New Portfolio Addition: Arovella Therapeutics

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 13,631,579 ALA shares. S3 Consortium Pty Ltd has been engaged by ALA to share our commentary on the progress of our investment in ALA over time.

Today we are finally announcing a new investment in the Next Investors portfolio.

Regular readers will know an addition to the Next Investors portfolio is a rarity. Our team analyses hundreds of companies every year, rarely do we come across companies that we like enough to invest in and add to our portfolio.

In 2021 we only made five new investments.

This is because in the Next Investors portfolio we are looking for companies we think have the best chance of delivering a rare but coveted 1,000% plus return over a long term hold.

Introducing our first Next Investors portfolio addition for 2022:

We think early stage biotechs will be a key investment theme over the next 10 years. We’ve been patiently waiting to add another biotech company to our portfolio.

Arovella Therapeutics (ASX:ALA) is a small ASX biotech going after a unique solution to the scourge of cancer - with cutting edge technology licensed from some of the foremost cancer research institutions - and has attracted big names to the project.

At stake, is a chance to improve the lives of millions by solving three core problems that existing technologies suffer from.

ALA's tech could prove to be cheaper, safer and effective across more cancers than those of existing technologies.

That sounds great to us, but to be clear, this is a very early stage company which carries all the risks associated with emerging biotechs.

Which is why we believe it’s perfect for our portfolio - high risk matched with high reward, an intrinsic part of our investment methodology and style.

The prize for a successful treatment is big, with the global cancer therapeutics market projected to hit nearly US$200B in the next four years.

So if ALA can crack the code and prove its technology works, it will be a great outcome for investors such as ourselves.

As we hinted above, the heavyweights of the Australian biotech industry are also involved.

ALA is backed by Merchant Funds Management, whose manager Andrew Chapman has an impressive track record in biotech investing.

His most notable success are:

- Polynovo: $0.04 to $2.30 ($4.05 high) – 10,025% (return low to high)

- BARD1 Life Sciences: $0.50 to $1.45 ($5.60 high) – 1,020% (return low to high)

- Race Oncology: $0.14 to $3.35 ($4.20 high) – 2,900% (return low to high)

The second biotech heavyweight involved is the ALA’s Chairman Paul Hopper, who has been involved in publicly traded biotechs for over 20 years.

Hopper was the Chairman of ASX listed Viralytics, which was acquired by global pharmaceutical giant Merck for $500M in 2018. Some of his most recent successes include:

- ASX listed Imugene: From ~$0.025 to $0.315 (1,160% return in under 2 years)

- ASX listed Prescient Therapeutics: From ~$0.04 to $0.195 - (388% return in under 2 years).

While obviously past performance doesn’t guarantee future success, for our investment in ALA, we are again listening to the expert opinions and following the money of early stage biotech experts that we know and trust.

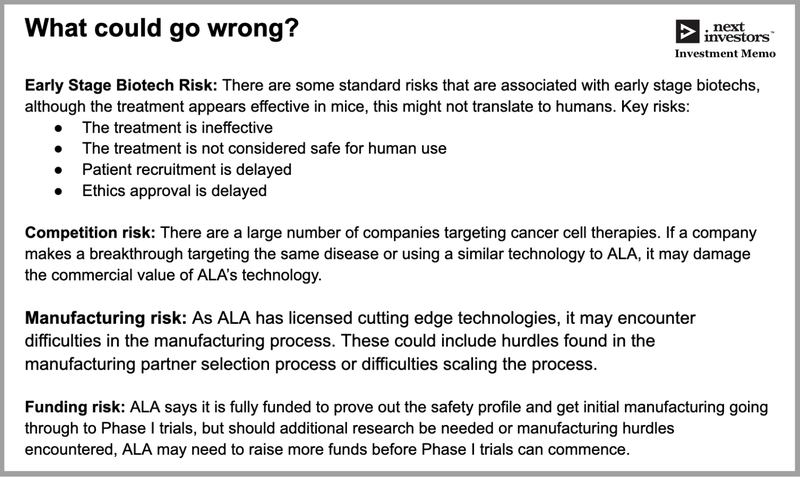

In the next 24 months, ALA’s success hinges on scaling this new cancer treatment from the lab through to eventual Phase I clinical trials. Something which has a diverse set of risks associated with it.

Phase I is just “base-camp” for the company. After that, there’s Phase II and Phase III, and assuming its treatment clears these hurdles, only THEN can investors start thinking about commercialisation.

Commercialisation could realistically be up to ten years away, but we believe there are opportunities for significant share price re-rates along the way, should the company’s journey prove to be successful.

It’s the medical equivalent of scaling Mt Everest from base camp, but we’re here for the long haul and keenly anticipating what this company can achieve in the next few years.

Arovella Therapeutics (ASX:ALA) is an $26M market cap company seeking to develop an ‘off-the-shelf’ cancer cell therapy treatment - part of the broader field of cancer immunotherapy.

ALA currently has a market cap of $26M. At the end of the December quarter it had $4.4M in cash, since then it went on to raise $4.6M at 3.8c in early January.

On top of this, ALA has a Share Purchase Plan open right now to existing holders (as of the record date of 21st January) also at 3.8c, to raise another $1.5M. The closing date for the SPP is the 9th of March. We think until the SPP is closed off there may be a bit of churn in the share price, as existing holders sell their shares in exchange for the 3.8c SPP shares they have on offer.

With the proceeds from the placement and SPP, we estimate that ALA will have $10.5M in the bank (Assuming the SPP is 100% taken up), which equates to an enterprise value of ALA to be ~$15.5M, which we think is quite small for a junior biotech doing frontier research with large upside potential on success.

With biotech stocks like ALA, we like to invest early and follow proven experts with an investing track record like Merchant and ALA Chairman Paul Hopper.

We also really liked the CEO and MD Michael Baker who we met with a few times during our DD process - he has 15 years experience in scientific research, drug development, is a genuinely good guy and really knows his stuff.

We back the ALA management and our plan is to patiently wait with our investment as the company delivers on a number of milestones towards its next major catalyst, which for ALA is the commencement of Phase I clinical trials in the first half of 2023.

We will hold the majority of our position into the Phase I trial and re-assess our investment plan based on the results.

Our ALA Investment Memo for 2022

We’ve been rolling out ‘Investment Memos’ across our portfolio to better track our portfolio companies.

