Following the company’s Brazilian lithium discovery in March 2022, our LRS holdings give us exposure to lithium. We think lithium offtakers will really need new supply as EVs continue to gain market penetration.

Opened: 10-Jun-2022

Shares Held at Open: 5,755,000

What does do?

Latin Resources (ASX: LRS) recently discovered a high grade lithium resource in Brazil. The company is now actively defining the size of the discovery and aiming to become a lithium producer.

What is the macro theme?

Lithium is the key component of EV battery cathodes and has recently experienced strong upwards price momentum after a long period in the doldrums.

We believe battery metals are the most compelling investment theme of this decade. With a lithium supply deficit anticipated in 2024.

We think spodumene resources like LRS’s Brazilian lithium discovery should do well in this environment.

Our Big Bet for

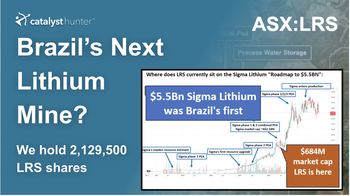

LRS increases the scale of its lithium discovery to the level of its multi billion dollar regional peer - Sigma Lithium. With this we would expect the market to value LRS similarly.

Why did we invest in ?

Exposure to Lithium

Following the company’s Brazilian lithium discovery in March 2022, our LRS holdings give us exposure to lithium. We think lithium offtakers will really need new supply as EVs continue to gain market penetration.

Potential to re-rate again

LRS has a large retail following and hence has the potential for significant share price re-rates on good news. The opposite also applies if the news is bad. We hope the definition of a JORC resource or offtake deal could see LRS re-rate again with this retail backing.

Favourable peer comparison

LRS is at an early stage in its development as a lithium company, meaning its current valuation may have more upside as compared to its peers.

Funding risk mitigated

LRS raised $35M in April 2022 and we think it is well funded to advance its Brazilian lithium project over the next 12 months.

Billion $ capped neighbour with similar geological setting

US$1.7B capped Sigma Lithium’s project, ~100kms to the south, is a good model for how LRS can progress its project. Sigma’s project is in the construction phase and LRS can take learnings from Sigma.

What do we expect to deliver?

Objective #1: JORC resource at the Brazilian lithium projects

A JORC resource would allow LRS to engage in more substantive conversations with offtake partners and allow the market to appropriately value LRS versus its peers.

We want to see an overall grade for the resource >1% lithium and have set up our expectations for overall tonnage as follows:

Milestones

![]() 25,000 metre infill resource definition drilling

25,000 metre infill resource definition drilling

![]() Assay results

Assay results

Objective #2: Start feasibility studies

We expect LRS to begin a feasibility study (scoping study or pre feasibility study) at some point over the next 12 months following resource definition.

Milestones

![]() Testwork reporting (metallurgy) (Q3-Q4)

Testwork reporting (metallurgy) (Q3-Q4)

![]() Commencement of feasibility study (Q3-Q1 2023)

Commencement of feasibility study (Q3-Q1 2023)

![]() Bonus: completion of feasibility study (Q2 2023?)

Bonus: completion of feasibility study (Q2 2023?)

Objective #3: Offtake Agreement

While demand for lithium remains strong, we are hoping LRS manages to sign an offtake agreement in the next 12 months. Perhaps around the time that its JORC resource comes out.

Milestones

![]() Letter of Intent or Non Binding MoU / Binding Offtake (by end of year)

Letter of Intent or Non Binding MoU / Binding Offtake (by end of year)

![]() Binding Offtake Agreement

Binding Offtake Agreement

Objective #4: Additional exploration at lithium tenements

LRS is looking to do more drilling at a recently acquired lithium prospect and an existing lithium prospect that has previously not been focussed on - this could increase the size of its resource.

Milestones

![]() Drilling at recently acquired lithium tenements

Drilling at recently acquired lithium tenements

![]() Assays

Assays

What could go wrong?

Development risk

After the discovery hole, LRS will face a new set of challenges with regards to developing the project. LRS will have to start thinking about feasibility studies as well as factors like logistics and processing plants.

Exploration risk

There are no guarantees that LRS continues to find more (or enough) lithium at its newly acquired and under explored lithium tenements. Alternatively, LRS doesn’t find enough lithium in infill and resource definition drilling at its lithium discovery to justify a mine.

