Managing a market crash - lessons from March 2020

Published 25-SEP-2021 12:00 P.M.

|

14 minute read

Earlier this week the mainstream news had everyone worried that Evergrande’s default and its ripple effects in the global economy might be the start of another market crash.

Evergrande is a giant Chinese property developer and is at risk of defaulting on some pretty big loans. Over the last 48 hours the Chinese government is reported to have stepped in to shore things up.

After last weekend’s fearful media reports on the situation, Monday was a worry — all we could see was red in our portfolio. Was this the start of a crash or market correction?

We hold long term positions in companies we have researched and believe in, so we continue to hold.

Tuesday morning looked like further beginnings of a market crash, but around midday an army of buyers swarmed in from the sidelines and small cap stocks finished mostly green.

Towards the end of the week mainstream media was reporting that China was taking measures to stabilise Evergrande and sentiment seems to have calmed down for now. Was it a blip? Will there be more to this story? Highly likely and we will be watching with interest.

For now, many seem to be back to thinking more about commodity supercycles and demand surges for battery materials to power the global switch to clean energy.

So why did everyone get so worried and what drove the panic selling?

Many people remember previous market crashes and want to get out first before a crash happens, which can cause a rush of selling when there is even a sniff of a potential crash, most times it’s a false alarm.

Myself (Damian) and Jason (co-founders of Next Investors) are now in our late 30’s — we have seen just three big market crashes during our lifetime.

We were in highschool during 1999 just before the “tech wreck” where the technology bubble burst. We mostly watched that one from the sidelines aside from a couple of questionable small caps I was holding at the time that got pretty beaten up.

The global financial crisis (GFC) happened in mid 2007 triggered by the Lehman Brothers investment bank collapse and “collateralised debt obligations”. I was in my first day job after uni but was actively investing in my spare time. I thought it would be a good idea to buy the dip on some blue chips after the market first started crashing... using a margin loan... and you guessed it, the market just kept on dipping... by another 40%. Another lesson learned.

Fast forward 10 years, and while not a well known “crash”, special mention goes to 2017 and 2018, which were two very slow years in the Australian small cap market. Early stage resources stank, NOBODY cared about small cap stocks and nothing was going up (even though the broader market was generally fine).

During 2019, we launched our Next Investors portfolio model and made our first investments in WHK, EXR, TMR and VUL.

The COVID-19 market crash came in February 2020. We were one year into our portfolio model and we had every cent invested in the small cap market. In addition to investing, our business takes it’s fees in stock in the companies we believe in, so you can imagine how terrifying it was to have all our cash tied up in the small cap market and seeing the COVID crash halve our portfolio value in a couple of days, and then more as the broader market fell by over 39% in just four weeks...

We held on to every single position in our portfolio during the March 2020 crash.

We certainly DO NOT recommend anyone doing this, but it was the strategy we adopted at the time (you need a strategy that works for your financial situation and risk profile). This could have been a terrible idea and was nerve-wracking at the time, but we really believed in each of our investments and fortunately the market came back strong over the next 18 months.

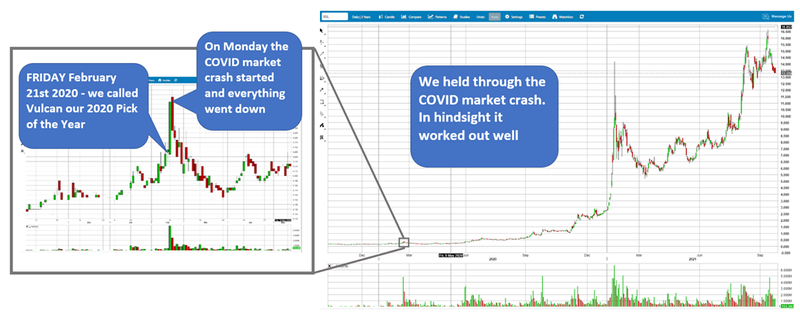

How is this for bad timing for a market crash: We called VUL (our best investment to date) as our top Pick of The Year for 2020 on Friday Feb 21st - LITERALLY the next trading day on Monday 24th Feb 2020 the COVID market crash started.

