Vonex Share Price Set to Double, Says Analyst

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The communications sector has been one of the more resilient market segments during the current wave of market volatility.

Through that resilience stocks have emerged that appear to be unjustifiably sold down or are now in a position to realise that game-changing event investors have been waiting for.

Within the telco segment there looks to be a couple of small cap stocks worth keeping an eye.

One company we have kept a close watch on is Vonex Limited (ASX: VN8).

The Next Investors has been bullish about Vonex (ASX: VN8) for a couple of years and it seems this year the company is really lifting its game.

Vonex presents a strategic way to play the sector as it has a broad range of product offerings that target a diversified client base and doesn’t leave the company overexposed to any one industry.

As well as achieving strong revenue growth in the first half of fiscal 2020, Vonex is accelerating its recurring revenue streams as the company develops, delivers and licenses its own advanced communications technology, providing investors with earnings predictability.

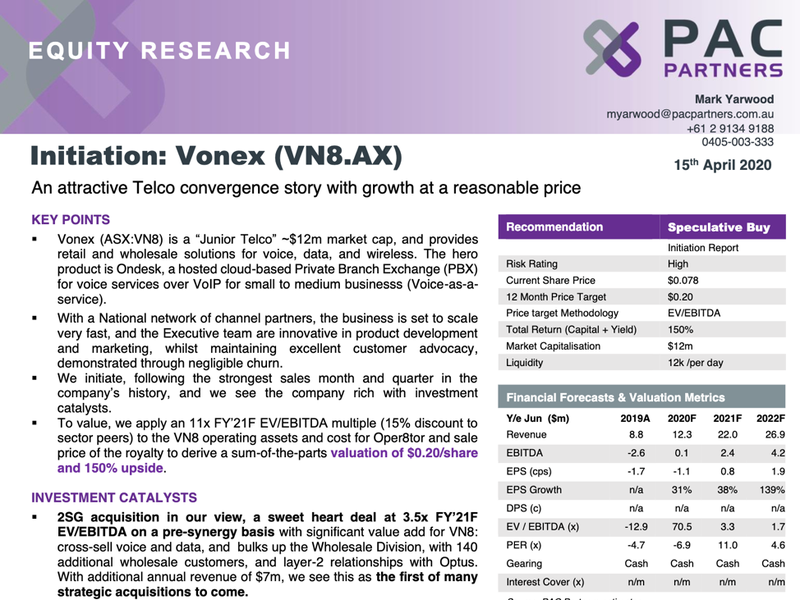

Recent research conducted by PAC Partners also recognises Vonex’s strengths.

PAC Partners analyst Mark Yarwood ran the ruler across Vonex recently, attributing a 12-month target price of 20 cents per share to the stock, implying upside of 100% relative to Monday’s closing price of 10 cents.

Noting Vonex’s national network of channel partners, Yarwood is of the view that the company is set to scale up very quickly with its diversified product suite including voice, data, wireless and PBX, targeting a mix of retail and small to medium businesses, a strategy that should drive strong revenue and earnings growth.

There is certainly plenty of upside for Vonex and its investors as we move into the back half of 2020, so let’s take a look at the momentum it has built in 1H 2020 and dive deeper into PAC Partners’ research.

Catching up with ...

Share Price: $0.10

Market Capitalisation: $17.95 million

Cash on hand: $2.6m as at 1H 2020 (not including the conditional sale of non-core mining royalties to the value of $2.5m)

Here’s why I like VN8:

Vonex goes from strength to strength

Vonex has started off 2020 on the front foot, having not only completed the acquisition of 2SG, but also recorded strong growth from its established businesses.

If you are unfamiliar with Vonex, the following presentation will bring you up to speed:

The company announced record sales in March which contributed to an all-time record quarter with total contract value of new customer sales for the three months to 31 March, 2020 standing at nearly $2 million.

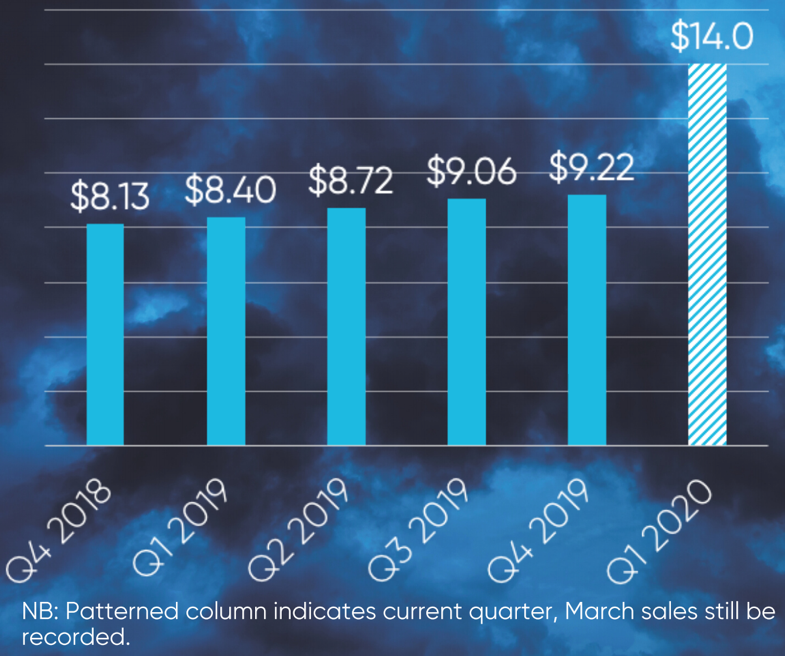

The following chart highlights the consistent growth in annual recurring revenues (ARR) that Vonex has delivered as its Retail and Wholesale businesses have gained scale in FY19 and FY20 (to 30 March, 2020).

