DXB Announces Success on Interim Phase III Trial - China and US next for licensing deal?

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 1,322,332 DXB shares and 1,278,334 DXB options. The Company has been engaged by DXB to share our commentary on the progress of our Investment in DXB over time.

Our 2021 Biotech Pick of the Year Dimerix (ASX:DXB), just announced success on its interim Phase III clinical trial for rare kidney disease, FSGS.

The interim analysis is a binary pass/fail point in the trial.

And DXB has just announced their treatment has SUCCESSFULLY PASSED.

By passing, DXB has shown an independent body that DXB’s drug is working better than placebo (potentially) to a statistically significant and clinically meaningful degree.

DXB has now officially passed part one of its phase III trial.

So what happens next?

With today’s success, DXB has proven it can move to part two of its phase III trial - more patients, in more locations, including China.

A phase III trial is the final phase of clinical research required by regulatory agencies before a new drug or treatment can be approved for use in patients.

Phase III trials involve large numbers of patients, often hundreds or thousands, and are designed to confirm the efficacy and safety of the drug or treatment.

If DXB is successful AGAIN on the second part of this phase III trial, then the next stage is commercialisation of their treatment.

To fund this next set of activities, DXB went into a trading halt to raise $20M before the stock could trade on the news.

The placement price was 30c - the same as the last trade, and 29.2% premium to the 30 day VWAP.

Apparently the placement was heavily oversubscribed - anecdotally, we bid $300k and got scaled back to $50k.

Next key DXB catalyst?

First thing we want to see is price discovery post the successful interim trial result, and strengthened balance sheet, when DXB recommences trading today.

We also want to see DXB announce another licensing agreement, this time with the giant markets in the US or China.

Like any commercial deal - timing on when this might happen is unclear.

However we do know DXB will now be coming to those negotiations with a stronger cash position AND stronger clinical data.

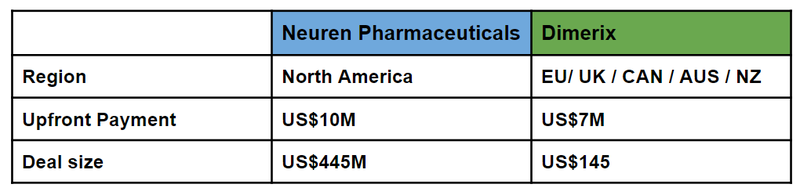

Four months ago, DXB announced a $230M regional licensing deal with Advanz Pharma.

(which included a $10M upfront payment to DXB that has been paid, the rest of the payments are on successful commercialisation including royalties)

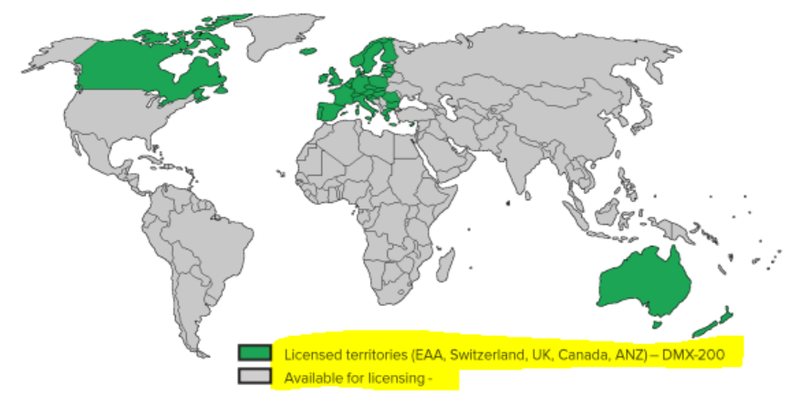

The total deal is worth up to $230M BUT only covers Europe, Switzerland, UK, Canada, Australia and New Zealand.

Only about 20% of the global population.

So plenty more countries that DXB could announce a deal with soon, especially off the back of this successful interim phase III trial news.

Investor webinar on today at 10:30AM AEDT

We will be tuning in. Here is the link for those who want to listen in:

We all want our medicines to work - and yesterday’s interim analysis points to this being the case for DXB’s treatment.

DXB’s treatment performed better than the placebo in a much larger population than its Phase II study.

As a result, by passing the interim analysis, it could give big pharma companies the confidence to open the cheque book for DXB’s treatment.

