When will it get better?

Published 10-AUG-2024 14:05 P.M.

|

16 minute read

- Commentary: Just when you thought things couldn’t get worse... horror week for small caps. SGQ sell off caused by “mis-information”? Catch up with some of our Portfolio companies in Perth.

- Quick Takes: CND, MAN, AL3, GGE, SS1, ALA, GUE, EXR, KNI

- This week in our Portfolios: EXR, SGQ, HVY, SGA

My grandad used to have a saying:

“Always remember that things are never so bad... that they couldn’t get even worse”

While he used it mostly to fend off any whingers he encountered while living in the grim times of post-WW2 Eastern Europe, the saying also has some utility in the small end of the market.

As we unfortunately saw this week.

It’s been a terrible two years in the small end of the market - surely it couldn’t get worse right?

...right?

While a mostly green July got our hopes up last month, last week has been a shocker in markets both big and small.

It had been a long positive run for the top end of the global markets over the last year or so.

And if that positivity did keep going, then the small cap side of things should have eventually caught up.

All seemed to be looking good in July...

Then the US markets lobbed in a near correction, down 6.3% on Monday and further 3% on Tuesday.

Like a car exhaust backfire scaring off a flock of pigeons in the Kraków town square, investors and liquidity disappeared from the small end of the market in an instant.

...Or like Fenton the escaped dog startling a herd of deer from one of the early “viral” videos from ~15 years ago:

(relive the original Fenton video here)

The only positive to take is that rapid falls can sometimes be followed by quick bounce backs if they are overdone, which we saw happen in the US back up over 3% in the last two trading sessions.

Speaking of volatile weeks, spooked investors and overdone price drops, our latest Investment St George Mining (ASX:SGQ) definitely had an interesting one.

Tuesday morning SGQ came out of halt to announce it is acquiring an advanced stage niobium and rare earths project in Brazil and a capital raise to fund the acquisition.

(we participated in this cap raise)

We chose to put cash into the placement and add SGQ to our Portfolio because its advanced stage project sits right next door to the largest niobium mine in the world.

Also, money appears to be flowing towards niobium projects (WA1 capped at ~$880M and ENR capped at ~$220M) and rare earths in Brazil (MEI capped at ~$220M and BRE capped at ~$581M ).

So SGQ is at a $55M post transaction market cap, with an advanced stage niobium and rare earths project, and our rationale is that the market should re-price SGQ upwards.

Despite SGQ coming out of halt with the new project on one of the worst weeks the market had seen in years, all was looking good with the share price trading up around 4c and hitting a high of 4.4c.

But then a couple of posters on hotcopper and social media started trying to find and post something negative about the project that may have strayed into spreading “mis-information”.

Finding potential issues with a project is important, and we certainly encourage and like to see it happen... it helps us in our ongoing research and analysis.

Provided the criticisms are true and factual.

On Wednesday SGQ traded up again until around 12pm AEST when out of nowhere the sellers overwhelmed the buyers and the stock ended the day all the way back from ~4c to 2.5c per share.

In the bleak global market conditions of the week - fear won out.

The sudden share price drop was strange enough that SGQ put itself into a trading halt on Thursday morning pending the release of an announcement to “correcting mis-information circulating in the market in relation to the Araxa Project.”

The trading halt says that SGQ would address it with an announcement by Monday - we will be watching to see what it's all about.

It's hard to know for sure what the “mis-information” is, especially nowadays where there are hundreds of opinions posted anonymously, in real time across social media and other forums.

What we can say for sure is that there are always cynical takes on just about every investment opportunity out there, it’s healthy and all a part of investing.

(again, provided it is factual and accurate - the same absolutely also applies to positive information provided about a company)

Before its discovery, there were those who said WA1 was wasting its time and shareholder funds drilling in the middle of nowhere before it made a game changing discovery in the West Arunta...

There were those who said Woodside’s assets in the North West Shelf would never amount to anything...

And there were those who said Fortescue Metals Group would go bankrupt all the way back at its lows in 2015.

These are obviously rare, cherry picked winners, but the point is that there will always be people pointing out what’s potentially wrong with almost anything.

As long term Investors in SGQ we are looking forward to the company’s response which should be out on Monday.

We expect an interesting day of trading should it turn out that false information was being spread and is responsible for the Tuesday afternoon sell-off in SGQ.

We will look to put out our take on the announcement once SGQ provides the market with a clearer picture on what the “mis-information” is.

