OPEC Production Cuts and Our Portfolio

Published 08-OCT-2022 12:00 P.M.

|

14 minute read

Why is this week's Saudi and OPEC oil production cut such a slap in the face of the current US-led world order?

...and what are the broader implications of this key event for early stage energy AND resource stocks?

Here are the headlines from this week:

Isn’t there an energy crisis? Aren't the USA and Saudi Arabia meant to be allies under the 1951 Mutual Defence Assistance Agreement?

This is a lot to compress into ~50 sentences, but let’s start at the beginning:

The USA has been the dominant world power since the end of World War II, nearly 80 years ago.

On “Team USA” are Western Europe, Canada, Japan, South Korea, Australia and a few others key allies (like, umm, Saudi Arabia?).

Most other countries have also fallen in line with the USA-led world order over recent decades because “globalisation” provided international trade opportunities and new markets.

One problem over this long period of prosperity was the concentration of global natural resource supplies within a few countries.

This is all well and good if those countries are friendly and co-operating under a US-led global system...

Enter China - who has been rising in military and economic power over recent decades to slowly start challenging the US-led world order.

Nothing too serious has happened between the USA and China just yet... aside from a few tit-for-tat trade sanctions and strong words to each other about Taiwan.

(Breaking News: last night the US announced a ban on selling supercomputer and AI computing components to China...)

However, the key event to test the “Team USA” world order occurred earlier this year when Russia invaded Ukraine, right on the doorstep of key US ally, Europe, and several NATO treaty countries.

It appears that China (so far) has largely sat on the sidelines watching to see what will happen, obviously with their eye on Ukraine as a case study of how the world might react to a move on Taiwan.

This quasi-test by proxy of the current world order’s resolve is ongoing and likely being watched by other supporters of a potential NEW world order, such as Iran, North Korea, China allies, and any country who feels it would benefit in a “changing of the global guard”.

The response from Team USA countries has been to impose economic sanctions on Russia.

In response, Russia cut critical energy supply to Europe, leading to the current energy crisis.

Aside from an all out war, withholding the supply of energy and resources is the next best way to exert pressure and inflict pain on your geopolitical rivals.

Team USA countries are rushing to address the energy crisis before the European winter, doing everything they can to find new energy supply and keep a lid on energy prices.

Which brings us back to Saudi Arabia and why this week's news is a big domino to fall in the ongoing global power struggle.

The Saudis are meant to be firmly on Team USA, but they went against the script this week, handing Russia a huge win by pushing OPEC to significantly cut production of oil, stoking higher energy prices.

This is the OPPOSITE of what the USA and Europe want, and is yet another example of using access to natural resources to exert pressure.

Looking back into history, we find that the USA and Saudi Arabia formally became “best buddies” when they established the Mutual Defence Assistance Agreement in 1951.

Since then, in return for securing oil supply from Saudi Arabia, the USA sent many billions of dollars in arms to the Saudi kingdom.

On top of these arms, the USA also used its military might to contain Saudi Arabia’s aggressive neighbours Iraq and Iran.

The first Gulf War started in 1990/1991 when Iraq invaded Kuwait in a land grab for Kuwait's oil. The Saudis, who have a lot of oil and share a long border with Iraq, got worried they would be next and called in a favour from the US and its allies.

The Saudis had been in Team USA up until a few recent diplomatic spats, culminating in this week’s pretty epic slap in the face for the West by cutting oil production during the energy crisis.

So what does this all have to do with small cap energy and resource stocks?

The Saudi news is another small step away from the incumbent USA-led world order.

This and several other key events in 2022 point to an acceleration towards a two power world order.

USA and its allies on one side.

China and its allies on the other side.

...and a bunch of neutral countries who will side with whoever suits them at any given time.

And with Russia withholding energy supplies, and now the Saudis and OPEC joining in, it’s clear that withholding resource supply is going to be a key chess piece in this global struggle.

A key strategy of the West to defend their “achilles heel” of dependence on oil & gas is to switch to electric vehicles and renewable energy.

