Two stocks in the spotlight: TYX, EV1

Published 10-SEP-2022 22:09 P.M.

|

10 minute read

As the global energy crisis rolls on, lithium is back as the story of the week.

A vital component in batteries, the lithium price is now up 300% from a year ago, at near record highs above US$71,000/t.

And with tight supply forecast through 2025, prices still have even further to rise — multiple analysts have lifted their price targets by 20-40%.

With the outlook for lithium remaining strong for years to come, this week we announced early stage lithium explorer Tyranna Resources (ASX:TYX) as our Catalyst Hunter 2022 Pick of the Year.

TYX is focused on making a new hard rock lithium discovery in Angola and says it will commence the first ever lithium exploration campaign into this project in Q4 2022.

We believe they have a good chance of making a significant lithium discovery.

Much of that belief has to do with TYX’s Technical Director, Peter Spitalny, an exploration geologist who was behind AVZ Minerals’ multi-billion dollar lithium resource in the DRC — now one of the largest undeveloped hard rock lithium deposits in the world.

His work at AVZ saw its share price rise from 4.3c to a peak of $1.35, with AVZ trading on a market cap of $2.7BN, prior to its voluntary suspension in May.

Peter found and brought this new lithium project to TYX, has now joined the TYX board, and will become a substantial shareholder of TYX if his performance shares convert on successful performance milestones.

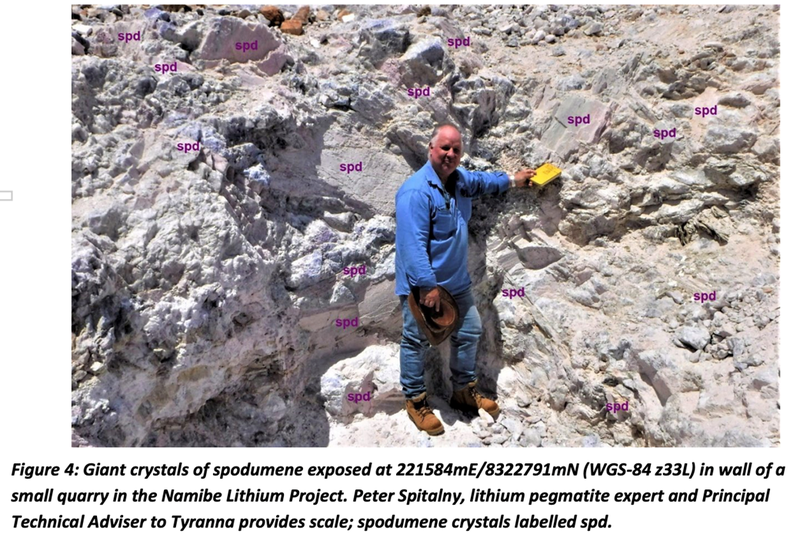

TYX’s project has never been properly explored or drilled for lithium before, yet it has over 600 different outcropping pegmatites (pegmatites being the main source for hard rock lithium deposits), and research has indicated the presence of spodumene — an indicator for high grade lithium mineralisation.

Our big bet for TYX: We hope that TYX discovers and defines a large, simple to process lithium resource that is on par with world class multi-billion dollar ASX peers such as Pilbara Minerals, Core Exploration, and Liontown Resources, AVZ Minerals, and Sayona Mining.

TYX is preparing for the first ever drill campaign on its unexplored project — scheduled to commence in the next quarter, we don’t have long to wait.

Read our full Note: Catalyst Hunter: 2022 Pick Of The Year - Tyranna Resources (ASX: TYX)

On the topic of EV batteries and the energy crisis, this week we also provided an update on our 2021 Wise Owl Pick of the Year and graphite Investment, Evolution Energy Minerals (ASX:EV1).

Along with lithium, graphite is another critical and non-substitutable EV battery material, making up around half of a battery’s ingredients.

This is a rapidly growing market. Over the past 12 months we’ve seen the big automakers move quickly to secure battery materials supply as global EV sales jumped by more than 50% from January to July this year.

On top of this, with a bit of downstream processing, graphite is used in nuclear energy which is currently being embraced amid the ongoing global energy crisis.