Based on our own research, the project and similar companies in the market, our thesis still stands that SGQ re-rates once the market digests the project in full and the transaction is complete.

We are Invested at 2.5c, our plan is to hold a position for 3-5 years and see how far SGQ can take the project.

And hopefully this “mis-information” based sell-off is just a blip in the short term.

We’ll find out on Monday.

See our initiation note on the company here: Our New Investment is St George Mining Ltd (ASX: SGQ).

What else we got up to - on location in Perth

One of our team attended the Critical Minerals, Mining & ESG Summit on the outskirts of Perth last weekend as a guest of Kuniko (ASX:KNI).

There was a cricket game (he took some catches) while also getting a chance to hear from Dr. Francis Wedin who is Executive Director of our all-time best Investment Vulcan Energy Resources (ASX:VUL).

VUL delivered a key milestone this week commencing the commissioning of its downstream lithium hydroxide optimisation plant, just outside of Frankfurt, Germany.

It is amazing to think how far VUL has come since we first Invested in the company in 2019 and it's a credit to Francis and the entire team at VUL that they have achieved so much in such a short period of time.

Fun Fact: We called VUL (our best investment to date) as our top Pick of The Year for 2020 on Friday Feb 21st - LITERALLY the next trading day on Monday 24th Feb 2020 the COVID market crash started...

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

(noting here that we just added SGQ as a new Portfolio addition during the worst week of the market in years...)

Most mineral projects don’t ever make it close to production... but VUL’s news this week was a big milestone for the company and the European critical mineral industry.

KNI was spun out from VUL.

And we’re hoping with time the market starts to realise the strategic importance of KNI’s projects.

It feels like the wind has come out of the sails for critical minerals in Australia though...

At least on the ASX, most critical minerals projects are not getting much love from the market.

But jurisdiction is really important - and Europe is hell bent on securing supply.

KNI is advancing a nickel project in Norway, and has some potentially large targets to drill following EM surveys.

Norway has also put in place a reduced permitting schedule to speed mines to production.

So KNI has some significant advantages that are not enjoyed by some of the projects in Australia.

The summit we attended was intended to address this lack of domestic enthusiasm in Australia...

It also functioned as a charity fundraiser for the LBW Trust which uses education to advance more equitable outcomes for children in rural and remote Australia, as well as overseas.

Our analyst scored a souvenir hat:

We also met up with some of our other Investments in Perth. Here’s what we learned...

Lightning Minerals (ASX:L1M)

Another of our team was on site with our lithium explorer Lightning Minerals (ASX:L1M) in Brazil in June.

We got to catch up with Alex Biggs this week who is Managing Director of L1M in Perth.

L1M has just kicked off exploration works near Salinas, Minas Gerais, Brazil.

The whole region is being dubbed “Lithium Valley”... which is a clue that there might be more lithium deposits to uncover in the region, following in the footsteps of the $1.5BN capped Sigma, and another one of our all time best Investments, Latin Resources (ASX: LRS).

Minas Gerais is a great jurisdiction for mining - and it’s also the home state of SGQ’s new niobium and rare earths project.

L1M made a counter cyclical acquisition in the same region as LRS, and one of the main takeaways from our chat with Biggs was the long-term conviction he had in the lithium thematic.

Things might not be great for the lithium price right now, but over the long run, we think L1M made a shrewd move to acquire the highly prospective ground well in advance of a rebound.

We share that sentiment for lithium - we think it's a matter of time (how long? We don't know) until the lithium market comes back into favour.

Biggs feels comfortable with how the company is progressing towards refining lithium drill targets, and with $3.1M in the bank at 30 June 2024, we’re looking forward to what L1M might be able to turn up over the coming months in one of the best lithium jurisdictions on the planet.

Biggs was also keen to stress that the ground vendors have milestone payments tied to large tonnages of lithium - which is a key part of our Investment Thesis for L1M.

i.e the vendors have high confidence in the prospectivity of the project - which is definitely a good sign.

Read our L1M Investment Memo here

Mandrake Resources (ASX:MAN)

Speaking of lithium...

On our Perth trip, our analyst was also able to have a chat with James Allchurch who is MD of Mandrake Resources (ASX:MAN).

Again, it’s a similar story here - Allchurch is confident that the US jurisdiction will benefit greatly from the energy transition and MAN’s project in the Paradox Basin is shaping up nicely.

We recently Invested in MAN again at 3.3c and remain confident that its US lithium brine assets will be highly desirable over the long run, given the amount of capital that is going into the space.

MAN was recently able to get a US$1M grant from the US government in conjunction with other groups.