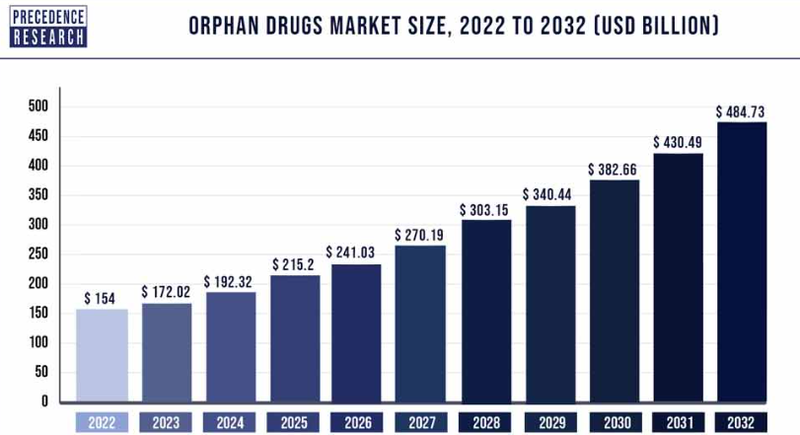

FSGS is classified as an orphan disease and we know that treatments for orphan diseases can bring in particularly lucrative licensing deals.

Orphan designation is used by regulators to incentivize companies to develop new drugs for rare diseases. DXB has this status in the US, EU and UK.

Average orphan drug pricing was US$84,000 per year in 2018. This is actually cheaper than the US$120,000 per year for other rare kidney treatments...

The market for orphan drugs is set for further rapid growth over the next decade:

(Source)

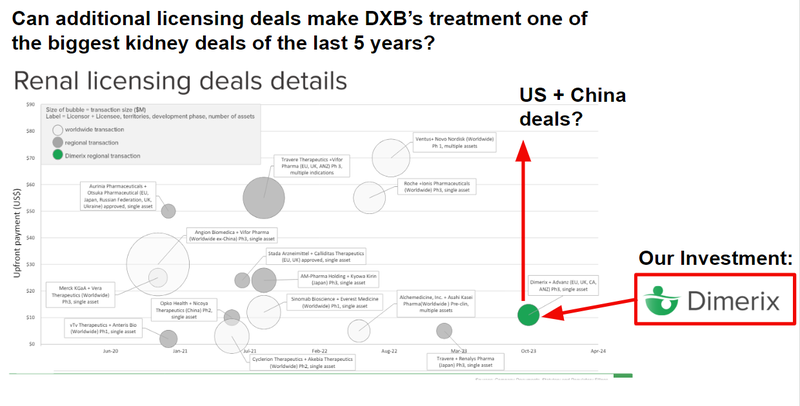

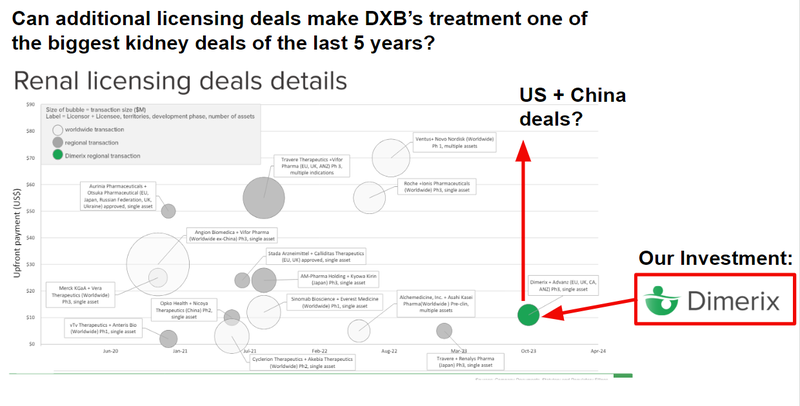

And we also know that kidney disease deals have been attracting increasingly larger sums of capital:

It all adds up to a big six months for DXB to look forward to, and who knows?

Maybe the second major licensing deal that the company has guided the market to expect will come faster off the back of DXB’s successful interim phase III results.

Our DXB Investment

We first Invested in DXB at 20c back in August 2021.

We then increased our position in the 8c placement in May 2023.

