Up 2,150% - Will IVZ Repeat this Run?

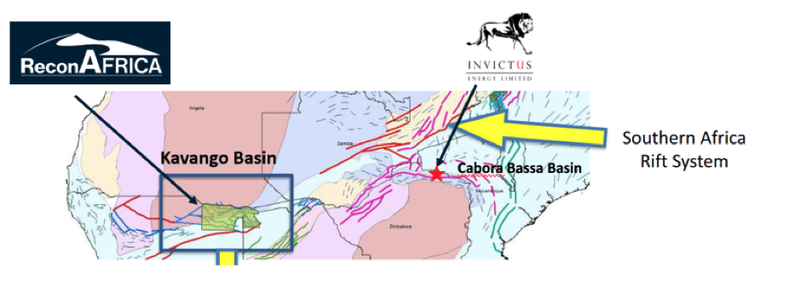

Our 2020 Energy Pick of the Year Invictus Energy (ASX:IVZ) plans to drill the largest undrilled onshore gas prospect in Zimbabwe Africa this year.

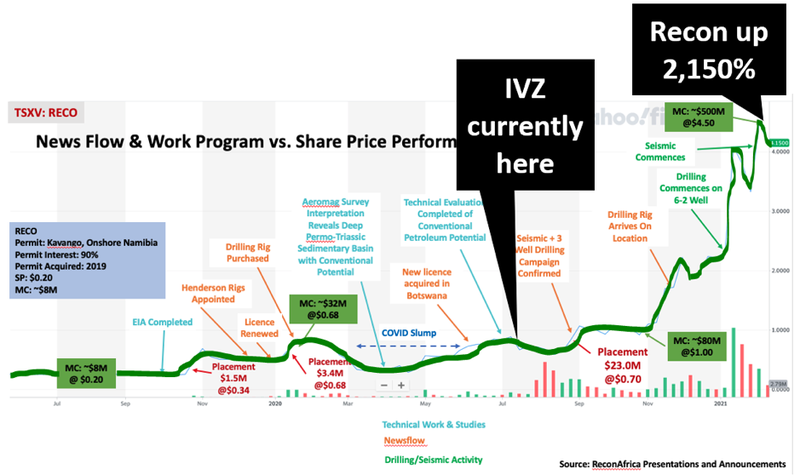

We think IVZ can repeat the 2,150% gains made in 12 months by nearby peer ReconAfrica, which is currently drilling in Namibia.

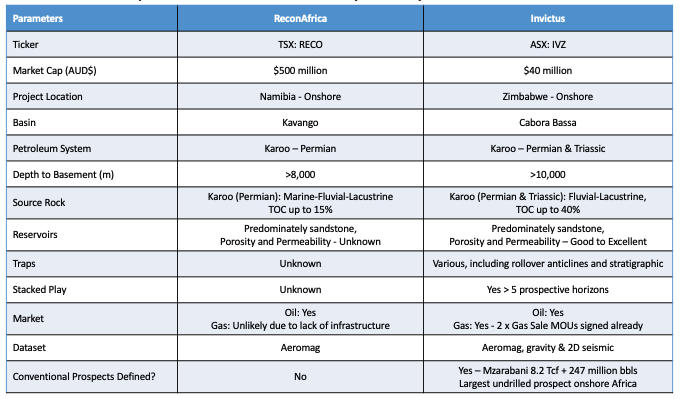

Recon is a few months ahead of IVZ and is capped at $500M... IVZ is currently capped at just $40M and we think it is technically better (we’ll show why in a comparison table below).

Full details of why we invested in IVZ in September 2020 are in our article IVZ: Our Top Energy Pick of 2020.

Compared to ReconAfrica, which has grown to a $500M market cap in recent months, you can see IVZ is earlier in its journey below.

IVZ is very close to a large potential value uplift, given drilling is around the corner:

For any technical oil and gas boffins out there, here is a side by side comparison showing why IVZ is better technically:

The good news for IVZ is that the more success ReconAfrica has, the better chance IVZ has of finding an offtake partner before it drills.

Alternatively, a takeover could become apparent before it drills at all.

The next IVZ catalysts to watch out for ahead of drilling are:

- Conclusion of the non-binding farm-in offer IVZ received late last year - any week now...

- Seismic acquisition to begin - likely April.

For all our commentary and research in our investment in IVZ, check out our IVZ company page:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.