An Investment Memo is a short, high-level summary of why we invested and what we expect the company to deliver in 2022, including risks and our investment plan.

We’ll be using this Investment Memo as a way to assess ALA’s progress during 2022 and also examine how our investment thesis plays out throughout the year.

Here is a breakdown:

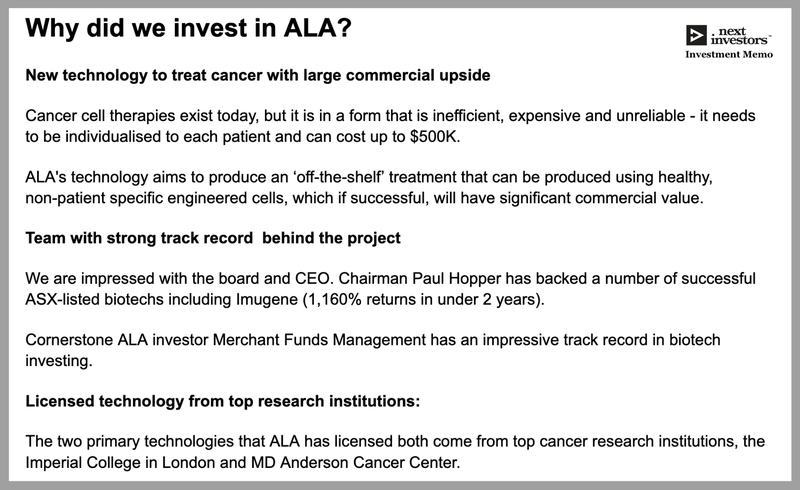

Quick summary of why we invested in ALA

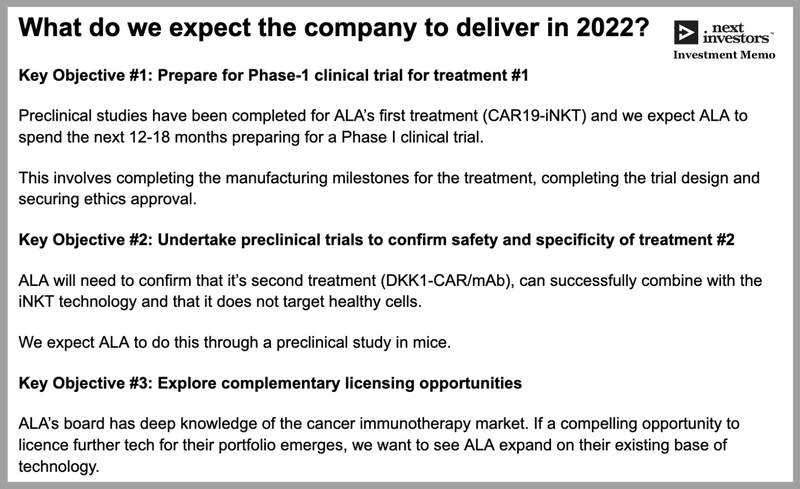

Here is what we want to see ALA achieve in 2022

What are the key risks?

Our ALA Investment Plan

So what is ALA actually doing?

From the start, we want to stress that there are some difficult scientific concepts to digest here, concepts that took a fair few late nights on our behalf to properly understand.

We are not doctors or scientists, we are investors. When we invest in companies pursuing technologies with scientific concepts that are outside our expertise, we follow the lead of other successful investors - in this case Merchant Funds Management and biotech entrepreneur Paul Hopper.

We trust that their track record and experience in the industry will increase the chances of developing a successful biotechnology.

To get a better understanding of what ALA is trying to achieve, let’s start with the broad context.

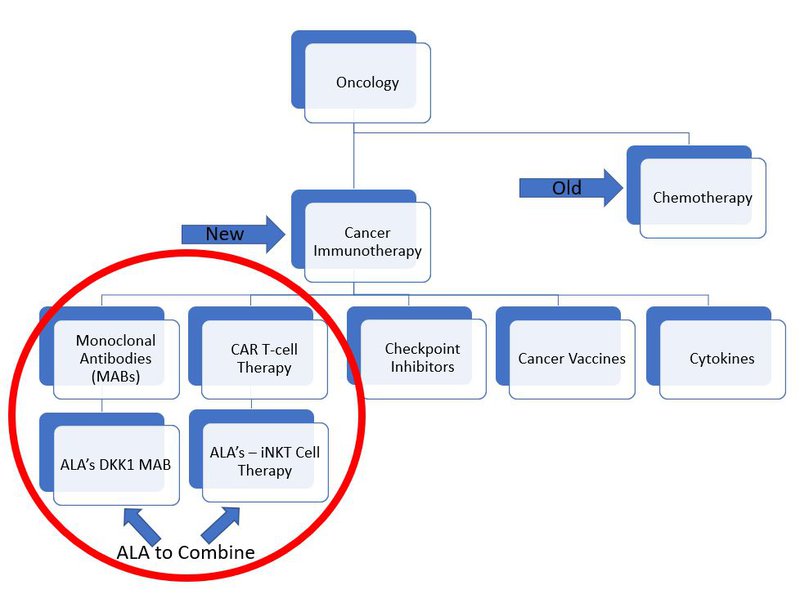

“Cancer immunotherapy” aims to stimulate the immune system to treat cancer, effectively using the body's own defenses to fight the disease.

In contrast, current chemotherapy treatments take a blunt hammer approach.

Chemotherapy relies on powerful drugs to kill the cancer, and because healthy cells are part of the collateral damage of chemotherapies, it’s a nasty experience, with a number of drawbacks for health systems, patients and families.

This is where ALA fits in. ALA operates in the sub-specialty of cancer immunotherapy called “cell therapy”.

Cell therapies use genetically engineered cells to target and kill cancer cells, while minimising collateral damage to the other healthy cells in the body.

The most common form of cell therapy is “T cell therapy”, which is currently used today to treat patients with cancer.

The only problem is that this therapy needs to be made specifically for each cancer patient, rendering it expensive, insufficient and unreliable for scale.

