Mainstream media casts a big spotlight on Green Hydrogen

Published 16-OCT-2021 13:00 P.M.

|

15 minute read

This week we saw a segment on free-to-air, prime time news explaining “green hydrogen”.

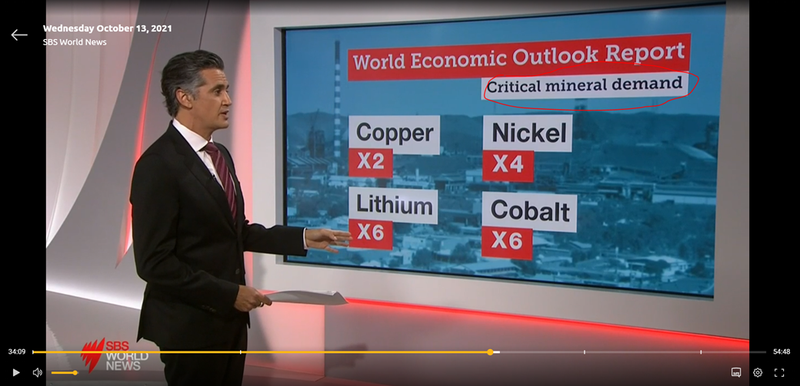

The prior day there was a news segment explaining battery metals and why demand is going to surge.

An explainer of how green hydrogen works or which critical metals are required to create an electric vehicle battery are usually buried deep in the special interest section of a newspaper, not on the six-o’clock news.

In small cap investing, when a long term thematic you are invested in starts getting more and more coverage in the mainstream media, it’s a good sign that it is getting enough traction to “be in the public interest”, and important enough to inform the broader population.

.. which means that these themes are likely to start forming an important part of the country's future, meaning it will start to get political and the public are getting prepped with information to start making voting decisions ... hopefully for huge amounts of government spending and support to drive these new industries.

On Wednesday SBS free-to-air TV nightly news gave a crash course in battery metals and how demand is increasing exponentially (check out the video at 33m:46s):

Our investment Kuniko (ASX:KNI) has exploration ground for ALL the above listed metals.

The next day (Thursday), our favourite TV news reader Janice Petersen allocated a whopping ~3 minutes to an explainer on green hydrogen (starts at 21m:30s):

I recall back in the early 90’s when I was in primary school, my dad used to get excited when there were TV adverts explaining what “liquified natural gas” was (back when there were only 5 TV channels) and the nightly news was educating people on natural gas uses and future export markets to Japan from Western Australia’s North West shelf.

Over the next 30 years the public and government supported various gas companies to invest BILLIONS of dollars to develop natural gas projects, and now natural gas production is expected to become the most significant source of Australian revenue in the short term.

For a more recent example, can you imagine being an early believer and investor in bitcoin when nobody cared, and then suddenly the bitcoin price is being reported daily alongside currencies, oil and gold prices on TV? Not to mention being adopted as legal tender by El Salvador... But most importantly your bitcoins are up 100,000% (disclosure: we totally missed out on the bitcoin run. Every single one.).

Anyway, normalising new and emerging concepts among the broader population is usually the precursor for acceptance, improved government policy, regulation and capital/incentives to flow in - the holy grail for early stage investors and believers.

30 years after TV ads explaining the benefits “natural gas”, here is our government’s current advertisement about what green hydrogen is and how it is going to create regional jobs and prosperity - if you still haven’t learned what green hydrogen is this video is a pretty nice and simple explanation:

We have been seeing a LOT of green hydrogen MAINSTREAM news over the last few weeks.