This growth caught the interest of PAC Partners’ analyst Mark Yarwood.

Based on Vonex’s current trajectory, Yarwood is forecasting income to increase from $12.3 million in fiscal 2020 to $22 million in fiscal 2021 with the latter translating into EBITDA of $2.4 million, implying earnings per share of 0.8 cents. This would see the company trading on a PE multiple of 13.1 (at the current 10¢ share price) which appears conservative given earnings per share are then expected to increase by 139% in fiscal 2022.

Of course no one can guarantee future market movements, but PAC Partners' initiation is a strong sign / validation of what Vonex is doing and how it is going about getting things done.

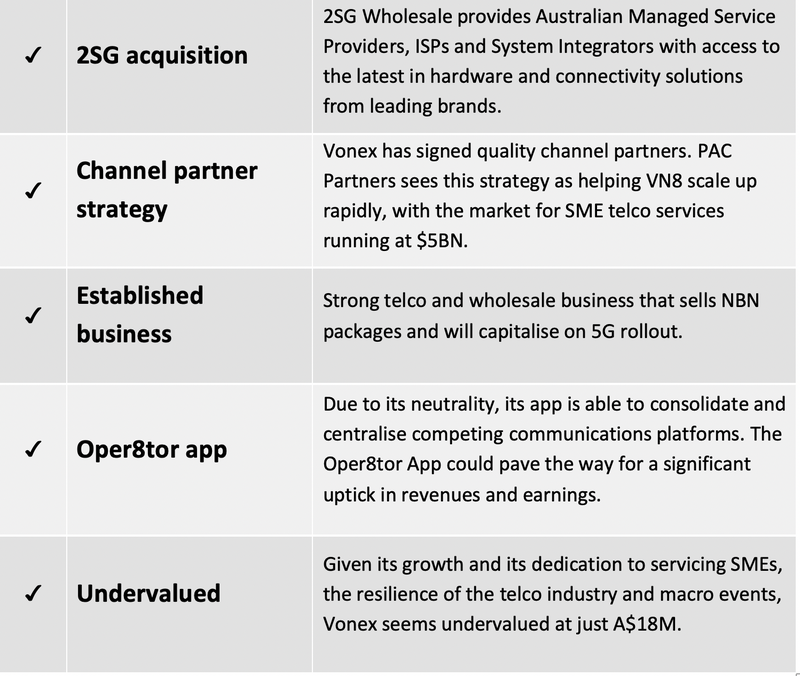

There are several key elements to Vonex’s business operations that are fueling this renewed interest and guiding investors to consider whether the company is undervalued.

CEO Matt Fahey best summed up the low valuation when he told The Next Investors: “We have reached the point we are at now by continuing to make great progress including the acquisition of another company. With close to $15 million in annual recurring revenue and a market cap just over that, we would look to be undervalued compared to our peers.”

2SG acquisition crucial to growth strategy

Vonex recently acquired the 2SG Wholesale business, which provides Australian Managed Service Providers, ISPs and System Integrators with access to the latest in hardware and connectivity solutions from leading brands.

The acquisition provides direct and established relationships with Optus and NBN, while boosting Vonex’s wholesale business from 20 to more than 160 wholesale partners.

These carrier relationships are valuable in facilitating better support, rates, control of customer internet and cost of supply.

Importantly, the 2SG acquisition will provide a substantial boost to annualised recurring revenues which are expected to increase to more than $14 million on completion.

It is also expected to contribute $750,000 to EBITDA in fiscal 2021, its first full year under the Vonex banner.

‘’The recent 2SG transaction highlights management’s appetite and ability to acquire smaller telco companies which we see as rich in opportunities,” Yarwood said in his research note.

“2SG was an asset rich purchase given its relationships with Tier-1 carriers, 100+ wholesale customers, along with direct access into NBN, offering the ability to cross-sell with the potential to build out a direct NBN presence.’’

You can read more about the 2SG acquisition in this Finfeed article:

The successful integration of 2SG Wholesale with Vonex resulted in the first month of sales being a record month in mobile broadband product, up 118% on this time last year.

2SG Wholesale is providing fast stable business grade wireless broadband, meeting strong end customer demand as the nation continues to work from home.

Vonex’s channel partner strategy is also improving its bottom line.