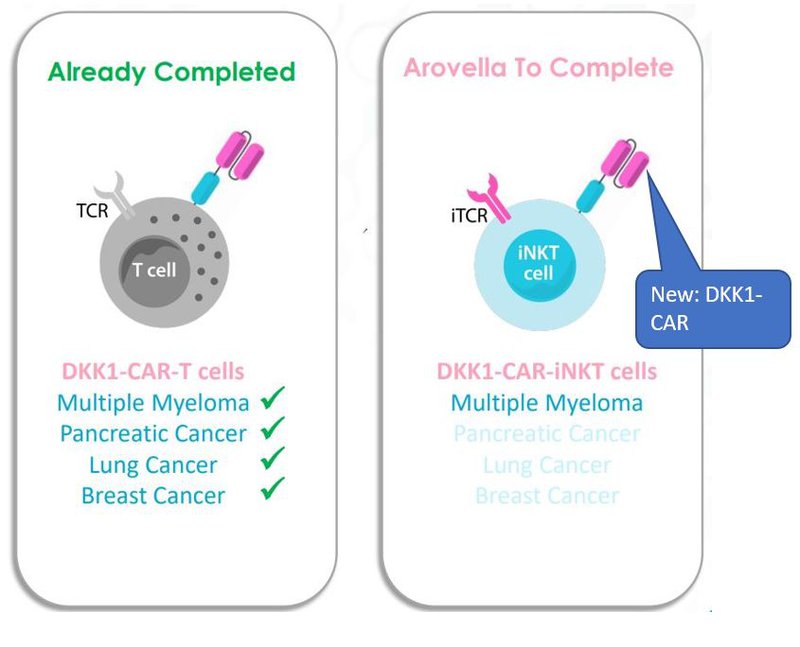

ALA aims to reduce these limitations by developing an ‘off-the-shelf’ solution. It has two lead programs:

- Its Natural Killer T (iNKT) Cell Therapy Platform, which produces a CD19-CAR to kill blood cancers that produce CD19 (iNKT technology), and;

- DKK1-CAR monoclonal antibody - a modification to the iNKT cell to help it destroy a number of cancers.

ALA hopes that these two technologies will develop into ‘off-the-shelf’ cell therapies that can treat thousands of patients with cancer, without the need for an individualised treatment.

This is very cutting-edge technology and it’s important to understand how it fits in the broader framework for cancer treatment:

Currently both monoclonal antibodies and CAR T cell therapy are used to treat cancer, but there is yet to be an approved treatment that combines iNKT cell therapy and monoclonal antibodies together.

ALA aims to be the first.

Success is no guarantee here, and this is a high-risk, high-reward investment.

However if ALA does succeed, there will be outsized returns for early stage investors betting on ALA’s success.

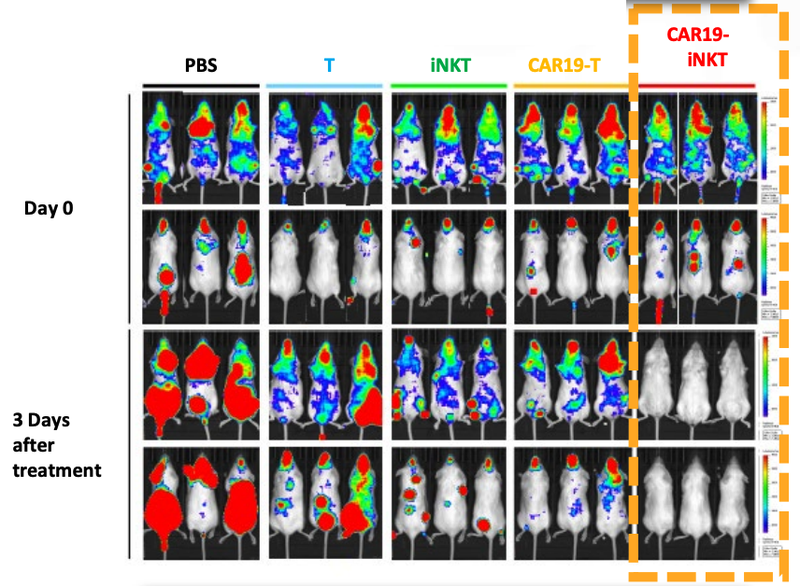

ALA’s technology has been trialled on animals in a preclinical study with very promising results.

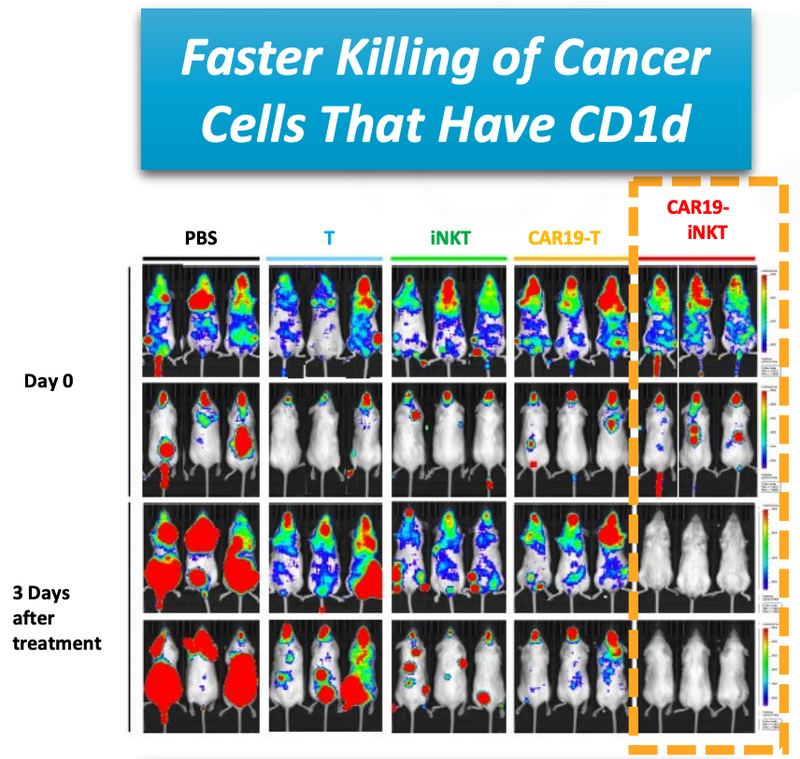

As you can see below, ALA’s therapy on the far right hand side (CAR19-iNKT), killed the cancer faster (removed the coloured blobs) than other similar treatments:

We’ll go into more detail on the preclinical studies a little bit later, but these are early promising signs that the technology is working - at least in mice.