The US$1M was given to MAN and others so that the company can work on ‘Characterizing and Estimating Reserves of Lithium and Other Critical Minerals in the Paradox Basin, Utah’.

The US$1M adds more funds to the $14.9M cash the company had at 30 June to put into its lithium project.

Clearly the US government is interested in seeing company’s like MAN unlock the lithium potential of projects in this part of the US.

MAN’s Direct Lithium Extraction (DLE) project should see a JORC resource shortly too.

MAN is working with two DLE tech providers - one backed by Bill Gates (Electroflow) in the US, the other backed by Rio Tinto (ElectraLith) in Australia.

Both have already shown they can process MAN’s brines - with one of them producing 99.9% pure battery grade hydroxides.

With a JORC resource out soon we’re hoping the $17M capped MAN can catch up to its regional peer Anson Resources, which is capped at $125M.

Read our MAN Investment Memo here

Pantera Minerals (ASX:PFE)

We don’t make any secret that we think DLE has big potential (particularly in the US) and another of our US lithium Investments, Pantera Minerals (ASX:PFE) is also pursuing a DLE project, this time in Arkansas, USA.

Our analyst also got to speak to PFE’s MD Barnaby Egerton-Warburton on his trip, who had just returned from the US.

PFE’s project is in the Smackover, which is home to major investments from companies like Exxon, Albemarle, Tera Technologies and Standard Lithium.

Exxon has been going hard and fast trying to develop its project and recently completed an 8 well drill program:

(Source)

Barnaby was as bullish on US lithium as you’d expect, but he really wanted to highlight some of the M&A activity by energy supermajors in the Smackover.

Norwegian North Sea energy giant Equinor recently did a JV with Standard Lithium for a 45% slice of two of their projects in the region.

PFE has been snapping up land aggressively, and we think that the land has an increasing value as more major players move into the area.

While the market might not be fully cognizant of the value of PFE’s land holdings in the region, we’re hoping it can be an underpinning force in the valuation of the company in the future, particularly if the lithium bull market returns.

Click here to read our PFE Investment Memo

Condor Energy (ASX:CND)

Talking to CND’s Ricardo Garzon Rangel who is a non-executive director and Chief Operations Officer of CND was a great chance to pick up some insights on our 2023 Energy Pick of the Year.

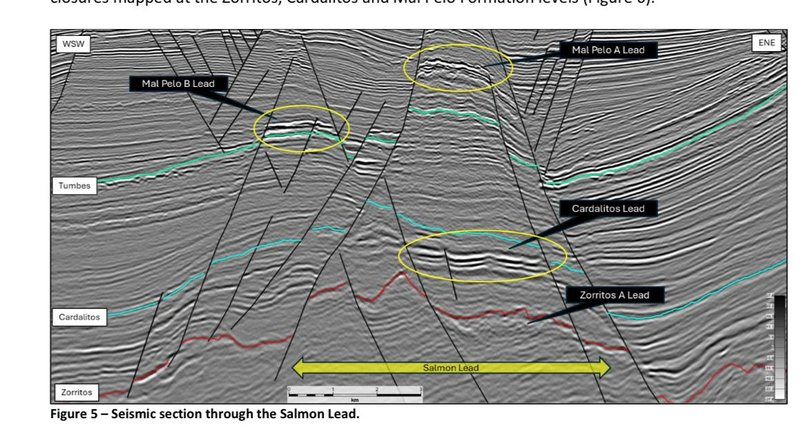

CND has recently revealed that their large Peruvian offshore oil and gas project has a new priority target on its 4,858km2 of ground.

CND already has a 404 Bcf contingent and 2.2 trillion cubic feet prospective resource at its Piedra Redonda discovery.

Things are shaping up nicely, and it was good to hear from Ricardo that the Peruvian government is very interested in supporting the domestic hydrocarbon industry.

Looking at the seismic, Ricardo showed how the new Salmon target has the potential for a multiple stacked target scenario:

Multiple stacked targets are good as it gives drilling multiple “bites at the cherry” - we’ve had success with these types of targets before.

Read our CND Investment Memo here

Emyria (ASX:EMD)

Finally, we made a trip to the Empax centre which is the clinic that our psychedelic assisted therapy Investment Emyria (ASX:EMD) has recently acquired.

It’s a state of the art facility and EMD Managing Director Michael Winlo was kind enough to give us a tour.

Of particular note to us, was the demonstration of EMD’s AI generated music which provides patients with the right music at the right time to elicit the right assisted therapy experience.

