Strong metwork results from lithium project - JORC resource next

Our lithium exploration Investment Latin Resources (ASX: LRS) just put out strong metallurgical test work results from its Brazilian lithium project.

Our key takeaway from today’s announcement is LRS’s ability to produce high grade lithium concentrates using a simple Heavy Liquid Separation (“HLS”) processing technique as follows:

- High recovery rates - Recovery rates of ~80.5% lithium oxide using a simple processing setup with a low level reliance on flotation.

Importantly, the simple processing method could mean lower operating costs when it comes time to actually mine and produce lithium from LRS’s project.

We expect this to have a positive impact on the overall project economics.

- High grade concentrates - LRS was able to produce lithium oxide concentrates grading as high as 7.96%. Average grades across the testwork program was ~6.3%.

For some context, LRS’s results are only slightly lower than the theoretical maximum pure spodumene grade of ~8.03%.

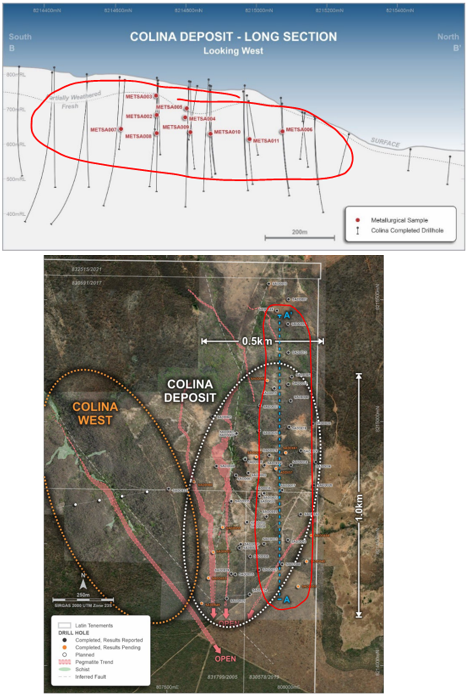

The processing results came from a batch of 10 samples taken across LRS’s project in a north to south direction.

The image below shows where the samples were taken from:

The obvious caveat to today’s announcement is the fact that the testwork is being done only at lab scale, and there is no guarantee that the same results happen at scale at the project level.

LRS is now in a position where it can use the results from this program to help optimise a flowsheet for its lithium project which will form the basis of the company’s Preliminary Economic Assessment study (PEA).

We expect to see the PEA completed by the end of Q1-2023.

What’s next for LRS?

The next major catalyst we are looking for is the maiden JORC resource estimate at LRS's Brazilian lithium project.

As the JORC resource will form the basis for the PEA, we expect to see this announced before any other newsflow can come out.

Our expectations for the resource number are as follows:

- Bull case (exceptional) = >15Mt JORC resource

- Base case = 5-15Mt JORC resource

- Bear case = <5Mt JORC resource

LRS is looking to emulate the success of its larger Brazilian neighbour, Sigma Lithium, which announced its maiden resource estimate in 2018 of ~13Mt with lithium grades of ~1.56%.

At that time, Sigma had a similar market cap to that of LRS today.

Sigma now trades with a market cap of more than $5BN — that’s around 18.5 times LRS’s current market capitalisation.