We haven’t even started on the trouble that China can cause to this energy independence plan if they decide to cut off supply and/or processing of:

- Rare Earths

- Lithium

- Copper

- Nickel

- Copper

- Cobalt

Withholding oil & gas is already being deployed as a political tool, so we don’t see any good reason that the critical materials required to transition away from oil & gas wouldn’t be withheld next.

Blocking the West from a move to electric vehicles and renewables helps keep it dependent on oil & gas, which as we have seen this year, is an important strategic position to maintain.

Let’s take a look at this at a very basic level (We are not historians or military strategists so excuse any generalisations, this is for illustrating a general example only).

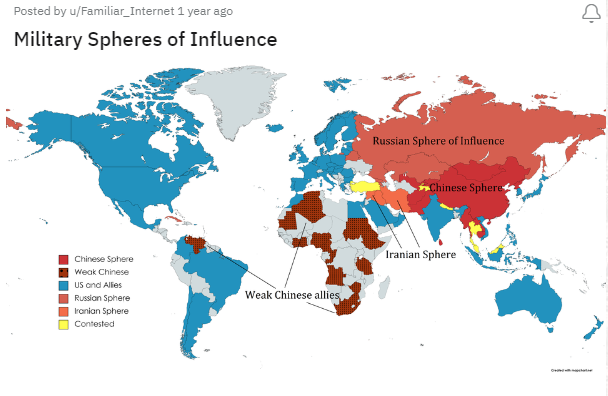

The map below shows a rough approximation of the USA-led world order in blue, and the challengers in red. Grey are neutral countries that can swing either way:

Map Source

Back in the days of peak globalisation (led by the US post-WW2), all critical natural resources were generally sold wherever they were needed and all countries mostly played nice, with profit being the main motivation.

Now that tensions between the red gang and blue gang are escalating, and access to critical resources is being rolled out as a strategic weapon to attack energy independence, we look at a very basic equation to work out where to Invest:

“If you are a blue country and any of your critical resources come from a red country, you need to find and replace that with supply from a blue country.”

Otherwise, increasingly hostile red countries will use your dependence on them against you.

And this is the reason why we have our Investment Portfolio overweight in companies that are trying to find new supply of oil & gas AND critical materials for batteries and renewable energy.

We believe that in the current escalating geopolitical climate, these companies will perform well. That assumes they are successful, of course — exploration is high risk and the company may fail to find a resource deposit.

We have a number of Investments across these explorers in the hope that a few will succeed and deliver outsized returns to offset those that fail.

Our current investments in oil & gas explorers: Energy Portfolio

Our current Investments in critical material explorers/developers - Battery Metals Portfolio

Just click on any company in the portfolios to see our Investment Memo for the company where we cover why we Invested, the macro theme, key objectives we want the company to achieve, key risks and our Investment plan.

Now Let’s take a look at what critical resources are sitting in red countries on the above map, where the West likely needs to secure alternate supply.

When we say critical resources, we mean oil & gas OR materials to achieve energy independence from oil & gas through electric vehicles plus renewable energy.

Anything that can be used to put pressure onto a country by withholding supply.

We know that withholding oil & gas is already successfully being used by Russia, so let’s see what China might be able to withhold from the West to stifle attempts to gain energy independence.

Again, just last night the US announced a ban on selling key components for supercomputers and artificial intelligence to China, aimed at stopping China’s push to develop its own chip industry and advance its military capabilities.

We can only assume China will look to retaliate somehow and are waiting to hear a statement from them over this weekend in response to last night's announcement.

