TMZ’s Releases Webbs MRE Chasing 100Moz Target

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and Associated Entities, own 5,472,748 TMZ shares and 1,368,190 TMZ options at the time of publication. S3 Consortium Pty Ltd has been engaged by TMZ to share our commentary and opinion on the progress of our Investment in TMZ over time.

The market looks rough and traditional safe havens like precious metals aren’t proving immune to the sell off.

But we think potential inflation hedges like gold and yes, SILVER, may come back into vogue in the coming 12 months.

Not to mention the strong demand for silver projected to come from solar panels as the world goes hard on renewable energy.

In this context, we want to check in on our silver Investment.

Thomson Resources (ASX:TMZ) released its latest Mineral Resource Estimate (MRE) for its Webbs deposit last week - another tick mark for the company on the road to a planned 100Moz silver equivalent resource across its five deposits.

This is TMZ’s fifth JORC 2012 MRE release and is an essential part of its push towards production.

We want to be forthright about TMZ - this Investment hasn’t worked out so far like we hoped.

That doesn’t exclude the possibility that it may work out in the future though.

We first Invested in TMZ at 8.8 cents when we thought there was a real possibility of a silver squeeze playing out. TMZ shares currently sit well below our entry at ~2.7 cents.

While this paper loss stings, we’re also conscious of the fact that TMZ is doing the hard yards to bring its project into reality.

Development phases for mining companies can often see market sentiment turn - something that appears to have played out for TMZ.

We don’t think funding is an immediate concern for TMZ, but its margins for error are thin.

We note that TMZ had $1.4M in cash at 31 March and access to $5M over the next 12 months via an Equity Funding Facility Agreement with Securities Vault.

The facility is an “at the market” facility that is basically a pool of capital. In TMZ’s case this is $5M, which TMZ can access whenever they see fit.

Once a draw-down of that cash happens TMZ issues shares to Securities Vault totaling the amount of cash drawn-down from the facility.

It is relatively similar to a “convertible note” except there is no interest attached to TMZ’s facility.

Every time TMZ does a draw-down it will receive the gross amount drawn minus a 6% commission.

There is no obligation to use the facility - but it's there if they need it.

It also doesn’t help that Silver Mines which held 9.88% of TMZ as of 16 March, sold down to 7.86% as of 4 May.

When we first Invested we had assumed Silver Mines would be a more sticky holder and this sell down hurts TMZ’s ability to raise money at non-dilutive share prices.

That being said, TMZ currently has a market cap of $17.8M. Adding up the previous four restated JORC 2012 compliant MREs, this brings the total Indicated and Inferred mineral resource across TMZ’s five deposits to 54.4Moz silver equivalent.

We think TMZ compares favourably with ASX listed silver peers like Investigator Resources (market cap ~$61M, 53Moz of silver) and Silver Mines (market cap ~$213M, 275Moz silver equivalent).

While there are a number of variables at play here, we think TMZ could have more upside in a silver bull run.

These variables take the form of risks - which we address in our risks section.

However, with the Webbs JORC 2012 MRE in hand (as announced last week), TMZ is over halfway towards the 100Moz target that it thinks is necessary to make the five deposits economic to mine under its cohesive “Hub and Spoke” strategy.

With a Final Investment Decision slated for 2025, we intend to hold the majority of our TMZ position until it gets into production.

TMZ’s Webbs deposit resource announcement clearly outlined the next steps for the company and how it intends to get to that 100Moz silver equivalent target:

- Getting base metals into the re-stated Mt Carrington JORC 2012 resource estimate (key and in progress)

- Drilling at Texas Silver District to extend resource and test geophysical targets (to start in June)

- Webbs deposit drilling (to start Q3)

- Metallurgical and Process Pathway for central processing hub (happening now)

We think that if TMZ can accomplish all this, the 100Moz target is achievable.

If there’s one takeaway from today’s note it’s this: we’re confident that TMZ can hit the 100Moz AgEq mark or at least (base case) get very close.

We’ve outlined the following cases for TMZ:

Bullish case: >100Moz AgEq

Base case: 90-100Moz AgEq

Bear: <90Moz AgEq

So in today’s note, we’ll share the numbers from the Webbs MRE and what these next steps are.

