Billionaire Mark Creasy purchases $2.86M in shares on market

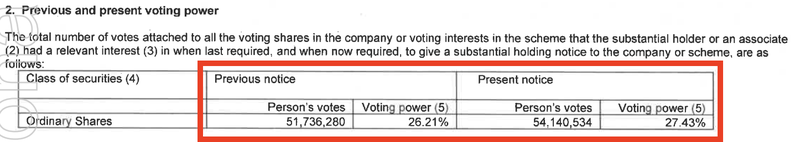

Yesterday we saw a “change in substantial holding” from mining billionaire Mark Creasy for our portfolio company Galileo Mining (ASX: GAL).

The notice showed Creasy had purchased $2.86M in shares on-market at an average price of ~$1.18 per share.

This isn’t the first time Creasy has come on market to buy shares in GAL after the company announced a palladium/platinum discovery at its Norseman project.

In recent months Creasy has purchased just over $11.5M in GAL stock, taking his shareholding to 27.43% of the company.

With the share price having come off its recent highs near $2 per share and now trading slightly below GAL’s placement price of $1.20, on-market buying from someone like Mark Creasy is a huge vote of confidence in the company.

The last time Creasy was aggressively buying shares on market, GAL’s share price went from ~70c per share to its high of just under $2 per share. We are hoping the same thing happens again.

What’s next?

With GAL actively drilling its Norseman project and assays from 8,600 metres of RC drilling and 1,400 metres of diamond drilling pending, we anticipate more positive newsflow from GAL.

Up next we expect the assays from the recent massive sulphide intercepts that the company made towards the eastern part of its discovery.

We think that these massive sulphides could be a game changer for GAL’s discovery because they tend to be the host rock for higher grade zones of mineralisation.

We touched on the significance of these massive sulphides in our last GAL note which you can read here: GAL Hits “Massive” Sulphides - Here’s Why It Matters.