ALA will need to undertake a rigorous clinical trial to evaluate the safety and efficacy of the treatment in humans, with the first stage being Phase I, slated for the first half of 2023.

In the meantime, ALA will need to secure manufacturing of its combined technology, as well as conduct further preclinical studies to get a better understanding of how their treatment works.

For a company capped at just $26M market cap with an enterprise value of ~$15.5M, ALA is highly leveraged to a share price re-rate if it can progress the technology.

If you would like a quick summary of why we invested in ALA, what we want to see in 2022 and the key risks, read our ALA investment memo:

[READ THE INVESTMENT MEMO HERE]

Summary: The 7 reasons we invested in ALA

Here’s the summary of the seven key reasons why we invested in ALA. Further down we will provide a deeper dive into each reason.

1.ALA’s treatment could solve problems with existing technology:

Cancer cell therapies exist today, but it is in a form that is inefficient, expensive and unreliable. This is because each therapy needs to be individualised and manufactured for each cancer patient.

ALA’s innovative iNKT technology aims to produce an ‘off-the-shelf’ treatment of this kind that can potentially treat hundreds or thousands of patients from one batch of engineered cells - avoiding the need for an individualised treatment.

A successful ‘off-the-shelf’ cell therapy technology will have significant commercial value if it is proven to be safe and successfully treats cancer.

- Licensed technology from top research institutions:

The primary technologies that ALA licensed come from TWO highly respected institutions at the forefront of cancer research, Imperial College London and MD Anderson Cancer Center (Texas).

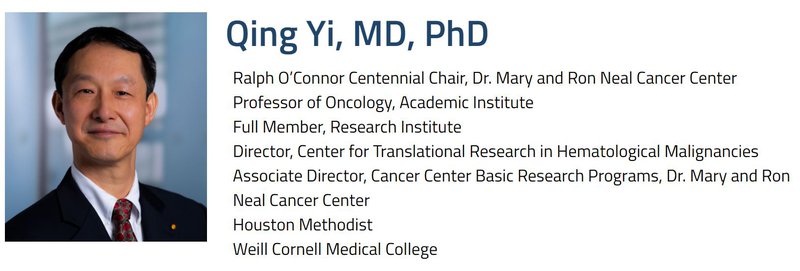

The people behind each technology, Professor Anastasios Karadimitris and Professor Qing Yi, are both incredibly well accomplished in their own right, and top researchers in the field of cancer immunotherapy.

- Key board appointments:

ALA’s cutting edge tech is bolstered by highly respected leaders in biotech which they have pulled together from both within Australia and around the world.

- Chairman Paul Hopper has backed a number of successful ASX-listed biotechs, Viralytics (Chairman, bought by Merck for $502M) and Imugene (Founder, market cap ~$1.6B)

- Director Dr. Liz Stoner has international pedigree via her work at Merck and Cornell University and is an Executive Partner at Boston based MPM Capital

- Director Dr. Debora Barton is an oncologist by training and the Chief Medical Officer of Carisma Therapeutics

- VP Manufacturing and Quality, Dr. Sandhya Buchanan brings specialist expertise in cell and gene therapy manufacturing via previous roles which included a stint at pharma giant Novartis.

- VP Development and Translational Medicine, Dr. Mini Bharathan brings more than 12 years’ experience in developing early stage therapies from well-known companies such as Celgene and Cellectis.

These key appointments give us confidence in the stewardship of the company as their presence is an endorsement of the technology ALA has licensed.

- Top shareholder has an impressive track record:

At time of initiation, Merchant Funds Management holds 7.89% of ALA and is the top shareholder.

Since its inception, Merchant has backed a number of successful early stage biotech companies. Merchant has a team of biotech analysts, working to discover the best and most undervalued small cap biotech opportunities on the ASX.

With Merchant on board, it gives us the confidence that ALA has passed the biotech expert investor test.

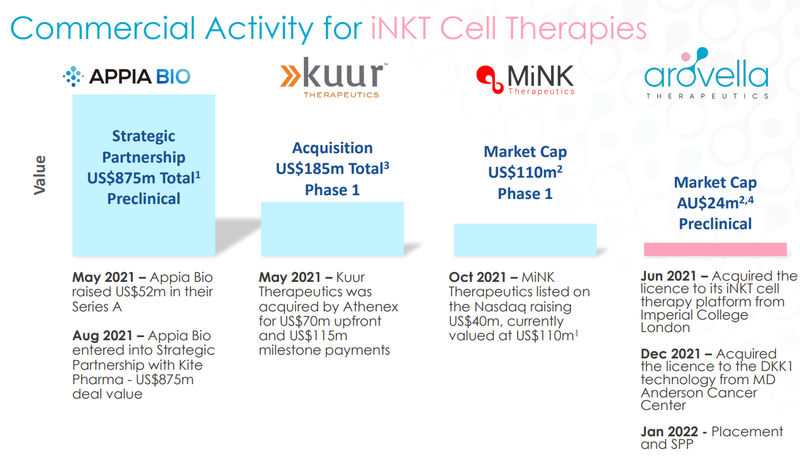

- Peer comparison shows money flowing into iNKT Cell Therapy:

ALA operates in a subspecialty of the cell therapy market, which is part of the US$156B cancer therapy market.

Cell therapy companies have proliferated at a rapid pace and there are now more than 250 working on various developments in the space.

Within the cell therapy market, there are ONLY THREE listed companies working on iNKT technology, with all three competitors valued at many multiples of ALA’s current market cap.

This means two things for us. One that money is flowing to the iNKT cell therapy space. And two, that ALA could re-rate upon early success.

- Promising results from animal trials:

As investors in very early stage biotechnology, it is important to find something in the preclinical data that indicates the technology is safe and effective.

The initial images from the preclinical studies on mice indicate that ALA’s technology is faster acting and potentially more effective than existing therapies at destroying cancer.

These are promising early signs, but the proof will be in the clinical trials, and there is no guarantee that the success translates to humans.

- Legacy tech could reduce cash burn:

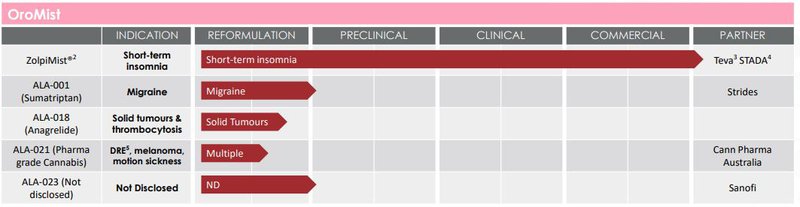

Prior to its rebranding as Arovella, ALA was called Suda Pharmaceuticals. As such, ALA has legacy tech from its previous business which is revenue generating.