Market risk

Lithium prices have cratered before and its possible supply/demand dynamics change and in turn impact market sentiment to lithium exploration/development companies such as LRS.

Geographic risk

While the region of Brazil that LRS operates in is a mining friendly jurisdiction, political changes could alter that.

What is our investment plan?

We are now free carried and have taken profit in our LRS Investment.

We currently hold 5,755,000 LRS shares and we intend to hold the majority of these shares while the fully funded LRS executes on its business plan to develop its lithium resource.

If the share price re-rates significantly on major news, likely either to be an offtake agreement, or the JORC resource exceeds expectations, we may look to take a profit once again.

Disclosure: The authors of this article and owners of Catalyst Hunter, S3 Consortium Pty Ltd, and associated entities, own 5,755,000 LRS shares at the time of writing this memo. S3 Consortium Pty Ltd has been engaged by LRS to share our commentary on the progress of our investment in LRS over time.

Opened: 17-Feb-2022

Closed: 10-Jun-2022

Shares Held at Open: 12,475,000

Shares Held at Close: 5,755,000

Reason Memo Closed: OUTPERFORM: LRS made a lithium discovery, subsequently raising $35M to define the size of the discovery. These are two material events that have triggered a new Investment Memo for us to track.

What does do?

Latin Resources (ASX: LRS) is a multi-commodity exploration and development company focussed primarily on lithium in Brazil and halloysite and kaolin in WA.

What is the macro theme?

Lithium is the key component of EV battery cathodes and has experienced strong upwards price momentum recently after a long period in the doldrums. We believe battery metals are the most compelling investment theme of this decade.

Halloysite is a carbon nanostructure clay with a range of high-tech and emerging use cases. With current use cases in the medical industry, ceramics and coatings. Due to its unique composition scientists are exploring further use cases for halloysite. This includes using it for carbon emission mitigation and advanced materials.

[Memo Assessment - 10-Jun-2022]: Grade = A

Our assessment that lithium prices could take LRS higher was on point we’re bullish on battery metals as part of a decade long investment thematic.

Our Big Bet for

LRS increases the scale of its lithium discovery to the level of its multi billion dollar regional peer - Sigma Lithium. With this we would expect the market to value LRS similarly.

Why did we invest in ?

Exposure to Lithium

The tenements that LRS holds in Brazil have been underexplored for lithium and early stage work has looked promising to date. We believe given market dynamics, a lithium discovery could generate significant upside and become a company making event.

[Memo Assessment - 10-Jun-2022]: Grade = A

This reason for holding LRS materialised early in the year with LRS making a new lithium discovery at its Brazilian lithium project. Off the back of this discovery LRS re-rated to a $200M+ market cap and managed to get a $35M capital raise completed. We think that the discovery was a clear “company making event”.

Exposure to Halloysite

LRS has a significant high grade halloysite deposit in WA with an existing JORC Mineral Resource Estimate. We believe this is the most likely near-term source of revenue for the company.

[Memo Assessment - 10-Jun-2022]: Grade = C

The halloysite project has taken a back seat ever since LRS made its new lithium discovery in Brazil. We were expecting this to become a slightly stronger part of the LRS story in the second half of the year and still think it may come into play but for now we are solely focused on seeing LRS developing its Brazilian lithium project. We don’t expect LRS’s halloysite project to drive significant value over the next 12 months.

Potential to re-rate

LRS has a large retail following and hence has the potential for significant share price re-rates on good news. This is a double edged sword however as the share price can drop too on average news or long periods without news.

[Memo Assessment - 10-Jun-2022]: Grade = A

This also materialised early in the year, LRS made its new discovery and the market rewarded it by taking the share price from ~3.5c per share all the way up to a high of 22.5c per share. We think this sharp rise in a matter of only 2-3 weeks was a result of LRS’ large retail following and the ability for the good news to spread really quickly bringing more eyeballs to the company.

What do we expect to deliver?

Objective #1: JORC resource at the Brazilian lithium projects

Complete at least two or three rounds of drilling to try and delineate a JORC lithium resource. We want to see LRS deliver lithium grades > 1% across the drilling programs which would make it more likely that a high grade JORC resource can be established.

