We just invested - Extra Exposure to Elephant Energy Explorer

Our 2020 Energy Pick of the Year Invictus Energy (ASX:IVZ) is chasing the largest, seismically defined, undrilled structure onshore Africa.

We first invested in IVZ in September 2020 at 4.9 cents. We maintain our full initial position and have just increased our holding at 11c in the placement.

We had today’s commentary about IVZ all written and ready to send, letting you know we have “Doubled Down”... business as usual.

But IVZ has just gone into an unexpected halt and we think we know why....

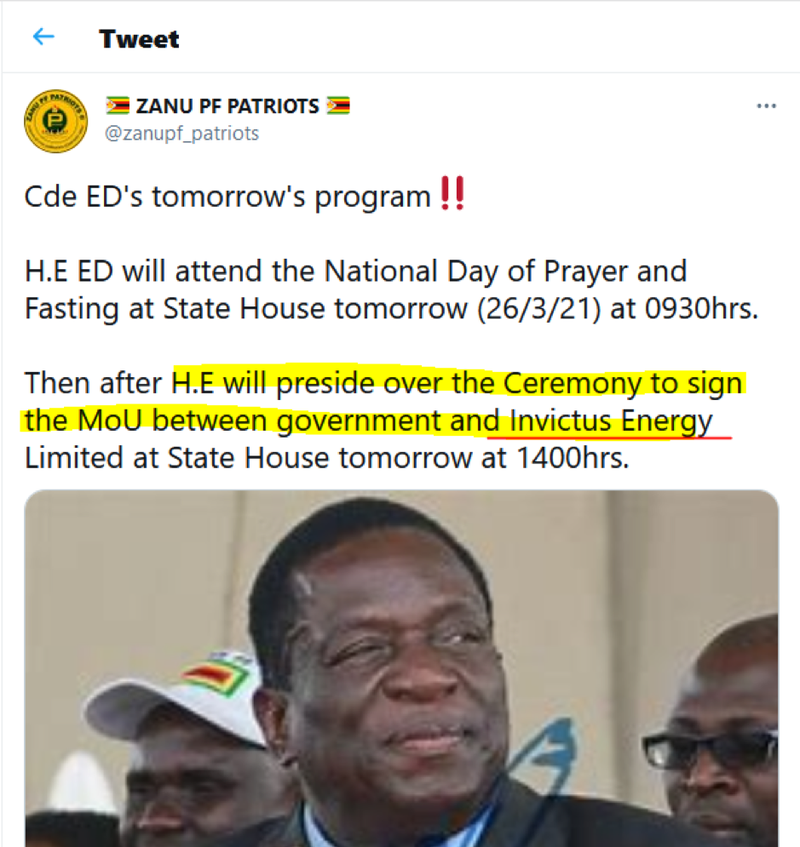

Check out this tweet Zthat has been doing the rounds - showing the Zimbabwe President’s meeting schedule today... including to “preside over the Ceremony to sign the MoU between government and Invictus Energy”.

We have no idea if this info is credible or real, but we are pretty sure this is why IVZ has just gone into a trading halt...

So what happens next? One of two things:

- The tweet is true and the IVZ will have finally signed the long awaited Production Sharing Contract with the Zimbabwean government - a huge milestone and catalyst!

- The tweet is false, and IVZ resumes trading as normal.

Either way, we will be watching when IVZ opens again...

IVZ is one of only three oil and gas exploration stocks in our portfolio.

All of them have run well recently as you can see below:

- EXR - We entered our 2019 energy pick of the year at 3.9c - it is now trading 37c.

- 88E - We invested in 88E in July 2020 at 0.6c and then doubled our holdings in Sept 2020 in the placement. 88E is currently trading at 3.6c.

- IVZ was our2020 energy pick of the year. We first entered at 3.9c and it is now at 15c.

Even though IVZ has just been put into a halt, we thought we may as well publish our commentary anyway...

This week, IVZ raised $8M at 11c per share - the new shares will be on the market on the 30th March.

While IVZ has had a pretty good run over the last few months, we are still holding our full initial position and have just invested again in the placement.

With drilling still a while away, we think there is upside from here especially with several near term catalysts to come including:

- Signing of PSC (as leaked in tweet, might not be real)

- Finalisation of farm out

- 2D seismic campaign to refine drill targets...

... And then the big one:

IVZ to drill the largest seismically defined, undrilled structure onshore Africa.

The share price of oil and gas explorers usually run in the lead up to big drilling events - when speculation of a ‘company making’ result is rife.

We first invested in IVZ when drilling was still AT LEAST 12 months away and speculation of a great result was yet to work its way into the share price.

Regular readers know our strategy for early stage explorers is to:

- Invest long before the drilling starts

- Patiently hold for the long term and take some profit before the results come in

- Leave a free carried holding in place to ride the result - hopefully a big one.

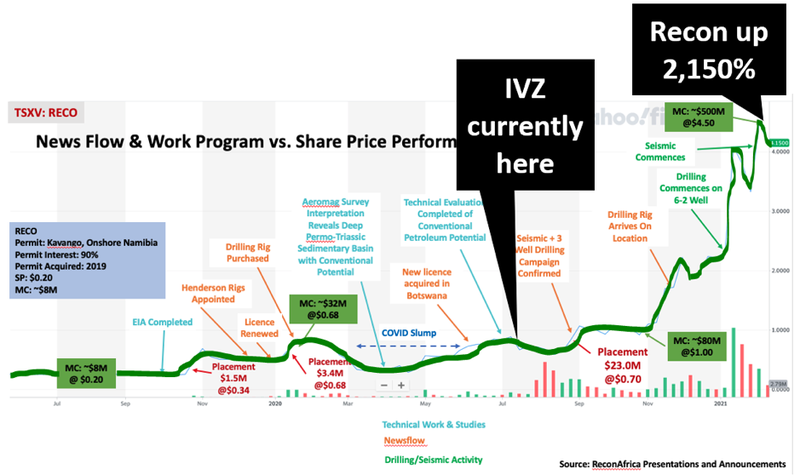

We hope IVZ can repeat the 2,150% gains made in 12 months by nearby peer ReconAfrica, which is currently drilling in Namibia.

In summary, we have had great success with EXR and 88E by investing early and holding in the lead up to drilling as speculation on a positive result takes hold.

IVZ is still a while away from its drill so we hope it has room to run (like its peer ReconAfrica has).

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.