Our Big Bet for our Investment in EV1: EV1 will achieve first production of the world’s most sustainably produced graphite by early 2024 (including value adding processing) — coinciding with the onset of a long-term supply shortage in the graphite market.

EV1 has an advanced graphite project in Tanzania and is now coming up on a Final Investment Decision to build its “ESG First” graphite mine. It is soon to release an updated Definitive Feasibility Study and already has an ESG fund as a cornerstone investor.

We recently Increased our Investment in EV1 and have not sold any shares since we first Invested back in 2021 as we believe there is a strong chance that EV1 will deliver first graphite production before 2024 given:

- EV1’s excellent execution of its plan to date.

- The low cost to build the project (US$87M CAPEX to deliver an NPV of US$323M).

- EV1’s “ESG grade” investment status to attract ESG funds to build the mine.

Read our full Note on EV1 from this week: Increased Investment: “Value added” Graphite for Electric Vehicles and Nuclear

Today’s update is a quick summary of what we released this week.

We realise this was a bit like a “simpsons flashback episode” but we have an early start today and are busy all day on a site visit to a new seed Investment we recently made in a seaweed technology business in Port Phillip Bay.

The company is growing Asparagopsis, a special type of seaweed which can be mixed into cow feed to reduce methane emissions (basically from cow farts and burps) — methane from agriculture is a significant contributor to global emissions.

While this Investment doesn’t have any plans to list on the ASX, it is still quite interesting — see what it does here.

Company Progress Trackers

When we are first Investing in a company, we put together an Investment Memo that outlines what the company does, the macro investing theme it sits in, why we like the company, what we expect them to achieve over the next 12 months, the near term risks and our investment plan.

To complement our Investment Memos, we have started using “progress trackers” to help digest CURRENT news within the context of previous announcements, all of which contribute to a singular long term objective the company is trying to achieve.

When a company releases a new announcement, our process is to check our Investment Memo again to see how the news ties into the long term goal or risks, then do a scan of the progress tracker to see how it fits into the long term Investment goal.

Regular readers may have seen some of these trackers already, but here is a list of the trackers we have shared so far and some of the new ones we put together this week.

New trackers released this week:

Tyranna Resources (ASX:TYX) - TYX is planning a drilling program to prove that outcropping pegmatites at its project extend undercover enough to confirm a lithium discovery.

Click here for our TYX Progress Tracker

Evolution Energy Minerals (ASX:EV1) - EV1is working to achieve the world’s most sustainably produced graphite by early 2024 (including value adding processing), coinciding with the onset of a long-term supply shortage in the graphite market.

Click here for our EV1 Progress Tracker

Existing trackers:

Province Resources (ASX: PRL) - PRL together with its now 50:50 joint venture partner Total Eren is looking to develop a large scale green hydrogen project in WA.

Click here for our PRL Progress Tracker

Noble Helium (ASX: NHE) - NHE is chasing a helium resource that has the potential to be the third largest helium reserve in the world. NHE plans to drill test its project in 2023.

Click here for our NHE Progress Tracker

Dimerix (ASX: DXB) - DXB is an early stage biotech research company that is developing an anti-inflammatory drug to treat respiratory and kidney diseases, with potential applications to treat COVID.

Click here for our DXB Progress Tracker

88 Energy (ASX: 88E) - 88E will be looking to replicate the success of its $1.9BN neighbour on the north slope of Alaska - the home to the biggest oil discovery ever made in the US (Prudhoe Bay). 88E is gearing up for a 2023 drilling program to test the same reservoir units its neighbour has had success drilling into.

Click here for our 88E Progress Tracker

Invictus Energy (ASX: IVZ) - IVZ is gearing up to drill Africa’s largest untested conventional gas prospect in Zimbabwe. Drilling is expected to commence in the coming weeks.

Click here for our IVZ Progress Tracker

Sarytogan Graphite (ASX: SGA) - SGA only recently IPO’d and is still relatively early in proving out a giant graphite resource. SGA’s project has the highest grade graphite on the ASX, and has the second highest contained graphite of any ASX listed company.

Click here for our SGA Progress Tracker

Galileo Mining (ASX: GAL) - After 18 months of drilling, GAL made a PGE discovery at its Norseman project, off the back of the discovery GAL raised $20M and is now looking to grow the size and scale of its new discovery. Below is our progress tracker for GAL’s PGE discovery.