We hate to think if we had panic sold given what a life changing investment VUL has been for us.

We still think the best is yet to come from VUL and expect it to quickly digest the current $13.50 placement now that it is in the ASX 300.

Right now we are very comfortable to hold long term positions in all our portfolio stocks. We back the management, the projects and believe in the long term investment themes.

Most of our companies have recently successfully completed a significant capital raise and are well funded for the medium term, especially EXR, VUL, LCL, PRL, DXB, KNI, GAL, 88E, GTR, IVZ, PFE, BPM - most others have revenue and/or cash at bank so should also able to weather any market storms if they do come along.

In general, some investors will jump ship at the first sign of trouble or sniff of a crash/correction. If you feel the need to pull out of an investment when you think the market might go down you probably have too much invested. Remember that small cap stocks are risky and only invest what you can afford to lose.

Also always remember when investing in the small cap market, if you are a long term investor and are sitting on a big paper profit in one of your positions and the market is hot, stop and think: is it a good idea to sell 5% to 10% of the position just in case there is a crash in the future? And put some of that cash away for a rainy day? See our ebook for more on our investment strategy.

So in summary, some people panic sold this week anticipating a crash, but the week ended with the small cap market feeling positive again. Let’s see what next week will bring.

Bored during the weekend when the market is closed?

To get your stock market fix over the weekend check out “Reminiscences of a Stock Operator” by Edwin Lefevre - first published in 1923 it’s an account of the life of a young man who starts working in the stock market who provides his insights into trading and speculation as he learns. There are many stock market lessons shared in this book that still 100% apply today.

Our key takeaway is that while technology has improved, human psychology in investing and the stock market hasn’t changed in 100 years. Except today we are speculating on battery metals and green energy, instead of railroads, oil, industrialisation, electricity into homes and “automobiles”.

Everything you see in the markets has happened before and will happen again.

Full audiobook version can be listened to on youtube here

📰 This week on Next Investors

Our telco investment Vonex (ASX:VN8) provided an update on the integration of its latest and largest acquisition — the $31M Direct Business purchased from MNF Group saying that the integration is progressing well.

The new division has helped increase monthly retail/SME customer billings by more than 185% from a year ago and has substantially grown VN8’s customer base and channel partner network. It has also seen VN8 tick off two key milestones that we track on our investment journey.

We added VN8 to our portfolio 12 months ago as our first and only small cap telco holding, gaining exposure to a sector that we viewed as crucial as businesses adjusted to the new pandemic remote work lifestyle. We were also fans of VN8’s aggressive acquisition strategy, which has now netted three value-adding businesses in just 18 months. And we suspect that VN8 may eventually be acquired by a big telco once it reaches a certain size.

📰 Vonex Integrates $31M Direct Business into its Operations

After the success of 88 Energy’s (ASX:88E) Merlin-1 exploration well at its Project Peregrine on Alaska’s North Slope earlier this year, where light oil was detected across three horizons, 88E is preparing to drill a follow up well to get a better understanding of just how much oil it could be sitting on.

Having recently improved its balance sheet via a $24M capital raise at 2.8¢, 88E is preparing to drill the follow-up Merlin-2 appraisal well in the upcoming Alaskan winter drilling season with rig selection and drill permitting now underway.

The Merlin-2 well is targeting 652 million barrels of oil after Merlin-1 demonstrated the presence of an active hydrocarbon system of enormous potential. And being an appraisal well, Merlin-2 has a much higher geological chance of success than the initial exploration well.

During the drilling of Merlin-1 and whilst waiting for a result, wild speculation rapidly drove 88E’s share price from 0.8¢ up to as high as 9.6¢, before it just as quickly fell back to 2.5¢ (still a healthy gain from 88E’s pre-drill share price).