While we are invested in ALA primarily for its cancer cell therapy treatment, its commercialised oral mist treatment for insomnia could reduce ALA’s cash burn as it pushes towards Phase I trials of its main cancer tech.

ALA’s Technology Overview

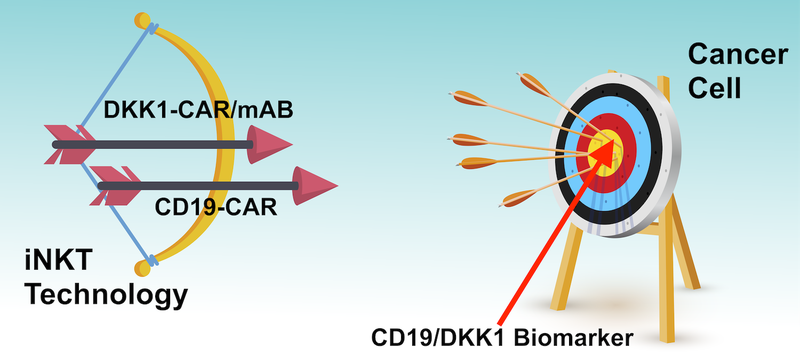

Just before we deep dive into our seven reasons why we invested in ALA, we wanted to first explain a bit more about these technologies, using the best analogy we could come up with.

Bear in mind that this is just a rough analogy, however we think it captures the main thrust of ALA’s approach to cell therapy.

Think of ALA’s technology like archery, where the cancer cells are the target that the treatment is trying to hit.

The tools at ALA’s disposal are a bow and arrow.

The ‘bow’, in our analogy, is the Natural Killer T Cell Therapy Platform - this is the cell type that is used to destroy the cancer cell (iNKT technology).

ALA has two ‘arrows’, CD19-CAR to target CD19 producing blood cancers, and DKK1-CAR/mAb to target different types of blood cancer and potentially solid tumours.

The bull’s eye, in the analogy, is the biomarker, CD19 or DKK1, which sits on the outside of the cancer cell.

The idea is for ALA to put the arrow in the bow, and try to hit the bull’s eye without taking out any innocent bystanders.

Those innocent bystanders would be other healthy human cells.

If the iNKT technology ‘hits’ the biomarker it can then go and kill the cancer cells.

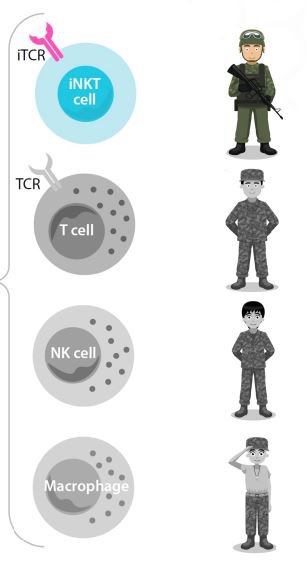

The iNKT cells are the “special forces” of the body's immune system. They are the most potent, naturally occurring immune cells.

They’re like T cells, but better. Better than NK cells and better than macrophages - the other enforcers in the body’s immune system.

ALA even has a nifty cancer killing strength hierarchy of these immune system respondents:

In short, ALA’s technology uses iNKT cells combined with either CD19-CAR and DKK1-CAR/mAb to target and kill cancer cells.

This is the scientific theory behind the technology.

ALA will need to prove that this solution is both safe and effective in humans via a clinical trial. ALA’s current market cap reflects the unproven, early stage nature of the technology - if successful, we expect a re-rate in the share price.

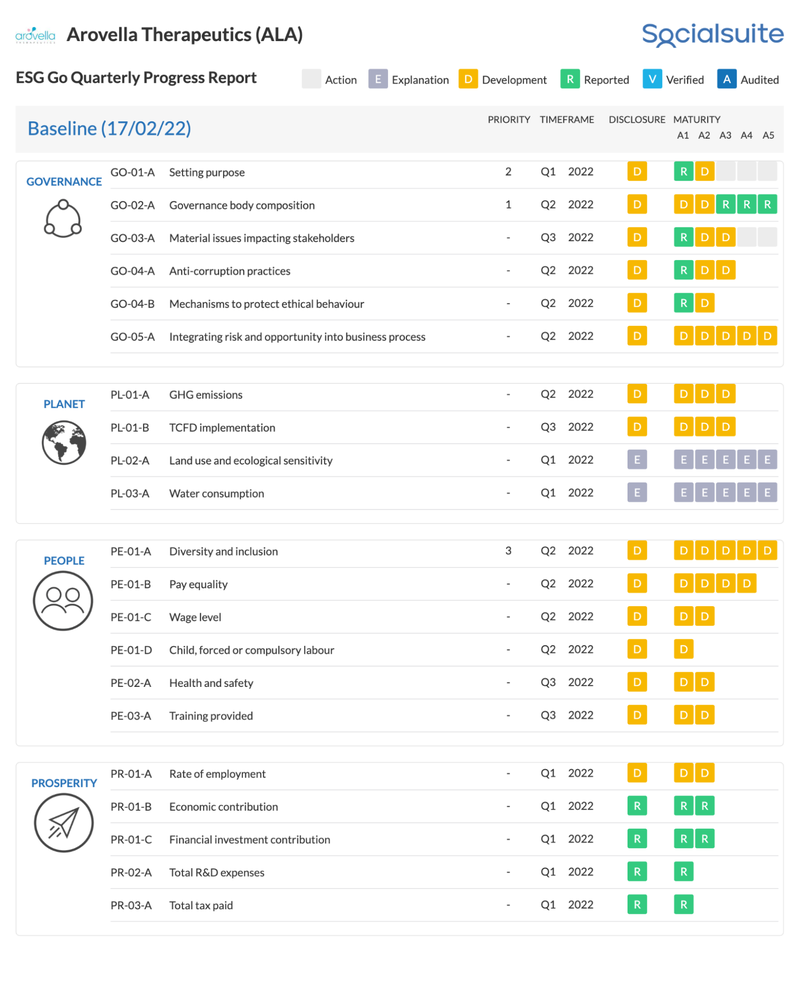

ALA is taking Environmental, Social and Governance (ESG) disclosures seriously

We invest in companies that regularly disclose and improve ESG because they are better able to:

- Access ESG funds – There is currently more ESG money than there are ESG investment ready opportunities.

