$14BN MinRes to pay GAL $7.5M for 30% of its Lithium Rights

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 1,777,000 GAL shares at the time of publishing this article. The Company has been engaged by GAL to share our commentary on the progress of our Investment in GAL over time.

We have been waiting for nickel-PGE drill results that are due any week now...

And while we were waiting - this happened today:

Galileo Mining (ASX:GAL) just signed a JV agreement with Mineral Resources - yep the $14BN heavyweight commonly referred to as MinRes.

The deal sees GAL get paid $5M in cash this week, plus another $2.5M within 12 months.

The JV payments are for the rights to ONLY 30% of any lithium discovered on GAL’s ground at Norseman, WA.

GAL is exploring for nickel-PGE deposits on the same ground, where it has already defined a 17.5 Mt JORC resource, and is drilling now to try and make more nickel-PGE discoveries.

Aside from the nickel and PGE, it turns out this ground is also highly prospective for lithium, and MinRes are interested in finding out more.

The deal cut with MinRes doesn't include GAL’s nickel-PGE resources or future discoveries.

AND the next batch of GAL’s nickel-PGE drill results are due any day now.

The $7.5M it is getting from MinRes for 30% of the Lithium Rights comes on top of the $10M GAL already had at the end of last quarter.

This is a strong cash runway that allows the company to focus on making new nickel-PGE discoveries.

The same kinds of discoveries that delivered a share price run of 875% in 2022 on its first nickel-PGE discovery at Norseman...

We are hoping GAL is able to replicate the discovery it made in 2022.

Coming back to GAL’s announcement today...

GAL has just signed a Joint Venture Agreement with Mineral Resources (MinRes) for the lithium rights to its Norseman project.

MinRes is paying $7.5M ($5M now, $2.5M in 12 months) for an initial 30% of GAL’s lithium rights at Norseman.

That’s a read through value of ~$25M for the lithium rights alone.

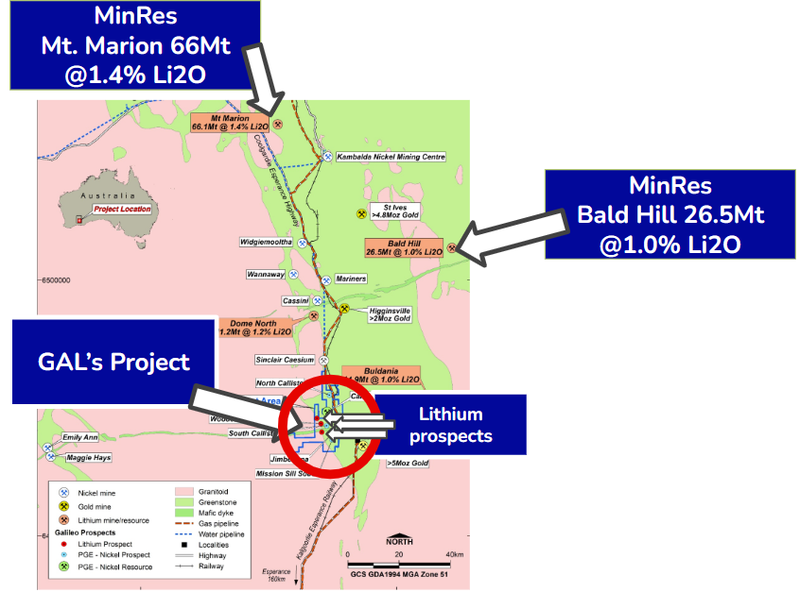

Yes MinRes - the $14BN lithium and iron ore major - who has lithium operations at Bald Hill and Mt Marion in WA.

Due diligence is already done, and the offer is unconditional with the first $5M due by the end of this week.

On top of the first 30% earn in, MinRes can later earn another 25% by sole funding lithium exploration expenditure of $15M over 4 years.

And then another 15% by sole funding lithium exploration up to a Decision to Mine.