We are hoping the Merlin sequel can be better than the original - fingers crossed. Of course this is still early stage oil exploration - so no guarantees.

📰 88E’s drilling ‘sequel’ to deliver a blockbuster result?

🗣️ Quick takes on key portfolio company events this week:

We saw another busy Monday this week for our portfolio companies with announcements from VUL, ONE, PUR, BPM, and LCL.

Vulcan Energy Resources (ASX:VUL) was added to the S&P/ASX 300 Index on Monday — a major milestone as it makes the stock attractive to fund managers and large institutional index investors.

VUL also announced the addition of two new communications professionals to the team, one in Germany — ahead of the company’s upcoming listing on the main Frankfurt stock exchange, and one in Australia.

The S&P quarterly index rebalance also saw telehealth and health tech provider, Oneview Healthcare (ASX:ONE), has been added to the ASX all technology index.

ONE — our 2021 Tech Pick of the Year and biggest holding behind VUL and PRL — provides hospital patients with a “virtual care and digital control centre” at their bedside to deliver the best possible patient experience during their stay.

Being added to this index is a big deal for ONE because larger managed funds that can only invest in index companies only or follow indexes can now invest in ONE.

Pursuit Minerals (ASX:PUR) is now actively drilling for platinum group elements, nickel and copper in the Julimar Province of WA.

After completing the first two drill holes of its maiden 1,500m diamond drilling a couple of weeks ago, PUR paused drilling to run downhole EM (DHEM) surveys to get a better idea of what lies beneath.

PUR reported that thanks to those DHEM surveys, it has now more accurately locked in on the location of the EM conductor that its first drill missed it by just 10 metres. The drill rig is now back on site and drilling has recommenced on the revised EM target.

Los Cerros (ASX:LCL) provided an update on its exploration progress at the Quinchia Gold Project in a region of Colombia that’s dotted with many multi-million ounce gold deposits.

LCL has already delivered a number of significant gold hits (including a pretty big porphyry discovery last year) and is now aggressively drilling to determine the extent of the gold contained.

The update included news that its backlog of drilling assay results will soon be cleared, drone magnetic surveys are underway, four rigs are now drilling, and that its IP survey program is being extended.

Following a review of historical information, BPM Minerals (ASX:BPM) announced that it now has “walk up” drill targets at its Claw Gold Project in WA. (A ‘walk up’ target requires no more pre-exploration work before drilling).

The Mt Gibson Project, a 2.1Moz gold project next door to BPM’s Claw Gold Project, was recently acquired by the $800M-capped Capricorn Metals in a $39.6M deal. Capricorn is planning to spend $5M exploring on the project over the next 12 months, including 30,000m of RC and diamond drilling.

This activity next door to BPM’s, and from a much larger player, is a positive sign for the early stage exploration project where BPM is particularly interested in two anomalies, one of which that’s just 1km along strike from the Mt Gibson Project.

BPM is also working towards drilling before Christmas at its Hawkins lead zinc project in WA. This is our “main bet” on BPM alongside a number of “side bet” projects including the Claw Gold Project.

📰 ONE, VUL all grown up... BPM, LCL finding targets. PUR drilling again.

Advanced Human Imaging (ASX:AHI)

We finally got an update late last night on the much anticipated $3.5M Nexus-Vita deal with further delays to the project being announced.

A term sheet was originally signed between AHI and Nexus-Vita in October last year, with the app slated for a January 2021 release.

In February this year, AHI granted an extension to conclude formal agreements. Extensions were granted again in May, then again in June, with the latest update provided yesterday.

The announcement doesn’t specify when investors should expect the app to be released and when AHI will secure the $3.5M. We will reach out to AHI’s management to clarify.