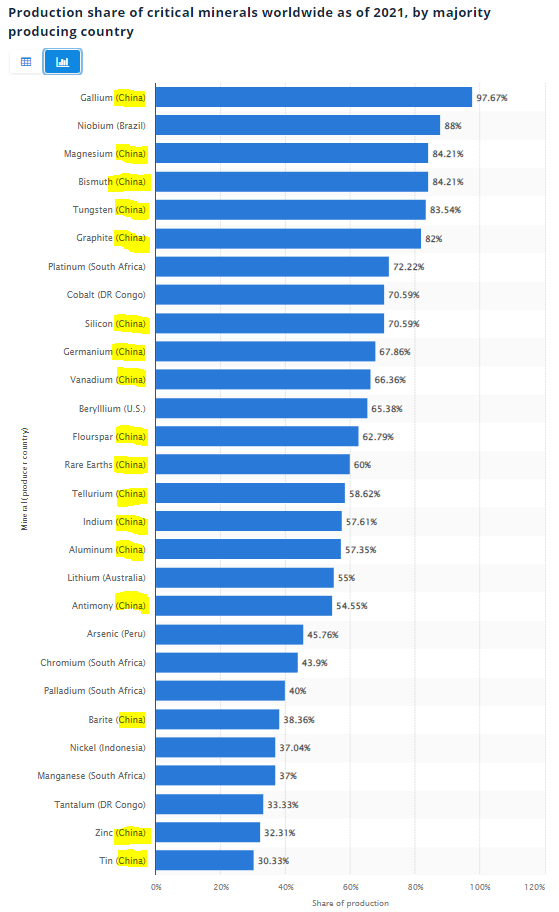

Here is a useful image showing the critical material supply currently dominated by China, showing its share of production as a % of total global production:

Source: Statista

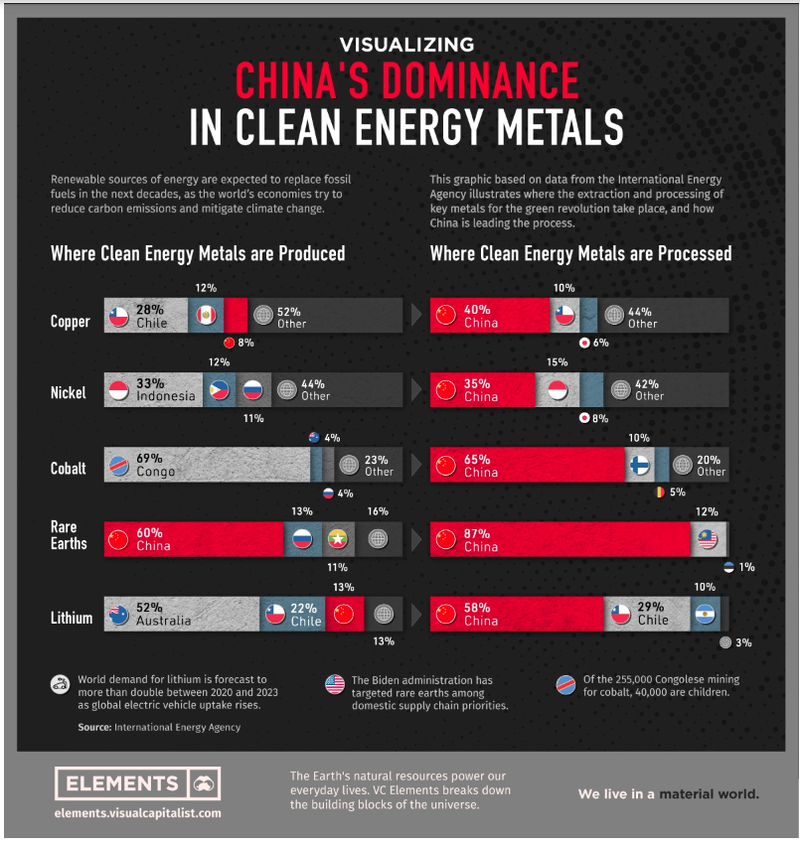

Critical materials for batteries and renewable energy also need highly technical processing before they can be used, and China is by far the most dominant in the space (see the column on the right):

Source: Visual Capitalist

This shows that China is in control of processing in particular across rare earths, lithium, cobalt, nickel and copper - all things that the blue countries desperately need to move away from dependence on Russian and Saudi/OPEC oil & gas.

