EMN Releases Operations Update as Global Manganese Supply Tightens

Euro Manganese Inc. (ASX:EMN) is developing a high purity manganese project in the Czech Republic. EMN has today released a solid update on progress of:

- Its Demonstration Plant,

- Definitive Feasibility Study,

- Final Environmental and Social Impact Assessment, and

- Discussions with potential off takers.

We invested in EMN at 6.5c, 20c and again at 60c in the most recent placement (we just transferred cash for the 60c placement tranche two last week).

We are strong believers in European battery metals to be one of the key investment thematics of this decade as every country rushes to switch to electric vehicles.

Simmering global geopolitical tensions have seen many countries rush to secure local supply of key battery metals, like manganese (EMN is aiming to be Europe’s ONLY primary producer of high purity manganese).

Both Tesla and Volkswagen have stated high purity manganese is their preferred alternative to cobalt in electric vehicle batteries.

And now over the weekend there appears to be a new story developing with implications for EMN - 7,000km away in China.

The Wall Street Journal published this story on Friday night:

From the article:

China is tightening its grip on the global supply of processed manganese, rattling a range of companies world-wide that depend on the versatile metal—including the planet’s biggest electric-vehicle makers.

[...]

The squeeze sent prices soaring in metal markets world-wide, snagging steelmakers and sharpening concern among car makers. China’s metal industries already dominate the global processing of most raw materials for rechargeable batteries, including cobalt and nickel. Three-quarters of the world’s lithium-ion batteries and half of its electric vehicles are made in China.

Read the full Wall Street Journal article here.

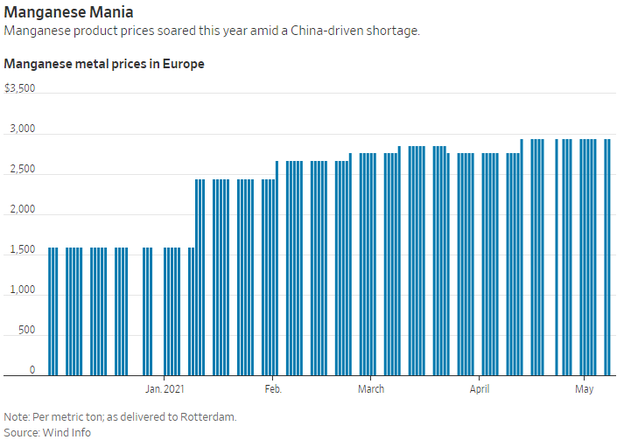

The Wall Street Journal article goes on to show the European Manganese price has almost doubled in the past few months, and continues to trend upwards:

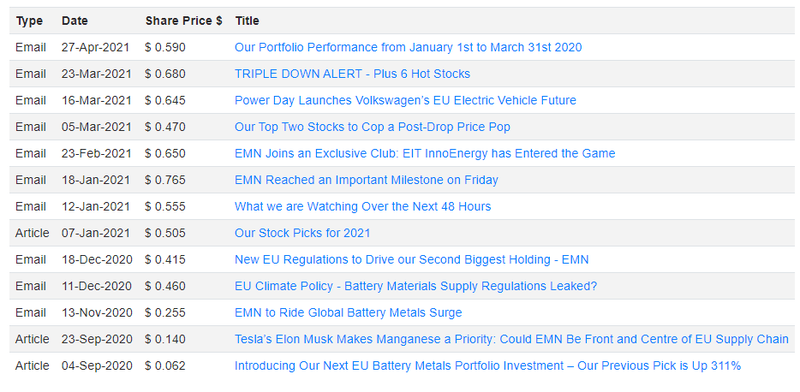

We are long term holders in EMN and have been covering key global themes that impact EMN since we invested in September 2020, including:

- Our Battery Metals Investment ebook when EMN was 13.5c.

- Our Tesla Battery Day coverage when EMN was 14c.

- Volkswagen Power Day when EMN was 64.5c

Every month the Electric Vehicle macro theme gets stronger and we are happy long term holders in our European battery metals investments.

We think the Wall Street Journal’s story will be a positive for the multiple offtake agreement discussions that EMN reported in their announcement today.

Let's take a deeper look at today’s EMN announcement.

Today EMN has announced an Operations Update just as global supply is tightening.

In summary, EMN is busy working away with a number of milestones due in Q1 of 2022.

Here is what we can expect from EMN early next year - in the meantime, watch for progress updates between now and then:

- Final Environmental and Social Impact Assessment: On track for completion Q1 of 2022.

- Demonstration Plant: The demo plant is a 7x scale up of the EMN’s 2018 pilot plant, and is critical to the supply chain qualification of EMN’s manganese for potential buyers. 97% of equipment has been procured. Operation of the plant to begin in Q1 of 2022.

- Definitive Feasibility Study: The DFS will get us an updated look at EMN’s project economics. On track for completion in Q1 of 2022.

EMN continues to have discussions with potential offtake buyers for the project’s high purity manganese - again, the completion of the Demonstration Plant is going to be crucial to these negotiations.

55% of EMN’s annual Demonstration Plant capacity has already been allocated to five major international High Purity Manganese customers - which is a strong sign EMN’s product will be in demand.

Here is our past our commentary on EMN:

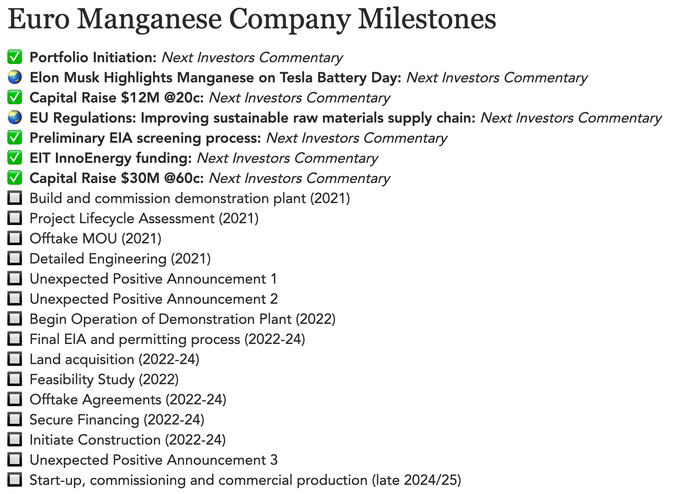

[NEW] Here are EMN’s company milestones as we see them

This is a new feature we are working on and will soon be rolled out to all portfolio companies, please reply to this email with any feedback/suggestions.

[NEW] Here is our investment strategy

Another new feature we will soon be rolling out to all portfolio company pages. Again, please reply to this email with any feedback/suggestions.

”Expected Company Milestones” are based on the company's publicly available execution plan and some assumptions made by our team on potential announcements that should de-risk the investment. “Our Investment Milestones” show our current long-term investment plan. Early stage investments are risky and there is no guarantee that the expected events will occur. The lists are not in sequential order.

Company Milestones and Investment Milestones are new features we are testing. Please provide feedback or suggestions by replying to this email.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.