Click here to see our GAL Progress Tracker

Tempus Resources (ASX: TMR) - TMR is trying to make new gold discoveries at its Canadian gold project, which has produced some ~230k ounces of gold in the past. With processing infrastructure already in place, we are holding TMR to see it make new discoveries that it can then feed through its mill.

Click here to see our TMR Progress Tracker

Lanthanein Resources (ASX: LNR) - LNR is preparing to drill its rare earth project which borders Hastings Technology Metals (capped at $430M) Yagibanna deposit and is only ~30km away from Dreadnought Resources (capped at $320M) new rare earths discovery.

Click here to see our LNR Progress Tracker

🗣️ Quick Takes

Here are this week's Quick Takes:

88E: 3D seismic helps define drilling sweet spots

BPM: Ground granted along strike $1.3BN Capricorn Metals

LRS: Lithium JORC resource by December - drilling with multiple rigs

LNR: Neighbour Dreadnought confirms significant discovery

GGE: Helium production test underway - initial results next week

NHE: Updated investor presentation for our helium Investment

PFE: Drilling completed at Hellcat, assays next month

SGA: Graphite drilling ramps up with second rig on site

TEE: Update on neighbours exploring for gas in the Northern Territory

TEE: Testing for natural hydrogen & helium prospectivity

TEE: Operational update across domestic gas projects

TG1: TG1 brings in Rio Tinto as a project partner

Macro: Copper demand to outstrip supply by early 2030s

⏲️ Upcoming potential share price catalysts list

Results expected in the near term:

- GGE is drilling its maiden helium well in Utah, USA (memo).

- Update: GGE is flow testing its first ever pure play helium well at its US helium project. Follow up operations are underway, aiming to deliver a successful flow test at its helium discovery. Initial results are due early next week.

- IVZ to drill its giant gas prospect in Zimbabwe - we have been waiting two years for this event (memo).

- Update: IVZ didnt put out an announcement this week but Managing Director Scott Macmillan did run a shareholder webinar which we attended. In the webinar he mentioned that drilling was less than two weeks away from starting. Check out the webinar here: https://www.youtube.com/watch?v=jDaKrpZ5O-g

- PFE is drilling its polymetallic (Hellcat) project (memo)

- Update: PFE has completed maiden drilling at Hellcat (4 diamond holes for 1832.7m). Assay results are expected in late-October.

- KNI is drilling its cobalt targets in Norway (memo).

- Update: No material news this week.

- BPM has completed drilling at its lead/zinc prospect in the Earaheedy Basin, close to Rumble Resources’ recent discovery (memo).

- Update: No material news this week

- PRL Joint development agreement with Total Eren(memo)

- No material news this week

- LNR is commencing drilling for rare earths along strike from Hastings Technology Metals. (memo)

- Update: No material news this week

- GAL commenced its latest round of drilling at its Callisto PGE discovery in WA.

- Update: No material news this week

This week in our Portfolios 🧬 🦉 🏹

🏹 Catalyst Hunter

With lithium prices at all time highs and still rising, we have Invested in early stage lithium explorer, Tyranna Resources (ASX:TYX),naming it our 2022 Catalyst Hunter Pick of the Year.

TYX has a promising, unexplored project in Angola that has over 600 lithium bearing rocks sticking out at the surface.

The company expects to commence the first ever lithium exploration campaign on the project in Q4 2022, where we are hoping for a material lithium discovery.

📰 Read our full Note: Catalyst Hunter: 2022 Pick Of The Year - Tyranna Resources (ASX: TYX)

🦉 Wise-Owl

Our graphite Investment and 2021 Wise Owl Pick of the Year, Evolution Energy Minerals (ASX:EV1), is coming up on a Final Investment Decision to build its “ESG First” graphite mine in Tanzania.

EV1, which already has an ESG fund as a cornerstone investor, has an updated Definitive Feasibility Study due shortly and has been steadily chewing through every key milestone we set for the company since its IPO last November.

📰 Read our full Note: Increased Investment: “Value added” Graphite for Electric Vehicles and Nuclear

Have a great weekend,

Next Investors

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.