.

We like EV1 as a later stage, DFS level investment that can practically take advantage of the battery metals boom.

EV1 in their meeting booth while we wait for our turn to speak with them

We noted that MD Phil Hoskins and Executive Director Michael Bourguignon were putting in a huge shift during the few days of the conference - every time we walked past the EV1 booth they were in a meeting, followed by attendance at various evening events hosted by investment banks.

Read more in our EV1 Investment Memo.

Minbos Resources (ASX:MNB)

Country: Angola

What does MNB do? MNB is seeking to build high-margin phosphate fertiliser supply business with the potential to dramatically transform Angola’s food security and crop yields.

MNB is also seeking to develop a green ammonia powered by cheap hydro-electric power, also located in Angola.

We met Managing Director Lindsay Reed at the conference and discussed the progress of the MNB Angola projects.

In a moment of serendipity, the ship carrying all of the parts to construct MNB’s phosphate production plant arrived at the port in Luanda (the capital of Angola) during the conference.

At the conference the Angolan Minister for Mining, Resources and Petroleum highlighted the importance for the country to become self-sufficient through both phosphate and ammonium.

We think that MNB will play a critical role in these initiatives and support the country's development.

Me and Lindsay at the Minbos Indaba Booth

It was interesting to note that MNB decided to attend the Mining Indaba conference instead of the 121 small cap conference - Indaba is generally tailored for later stage companies and attended by larger, later stage financiers - another sign of how far along the MNB phosphate project is.

Read more in our MNB Investment Memo.

Tyranna Resources (ASX:TYX)

Country: Angola

What does TYX do? TYX is a junior exploration company, focused on making a new hard rock lithium discovery in Angola, West Africa.

TYX’s project has over 800 lithium bearing rocks sticking out at the surface and completed its first drill program in December of last year. We are currently awaiting assays from this program and their next drilling campaign.

We caught up with TYX Chairman Joe Graziano and he confirmed final assay results are pending and TYX’s next drilling campaign will be happening soon.

At the conference, the Angolan minister directly mentioned TYX’s project in his opening address and highlighted lithium as an important opportunity for the country.

Below is an image of Joe presenting TYX and the Angolan minister (second from right) watching.

Read more in our TYX Investment Memo.

All up it was a great way to see and meet some of the major decision makers that affect our Investments in the region and the opportunities for miners in Africa.

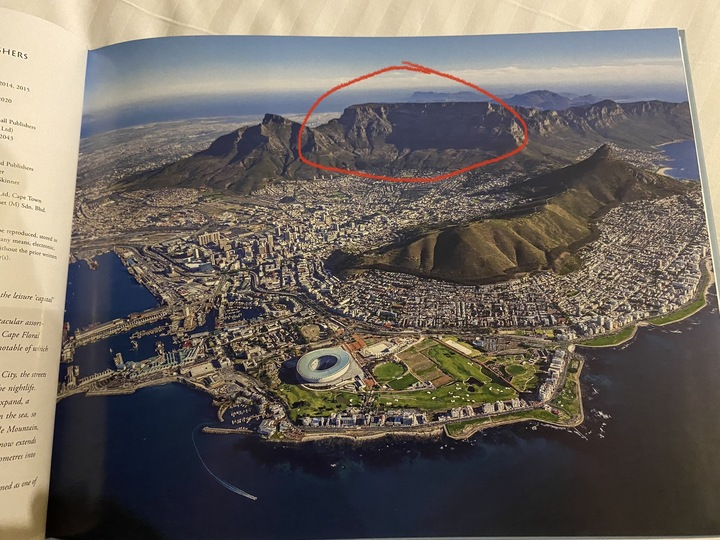

We finished off the Cape Town part of the trip by hiking up Table Mountain (that giant flat topped mountain right in the middle of the city that looks a bit like a table), which gave us a fantastic view of Cape Town:

Image Source: “Scenic Cape Town” by Mark Skinner - book purchased at airport

This week in our Portfolios 🧬 🦉 🏹

Alexium International Group (ASX: AJX)

Under a new commercially minded CEO and with an improving operating environment in CY2023, Alexium International Group (ASX:AJX) is now executing on a strategy to achieve sustainable profitability.

AJX has developed and is selling advanced performance chemicals to deliver thermal regulation and flame-retardant solutions.

It sells its technology to manufacturers in the US mattress and bedding markets and is expanding into other markets including military uniforms, athletic and workwear, and tactical body armour.

In order to deliver cash positive results, AJX is concentrating its near term efforts on three distinct areas, which we covered in our AJX note this week...

📰 Read our full Note: AJX Ready for 2023 with New Commercial Focus

88 Energy (ASX: 88E)

Our oil exploration Investment 88 Energy (ASX: 88E) is preparing to drill its Hickory-1 appraisal well on the North Slope of Alaska.

Now fully funded and permitted, the spud date is set for early March.

The drill program will target an already discovered hydrocarbon accumulation to get a better understanding of its extent and size with 88E looking to identify and prove working reservoir units are present.

The well is designed to drill through six stacked targets, which combine to form a 647 million barrel prospective mean unrisked resource (net to 88E).

This is the seventh well 88E has drilled on the North Slope, and it has been significantly de-risked from a technical standpoint, making it the lowest well risk to date.

📰 Read our full Note: 88E to drill Hickory-1 within a month. Here’s why its 88E’s lowest risk well from a technical perspective

Lycaon Resources (ASX: LYN)

Our Investment, Lycaon Resources (ASX: LYN), is an early stage explorer in the fast emerging rare earths / critical metals West Arunta Province in remote WA.

Also in the West Arunta Province is WA1 Resources, who made a niobium/rare earths discovery late last year that sent its share price up 2,200%.

WA1 Resources now trades with a market cap of ~$100M, while LYN is still a tiny $12M market cap stock.

LYN’s project shares some important characteristics with that of WA1 Resources’ project pre-discovery, which lies 94km to the south.

LYN has a clearly defined drill target in the form of a ~700m long geophysical anomaly — similar to the target that WA1 Resources drilled and made a discovery at.

We will be watching LYN this year as it prepares all the preliminary work required to identify drilling locations and prepare for drilling, with the ultimate aim of making a discovery of its own.

📰 Read our full note: Same rocks. Same region. Similar anomaly. Here’s why we like LYN right now

⏲️ Upcoming potential share price catalysts

Updates this week:

- 88E: Drilling for oil in the North Slope of Alaska next to UK listed Pantheon Resources.

- This week 88E fully funded its Hickory-1 well with a $17.5M capital raise at 0.95c per share. 88E expects to be drilling the well in early March, check out our full note on the news here.

- TTM: Drilling its copper porphyry target in Ecuador.

- This week TTM put out another batch of assay results from its drill program. We covered the news in a Quick Take which you can read here.

- KNI: Drilling the first of its three Norwegian battery metals projects inside the EU.

- KNI put out some historical assay results from its Ertelien Nickel project and confirmed that drilling so far was hitting massive sulphides which can be a precursor for high grade mineralisation. See our Quick Take on the news here.

No material news this week:

- GAL: Is undertaking a second round of drilling at its Callisto PGE discovery in WA.

- EV1: Updated DFS looking to improve on the already relatively strong US$323M NPV; Framework Agreement with the Government of Tanzania.

- GGE: Preparing to drill its US helium project looking for a commercially viable flow rate.

- PRL: Awaiting final execution of a joint development agreement with Total Eren.

- TMR: Maiden JORC resource estimate for its Canadian gold project.

- TYX: Assays from the company’s maiden drill program.

Have a great weekend,

Next Investors

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.