- Secure top tier customers – Top companies are conscious of ESG in their supply chain – think Merck, Pfizer, Roche, Governments etc.

- Attract the most talented teams – Smart people do not want to work for non-ESG companies.

- Positive community perception – Doing business at all levels is just easier when the community wants you to exist.

- Shareholder returns with positive impact – Be proud they are creating a positive change in the world while providing outsized returns to shareholders.

ALA has committed to ongoing ESG reporting and disclosures, which can be tracked in their quarterly ESG report here (click the image to view ALA’s live ESG dashboard):

Deep Dive: The 7 reasons why we invested in ALA

1. ALA’s treatment could solve problems with existing technology

Today, the leading cancer cell therapy treatment is the ‘CAR T cell therapy’.

In 2017, two CAR T cell therapies were approved by the FDA, one for treatment of children with leukaemia and the other for adults with lymphomas.

This treatment uses the patient’s own immune cells, which have been extracted and modified in a laboratory and re-inserted into patients, to combat cancer.

Take this snippet of an article from The Guardian as an example of what’s possible with T cells:

T cell therapy is great, but here’s the key problem - it is prohibitively expensive.

Currently T cell therapy costs over $500,000 per patient (source). That cost is down to the specialist manufacturing process that is involved to create CAR T cells.

With a cost that high, we think it’s unlikely that this treatment will be available to the masses any time soon.

The reason for this expense is that each treatment is bespoke to the individual and the technology struggles to scale as a result.

But why can’t patients use T cells that are donated?

T cells that are donated can cause “graft versus host disease” or GvHD.

GvHD is a condition that sometimes occurs after a cell transplant, where the body rejects the donated cells leading to an immune response against the patient’s tissues and organs.

This is where ALA’s technology comes in.

iNKT cells, as opposed to T cells, are more safely imported from a donor - indeed they have been shown to naturally suppress GvHD.

By using iNKT cells instead of T cells, ALA aims to create an ‘off-the-shelf’ solution, drawing down the cost of the treatment and mitigating the risks associated with using the patient’s own blood.

The risk of T cell therapy includes:

- Unusable cells because the patient’s cells are damaged (due to age or the cancer)

- The delay between cell extraction, modification and treatment

- Significant side effects caused by T cell therapy

- The inability to target and kill solid tumours

As you can see, the need for an off-the-shelf therapy is pressing as the current technology cannot be scaled up, for now.

The market for off-the-shelf cell therapies is big, with the world’s largest biotech company Roche investing up to $3B to develop five off-the-shelf cancer cell therapies in September last year:

There are a few other players in the iNKT cell space targeting off-the-shelf therapies, but ALA is the only company targeting the DKK1 biomarker.

This is important because the DKK1 biomarker (the bull’s eye) is prevalent in hard to kill cancer cells.

Although ALA is conducting trials to initially target one type of cancer, the DKK1-CAR/mAB (the arrow), has demonstrated activity against blood cancers, breast cancers and solid tumours.

Ideally for ALA, its therapy becomes a ‘platform technology’, where the underlying technology can be used on multiple cancers.

We think that the DKK1-CAR/mAb ‘arrow’ enables ALA to target multiple cancers, as it has shown early signs of effectiveness in animal trials.

In summary:

- Current cancer cell therapy is expensive, inefficient and unsafe for some

- ALA is targeting an off-the-shelf solution with iNKT technology

- ALA’s technology can target multiple cancers through the DKK1-CAR/mAb

ALA will undertake Phase I clinical trials on its CAR19-iNKT treatment while it confirms the safety and specificity of the DKK1-CAR/mAb ‘arrow’ in combination with the iNKT technology.

2. Licensed technology from top research institutions

Both of ALA’s technologies have come from two institutions that have impressive reputations.

These technologies have come from some of the brightest minds in the research field.

The first technology - the iNKT technology - comes from Imperial College London and is led by Professor Anastasios Karadimitris.

The second technology - the DKK1-CAR/mAB - was developed at MD Anderson Cancer Center (Texas) by Professor Qing Yi.

The Imperial College London is a top ten university globally, MD Anderson is consistently ranked in the top cancer research institutions around the world and Professor Qing Yi is one of the preeminent researchers within the field of cancer immunotherapy.

It’s rarefied air that ALA’s technology comes from TWO top cancer research institutions - a unique achievement in it’s own right for a small ASX company with a market cap of $26M.

Technology #1: ALA’s iNKT Cell Therapy Platform (the bow)

Returning to the highly respected origins of ALA’s tech, the iNKT technology can be traced back to Imperial College London’s Centre for Haematology, whose co-director is Professor Anastasios Karadimitris.

Professor Karadimitris has been working on iNKT cell research since as early as 2005:

Professor Karadimitris subsequently published dozens of works in the field which, and some 13 years later that research lead to this article profiling the potential of iNKT technology:

You can watch ALA CEO and MD Dr Michael Baker introduce Professor Karadimitris in the video below:

Suffice to say, when ALA licensed the iNKT technology in June 2021 it marked a major achievement for Karadimitris and his team - and also marked the beginning of ALA’s new venture in cell therapy.

When investing in biotechs, we think that it is important for the original founder of the technology to be involved in the project, as they provide a wealth of experience to the development of the technology.

In August last year Karadimitris joined ALA as the Chairman of its Scientific Board for the iNKT technology - a great “get” for the company.

Remember the bow and arrow analogy though - the iNKT technology is the bow, but it still needs additional arrows...

Which is where the next technology enters the frame.

Technology #2: Introducing ALA’s DKK1-CAR/mAb (the arrow)

In December 2021, ALA licensed Professor Qing Yi’s “DKK1-CAR/mAb” also referred to as “DKK1-CAR”.

CAR stands for Chimeric Antigen Receptor - which is a receptor protein that has been engineered to give T cells the new ability to target a specific protein.