Our investments in green hydrogen include:

- Our Small Cap Pick of the Year for 2021 Province Resources (ASX:PRL) is aiming to develop Australia’s first truly “Zero Carbon” Green Hydrogen project... and they are aiming for a monster 8 Gigawatt solar and wind farm to power it in a proposed partnership with global energy major Total - our latest commentary on PRL

- Minbos Resources (ASX:MNB) quietly announced in April that they are investigating zero carbon “green” ammonia (which is made from green hydrogen). Check out this AFR article on Japan testing replacing coal with ammonia for power generation - read the our commentary on MNB’s green ammonia project here

- Elixir Energy (ASX:EXR) is expanding the scope of its operations to develop green hydrogen on its gigantic land position in Mongolia’s very sunny and windy South Gobi region - our latest commentary here

We’ve spent the morning reading green hydrogen articles from the last couple of weeks, here are the key takeaways:

Twiggy is the champion of green hydrogen in Australia, moving the industry forward through sheer force of will (and rubbing a few stakeholders up the wrong way...)

This week, Twiggy announced in partnership with the Queensland government that one of the largest hydrogen equipment and manufacturing plants will be built in Gladstone, QLD.

Twiggy also went on ABC National Press Club this week to give a long winded speech urging governments and investors, big or small, to take notice of the fuel of the future - hydrogen.

You can watch the full video here:

The newly appointed New South Wales premier Dominic Perrott quickly followed suit, announcing $3 billion in grants and waiving fees for hydrogen producers, making the state one of the cheapest regions to produce green hydrogen in the world.

We are most encouraged however to see how the WA Government supports the growing hydrogen industry, being the location of our favourite green hydrogen stock PRL.

According to this ABC article a terse-ish exchange between the WA Hydrogen Minister Allannah MacTiernan and Andrew Forrest highlights Twiggy’s methods to bully his way through the WA government to get a green hydrogen project up super fast. PRL on the other hand is using a more cooperative approach, closely liaising with communities and the state government to ensure that the framework is in place to support its hydrogen projects.

We are watching this space closely, to see how the WA government will advance this industry.

All eyes will turn to the Australian federal government over the next few weeks to see if they will commit, like each of the states have, to net zero emissions in Australia by 2050 at COP 26 - the annual UN National Climate Change Conference scheduled for the end of this month.

Energy super-major TotalEnergies SE (PRL’s potential MoU partner) recently pledged to contribute 100 million euros to a fund that aims to invest 1.5 billion euros in clean hydrogen infrastructure.

Investment of $US1.2 trillion ($1.6 trillion) is needed worldwide in low-carbon hydrogen this decade to get on track for net zero emissions, according to the International Energy Agency, which has singled out Australia’s “tremendous” potential to be an affordable supplier for Asia.

Macquarie Group CEO Shemara Wikramanayake has also recently cited green hydrogen as an area where Australia can capitalise on its significant natural advantages to make real progress on emissions reduction and open up opportunities for investment.

Australia’s largest single buyer of commodities, South Korean steel giant Posco, has singled out Australia as a “regional strategic base” to help achieve its clean energy aspirations in one of the strongest signs yet of the radical transformation in trade being wrought by the race to tackle climate change using green hydrogen.

The Economist reckons Hydrogens moment is here at last - After decades of doubts the gas is coming of age.

Our favourite and widest reaching green hydrogen “mention” was earlier this year when the wider global population was introduced to green hydrogen at the Tokyo Olympics Opening Ceremony when commentators revealed the Olympic Cauldron was burning using green hydrogen:

Hundreds of millions of people had just been introduced to green hydrogen as a fuel - it doesn't get any more mainstream than that.

So keep an eye out for green hydrogen, we have a feeling we will be seeing a lot more of it over the coming months...

What we are doing this weekend:

We are researching VUL’s new offtake partner that will be announced on Monday...

Our Zero Carbon Lithium investment Vulcan Energy (ASX:VUL) went into a trading halt last week citing it is “ in relation to a further binding offtake agreement” and is expected to reveal with whom on Monday before market open...

Spoiler alert: VUL’s THIRD offtake agreement is with Umicore, who let the cat out of the bag last night with this press release announcing the VUL deal.

A quick poke around reveals that Umicore is a producer of green materials for e-mobility, with nearly 11,000 employees and billions in revenue, they provide materials and tech to battery makers and autom makers... the Umicore investors preso is a good place to start.