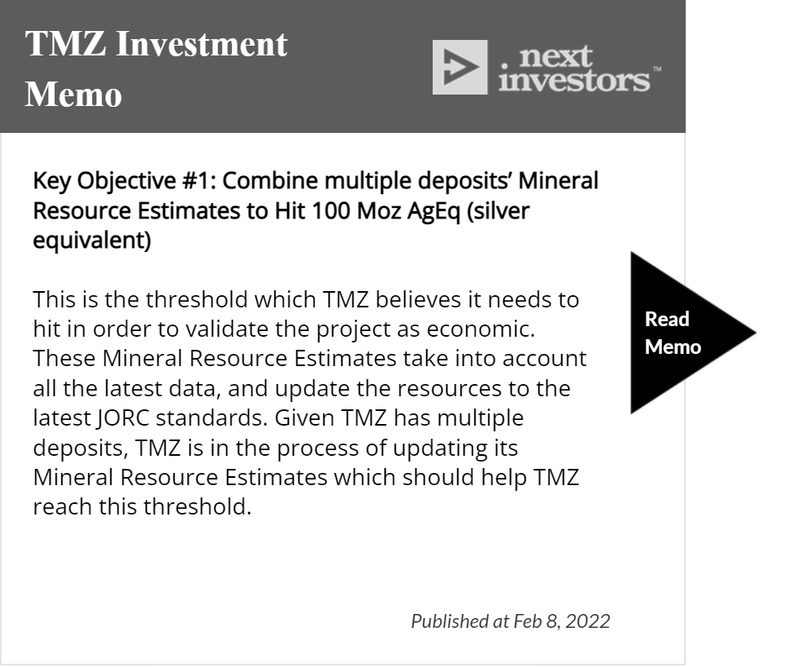

The announcement advances our #1 Objective for TMZ this year:

What was in the Webbs MRE?

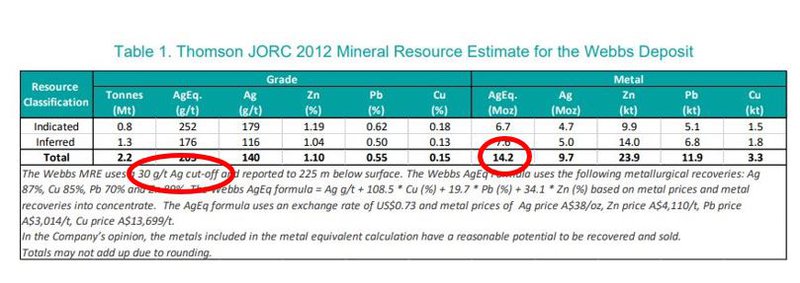

These are the key details from the 14.2Moz AgEq (silver equivalent using a 30g/t silver cut-off) Webbs MRE released last week:

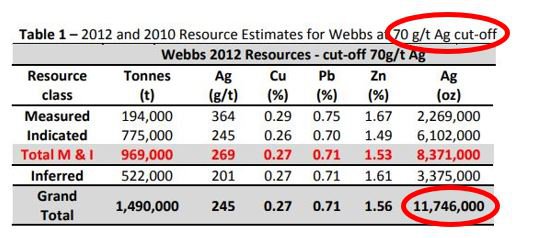

TMZ managed to squeeze an extra 2.5Moz out of the Webbs MRE (with a lower cut-off, circled) compared with the one that Silver Mines had released in 2012 (11.7Moz Ag):

Now granted, the TMZ MRE was silver equivalent while Silver Mines’ was just silver.

But what this new MRE does, however, is give TMZ increased confidence of what they actually have on its grounds, which sets TMZ up nicely for a run home to 100Moz in its next steps.

What does TMZ need to do next?