We took some off the table in the lead up to the interim results which is part of our risk management strategy, but as always retained a material position into the result.

And the result was a success.

DXB decided to do a quick cap raise before the stock could even trade.

Off the back of the successful interim phase III trial result, we put in a $300k bid into the current placement...

and got scaled back to $50k.

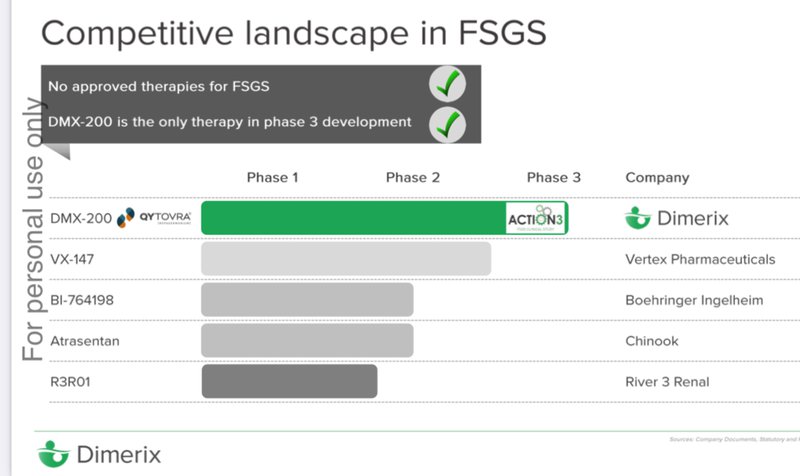

A big part of why we continue to hold onto our DXB Investment is because it's the most advanced biotech in the world when it comes to rare kidney disease, FSGS.

At the moment DXB has the only therapy in phase III trials anywhere in the world.

AND there is no other current approved therapy...

Having no other approved therapies on the market means that IF DXB has success with its phase 3 trial it can get its therapy to market quickly under an “orphan drug designation”.

Orphan drug status can be a game changer because, as we noted above, particularly in the US market, there are major incentives built into the regime around exclusivity and marketing.

To encourage the development of treatments of rare diseases, governments provide generous incentives to companies with orphan drug designation:

- Fast Tracked Approvals: This means that the company will not always need to undertake the entirety of a Phase III clinical trial in order to get the product to market.

- Market Exclusivity: Once the US FDA grants orphan drug designation to a drug, it also gets seven years of market exclusivity.

- Orphan drug pricing: Orphan drugs are priced at a point that encourages drug developers to make treatments.

So being designated as an Orphan drug means a fast to market pathway to approvals and high incentive prices once in the market...

🎓Read more about what orphan drugs are here: Orphan Drugs Explained

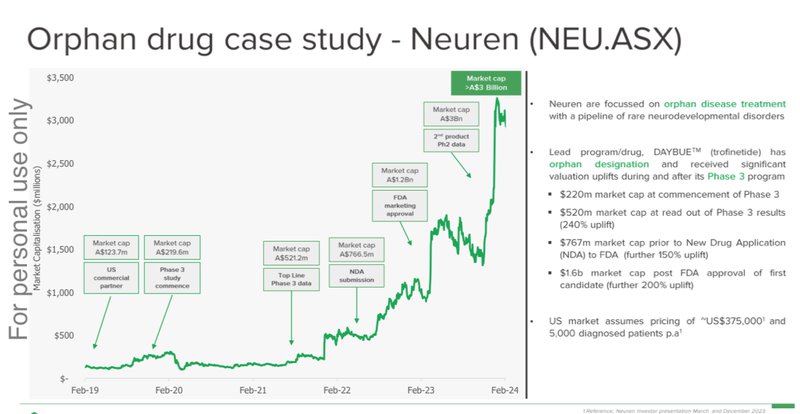

An ASX listed $2.6BN orphan drug success story - Neuren Pharma

Like our Investment DXB, Neuren Pharmaceuticals also went after an orphan drug designation and quickly became an ASX biotech darling after a long dormant period.

Neuren spent a long period trading in the ~$1 range before positive Phase 3 results were announced, subsequently Neuren reached as high as $25 as the story built momentum.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

DXB is looking to do the same thing - prove its treatment works with the Phase 3 trial and then quickly commercialise it under an orphan drug designation.