We will share our findings and commentary on Umicore on Monday once VUL announces the offtake terms, but with the lithium price continuing to rise over the last few days while VUL was in trading halt, we hope it will be a big day for VUL when they officially release this news to the ASX.

📰 This week on Next Investors

On Monday, Kuniko Ltd (ASX:KNI) confirmed it was granted 58 additional exploration licences, covering a combined area of approximately 523 km2 in Norway.

We like that KNI has been fast out of the blocks with news, progress and updates AND increasing their exploration portfolio while waiting for initial EM surveys on its first three projects (we are very keen to see these first survey results, hoping they return some EM targets to drill).

WHAT WE ARE WATCHING FOR NEXT: In our opinion, a huge result for KNI would be if the current EM surveys on any of their initial 3 projects reveal large EM conductors BELOW OR NEARBY any historically mined areas. Today KNI says these results will be coming in the next few weeks. Fingers crossed!

📰 Read More: Fast start for KNI with more news on Zero Carbon Battery metals

BPM Minerals (ASX:BPM) announced that two licenses in the Earaheady zinc-lead project have been granted, with the permit for the most advanced project slated for November approvals.

NEW information about BPM: this week Strickland Metals (ASX:STK) announced a NEW lead zinc discovery next to Rumble’s discovery, which bodes VERY well for BPM who sits on the same geology as both - STK was up 100% on the day.

Before BPM drills, it needs to get permits granted, do some geophysical work to identify drill targets and then finally... start drilling. We expect to wait a few months before the excitement of the first drill campaigns starts and the BPM share price starts responding on speculation of results.

Like with all our early stage exploration investments, our plan with BPM is to invest way before the drilling starts (done) and wait patiently while all the pre drilling prep work happens (now), then aim to sell a small portion before the drilling campaign starts once the price starts running, then hold a position for the drill campaign and hope for a lead-zinc hit.

📰 Our Full Opinion:BPM's Lead-Zinc Projects now Underway with Key Permits Secured

Earlier this week Pantera Minerals (ASX:PFE) announced approval of its Program of Works, detailing the next steps for its Yampi Iron Ore Project. PFE’s iron ore project is next door and along strike from Australia’s highest grade direct shipping ore hematite mine, the $550M capped Mt Gibson’s Koolan Island in Western Australia.

We like that PFE’s maiden drilling programme has arrived so soon after listing, which could deliver a market re-rate on success. The much anticipated bespoke portable heli- rig has been commissioned, and is now in Derby, about 140km south of Yampi, awaiting mobilsation to site.

We are looking at a 6 week, 5 hole programme, to determine if the geology and high grade from surface sampling exists at depth. Then we expect it will take another 8 weeks for the labs to return the assay results. So by late January, we should have initial drill results, providing a clearer idea of just what PFE has in its hands at Yampi.

📰 The Full Breakdown: Pantera (PFE) set to unleash the heli-rig - first drilling starts next week.

It had been a long time since we wrote about our 2019 Energy Pick of the Year, Elixir Energy (ASX:EXR). But we were excited to provide a much anticipated update on the company’s exploration activities on the Mongolian-China border and expansion into green/blue hydrogen.

On Tuesday, EXR announced that it has signed an MoU with Mongolia’s Ministry of Energy to co-operate over Hydrogen to create a new hydrogen industry in Mongolia. We think that this is the right time for EXR to expand its project into green hydrogen as China’s crackdown on coal use intensifies.

EXR have been working on their green hydrogen plans for some time now, but we see this MoU MoU as an important first step for EXR’s clean energy aspirations, with more news still to come, it is an exciting time to be an EXR investor.

📰 Read the full report: EXR Signs Hydrogen MoU with Mongolian Ministry of Energy while Three Drill Rigs Continue Gas Search

In our other portfolios 🧬 🦉 🏹

🧬 FinFeed

Yesterday, the Next Investors 2021 Biotech Pick of the Year Dimerix (ASX:DXB), announced that its phase III study to evaluate the effectiveness of its oralCOVID-19 treatment will be extended to Australia.