The DKK1-CAR looks like this in an iNKT cell:

This technology comes via research from Professor Qing Yi at the University of Texas MD Anderson Cancer Center and is ALA’s competitive edge compared to other iNKT technology players.

Professor Yi and his colleagues have published more than 160 peer-reviewed research articles - something that played a significant role in his appointment to an Established Investigator role at another top cancer research centre, Houston Methodist on a $6M grant.

This is the Professor below:

A seriously impressive character - we’ve profiled both him and Karadimitris for a specific reason.

Namely, that the quality of the tech that these two accomplished researchers have devised, is backed up by decades of study and institutional recognition.

Our reasoning here shares some similarities with how we go about investing in commodities stocks...

It pays to have top notch personnel behind the project.

Whether that be geos, directors or a CEO with a proven track record. This is where ALA’s appeal to us starts to shine through - they’ve got a board that is peppered with big names in biotech.

3. Key board appointments

In this section we profile four key ALA board members who are:

- Chairman Paul Hopper

- Director Dr. Liz Stoner

- Director Dr. Deborah Barton

- VP Manufacturing & Quality Dr. Sandhya Buchanan

- VP Development & Translational Medicine Dr. Mini Bharathan

In short, these key board appointments give us confidence in the stewardship of the company as their presence is an endorsement of the technology ALA has licensed.

Below are our quick takes on these true industry specialists:

ALA Chairman, Paul Hopper

Paul Hopper is an Australian bio-entrepreneur with over 25 years’ experience in the healthcare and life sciences fields, focussed on start-ups and rapid growth companies.

He is the founder, chairman, non-executive director or CEO of more than fifteen successful companies in the US, Australia and Asia.

He was also the chairman of ASX listed cancer company Viralitics which was acquired by global pharmaceutical giant Merck for $500 million in 2018.

Hopper has founded or seeded over six companies that are now listed on either the ASX or the NASDAQ. The exit for Viralytics shows that he can not only build these companies but also take them through their full life cycle through to a takeover.

More recently Hopper has been involved in two key ASX biotech success stories, which have seen their share prices move significantly over the last 2 years:

- Imugene: from ~$0.025 to $0.315 (1,160% return in under 2 years); and

- Prescient Therapeutics: from ~$0.04 to $0.195 - (388% return in under 2 years).

Hopper has ‘been there and done that’ with outsized biotech success stories - generating large returns for investors.

We are extremely pleased he is chairing our $26M market cap biotech investment.

ALA Director, Dr. Liz Stoner

Dr. Stoner started her career in some of the most prestigious US based universities research teams before moving into executive roles within the industry.

Stoner is currently the Senior Clinical Advisor of Nasdaq listed AlloVir (Capped at US$558M) and Rhythm Pharmaceuticals (Capped at US$334M).

Stoner is now an executive partner of US based biotech venture capital fund MPM Capital. Before joining MPM she was the Senior Vice President of Global Clinical Development Operations at Merck Research Laboratories - responsible for its clinical development activities in more than 40 countries.

Dr. Stoner brings to ALA a deep understanding of the biotech space, if there is anything happening in the industry that is relevant to ALA then we think Stoner will be the first to bring it up in board meetings.

This kind of experience on the board of micro cap stock with a market cap of $26M is really unique.

ALA Director, Dr. Debora Barton

Dr. Barton has over 20 years of oncology experience in academia, as a practising physician and in the biotech industry.

Most of her work is specialising in cell therapies and more recently as Chief Medical Officer of Charisma Therapeutics where she secured a major deal with Moderna that netted the company over US$45M in upfront payments.

Most recently, she served in executive positions in cell therapy and radiopharmaceutical biotech companies including Iovance Biotherapeutics and Advanced Accelerator Applications – which was acquired by Novartis for ~US$3.9 billion during Dr. Barton’s tenure.

Another industry expert added to the already strong team at ALA - someone who has been there and done it all in Chief Medical Officer roles.

We specifically like that she was still at Advanced Accelerator Applications when Novartis came knocking with a US$3.9 billion all cash takeover offer.

This type of experience is invaluable for any biotech and for ALA to have it this early on is a true testament to the potential of its technology.

ALA VP Manufacturing and Quality, Dr. Sandhya Buchanan

Sandhya has more than 20 years experience working in cell and gene therapy.

Dr. Buchanan was formerly at Atara Biotherapeutics as the chemistry manufacturing and control technical lead for autologous CAR-T programs and head of the Viral Vector Development program.

Sandhya brings deep clinical experience, her involvement in the development of some of the first CAR-T cell therapy is again invaluable to ALA.

The fact that ALA can pick up the phone and call someone with 20 years+ experience developing these cell therapies will go a long way for the ALA team to execute on its goals.

ALA VP Development and Translational Medicine, Dr. Mini Bharathan

Dr Bharathan has more than 15 years’ experience in the field of immunology with more than 12 years focused on the development of cell therapies.

Before joining ALA, Dr Bharathan held senior roles for the development of early stage cell therapies at well known cell therapy companies like Intrexon (Capped at US$447M), Immatics (Capped at US$577M), Celgene (which was acquired by Pharma giant BMS for US$74 billion), Celularity (Capped at US$798M) , Cellectics (Capped at €221M) and the US Department of Health.

For us the most notable was her time at Celgene which during her tenure was acquired by US listed pharma giant BMS (Capped at US$147 billion) who paid US$74 billion for the company she worked for.

Another example of an appointment with a strong background in developing therapies and being a part of teams that are taken out by majors in the global pharmaceutical industry.

As investors in ALA, we are putting our trust in this dream team of cell therapy and biotech experts, to deliver on its strategy and progress its technology in a meaningful way.

Each new recruit has options in the company, so they are incentivised to deliver meaningful value to the business.

4. ALA’s number one shareholder has an impressive track record

ALA’s top shareholder is Merchant Funds Management which has a 7.89% stake in the company.

Led by Andrew Chapman, Merchant is one of the most successful small cap biotech fund managers in Australia.