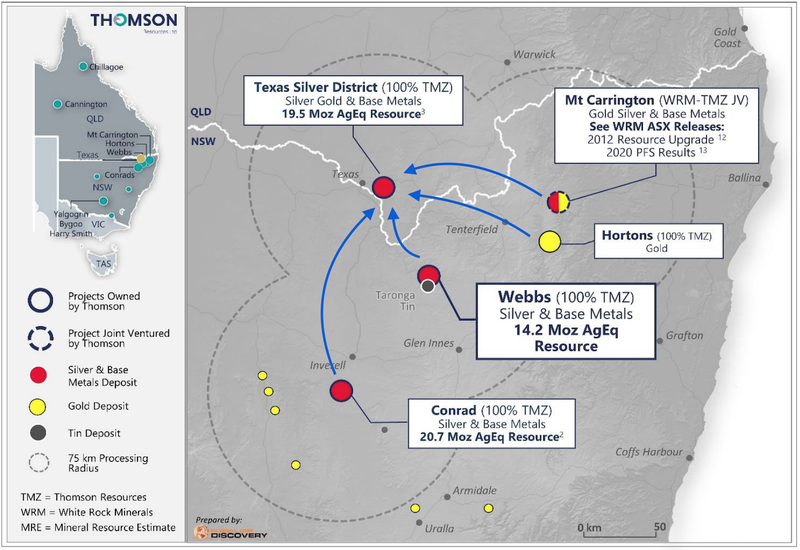

Here’s a short summary of TMZ’s strategy:

TMZ’s plans to combine multiple resources to bring together the firepower necessary to make the project economically viable.

Part of this strategy involves further defining several different smaller scale deposits within close proximity to each other.

These will form the basis for a large silver resources hub (plus gold, zinc, lead, copper, tin) all of which is processed through one central processing facility.

TMZ calls it the ‘Hub and Spoke’ strategy, because it looks like this:

There’s Mt Carrington on the right (east), Webbs in the middle (which had its MRE released) and Texas in the middle - the proposed hub of the ‘Hub and Spoke.’

We’ll discuss next steps at Mt Carrington, Webbs and Texas today.

Mt Carrington

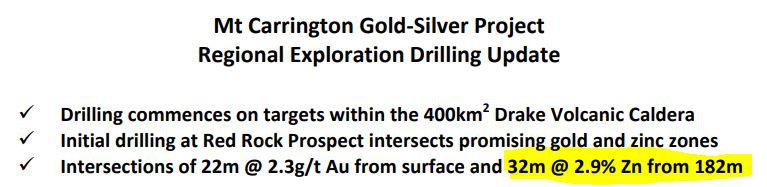

A core component of TMZ’s next steps is the inclusion of base metals at Mt Carrington.

In May of last year, TMZ restructured the JV with White Rock to include gold, silver, zinc, copper and lead in the new polymetallic Mt Carrington MRE.

Mt Carrington already has JORC 2012 and JORC 2004 MREs of gold and silver contained in eight deposits that are suitable for open pit mining methods and a JORC 2012 gold Reserve.

This is what the resource looked like as of 2012:

Gold: 284,000oz

Silver: 23.3Moz

Under the restructured JV agreement, TMZ can earn-in for up to 70% of Mt Carrington. Rough back of the envelope calculations on the silver resource at Mt Carrington would bring TMZ closer to that 100Moz AgEq number.

Silver alone at 70% of Mt Carrington would be 16.3Moz, adding to the 54.4Moz after last week's Webbs MRE, and bringing the total to around 70.3Moz.

We expect TMZ to now run the maths on how the gold fits into silver equivalent ounces and demonstrate how zinc, copper and lead can add to the resource.

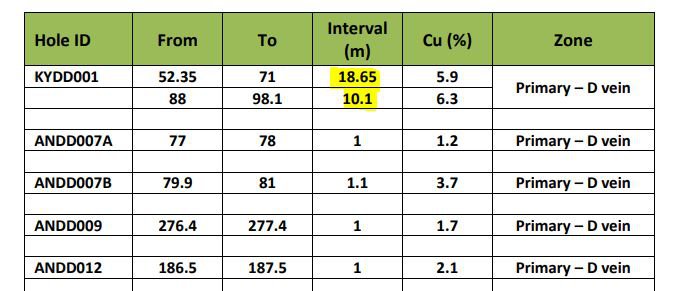

We did some digging, and back in the day it looks like the Mt Carrington deposit had a history of solid zinc and copper intercepts:

That’s a pretty good zinc intercept.

And some high grade copper intercepts:

Given these base metal intercepts, we think the following...

Key takeaway: We’re confident that TMZ can this year hit the 100Moz AgEq mark, or at least (base case) get very close.