In that scenario, MinRes would hold 70%, and GAL would maintain a 30% interest in a mining JV to establish a producing lithium mine, which it could convert into 1.5% FOB Revenue Royalty.

Prior to today’s deal GAL was capped at $48M, with $10M in cash, and a 17.5Mt nickel-palladium JORC resource at Callisto in Norseman.

The MinRes deal allows GAL to continue its focus on new nickel-palladium discoveries on the ground, while MinRes handles the lithium exploration.

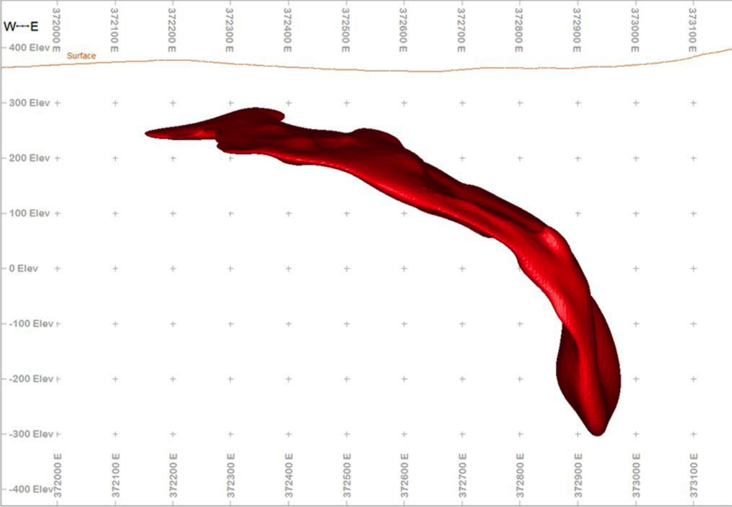

Following the 2022 nickel-PGE discovery, GAL went on to define its 17.5 Mt JORC resource, which underpins a lot of GAL’s current valuation.