Rare earths supply is clearly the most at risk - we have a position in ASX:LNR who are currently in the middle of their first drill campaign looking to make new rare earths discovery in Western Australia (see our LNR Investment memo).

Now let’s take a look at oil & gas.

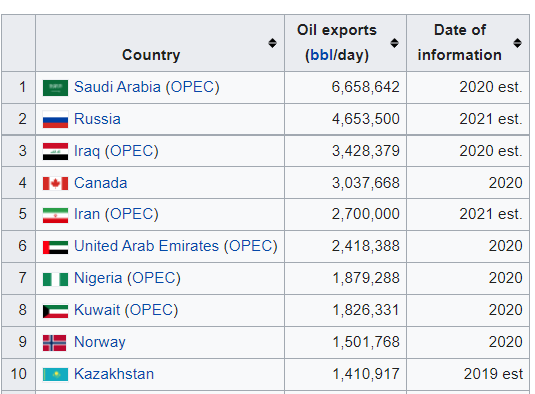

The image below shows the world's top 10 oil exporters:

Source (wikipedia)

There’s not too many friendly faces on this list if your country is on Team USA, and now that withholding oil & gas supply is actively being deployed to exert pressure, it is even more important to find and develop new supply in friendly or neutral countries.

We are Invested in ASX:IVZ who are currently drilling the largest conventional onshore prospect in Africa, with a prospective resource that now sits at >5.5 billion barrels of oil equivalent across a number of targets - see our IVZ Investment memo.

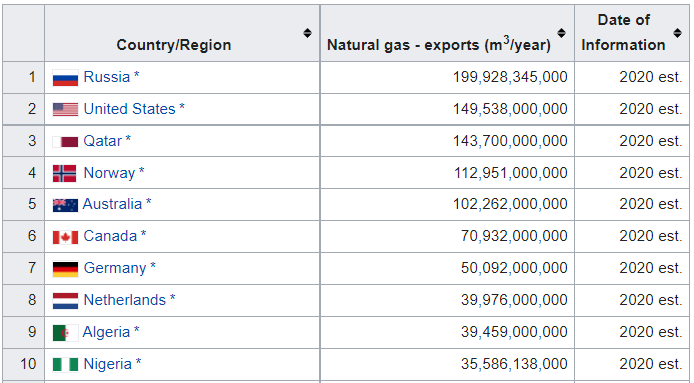

The natural gas exporters list tells a different story with a few more US allies on the list, but it is still dominated by Russia with enough to cause trouble:

Source (wikipedia)

The key point is that over the next decade we believe finding and securing critical energy and critical materials supply within friendly or neutral countries will be a matter of national security.

This won’t just be a matter of economics - supply and demand, but of strategic national importance to many countries.

Again, our current investments in energy explorers: Energy Portfolio

And our current Investments in critical metals explorers/developers - Battery Metals Portfolio

Also, if you are interested in more information on the history of changing world orders, check out this book by renowned hedge fund manager Ray Dalio.

Here’s a high level summary of the key points in the book in this 40 minute video.

We highly recommend spending the 40 minutes to watch the video because understanding other times in history where the world was in a similar situation as today helps to try and make sense of everything that is happening now.

Next Investors

🗣️ This week’s Quick Takes

EV1: Chilalo graphite project demonstrates low carbon footprint

FYI: More positive results for HPA-doped anode coatings

TEE: Operational update across domestic gas projects

TEE: Update on neighbours in the Beetaloo

TMZ: First look at hub and spoke strategy economics

TMZ: Tough Funding Environment

This week in our Portfolios 🧬 🦉 🏹

Invictus Energy (ASX:IVZ)

Invictus Energy (ASX: IVZ) has provided an update on the drilling of itsMukuyu-1 well in Zimbabwe reporting that it is 593m into its planned 3,500m well depth. This suggests that IVZ could be just from piercing the first of its seven targets.