EMD is treating patients with serious PTSD conditions, and PTSD is a condition which is characterised by a close association with extremely painful memories, as well as causing short and long term memory loss as well (Source).

There are over 1 million people with PTSD in Australia (Source).

And given recent research that music and memory are very closely linked (and can help with Alzheimer’s - Source), we think EMD’s AI generated music could have a profound beneficial effect on what we hope is a growing number of patients.

Read our EMD Investment Memo here

What we wrote about this week 🧬 🦉 🏹

Elixir Energy (ASX:EXR)

Elixir Energy (ASX:EXR) has resumed flow testing at its Daydream-2 well in Queensland, aiming to confirm commercial gas flow rates.

After discovering conventional, free-flowing gas earlier this year, the company is now well-funded following a $6.5M raise.

Success could attract interest from larger gas producers and position EXR to help address Australia’s east coast gas crisis.

Read: ⛽ EXR - back on site flow testing - results in coming weeks?

Our New Investment - St George Mining (ASX:SGQ)

St George Mining Ltd (ASX:SGQ) has acquired a niobium and rare earths project near the world’s largest niobium mine in Brazil.

Read about why we Invested in SGQ, what we want the company to deliver next and why we want to be leveraged to the niobium and rare earth thematic.

Read: ⛏️ Our New Investment is St George Mining Ltd (ASX: SGQ) (nextinvestors.com)

Heavy Minerals (ASX:HVY)

We invested in Heavy Minerals (ASX:HVY) at 10c over a year ago.

HVY recently completed a $2.12M royalty sale to fund its Pre-Feasibility Study for a garnet project in WA, a material with rising demand due to industrial shifts.

The project, valued at $253M in its 2022 Scoping Study, is now financially secured, positioning HVY to progress its PFS and potentially attract major financiers, as production is expected by 2026.

Read: ⛏️ $6M Capped HVY Completes $2.12M Royalty Funding Round

Sarytogan Graphite (ASX:SGA)

Sarytogan Graphite (ASX:SGA) secured a $5M investment from the European Bank for Reconstruction and Development (EBRD) at 16c per share, giving the bank a 17.36% stake.

This investment, at a premium to SGA’s last close, signifies strong external validation for SGA's giant graphite project in Kazakhstan.

The upcoming Pre-Feasibility Study (PFS), due by September 2024, will reveal the project's economics, crucial for future development.

As a strategic resource for European battery supply chains, this backing enhances SGA’s prospects, positioning it as a key player in the region’s critical minerals strategy.

Read: ⛏️ SGA seals $5M funding injection from EU bank - PFS “imminent”

Quick Takes 🗣️

CND ranks new targets in offshore Peru

MAN gets US$1M Department Of Energy grant

GGE secures drill permits for US helium project

SS1 silver paste technical assessment is underway

ALA’s Positive Pre-IND FDA Meeting

GUE starts uranium drilling program

EXR provides updates on their Daydream-2 Operations

Kuniko reveals new EM Conductors

Macro News - What we are reading & listening 📰

Biotech:

Nvidia, Pfizer lead $80 mln funding for Israeli medical AI tech firm CytoReason (Reuters)

- CytoReason raised $80M with Nvidia, Pfizer, and others to expand its AI disease models and open a Cambridge office.

- Pfizer's partnership with CytoReason includes a potential $110M investment and aims to enhance drug development using AI.

Gold:

Soaring Prices Have Australian Gold Bugs Expecting M&A Splurge (Bloomberg)

- Australia's gold industry anticipates increased M&A activity, with smaller miners targeted due to low exploration and high costs.

- Rising gold prices and strong market conditions are spurring interest, despite a global decline in gold M&A deals.

Joe Lowry’s thoughts on the state of Lithium:

Podcasts:

Lithium-ion Rocks!: E114: Rational Optimism. Lithium Royalty Corp's Ernie Ortiz on Apple Podcasts

Money of Mine: Everything Rare Earths with Mike Bevan (this one was really good to listen to if you want to learn more about Rare Earths projects - in particular SGQ’s newest acquisition).

Developing cancer cures through the ASX | going public with Leslie Chong and Paul

Hopper (A great podcast on how the small cap asx biotech arena operates)

How exquisite timing helped Kerry Harmani forge a fortune (one of the great modern day mining success stories - Kerry Harmanis talks about the journey from ASX small cap to the multi billion dollar sale of Jubilee Mines)

Have a great weekend,

Next Investors

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.