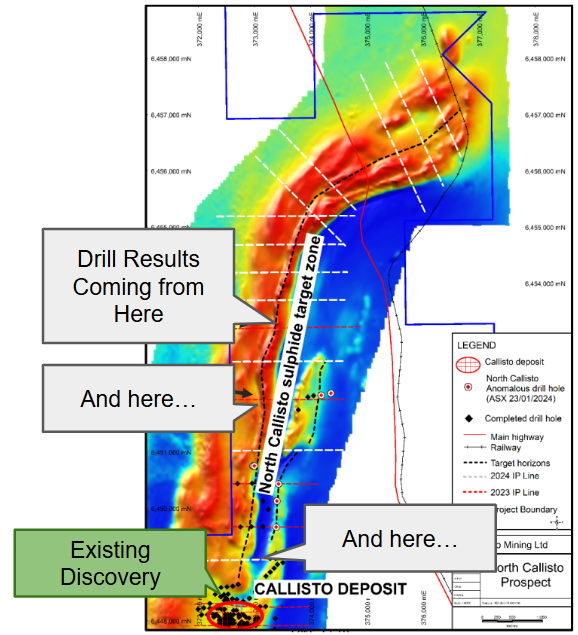

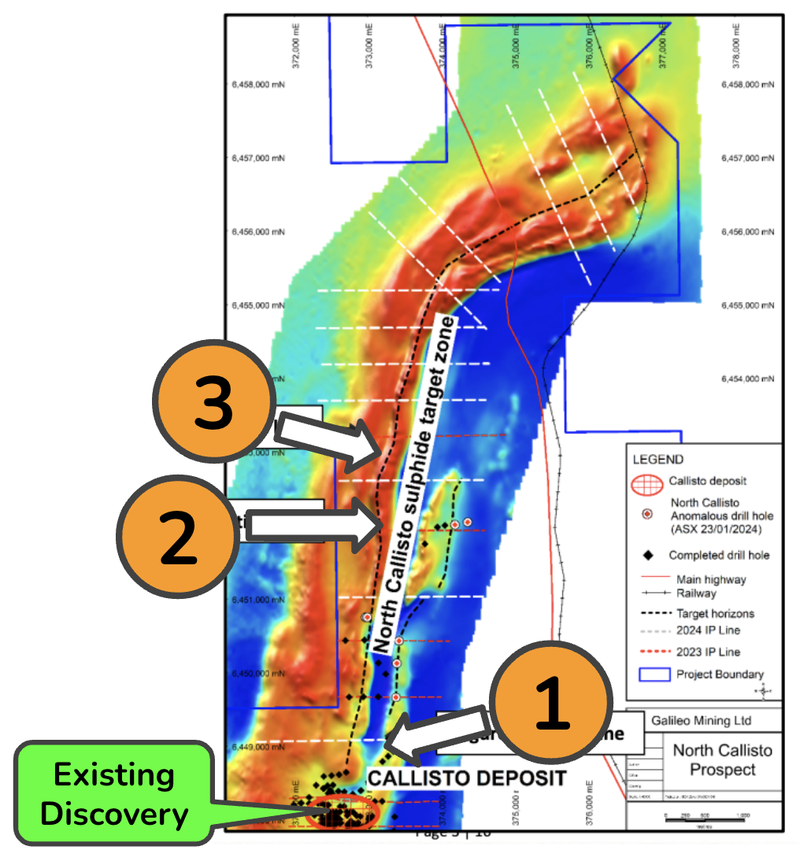

Over recent months GAL has been working up more targets along a 20km strike to the existing discovery, and now plenty of cash for drill testing them.

In fact, GAL would be close to finishing its first drill program of the year (drilling started in late April and was supposed to take about 5 weeks), with more planned in August - testing strong geophysical anomalies it has detected.

First assays from current drilling were flagged for early June - which is right about now - this is the next material news we are waiting on for GAL.

With no threat of a near term capital raise given the MinRes deal and healthy cash balance, market interest in GAL might increase off the back of the next batch of assay results.

Selling the lithium rights on its ground to a deep-pocketed, highly experienced company like MinRes allows GAL to focus on what it does best - that is to chase new nickel / palladium discoveries, like its 2022 discovery.

GAL can sit back now and let MinRes invest the millions of dollars required to try and make a lithium discovery on its ground.

Given that GAL had no ambitions to develop the lithium potential over its project, we think this is an excellent deal for both GAL and existing shareholders.

The funding is non-dilutive and basically provides GAL a free option on a lithium discovery, while it develops its nickel-PGE asset.

Importantly GAL’s Mining Lease which contains the Callisto resource and significant exploration potential is not part of the MinRes Exploration JVA.

Here’s more on GAL’s lithium potential and what we are looking for in the next few weeks...

GAL has Nickel-PGE and now lithium exploration upside:

Turns out, like a lot of ground in this region, GAL’s ground is also highly prospective for lithium - and MinRes wants a piece of it - before any real drilling or lithium exploration work has been done.

Here is where GAL’s project sits in relation to MinRes’ lithium producing mines Mt Marion and Bald Hill.

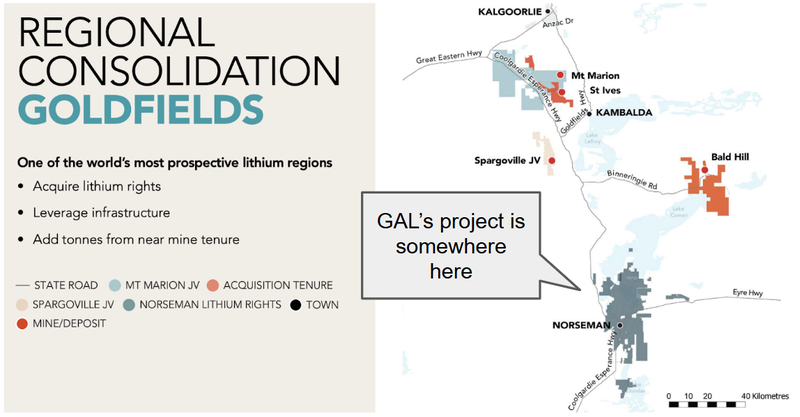

MinRes’ WA lithium plan is clear - acquire as many lithium mineral rights in the Goldfields area to lock up potential discoveries in the area:

(Source - MinRes 2023 AGM Presentation)

And GAL’s Norseman ground could be part of MinRes’ plan.

We first Invested in GAL in 2020 with the primary focus of the company on nickel and PGE exploration.

In 2022 the company made a nickel-PGE discovery and at its share price from 20c to $2.50.

The company then raised ~$20M at $1.20 (we participated in the raise) and defined a 17.5 Mt nickel-PGE JORC resource at its Callisto project.

This is what the resource looks like starting from ~75m below the surface:

But GAL (and the market) always wants more.

The current deposit is analogous in mineralisation style to the massive Platreef PGE deposits in South Africa - which means there could be more discoveries where this one came from.

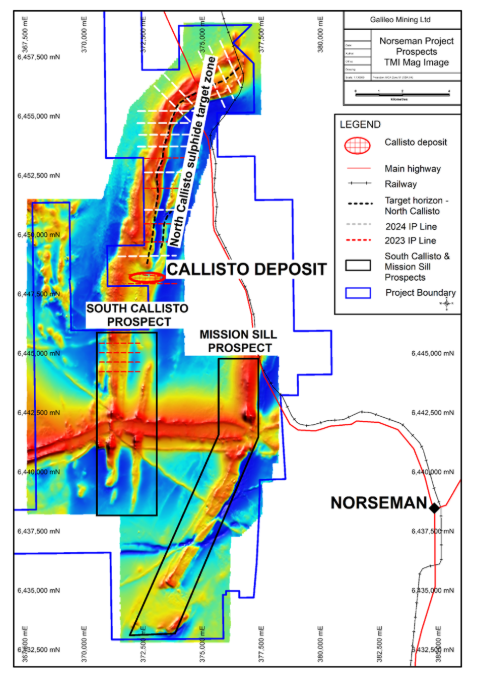

GAL has three key target areas - the North & South Callisto and across its Mission Sill trend - all prospects are visible in magnetic data.

GAL is going to use a combination of campaign drilling and IP geophysical surveying to advance toward new discoveries.

This work is going to keep GAL busy for the foreseeable future, so it makes sense for the company to farm out the lithium rights to the ground now.

This deal with MinRes allows the company to explore for lithium, without diverting capital away from the company’s main prize, which is more nickel-PGE discoveries.

Since April, GAL has undertaken 3,000m of RC drilling on three high-priority targets that were identified in a geophysical survey earlier this year.

Assays are due any day now.

Why we like this deal with MinRes is that it doesn’t disturb GAL’s main focus, while providing a non-dilutive “option” on a potential lithium discovery.

Details on the GAL - MinRes deal

Here are the key details of the three staged deal:

- MinRes and GAL will form a joint venture exploration company.

- The deal is for lithium ONLY, GAL still has rights over nickel, PGE and other discovered minerals.

- To be clear - GAL’s Callisto deposit, a 17.5Mt nickel-PGE resource, is NOT part of the deal.

- Stage 1 - MinRes pays $7.5M for 30% of the Lithium Rights over the Norseman Project - $5M paid immediately and $2.5M in 12 months time.

- Stage 2 - MinRes can earn a further 25% of the Lithium Rights over the Norseman Project if it solely funds another $15M in drilling over the next four years.

- Stage 3 - MinRes can then earn a further 15% by sole funding all exploration through to a Decision to Mine lithium.

- If the JV gets to that point, MinRes would have 70% of the lithium rights, and GAL would retain 30%.