Mukuyu, one of the largest oil and gas exploration prospects to be drilled globally in 2022, will be followed by the Baobab-1 well, which will test an independent play along the basin margin and will take approximately 30 to 40 days to complete.

Importantly, these target areas are separate from one another, meaning IVZ gets two shots at making a basin opening discovery.

IVZ also upgraded its prospective resource this week, adding an extra 1.2 billion barrels of oil equivalent across its basin margin targets (a “String of Pearls” play) in the Cabora Bassa Basin.

📰 Read our full Note: IVZ basin opening drill at 593m out of planned 3,500m - over half way to first target at 850m

Vonex Ltd (ASX:VN8)

Emerging telco Vonex Ltd (ASX:VN8) is following the tried and tested telco consolidation strategy to growth — driving revenue through acquisition, integration and achieving economies of scale.

This week VN8 signed an agreement to acquire Queensland based telco OntheNet. The acquisition adds ~$15M in recurring revenue, growing VN8’s annual recurring revenue to ~$51M, and adds ~$2M in EBITDA, bringing underlying EBITDA to ~$8.5M (on a pro forma basis).

This acquisition brings us closer to our Big Bet for VN8: that it grows to a size that attracts a takeover bid from a larger telco (at multiples of our Initial Entry Price) by acquiring and consolidating smaller telco businesses.

📰 Read our full Note: VN8 grows to $51M Annual Recurring Revenue with Latest Acquisition

Oneview Healthcare (ASX:ONE)

Over the past 18 months, our 2021 Tech Pick of the Year Oneview Healthcare (ASX:ONE) has signed on an additional 5,216 hospital beds, a >50% increase on the 9,259 beds signed on in the prior 13 years.

But, largely due to the global tech wreck that started on the NASDAQ back in January this year, that growth is yet to be reflected in ONE’s share price.

However, just weeks before the US tech crash started and tech funding dried up, ONE secured $20M in a placement at 27c. This provided enough cash for ONE to continue executing on its growth plans, while we wait for global tech sentiment to improve.

Since then ONE has secured its biggest ever deal and the dynamics around health tech appear to be shifting in ONE’s primary target market — US hospitals.

📰 Read our full Note: Accelerating growth, when will the macro catch up?

Latin Resources (ASX:LRS)

Our lithium exploration Investment, Latin Resources (ASX:LRS) has made a new lithium discovery at its project in Brazil.

This new discovery included 18.71m of lithium at a grade of 1.32%. This intercept is just 500m west of its original discovery... and this new zone is open in all directions.

This has the potential to add significant scale to LRS’s JORC resource estimate, which is now due to be delivered in December.

LRS also announced the appointment of experienced lithium executive, Peter Oliver, who oversaw the development of the Greenbushes lithium mine, one of the most profitable lithium operations in the world.

📰 Read our full Note: Another Lithium Discovery - are they connected?

⏲️ Upcoming potential share price catalysts

Results expected in the near term:

- IVZ drilling its giant gas prospect in Zimbabwe - we waited two years for this event (memo).

- Update: IVZ has now drilled 593m of a planned 3,500m in its Mukuyu-1 well. It also increased its prospective resource by 1.2 billion barrels from 5 drill ready prospects.

- GGE is drilling its maiden helium well in Utah, USA (memo).

- Update: No material news this week.

- LNR has recommenced maiden drilling for rare earths along strike from Hastings Technology Metals (memo).

- Update: No material news this week.

- GAL is undertaking a second round of drilling at its Callisto PGE discovery in WA.

- Update: No material news this week.

- KNI is drilling its cobalt targets in Norway (memo).

- Update: No material news this week.

- PRL: Awaiting final execution of a joint development agreement with Total Eren(memo).

- Update: No material news this week.

- BPM has completed drilling at its lead/zinc prospect in the Earaheedy Basin, close to Rumble Resources’ discovery (memo).

- Update: No material news this week.

- PFE is drilling its polymetallic (Hellcat) project (memo).

- Update: No material news this week.

Company Progress Trackers

[New]ONE Progress Tracker

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.