We’ve outlined the following cases for TMZ:

Bullish case: >100Moz AgEq

Base case: 90-100Moz AgEq

Bear: <90Moz AgEq

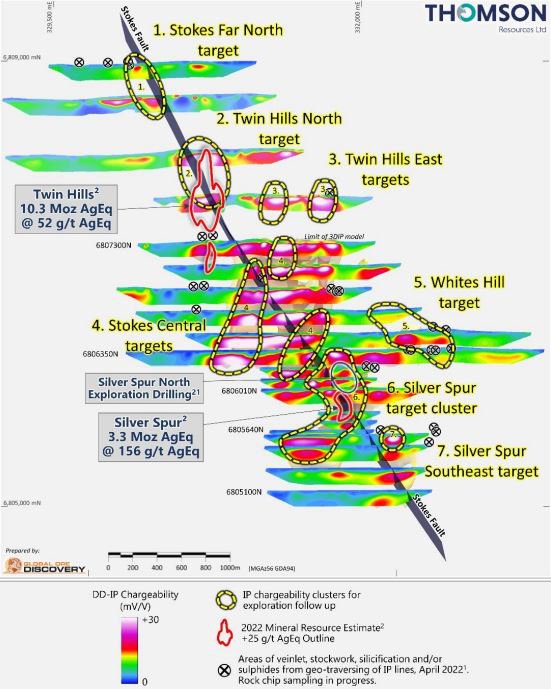

Aiding TMZ’s cause should be additional drilling at the “Hub” of their “Hub and Spoke Strategy” the Texas deposit.

Drilling at Texas

Resource extension drilling is planned for this month at Texas which could throw up some good hits.

We base this expectation on the fact that TMZ recently completed a Dipole-Dipole Induced Polarisation (DDIP) geophysics survey at Texas in late May.

That survey yielded seven groups of “strongly anomalous previously undrilled chargeability anomalies.”

These are the “colourful blobs” we talk so much about:

TMZ plans to follow up on this geophysics survey and we think the proximity to the existing deposits here is a good thing.

TMZ will be familiar with the terrain and has a range of targets to choose from - we’re looking forward to the results from this drilling program.

Webbs deposit drilling

Given how TMZ was able to go over Webbs with a fine toothed comb by releasing last week’s MRE, the company now says they have more targets to drill at Webbs.

That drilling will take place in Q3 and could be an added bonus to the already comprehensive understanding that TMZ has at Webbs.

Metallurgy will be important

We’ve previously had a look at TMZ’s metallurgical work, which is ongoing.

TMZ is working with multiple resources and multiple different metals. If its “Hub and Spoke” strategy is to work, the company will need to know how to process the various metals from different deposits.

We expect to hear more from TMZ on metallurgy work in the coming months.

This forms Objective #2 for TMZ from our Investment Memo:

Risks

We’ve highlighted the risks for TMZ below:

We believe that market risk and funding risk are the two most pertinent risks for TMZ right now.

The two work together - poor investor sentiment towards silver will naturally make access to capital harder for TMZ.

TMZ had $1.4M in cash at 31 March and access to $5M over the next 12 months via an Equity Funding Facility Agreement with Securities Vault. We want TMZ to be a good steward of this capital as margins for success are thin if the silver price takes a major hit (it’s currently sitting at ~US$21.67).

Here’s a word on what’s going on in markets right now.

Markets and why TMZ is a long term hold for us

The market is looking pretty rough right now and a TMZ has followed a path down the charts like many of our stocks.

We’re always looking to improve our Investment methodology and we’ve learned the following from our TMZ Investment:

- The silver squeeze didn’t materialise, likely due to the sheer size of the silver market

- Our entry or initial Investment could’ve been better timed (we Invested at 8.8c and then at 10c)

- Development companies have a number of risks that exploration companies don’t (it can be complex and time consuming to bring a mine to production)

With that said, we intend to hold the majority of our position in TMZ through to production which is on an indicative timetable to occur shortly after a Final Investment Decision in 2025.

That may seem like a long way away - but we’re not phased. We’re explicit when we say we invest for the long-term.

In the meantime, we’re bullish on silver's prospects in the coming years as both an industrial and precious metal (it’s used in jewellery AND solar cells).

TMZ gives us exposure to silver like few other Investments can - it has one of the highest grade undeveloped silver projects in Australia.

Our TMZ Investment Memo

In our TMZ Investment Memo you’ll find:

- Key objectives for TMZ in 2022

- Why we continue to hold TMZ

- Risks

- Our investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.