- Both companies would then contribute all future development costs in the same percentage to its JV share. Or, GAL can convert its percentage shares to a 1.5% FOB Revenue Royalty.

What is GAL doing right now?

GAL kicked off its latest round of drilling in late April, which was expected to take 4 weeks. Assays were expected in ‘early June’ which is right about now.

Leading up to drilling, GAL ran a geophysical survey over its Callisto project - next to its existing JORC 17.5 Mt nickel-PGE discovery.

The IP surveys highlighted several priority targets for the company to drill, and in April, GAL commenced a 3,000m RC drilling program to test these targets.

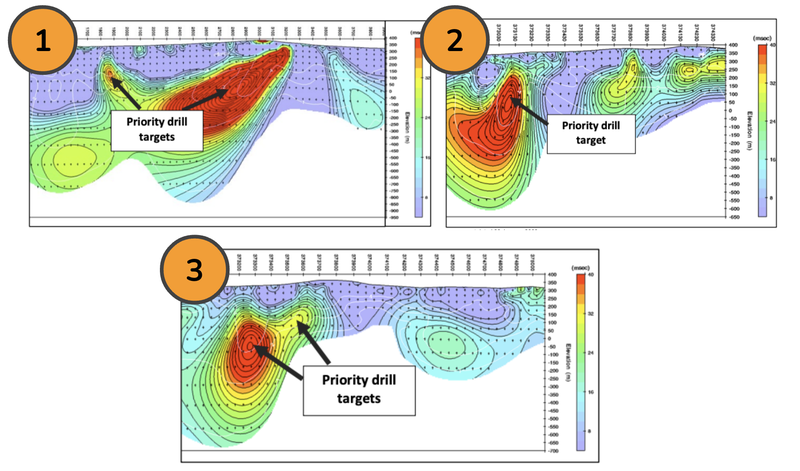

In a nutshell, IP surveys scan underground looking for signatures that COULD be sulphides.

Sulphides are the valuable stuff that contains all the nickel and palladium that GAL is searching for.

The goal is to first find sulphides, and then hope it is mineralised.

The big red blobs indicate areas where GAL could either hit sulphides (the good stuff) or non-economic graphitic shales (the not-so-good stuff):

The primary objective for this round of drilling is to try and find repeat nickel-PGE discoveries.

(Hopefully bigger than or equal to the first.)

We saw what happened when GAL made its first discovery in 2022

The share price went from ~$0.20 to ~$1.95 (in a notably hot market for small cap stocks), and then GAL managed to raise ~$20M at $1.20 (we participated in the raise).

Since the discovery, and subsequent drilling the GAL share price has come down a lot, and is now trading at around 25-30c mark, and has been for some time.

As GAL share price trended downward, it defined a 17.5 Mt JORC resource at 2.3g/t palladium OR 0.52% nickel - equivalent to ~1.27M ounces of palladium or ~91k tonnes of nickel.

This underpins the company’s current market cap and provides a solid base for upside potential in the event of more discoveries.

We think that GAL’s share price performance since the 2022 discovery has a lot to do with four factors:

- Sentiment for small cap stocks has been poor.

- The market expected the discovery to immediately grow and grow - to match the high share price - in reality these things can take time. Impatient investors exited chasing the next new shiny thing on the market.

- Nickel stocks have been hammered as Indonesian supply flooded the market and pressured prices to the downside.

- Palladium prices have been falling for over 12 months...

Regardless of the newsflow GAL put out, it's been a tough macro environment for a company with the type of discovery GAL made.

However we think the macro sentiment now looks to be improving - nickel prices have bottomed and palladium prices look to be bottoming out too - a much better environment to be putting out good news...

GAL is now looking to re-rate its share price on a second discovery... and assays for the first round of drilling is due this month.

We are hoping that one of these anomalies can turn up trumps for GAL and the company can make a second discovery at the North Callisto prospect.

