Tin conference set to expose this unassuming technology metal

Published 24-OCT-2018 10:11 A.M.

|

6 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Keeping an eye on the in-demand commodities from the boom in new technologies has paid off for investors in recent years. Lithium, cobalt, vanadium, and graphite have benefited from rising demand brought about largely by the growth in rechargeable batteries and the technologies they power, including electric vehicles.

However, Boston’s Massachusetts Institute of Technology (MIT) has compiled its own list of the commodities that it expects to be the most impacted by new technologies going forward.

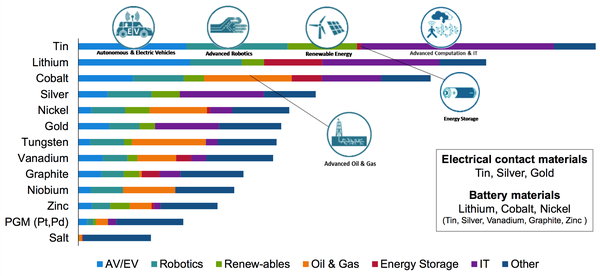

Rio Tinto (ASX:RIO) presented this information at the Lithium & Battery Metals Conference in Perth earlier this year, via the infographic below.

As you can see, tin came out far ahead of the pack as the metal that will be most affected by new technologies, ahead of the highly touted battery metals —lithium, graphite and cobalt.

These findings by MIT and presented by RIO, highlight the fact that tin is in demand from a whole host of new technologies including autonomous and electric vehicles, advanced robotics, renewable energy, and advanced computations and IT.

However, tin along with tin producers and exploration companies, haven’t yet generated the same level of excitement as other commodities ... even though tin has additional applications for robotics, renewables, energy storage and information technology.

That also comes despite the tin sector having strong fundamentals with a forecast global shortfall in supply due to have a significant impact by 2020.

While tin prices haven’t yet scaled the heights of other battery metals, now could be a wise time to take a closer look at the sector.

Around 50% of the tin produced globally is used in soldering in electronics. The trade current war between the United States and China and the increased tariffs of electronics, in particular, have kept the tin price somewhat depressed.

These tariffs will add to the challenges of a sector that has already been hit by China’s environmental clampdown on polluting industries.

That said, there remains a supply-demand gap to be filled as LME tin stocks are now close to historic lows, while the tin market has seen a consistent supply deficit in recent years. This is expecting to remain through 2022 due to increased regulations in producing countries and depletion of ore reserves.

As confirmed by MIT, tin has a bright future backed by new technologies, including the electric vehicle and battery storage markets with tin used in lithium-ion batteries, as well as it being widely used in lead-acid batteries. Demand also remains strong for electronic solders.

The fact that tin is extremely versatile bodes well for the price and market outlook going forward.

This upside for tin has been recognised by ASX-listed MetalsX (ASX:MLX). The company is a globally significant tin producer with its 50% equity interest in the Renison Tin Operations in Tasmania, including the world class Renison Tin Mine.

This is one of the world’s largest and highest grade tin mines with mining spanning three centuries. Renison is the largest tin producer in Australia and one of the few publicly held tin projects in the world.

MetalsX is just one of the many ASX-listed tin companies presenting at the Beer & Co. 6th Annual Tin Conference on November 7 in Melbourne. The other tin companies presenting are:

Aus Tin Mining (ASX:ANW)

Aus Tin Mining’s Taronga Tin Project (Taronga) is a world class resource of 57,000 tonnes of contained tin, as well as 26,400 tonnes of contained copper and 4.4 million ounces of silver. The company has completed a Pre-feasibility Study (PFS) that demonstrated that Taronga was technically feasible and economically viable.

The company also has in its portfolio the Granville Tin Project in Tasmania, as well as the Mt Cobalt Project, a nickel-cobalt-copper exploration project in Queensland.

Kasbah Resources (ASX:KAS)

Kasbah Resources (ASX:KAS) (75%) and its Joint Venture partners, Toyota Tsusho Corp (20%) and Nittetsu Mining Co. (5%), are advancing the Achmmach tin project towards production in the Kingdom of Morocco.

The DFS is now complete and funding is underway in preparation for construction that’s expected to commence in the first half of 2019.

Stellar Resources (ASX:SRZ)

Stellar Resources’ (ASX:SRZ) 100%-owned Tasmanian tin assets, including the Heemskirk Tin Project, are ideally situated, located just 18 kilometres southwest of Rension which is, as mentioned, one of the world’s largest and most productive tin mines.

Stellar is advancing the Heemskirk Tin Project towards a definitive feasibility study. At the same time, the company is searching for a suitable partner to help fund the project through to production.

Elementos Ltd (ASX:ELT)

Elementos Ltd (ASX:ELT) is focused on the exploration and development of tin mining projects. The company recently completed the first drilling program, and increased the JORC Resource Estimate, at the Cleveland tin-copper and tungsten projects in Tasmania since acquiring the project more than seven years ago.

The company is implementing a new corporate strategy to create a robust portfolio of tin assets at various stages of development, through the acquisition of the Oropesa Tin Project in Spain and Temengor tin project in Malaysia. ELT has now completed satisfactory due diligence on Oropesa.

New Age Exploration (ASX:NAE)

New Age Exploration’s (ASX:NAE) focus has been squarely on its 50%-owned Redmoor tin-tungsten project in Cornwall, UK.

A 20-hole drilling program was successfully completed at the end of 2017 when the project set the record as the world’s third highest grade new tin–tungsten project.

Recent drilling has intersected further high-grade zones in phase I drilling at Redmoor in the United Kingdom. The seven-hole program is complete with the third and fourth holes delivering the highest-grade length-averaged intercepts yet drilled at the project.

Thomson Resources (ASX:TMZ)

Thomson Resources (ASX:TMZ) is focused on the discovery and development of high quality mineral deposits in NSW, particularly its Bygoo tin discovery in the Ardlethan Tin Field, central NSW.

Approvals are largely in place and a drilling rig secured for drilling programs at its tin and gold projects in central NSW. Around 3000m of drilling is planned, the largest program undertaken to date by TMZ in the Ardlethan district. Outstanding earlier drill results at the Bygoo tin project include 35m at 2.1% tin: one of the best tin intersections seen in Australia for decades.

The keynote speaker at the Beer & Co. Tin Conference will be Reuters Asia Commodities and Energy Columnist, Clyde Russell. Russell has been a journalist and editor for 28 years covering everything from wars in Africa to the resources boom. He writes about trends in commodity and energy markets, with a particular focus on China.

The conference will be held on Wednesday, November 7 at the RACV Club in Melbourne. You can secure your free registration by registering at www.beerandco.com.au or sending an email to [email protected].

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.