Channel partner strategy drives organic growth

In discussing Vonex’s key growth drivers over the next few years, Yarwood alludes to Vonex’s channel partner strategy, which has helped VN8 scale up rapidly.

With the market for SME telco services running at more than $5 billion, PAC Partners see plenty of headroom for the company to grow.

“The latest communications report from the Australian Communications and Media Authority (ACMA) forecasts industry-wide revenue to grow from $44 billion to $47 billion by 2022.

“The recent acquisition of 2SG Wholesale’s business and assets this calendar year demonstrates that management is capable of pursuing and executing a merger and acquisition strategy to build out cross-selling opportunities and supplement their organic growth profile.”

Defensive qualities during market volatility

Apart from possessing a strong growth profile, Yarwood is also impressed with Vonex’s ability to continue to prosper despite a challenging economic and industry environment.

On this note he said, ‘’VN8 is operating in a defensive part of the market and we expect a rapid acceleration away from on-premise to solutions like VN8’s cloud-based PBX solution which should see a continual uptick in registered users.”

Looking at its Private Branch Exchange (PBX) cloud-based phone system platform, active user numbers exceeded the 37,500 mark last month, with growth driven by global events superseding what can historically be a seasonally slower period for SME investment decisions.

Growth in registered PBX users indicates business development progress as Vonex penetrates the multi-billion dollar Australian market for telco services to SMEs.

Yarwood also noted that the group’s channel partner strategy should continue to facilitate geographic expansion.

The total addressable market builds through the greenfield and brownfield expansion of NBN as enterprise customers migrate across to NBN, with activations running at 6.5 million, implying 3.5 million still to activate.

Activations are expected to accelerate as customers run out of time before the Public Switched Telephone Network (PSTN) copper is decommissioned.

March was a big month for sales and activations

As we noted earlier, Vonex chalked up a record month of sales in March and delivered an all-time record quarter with Total Contract Value (TCV) of new customer sales for the three months to 31 March just shy of $2 million.

TCV excludes existing customers re-contracting and revenue is normally realised over a period of between one to three years.

March quarter sales represented a year-on-year gain of 109%, placing the company in a robust position to deliver a strong fiscal 2020 result.

It is worth noting that customer sales in March were $787,000, which would equate to a quarterly run rate of more than $2.3 million, suggesting that momentum is building as the group progresses into the June quarter.

Social distancing has seen Vonex benefit from an historic shift towards working from home for staff of small to medium enterprises (SME).

The proactive ‘Stay at Home with Vonex’ marketing campaigns have seen the company grow softphone sales by in excess of 1,000% in February and March over the two-month period one year earlier.

Vonex’s softphone products are the desktop and mobile apps which act as an extension of a worker’s business phone system, offered as part of the company’s ONdesk monthly plans.

It is also worth noting here that key marketing partner, Qantas Business Rewards, was set to launch a “Business Essentials” campaign, showcasing Vonex to its SME members this month. This will provide members with an opportunity to earn Qantas Points on Vonex’s ONdesk and NBN products.

Vonex expects to deliver continued growth in TCV in fiscal 2020 as a mix of upfront and recurring revenue as it meets growing demand from SME customers.

As can be seen below, Vonex has delivered exceptional TCV growth in 2019/2020:

To illustrate how the company has grown over the last 12 months, March quarter sales were more than double that achieved in the three months to March 31, 2019.

Consequently, Yarwood’s strong growth projections over the next few years appear well within the company’s grasp.

Vonex continues to innovate

The imminent launch of Vonex’s Oper8tor App could pave the way for a significant uptick in revenues and earnings.

Oper8tor’s cross-platform message functionality across several social media platforms as well as SMS and its ability to call blast landline and mobile numbers has been verified.

“The development of Oper8tor to date has been a credit to our team in getting it from concept stage through many phases of development and testing to a functional app,” said Vonex Chief Technology Officer, Angus Parker.

“We are now moving forward involving larger scale controlled users to give us the feedback we need to improve functionality of the app, including user experience.”

There was more good news recently, with Vonex announcing that its innovation track record was recognised through enhanced intellectual property protection.

Vonex was recently granted a patent from the US Patents Office for the unique Oper8tor platform, which will allow the company to progress Oper8tor’s development with less risk to commercialisation.

In terms of commercialisation, Vonex engaged London-based investment advisory firm Ragnar Capital Partners LLP to target potential partners who could help take Oper8tor through its rollout and commercialisation phases.

“Now we are looking for a partner that could bring complementary expertise and support to further enhance the application’s design and functionality as we roll it out and commercialise,” Fahey said.

“Ragnar has reach into Europe and the Asia-Pacific regions which is a good fit as we target the right partner to help drive Oper8tor into the market.”

The same benefits that Oper8tor promised to afford Vonex shareholders are just as relevant as they were prior to the advent of COVID-19.

The company’s robust financial performance and the potential upside offered by Oper8tor have been instrumental in the company trading as high as 14.5 cents in the last four months.

With these factors still in place, the recent sell-off that has seen the company’s shares halve appears to be unjustified and PAC Partners’ predictions of an upside of 100% may not be far off the mark.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.