Assays for the drilling program are due this month, and these assays have the potential to be company-making for GAL IF a second discovery is found.

What is happening with the nickel and palladium markets?

Although GAL’s Callisto discovery contains trace elements of copper and cobalt, the main name of the game for GAL is nickel and palladium.

First, let's take a look at the nickel market.

The nickel price market has been a wild roller coaster over the last 5 years.

From September 2020 when Elon Musk announced on Tesla Battery Day “we need more nickel”...

... To when the price of nickel reached $48,000 USD/t after sanctions on Russia.

(the largest producing nickel mine in the world, Norilsk is located in Russia).

Since then the nickel price has gone up AND then back down, with increased supply out of Indonesia.

Finally bottoming out in February of this year, before bouncing back due to unrest in New Caledonia, which accounts for 25% of the world’s nickel reserves and 7% of global supply.

The demand for nickel has remained relatively constant, driven predominantly by its use in steel making and growth coming from EV batteries.

However, the supply side of the nickel equation is very up and down and driven by geopolitics and cost of production.

Ultimately, we still back the long term outlook for nickel as a critical mineral to the global energy transition, particularly nickel that is sourced from western jurisdictions.

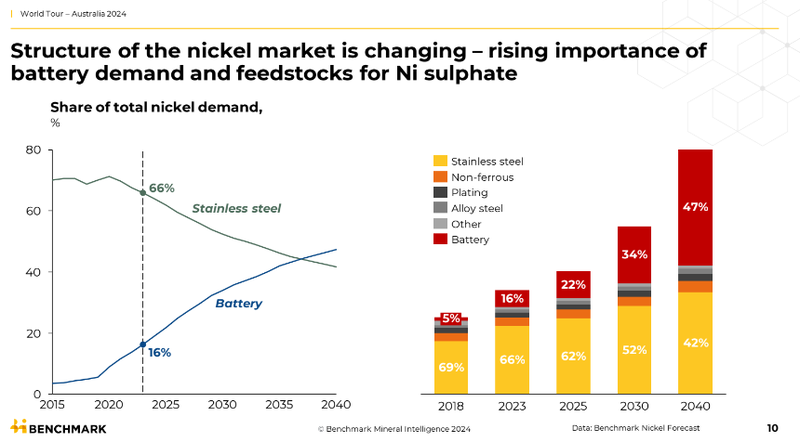

At the moment only 16% of nickel supply is used in batteries right now with most nickel going into producing stainless steel.

It isn't until ~2035 that nickel demand from the battery sector is expected to surpass the steel market.

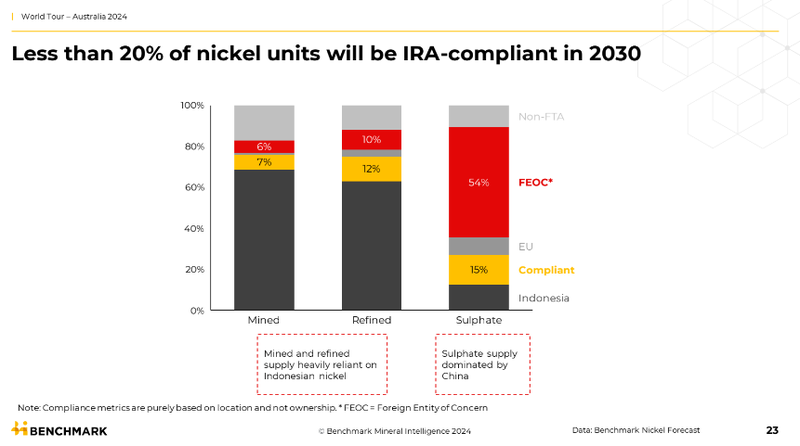

Adding to that momentum will be the IRA incentives that will force nickel to come from ESG friendly sources, from inside countries that have free trade agreements in place with the US.

