Investment Memo:

LCL Resources Ltd

(ASX:LCL)

-

LIVE

Opened: 27-Feb-2023

Shares Held at Open: 8,055,814

What does LCL do?

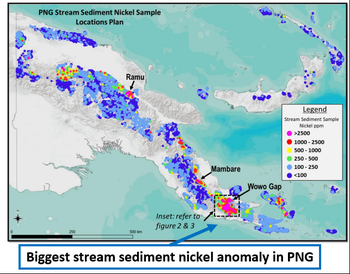

LCL Resources Limited (ASX: LCL) acquired multiple high-grade copper, gold and nickel targets across five project areas in PNG in late-2022. This adds to its 2.6Moz Quinchia Gold Project in Colombia.

The PNG acquisition creates new areas for exploration focus as LCL transitions towards development scenarios for its Colombian gold project.

What is the macro theme?

We think the outlook for battery metals, including copper and nickel, is positive in 2023 and are pleased to see that LCL has added some battery metals exploration exposure to its advanced gold project in Colombia.

Additionally, we expect gold to perform well over the coming year as it remains a safe haven investment and hedge against inflation that has historically outperformed in times of volatility.

Our Big Bet for LCL

LCL to re-rate 1,000% off exploration success on its PNG gold, copper, nickel projects OR from developing its advanced gold project in Colombia.

Why did we invest in LCL?

Management team

We are confident in backing LCL’s Managing Director Jason Stirbinskis, who we have been following for over 3 years. With the acquisition of the PNG assets, LCL gained its in-country geologists — Glenn Twomey and John Dobe — who bring a combined 60 years’ mineral exploration (8 years in PNG in senior roles for Barrick Gold) to LCL as executives.

High potential new projects

Work to date shows some of the highest grade assays we’ve seen. This region of PNG is elephant country — there are a lot of existing discoveries, producing mines, and majors operating. The new projects have multiple drill ready targets with near term drilling planned.

Adds battery metals exposure

Adding to the existing gold project in Colombia, for which LCL is now considering development options, the PNG projects add exposure to two of our favourite investment thematics for 2023: battery metals (copper and nickel) and more gold.

What do we expect LCL to deliver?

Objective #1: Drill the Kusi copper-gold prospect at the Ono Project

LCL has an extensive drilling program planned at the standout target of the PNG assets — the Kusi copper-gold prospect that is part of the Ono Project.

The maiden 3,000m drilling program over ~18 diamond holes is due to commence on schedule in March 2023. This upcoming drilling program is part of a larger Kusi exploration program.

There are three things we want to see from this exploration program:

1. The initial drilling will further test the gold-copper oxide skarn mineralisation within an upper limestone unit that was established from previous drilling, trenching and surface sampling. This will provide confidence in what LCL has on its hands in its target drilling areas.

2. Gauge the potential regional scale. The wider Kusi exploration program will include trenching and mapping to define the extent of the mineralised skarn horizon which occurs within the upper limestone unit and over a total area of approximately 3km x 1.5km. This will help answer the question of just how big is the skarn unit?

3. Gain a better understanding of the central copper porphyry. Drilling and surface work is instrumental in locating the porphyry source.

Objective #2: Drill the Veri Veri prospect, at the Liamu Project (nickel, copper-gold)

The Veri Veri target is prospective for high grade nickel sulphide. LCL says that relatively quick and inexpensive exploration could transform Veri Veri to a target of significance in the battery metals space.

LCL intends to kick off exploration at Veri Veri early this year after the maiden drilling program at Kusi. It will focus on the source of creek float boulders of massive nickel sulphides assaying up to 45.8% nickel with some samples also reporting high gold grades such as 23.4% Ni with 10.6g/t gold.

We want to see LCL commence field work at Veri Veri in H1 2023.

Objective #3: Secure JV/alliances to advance Imou or another PNG target

LCL has an abundance of targets at its PNG projects. While its primary near term focus remains on drill testing the high-grade gold-copper Kusi oxide skarn at the Ono Project, LCL is eager to see advances across multiple targets concurrently. It has specifically acknowledged the significant copper/gold targets across the Liamu, Ubei, Imou and Tauya projects.

In order to advance multiple targets concurrently while its own capital is largely being directed to Kusi, LCL is seeking joint venture partners.

As part of LCL’s strategy to seek joint venture partners, it has a field program planned at the Imou Project for Q2 2023, aiming to enhance the project’s prospectivity and broad appeal.

- We want LCL to commence its planned field program at Imou in Q2 2023.

- We want to see LCL attract a partner to help with additional exploration at Imou, Ubei, or at another of its PNG projects.