The only difference in strategy so far has been that DXB went and signed a “regional license” first whereas Neuren went directly for the US market.

What this shows is the upside potential still for DXB to licence into the US market.

As we said in our last DXB note:

“We think that DXB’s deal paves the way for more deals to come, particularly in the US and China - which we expect to trickle through after data outcomes are announced and the science de-risked.”

Well that science has now been further de-risked in a major way, following yesterday’s announcement.

What we want to see next from DXB

For the next ~12-18 months, DXB’s clinical goals will be focused on completing the phase III trial.

In parallel, the next major catalyst we think could re-rate DXB’s share price higher will be a licensing deal for the US and/or China.

At the moment DXB has a single regional licensing deal with Advanz Pharma.

The deal is worth up to $230M BUT only covers Europe, Switzerland, UK, Canada, Australia and New Zealand. A fraction of the global population.

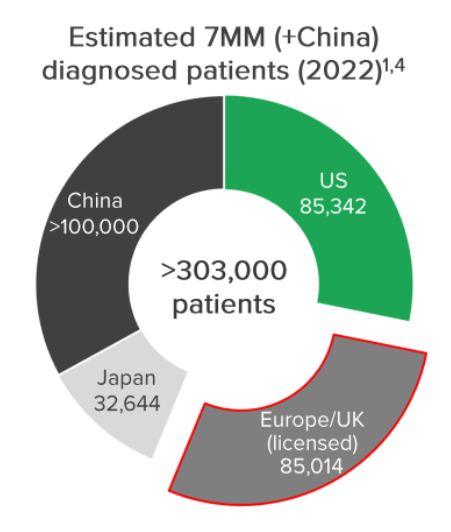

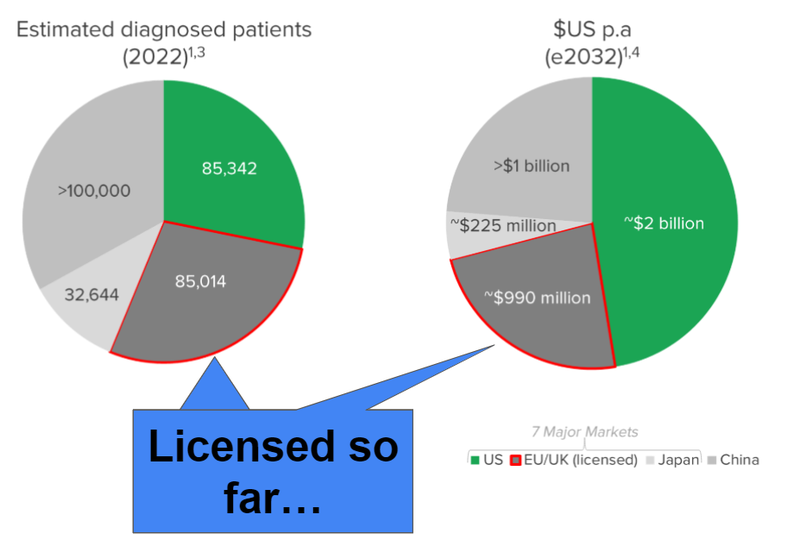

Those markets cover less than 30% of the global FSGS market opportunity.

For context - there are ~85,000 patients across those markets whereas there are >303,000 worldwide.

The two biggest markets - US and China - is where the game changing deal could come from.

AND usually the biggest deals for these type therapies get signed when the licensing discussions are on a worldwide basis.

The image below gives a decent snapshot of deal sizes and upfront payments - the white circles are the ones that include the US and sometimes China.

Managing directors “deal making" CV

DXB CEO and Managing Director Nina Webster joined DXB in 2018, bringing thirty years of experience in the pharmaceutical industry.

Over those 30+ years, Nina built up an impressive track record of large, commercial biotech deals.

She was previously the Commercial Director for Acrux Limited (ASX: ACR), where she led multiple commercial transactions with global pharma companies.

Collectively the deals Nina was involved in with Acrux netted over $300M in revenue.

Prior to Acrux, Nina was the Director of Commercialisation and Intellectual Property for Immuron Limited (ASX: IMC) and spent six years in new product development with Wyeth Pharmaceuticals in the UK.

Wyeth was eventually purchased by Pfizer in 2009 for US$68BN.