[Memo Assessment - 10-Jun-2022]: Sentiment = Unchanged

This is a key objective we have carried over into our new Investment Memo.

Objective #2: Offtake agreement for Halloysite project

We want to see an offtake agreement for the LRS halloysite project, following product qualification. This would firm up the prospect of LRS making near-term revenue from this project.

[Memo Assessment - 10-Jun-2022]: Grade = C

This was not achieved in the first half of the year and we’re hoping to see this in the second half of 2022. As a result, we think it would be unfair to give the company a lower rating than C for this objective.

Objective #3: Progress cattle rumen methane emissions reduction project

Methane makes up only 10% of greenhouse gas emissions - but over a 20-year period, it is 80 times more potent at warming the world than carbon dioxide.

Agriculture, and cattle in particular, compose a big part of these methane emissions. LRS has committed $3.2M in funding to a research organisation and engaged a former CSIRO Chief Research Scientist to explore the possibility for their high grade halloysite to reduce methane emissions from livestock, in particular cattle.

This project could help establish an additional end use for their resource and we want to see preliminary results from the research in 2022.

[Memo Assessment - 10-Jun-2022]: Grade = C

While this project is expected to take some time to deliver, LRS has been fairly quiet with respect to this hence its C rating. We can understand the lack of updates on this project, given the lithium discovery made and shift in company focus.

What could go wrong?

Exploration risk

There are no guarantees that LRS finds more lithium. Alternatively, LRS doesn’t find enough lithium to justify a mine.

[Memo Assessment - 10-Jun-2022]: Grade = B

LRS made a new lithium discovery which mitigates this risk significantly. LRS now needs to prove that the discovery can become a commercially viable lithium deposit worthy of development. Hence, the B rating. For us, a JORC resource would be when a company completely eliminates “exploration risk”.

Market risk

Lithium prices have cratered before and its possible supply/demand dynamics change and in turn impact market sentiment to lithium exploration companies such as LRS.

[Memo Assessment - 10-Jun-2022]: Grade = A

The lithium market is still fairly strong with prices for lithium carbonate trading only ~5% off all time highs. There is always a risk that lithium prices fall off a cliff and we see a situation similar to ~2017-18. Working in LRS’ favour is that it raised $35M at a market peak. This gives LRS enough runway to continue to define its discovery. We think LRS has managed this risk really well.

Production risk

The halloysite that LRS has may not be of sufficient quality for offtake partners or they may not be able to produce enough of it to make the deposit economic.

[Memo Assessment - 10-Jun-2022]: Risk = Unchanged

This risk is still present given halloysite has not been sold to anyone yet.

Geographic risk

While the region of Brazil that LRS operates in is a mining friendly jurisdiction, political changes could alter that.

[Memo Assessment - 10-Jun-2022]: Risk = Unchanged

This is still a risk factor that we have carried into our new Investment Memo.

Funding risk

LRS had $643k in cash at the bank as of 31 December 2021. As a result, we believe LRS will need to find sources of funding to continue its exploration and development activities. These may come through the exercise of options or a capital raise.

[Memo Assessment - 10-Jun-2022]: Grade = A

LRS was running its cash balance relatively low going into the first drilling program at its Brazilian lithium project. LRS has now made a new discovery and raised $35M off the back of it. This gives LRS a significant amount of breathing room and has completely transformed the company’s balance sheet. We think LRS have mitigated this risk completely for at least the next 12 months.

What is our investment plan?

We added more LRS to our position in early 2022 - we are holding to see what comes from the initial lithium drilling campaign and assays. If the share price runs we will look to sell down about 20% of our current position.

[Memo Assessment - 10-Jun-2022]: Grade = A

Share price had a serious run on discovery, hit our points for partial de-risk so we Top Sliced and Took Profit - we are now left with a Free Carried position into the next phase (covered in the next Investment Memo).

Disclosure: The authors of this article and owners of Catalyst Hunter, S3 Consortium Pty Ltd, and associated entities, own 12,475,000 LRS shares at the time of writing this memo. S3 Consortium Pty Ltd has been engaged by LRS to share our commentary on the progress of our Investment in LRS over time.