Objective #4: Explore development options at Quinchia Gold Project, Colombia

At the 2.6Moz Quinchia Gold Project in Colombia, LCL has transitioned to focus on investigating potential development scenarios, while reducing greenfield exploration activities.

While not the primary focus for LCL over the coming 12 months, we do want to see progress on works that would feed into a Preliminary Economic Assessment (PEA), which would help provide clarity around potential investment returns that development of the Colombian project could deliver.

Exploration risk

LCL is years away from production of its assets, and hence its value is derived from exploration success, which can not be guaranteed.

Capital requirements

LCL is an explorer, not a producer, and so requires continuous funding while it determines the value of its prospects.

Upon completion of its rights issue, LCL will have ~$12M cash that will be predominantly directed to drilling of the Kusi target. In order to progress exploration at its other targets, the company is open to joint venture partners.

As LCL is not generating any revenue, at some point it will likely need to again raise capital when its cash at bank drains. There is no guarantee that capital markets will be conducive at that time.

Underlying commodity risk

LCL is exposed to commodity price risk (in this case nickel, copper, lead, zinc, gold and silver), which depends on macroeconomic factors and demand and supply dynamics of the underlying commodities.

Market sentiment closely correlates with commodity prices, and hence LCL’s valuation will be impacted by commodity prices as well.

Sovereign risk

LCL’s projects are located in the developing nations of Papua New Guinea and Colombia.

There is no guarantee that local authorities and/or communities will favour development of LCL’s prospects, and so could hinder advancement.

LCL says it intends to instil its Colombian-style ESG approach to its PNG presence with modifications sensitive to local dynamics and culture.

However, it remains a jurisdiction with a high level of sovereign risk.

What is our investment plan?

We intend to take up our full entitlement in the LCL March 2023 Rights Issue.

Our strategy is to treat LCL like an exploration company, using the 3.0 cent raise price as a baseline.

If the share price materially increases from 3.0 cents in the lead up to a key drilling event, or on the back of a successful drilling result, we will look to Top Slice our Investment, and Free Carry our position.

Disclosure: Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 8,055,814 LCL shares and staff own 133,250 LCL shares at the time of publishing this memo. The Company has been engaged by LCL to share our commentary on the progress of our Investment in LCL over time.

Investment Memo:

LCL Resources Ltd

(ASX:LCL)

-

CLOSED

Opened: 02-Feb-2022

Closed:

27-Feb-2023

Shares Held at Open:

3,210,000

Shares Held at Close:

8,055,814

Reason Memo Closed:

What does LCL do?

Los Cerros Limited (ASX: LCL) is an exploration company on the hunt for world class gold assets in the emerging global minerals hotspot within Colombia. LCL is aggressively drilling to determine the extent of its flagship project and surrounding areas.

What is the macro theme?

Gold remains a safe haven investment and hedge against inflation, and has historically outperformed in times of volatility (e.g market bubble crash, armed conflicts, pandemics…). Bullish gold market conditions persist, particularly with the go-to response to the pandemic being unprecedented worldwide monetary and fiscal stimulus (ie ripe conditions for sustained inflation and lower interest rates).

[Memo Assessment - 27-Feb-2023]:

Grade = B

Despite lacklustre global share markets last year, the gold price was out of favour throughout most of 2022, although it has rallied in recent months following its September-October 2022 lows.

Longer term, we continue to back gold as a safe haven investment that should outperform in times of economic uncertainty and volatility and act as a hedge against inflation.

Our Big Bet for LCL

LCL to re-rate 1,000% off exploration success on its PNG gold, copper, nickel projects OR from developing its advanced gold project in Colombia.

Why did we invest in LCL?

Potentially a huge gold deposit

It’s all about size. More ounces translates to more value, and LCL has its hands on what appears to be a big (multi-million ounces?) gold discovery that's still growing, down the road from its existing smaller gold deposit. This year LCL intends to exceed its record for drilling, having secured 5 rigs on site, which in turn should lead to a maiden resource estimate [at Tesorito] - corrected on 9 May 2022.

[Memo Assessment - 27-Feb-2023]:

Grade = B

LCL announced a Maiden Mineral Resource Estimate (MRE) (Inferred) of 1.3Moz of gold grading 0.81g/t for the Tesorito Gold Porphyry, growing the total JORC resource to 2.6Moz of gold across the Quinchia project.

The sheer amount of drilling completed by LCL also saw it intersect mineralisation in new target areas aside from its primary focus at Tesorito gold porphyry discovery and the existing resource area of MIraflores.