The prize of a successful outcome for DXB is big, with US based pharmaceutical company Merck and Co. (NYSE:MRK, $200B Market Cap) the first to successfully advance an effective oral treatment for COVID-19.

Merck has already secured $1.2B from the US Government, and anticipate $7B in revenue from this drug by Christmas.

Interestingly, there are a lot of similarities in DXB’s trial design to Merck - but the true value will be in the results.

📰 Read the full breakdown:DXB to run a Phase III COVID-19 Study in Australia

🏹 Catalyst Hunter

On Monday, Alaskan gold explorer Nova Minerals hit a gold intercept that has been regarded as “in the top 40 best high grade gold intercept in the past 10 years”. This hit was right next to the tenement of our own investment in the region, Ragusa Minerals (ASX:RAS).

In this article we breakdown the different types of “nearology” and why we think that this particular nearology play is very promising for RAS.

📰 Read the full story:We Got Lucky - RAS’ Next Door Neighbour Delivers World Class Drill Intercept

🦉 Wise-Owl

It has been a strange month for our battery metals investment, FYI Resources (ASX:FYI), with the company signing a much anticipated joint venture deal with major Alumina product Alcoa Minerals but the share price nearly halving on the news (from a high of ~82c to settle around ~ 44c).

As longer term investors, we took this opportunity to double down as the traders and flippers left the building to seek shorter term catalysts.

In the article we breakdown the deal and next steps for the company, each reason why we think that the share price fell and our investment thesis - why we bought more.

📰 Read The Full Article: Doubling down on the dip in our favourite long term High Purity Alumina play

On Thursday afternoon, our European hard rock lithium investment European Metals Holdings Ltd (ASX: EMH), released a resource upgrade and re-classified its lithium resource into higher confidence categories.

Resource upgrades for companies like EMH are very important, as they provide greater certainty of the financial model and security to financiers that will facilitate bringing the project into production.

And, with lithium prices continuing to rise, it’s definitely a sellers market out there for lithium producers. We think financiers are going to be very interested in taking a stake in a large, near term lithium production asset, in the same region as a host of local EU battery makers.

📰 Read The Full Article: EMH Upgrades its EU Lithium Resource as Lithium Prices Continue to Soar

🌎 Mainstream Media:

Battery Metals (VUL, KNI, EMN)

Updated critical minerals list a boon for Australian miners (AFR)

Electric vehicles: the revolution is finally here (Financial Times)

Saudi Mining Plan Gets $3 Billion EV Boost From Australian Firm (Bloomberg)

Uranium (GTR)

Hedge funds snap up uranium in bet on green energy shift (AFR)

Uranium gets a boost from Japan’s nuclear sea change (AFR)

Australia can’t ignore nuclear in race to net zero: BHP (AFR)

Lithium (VUL)

Lithium Deal Shows China’s Accelerating Race for Battery Metals (Bloomberg)

Hydrogen (PRL, EXR)

The Hydrogen Stream: New magnesium-based composite for hydrogen storage and a big push from South Korea (PV Magazine)

Andrew 'Twiggy' Forrest says red tape cost WA big hydrogen project (ABC News)

Green hydrogen and climate change dominate Andrew Forrest's National Press Club speech | ABC News (ABC, YouTube)

Telecommunications (VN8)

Swoop Telecom raising $40m, Morgans to underwrite (AFR)

COVID-19 Treatment (DXB)

Merck's molnupiravir will be a blockbuster drug during pandemic. What about endemic COVID-19?(Fierce Pharma)

Psychedelics (CPH)

Will psychedelic mushroom vacations come to the U. S.? (Washington Post)

Startups are betting on a psychedelic gold rush (Vox)

How COVID-19 Opened the Door to a New Era in Psychedelic Medicine (Time)

Commodities

Commodity prices set for strong finish to 2021 (AFR)

Net zero will be a bonanza for Australian minerals, says IMF (AFR)

BHP warns energy crisis could repeat in metals (AFR)

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.