Like most other battery metals, the short term outlook for nickel looks challenged

However, if the long term demand picture for battery metals plays out as expected, then the cycle will turn in the long run.

Now, our thoughts on palladium

Palladium today is trading at around $913 USD/t, which is around a 5-year low.

The primary use for palladium is for catalytic converters used in internal combustion engines for traditional petrol vehicles and also hybrids.

Although the palladium price is in the doldrums, the market has actually been in deficit for the past two years, with Johnson Matthey publishing a PGM market report last month that highlights this:

(Source)

The reason that price is still falling - despite the deficit - is due to palladium inventory overhang from car manufacturers moving away from internal combustion engines and towards EVs.

The primary use for palladium is in internal combustion engines used for traditional petrol vehicles.

However, palladium is also used in catalytic converters for hybrids.

If hybrids are increasingly turned to instead of EVs, then the palladium price could turn, which could be further lifted given the significant supply deficit of the last two years and depleting inventories from the car manufacturers.

Hybrids are looking more and more likely to be a low-carbon alternative to EVs preferred by car manufacturers, as highlighted last month by the FT:

(Source)

A telling sign of how tight the supply market is when the London Metals Exchange banned nickel/aluminium from Russia, they didn’t ban palladium.

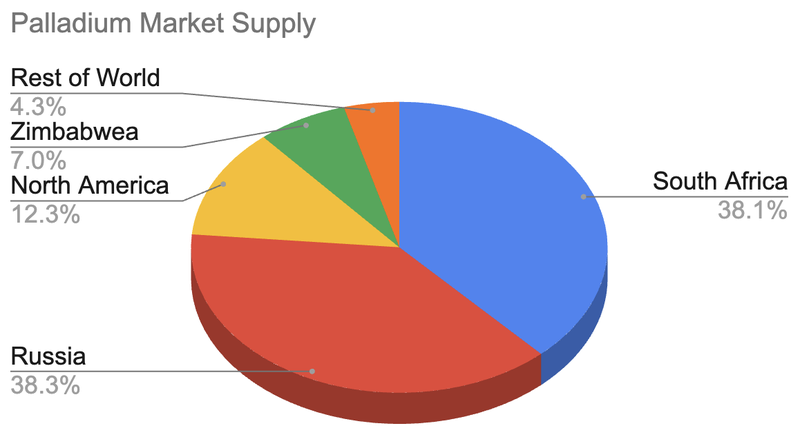

Russia accounts for 38% of the palladium market while another 38% comes out of South Africa:

(Source - Statista)

Both countries have had their challenges, with South Africa's being highlighted recently due to the Anglo-BHP merger deal:

(Source)

Since the deal was announced about four weeks ago, Anglo has decided to de-merge from its South African palladium projects.

If these projects are picked up by China or Russian entities, then western countries may look for strategic supply of palladium.

The palladium markets are on shaky ground, and if the price turns then it could be the right place, right time, right commodity for GAL if it is able to make a second discovery at its project.

What’s next for GAL?

2024 Drilling Program - Callisto

✅ Drilling Program Announced

✅ IP Surveys

✅ Drill targets selected

✅ Drill commenced

🔄 Drill results (expected June)

What are the risks?

Exploration Risk

The key risk for GAL in the short term is “exploration risk”.

All exploration is risky.

It is possible that GAL fails to deliver any good drill results from its current round of drilling.

IF that were to happen the market could start to price in poor exploration potential across GAL’s Callisto project and as a result GAL’s share price could move lower.

With assays due inside the next month this is the key risk to our GAL Investment Thesis.

To see all the other risks we listed as part of our GAL Investment Memo click here.

Our GAL Investment Memo

For a full rundown of our investment thesis, read our GAL Investment Memo, where we share:

- What GAL does

- The macro theme for GAL

- Our GAL Big Bet

- What we want to see GAL achieve

- Why we are Invested in GAL

- The key risks to our Investment Thesis

- Our Investment Plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.