Brazil Lithium: LRS reveals $3.6BN Net Present Value for $400M CAPEX

Sep 28, 2023

Sep 28, 2023 |

13 min

Our investment, Latin Resources (ASX: LRS), has just released a report on the economics of it's Colina Lithium project in Brazil. With an attractive NPV and low CAPEX, we believe LRS could be the next billion-dollar Sigma 2.0.

LRS takes another step towards lithium production and becoming Sigma 2.0

Jun 21, 2023

Jun 21, 2023 |

13 min

Yesterday our Investment Latin Resources (ASX: LRS) released its long awaited JORC resource upgrade on its Brazilian lithium deposit. This resource is comparable to some of the biggest billion dollar plus Australian lithium producers.

LRS now drilling west of its lithium JORC resource

Jan 24, 2023

Jan 24, 2023 |

8 min

Latin Resources’ (ASX: LRS) has just released some more lithium assays and the geology manager says that they are “on par” or “better than” the main deposit...

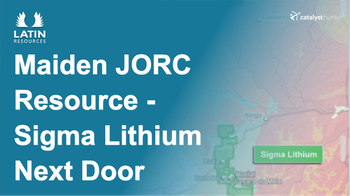

LRS Delivers Maiden JORC Resource - Following $5.5BN Regional Peer’s Playbook

Dec 8, 2022

Dec 8, 2022 |

12 min

LRS announced its maiden JORC resource for the Colina Lithium deposit in Brazil, with an estimate of 13.3Mt grading at 1.2% lithium oxide. Along with strong metallurgical results, we believe this is just the beginning for LRS which is following in the footsteps of its neighbour - Sigma Lithium - capped at $5.5BN.

Another Lithium Discovery - are they connected?

Oct 5, 2022

Oct 5, 2022 |

9 min

Today, Brazilian lithium exploration and development company Latin Resources (ASX:LRS) has made an entirely new discovery, this time hitting 18.71m of lithium at a grade of 1.32%.

Drilling results to lead to a major resource upgrade?

Mar 23, 2023

Mar 23, 2023 |

2 min

Our lithium Investment Latin Resources (ASX: LRS) just put out an update on its 65,000m+ resource extension drill program at its lithium project in Brazil.

Tesla looking to buy Brazilian lithium developer?

Feb 20, 2023

Feb 20, 2023 |

1 min

7 Diamond drill rigs on site, 3 more rigs on the way

Feb 16, 2023

Feb 16, 2023 |

2 min

Lithium project area now 367% bigger.

Feb 8, 2023

Feb 8, 2023 |

50.3 seconds

Updated investor presentation

Feb 7, 2023

Feb 7, 2023 |

43.2 seconds

How the U.S. Just Made Gold Mining a Strategic Priority

Mar 22, 2025

Mar 22, 2025 |

16 min

~30 hours ago US President Trump signed an Executive Order invoking “war-time powers” taking immediate measures to increase US domestic mineral production. This means more funding, faster permits and more support for critical mineral projects in the US.

Index Inclusion: A Small Cap’s Big Leap

Mar 8, 2025

Mar 8, 2025 |

16 min

A strong sign that a small company is graduating to a medium sized company is inclusion in a market “index”. Last night it was announced that CAY, ONE, ALA and DXB were added to the ASX All Ordinaries index.

Insights from Industry Leaders at IMARC

Nov 2, 2024

Nov 2, 2024 |

17 min

A few of our team was in Sydney this week for the IMARC conference, and to hear from some of our Portfolio Companies. IMARC is the largest mining conference in Australia - so the big mining companies show up, but also well attended by small cap companies and investors. The sentiment “vibe” is definitely improving, something we’ve been observing and pointing out in recent weekend editions.

Is it Bull o’clock yet?

Aug 18, 2024

Aug 18, 2024 |

20 min

Markets move in cycles. Right now, in the ASX small cap market, it feels like we are still firmly in “bear” mode. Equities prices have collapsed, liquidity too… But there have been signs that the gears on the crash-boom clock are turning ever closer towards “bull” mode.

When will it get better?

Aug 10, 2024

Aug 10, 2024 |

16 min

It’s been a terrible two years in the small end of the market - surely it couldn’t get worse right? …right?