Potential that their two discovered gold systems are actually connected

Late last year, geophysical surveys confirmed a huge, deep, metallic anomaly (which we’ve affectionately labelled “Jabba the blob” for its size) between LCL’s two most advanced prospects. This year, LCL is drilling Jabba to determine if it hosts a deeper, possible source porphyry deposit that links other known prospects - this could indicate that a much larger goldfield.

[Memo Assessment - 27-Feb-2023]:

Grade = C

Deep drilling didn’t confirm the thesis that two gold systems were connected or find the central porphyry, rather it revealed that one of the gold systems (Miraflores deposit) actually extends significantly deeper than first thought.

A new thesis was developed around Miraflores being significantly deeper, showing potential to double the depth of the existing mineral reserve at Miraflores, so we considered the result to be quite good.

Capital register set for growth

Backed by two of the world’s leading gold investment funds, and with Top-5 largest global gold producer Anglogold Ashanti on the register, LCL has a register with deep pockets and seeking Tier-1 asset discoveries.

[Memo Assessment - 27-Feb-2023]:

Grade = N/A

Substantial holders at 31 December 2021 were Lizeng Pty Ltd (Dr Minlu Fu) (9.11%) & Franklin Resources Inc (5.05%).

AngloGold Ashanti (1.64%).

What do we expect LCL to deliver?

Objective #1: Deliver a maiden JORC resource at its Tesorito gold prospect

Since its discovery in mid-2020, LCL has been drilling its flagship Tesorito prospect, but has yet to find all the limits of the deposit. This suggests a large gold system in place. We anticipate that LCL will continue to drill until at least 3 of the 4 edges are found, before determining the maiden resource estimate (MRE), likely sometime in mid-2022.

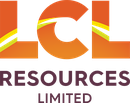

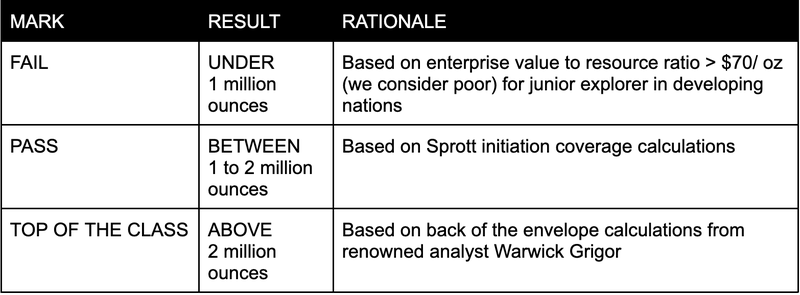

Here is how we will rank the JORC resource estimate result (our opinion only):

Sprott Initiation Coverage

Warwick Grigor Calculations

[Memo Assessment - 27-Feb-2023]:

Grade = A

In March 2022, LCL announced a Maiden Mineral Resource Estimate (MRE) (Inferred) of 1.3Moz of gold grading 0.81g/t for the Tesorito Gold Porphyry.

At first glance, that 1.3Moz earns a very respectable Pass (*with a distinction) from us.

But after running pit optimisations as part of the Resource estimation process, using a US$1,800/ounce gold price, the appropriate cut-off determined was 0.25g/t gold.

Using a 0.25g/t cut-off grade lifts the Resource to 134.3mt grading 0.53g/t gold for a total of 2.3 million ounces of gold — that’s above 2Moz and so earnt our Top of the Class mark.

Objective #2: Test if LCL's two gold systems are connected by drilling in-between them

- LCL suspect that it may have more than just one big deposit on its hands, as there is evidence that the flagship may just be one end of a bigger, regional goldfield

- Drilling is underway to test this, starting with several deep holes into “Jabba”. We anticipate first results by 2Q22. If these results are encouraging, we’d expect further drilling into Jaba to continue throughout the year.

- If the results from Jabba are not promising, we expect LCL to send those drill rigs to fast-track exploration at other advanced prospects nearby

[Memo Assessment - 27-Feb-2023]:

Grade = B

Deep drilling didn’t confirm the thesis that two gold systems were connected, rather it revealed that one of the gold systems (Miraflores deposit) actually extends significantly deeper than first thought.

A new thesis was developed around Miraflores being significantly deeper, showing potential to double the depth of the existing mineral reserve at Miraflores, so we considered the result to be quite good.

Objective #3: Commence scoping studies

Following maiden JORC resource at its Tesorito prospect, and incorporating existing Definitive Feasibility Study at Miraflores and potential ‘nested porphyries’ discoveries, we anticipate LCL to commence a scoping study in 2H22. This is significant as this will provide a clearer indication of what returns could be expected should the flagship be commercialised.