We are backing Nina’s deal making nous to deliver for DXB shareholders via additional licensing deals for its treatment across the globe, off the back of the first deal signed last year.

A look at the deal DXB already signed

We wrote a detailed note on DXB’s $230M commercialisation deal when it was announced in October last year.

You can read it in full here.

Key terms of the deal DXB signed with Advanz include:

- Upfront payment of A$10.8M (payment within 30 days) - this has been received by DXB ✅

- Earn up to another ~$220M in royalty payments on net sales

- Exclusive partnership in Europe, UK, Canada, Australia and New Zealand

- DXB retains the rights to commercialise its products in other jurisdictions (including China and the holy grail - the US).

- DXB retains the rights to its other treatments (including Diabetic Kidney Disease)

- Royalty in the mid-teens - 20%

The next 12 months for DXB

Phase 3 clinical trial 🔄

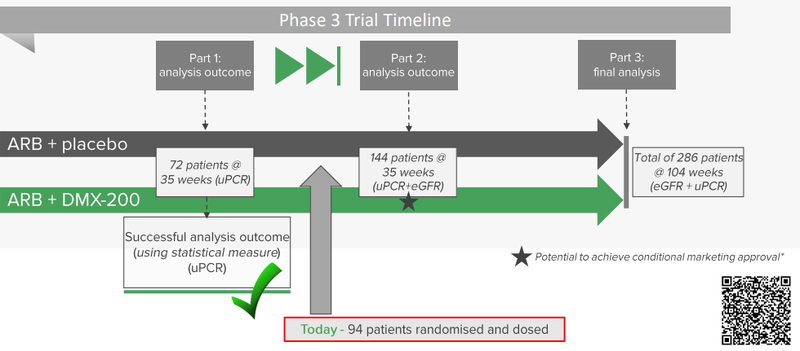

Now DXB will continue to recruit patients until it gets to 144 patients.

At the moment DXB has managed to recruit 94 patients.

After the first 144 patients complete ~35 weeks of treatment DXB will be in a position to put out its second batch of clinical trial data.

Given the patients need to be treated for at least 35 weeks and the time it would take to recruit the full set of 144 patients, we expect this to take at least 12 months.

in ~12 months time, off the back of what we hope are positive clinical trial results we hope to see DXB achieve our Big Bet which is as follows:

Our DXB Big Bet

“DXB re-rates 10x by successfully commercialising its drug through Phase-III clinical trials”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our DXB Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

We’ve been Invested in DXB for 3 years... here’s ALL our past coverage

DXB signs $230M Commercialisation Deal for ~20% of the global market

US$3.5BN kidney deal puts DXB’s current valuation in perspective

What could commercialisation actually look like for DXB?

DXB completes Phase III patient recruitment for crucial interim analysis

Pre-result build up? The “big catalyst” in 2023

Potential new use of DXB’s drug in US$2.5 Billion market

DXB Recruits First Patient, Gets FDA IND Approval

DXB Actively Recruiting Patients Across the Globe, First Dosing Soon

DXB: Making Strong Progress on “Main Bet,” Side Bet #2 Paused

Earlier than Expected - DXB Gets First Regulatory Approval in Europe.

DXB kidney disease treatment Phase III trial officially begins

DXB to run a Phase III COVID-19 Study in Australia

DXB announces approval for Phase III COVID-19 trials

DXB announces approval for Phase III COVID-19 trials in India

DXB kicks off Phase 3 clinical trials - Ethics approval lodged

Introducing: Our Biotech Pick of the Year 2021

🎓 Learn more about our Biotech Investment Strategy here: How we invest in early stage biotechs

Key risks for DXB

Over the next 12+ months, the key risk hanging over DXB’s head will be “Clinical Trial Outcome” risk...

If DXB fails in its clinical trial, it would be a significant setback for the company and our Investment.

We also think there is now “commercialisation risk” whereby the market may expect the company to sign further licensing deals which the company may not deliver.

If no deals are delivered we think it could have a negative impact on DXB’s share price.

Our DXB Investment Memo

In our DXB Investment Memo you’ll find:

- Our DXB Big Bet

- Key objectives went want to see DXB achieve

- Why we Invested in DXB

- What the key risks to our Investment Thesis are

- Our Investment plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.