In our other portfolios 🦉 🏹 🧬

🦉 Wise-Owl

On Monday, Food Revolution Group (ASX:FOD) released a market update on consumer demand and distribution growth for its range of Original Juice Black Label, Juice Lab Wellness Shots and Juice Lab Carbonated Beverages.

Three key points grabbed our attention that FOD’s turnaround strategy is progressing in the right direction:

- A new product launch – Carbonated Wellness Cans launched in Coles and Woolworths

- Existing product expansion – Apple juice now sold in Coles and Woolworths under the Original Black Label brand

- Expanded product distribution – Coles increase Wellness Shots distribution from 477 stores to over 1000 stores nationally

While the stock has been trading at all time lows recently, we think that the business is in the best shape it has been in the last two years and hope that the market will soon start to catch up on this.

📰 Carbonated Wellness Cans Launched as FOD Expands into Apple Juice

Bod Australia (ASX:BDA) has entered into an agreement to undertake a Phase IIB clinical trial with Australia’s leading respiratory and sleep institute, the Woolcock Institute, on its new CBD product to treat insomnia.

Since the TGA’s December 2020 landmark decision to allow CBD products to be purchased as over-the-counter treatments at pharmacies, there are still no TGA-approved CBD products that can be prescribed by pharmacists.

This presents a huge opportunity for BDA — which is one of only two companies undertaking clinical studies to evaluate the efficacy of CBD on sleep disturbance — in this new $250M over the counter market.

In addition to this opportunity, we like that BDA is already generating decent and growing revenues. Another point of difference is its established relationship with H&H and Swisse Wellness.

📰 ASX:BDA Cannabidiol (Cannabis) Product to Treat Insomnia

🏹 Catalyst Hunter

Latin Resources (ASX:LRS) reported that it has adopted a universal Environmental, Social, and Governance (ESG) framework to measure and report on its ESG performance.

LRS will comply with all relevant laws and regulations regarding health, safety, environment and community impacts, aiming to meet and exceed the World Economic Forum’s 21 core ESG metrics and disclosures.

This comes as the company is progressing a strategic review of its portfolio, with an increasing focus on exploring for and developing commodities that have a positive environmental impact and “developing minerals to provide the planet with environmentally sustainable products”. This includes an increased focus on exploration at its South American lithium project, as well as ongoing exploration at its halloysite project in WA.

📰 LRS strengthens lithium story with commitment to ESG

🧬 Finfeed

The first investment in our small cap biotech portfolio Dimerix Ltd (ASX:DXB) announced that the main drug regulator in India has recommended approval for its Phase 3 clinical trials for its COVID-19 treatment, specifically for patients with respiratory complications.

The study will evaluate whether DXB’s anti-inflammatory drug DMX-200 will be able to treat patients diagnosed with COVID-19 who are intended for hospital admission.

This was the final regulatory approval required to commence recruitment for the study and the first patient (of a planned 600 in total) expected to be dosed in the next few weeks.

DXB recently raised $20M and is now fully funded to deliver its Phase 3 trials for FSGS (a rare kidney disease). While we wait for the necessary approvals for that study, we will be watching the progress and results of this COVID-19 “side-bet”.

We’ll provide an in depth update to the Next Investors list on Monday.

📰 DXB announces approval for Phase III COVID-19 trials in India

🌎 Mainstream Media:

Natural Gas (EXR)

Natural-gas prices are spiking around the world (The Economist)

This video provides a great explanation on the energy crisis in The UK and why the Natural Gas prices are spiking: watch the video.

Battery Metals (KNI, VUL, EMN)

Mercedes-Benz Plans $8.2 Billion European Battery Venture (Bloomberg)

Hydrogen (PRL)

Mining Billionaire Spearheads Global Green Hydrogen Push (Bloomberg)

Alaskan Oil (88E)

Analysts weigh in on Pikka after merger (Alaska Journal)

Commodities

There’s a Fortune to Be Made in the Obscure Metals Behind Clean Power (Bloomberg)

Have a great weekend,

Next Investors

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.