[Memo Assessment - 27-Feb-2023]:

Grade = C

LCL has not yet commenced a Scoping Study at Quinchia. Instead it is undertaking work that could feed into a Preliminary Economic Assessment (PEA), which is similar to a Scoping Study that spells out the business case and the project’s potential profitability. Although a PEA is not a primary focus, with near term drilling at PNG the priority.

A pre-scoping production assessment review was recently completed. Several production scenarios were found to warrant further investigation. Potential production scenarios are being investigated in engineering works to feed into the PEA.

Objective #4: Get some big gold funds on the register

Given that LCL is close to releasing a maiden JORC, we would like to see a strategic raise to bring in a couple more major gold funds, preferable at a much higher share price than the current ~11c. Bringing on more major gold funds (or increased investment from the two gold funds already on the cap table) will underpin the valuation.

[Memo Assessment - 27-Feb-2023]:

Grade = D

We are not aware of any new major gold funds being added to LCL’s shareholder register or increased investment from the existing funds.

Exploration risk

LCL is years away from production of its assets, and hence its value is derived from exploration success, which is not guaranteed to eventuate. Drilling deep in between their gold systems is quite expensive (~$1m per drill hole), and hence if nothing substantial is revealed in the early holes, it is likely that LCL will preserve capital and focus elsewhere (ie no real return). Furthermore, if the maiden resource estimate at the flagship is underwhelming (we’d suggest anything under 1Moz gold), then we presume the market will be disappointed, likely leading to a sell down.

[Memo Assessment - 27-Feb-2023]:

Grade = B

Exploration at the Quinchia project has been overall successful with the company continuing to intersect mineralisation at various prospects across the project area. With a Maiden Mineral Resource Estimate (MRE) (Inferred) of 1.3Moz at Tesorito, LCL grew its JORC resource to 2.6Moz Au at the project.

Capital requirements

LCL is not a producer, remaining an explorer, and so requires continuous funding as it determines the value of its prospects . As such, the company will be required to raise capital for survival when the current cash at bank drains. There is no guarantee that capital markets will be conducive at that point.

[Memo Assessment - 27-Feb-2023]:

Grade = A

Having raised $20M in mid-2021, LCL remained well funded and did not need to raise capital over the past year.

Underlying commodity risk

LCL is exposed to commodity price risk (in this case, gold), which depends on macroeconomic factors and demand and supply dynamics of the underlying commodities. Market sentiment closely correlates with commodity prices, and hence LCL’s valuation will be impacted by commodity prices as well. There is no guarantee that gold sentiment will trend positively this year.

[Memo Assessment - 27-Feb-2023]:

Grade = B

While the gold price has rallied in recent months since its September-October 2022 lows, it was out of favour and declined throughout most of 2022.

Sovereign risk

LCL’s prospects are all located in the developing nation of Colombia. There is no guarantee that local authorities and/or communities will favour development of LCL’s prospects, and so could hinder advancement.

[Memo Assessment - 27-Feb-2023]:

Grade = D

Under a new President, the Colombian government pledged to reform the country’s mining industry, including creating a nationalised mining company, tackling mining pollution, and helping small scale miners. This introduced uncertainty to Colombia’s mining sector.

In acquiring its new PNG projects, LCL has diversified this risk. However, PNG is not without its own sovereign risk.

Whilst PNG is considered a risky, frontier location, there’s actually a lot of already discovered gold nearby, producing mines, and majors operating.

What is our investment plan?

Our strategy with advanced explorers is to achieve free carry prior to decision to develop, which is likely beyond 12 months away. Given the success at Tesorito and introduction of several respected gold funds, we intend to hold ~60% of the initial position to see the entire story play out over at least 2 to 3 years.

[Memo Assessment - 27-Feb-2023]:

Grade = A

As per our investing strategy we did not sell any LCL shares as exploration activities continued to progress in Colombia.

We had previously Top Sliced our Investment and were comfortable holding the position.

The change in government in Colombia introduced added uncertainty to the country’s mining sector, after which LCL’s share price fell from 13c to a 52-week low of 2.1c.

We expect LCL to focus on exploration at its new PNG projects, while it scales back exploration activities in Colombia where it will instead consider development scenarios for the project.

Our Investment strategy will reflect this, as LCL’s new project is closer to the exploration stage, rather than the feasibility stage.

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 3,210,000 LCL shares at the time of writing this memo. S3 Consortium Pty Ltd has been engaged by LCL to share our commentary on the progress of our investment in LCL over time.