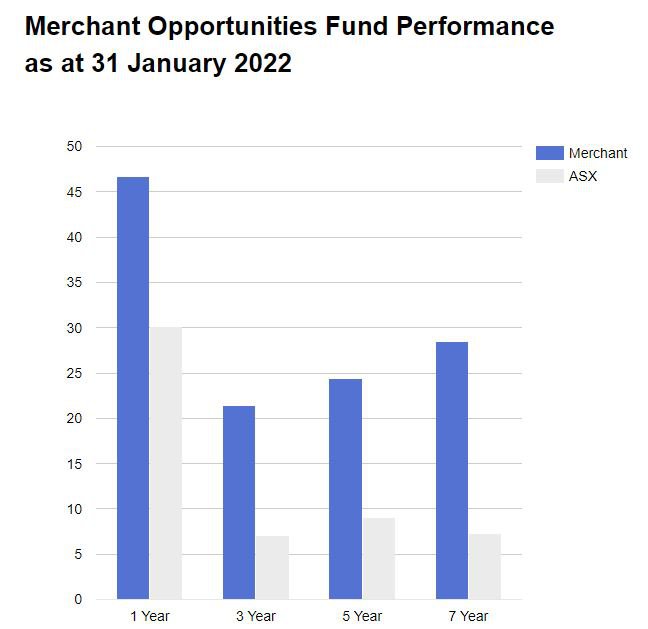

Chapman’s first fund, the Merchant’s Opportunities Fund (MOF), grew from $9M to $188M in assets under management - after picking a number of high growth, high conviction early stage biotechs.

Here is a run-down of returns from Chapman’s best biotech picks in the Merchant Opportunities Fund:

- Polynovo: $0.04 to $2.30 ($4.05 high) – 10,025% return (Low to High)

- BARD1 Life Sciences: $0.50 to $1.45 ($5.60 high) – 1,020% return (Low to High)

- Race Oncology: $0.14 to $3.35 ($4.20 high) – 2,900% return (Low to High)

While past performance is no guarantee of future performance, and Merchant without doubt would have incurred a number of loss making positions over its lifespan, it shows how powerful getting a small cohort of major biotech winners can be for a portfolio.

Our plan is to follow Merchant into ALA, and hopefully achieve similar outsized returns with this investment.

Chapman’s approach is meticulous and based on a simple premise:

“We [Merchant] will favour biotech positions away from the biggest names... believing that most blue chip investors will already have some of these names in a portfolio and shouldn’t pay a fund manager to invest in them.’

We believe that strategy has clearly worked for Chapman:

Over the 7 years since its inception, Merchant has consistently outperformed the ASX overall indexed return.

So with our ALA investment, we’re more comfortable in our position as it's backed by a biotech fund with a strong track record.

Chapman’s investing methodology is similar to ours - enter a high risk/high reward small cap, then hold for the long term until it achieves the initial goals set out by management.

This can take 5-10 years in the biotech industry, as there are a number of phases and trials a drug or potential treatment must undergo before it can be commercialised.

The mentality remains the same however - identify first, enter, then hold onto the investment for long enough to assess whether the initial investment thesis was correct.

In short, we have no qualms holding our ALA position for a prolonged period as it progresses its business plan. Merchant’s investment in ALA’s tech adds to our confidence.

5. Peer comparison shows money flowing into iNKT Cell Therapy

ALA operates in a subspecialty of the CAR T cell therapy market, which is part of the US$156B cancer therapy market.

According to one market research report, the CAR T cell therapy market currently stands at ~US$5B and is projected to grow at a whopping 19.7% compound annual growth rate through to 2027 (source).

That would mean by then the CAR T cell therapy market would be worth more than US$19B.

Indeed, CAR T cell companies have proliferated at a rapid pace and there are now more than 250 companies working on various developments in the space (source).

The space is also prone to a significant amount of M&A activity with lucrative partnerships and big deals.

Big pharma is increasingly looking at CAR T cell therapy companies, with Bayer (€53B market cap) inking a deal for T cell therapy company Atara to the tune of $US610M (source) and AbbVie (US255B market cap) signing a collaboration and licensing agreement with Caribou Biosciences for US$340M (source).

This gives you a sense for the scope of what ALA is trying to accomplish within its sub-specialty of iNKT cell therapy.

Currently, there are only three other players specialising in iNKT cell therapy, all of which are valued at multiples of ALA’s current market cap of ~$26M:

ALA is the only ASX-listed company working on this tech.

What’s more, given that iNKT cell therapy is such a new space we don’t view these companies as competitors. Meaning we don’t see them as edging each other out - multiple companies can succeed at once.

Here’s a quick summary of what exactly these three other companies are working on:

Appia Bio - Raised US$52M in their series A financing round and then in August 2021 signed a strategic partnership with Kite Pharma in a deal worth US$875M.

The largest of the bunch, Appia, is still early stage and preclinical, and not expected to enter clinical trials until the end of 2023. Appia, as opposed to ALA, generates CAR-iNKT cells from stem cells.

Despite its early stage, Appia managed to sign a monster deal with Kite Pharma for US$875M and raise $52M from venture capital funds.

This bodes well for ALA, currently capped at AU$26M - even a hint of promising technology developments could pull the interest from big pharma, like it has with Appia Bio.

Kurr Therapeutics - Acquired for US$70M upfront cash + US$115M in milestone payments in May 2021.

Kuur’s lead candidate, KUR-501, is currently in the phase 1 clinical trial involving children with a high-risk neuroblastoma (a type of cancer that starts in early nerve cells).

Their second CAR-NKT cell candidate, KUR-503, is an off-the-shelf product targeting liver cancer.

Although the technology is similar, Kuur is targeting different cancers to ALA.

As soon as Kurr went into phase 1 trials, they were acquired for US$70M upfront cash payments and US$115M in milestone payments.

Multiples the size of ALA’s current AU$26M market cap.

MiNK Therapeutics - Listed on the NASDAQ in October 2021 raising US$40M, reaching a high of ~US$650M market cap, currently trading at a US$95M.

MiNK’s most advanced product is AGENT-797 - another off-the-shelf iNKT cell therapy being evaluated for the treatment of solid tumours and multiple myeloma (things ALA are looking at).

MiNK listed on the NASDAQ in October 2021 raising US$40M.

The share price quickly moved up to an all-time high of ~US$22/share which gave the company a market cap of US$650M+.

It has since come off, we think because investors realised the company is still in Phase 1 trials and a long way from commercialisation but it still trades at a ~US$95M, again multiples above ALA’s current market cap of AU$26M.

The key takeaway from all of this is that ALA is operating in an emerging sub-section of the cell therapy market, and there are plenty of investor dollars to go around.

The macro tailwinds combined with manufacturing success could cause ALA’s market cap to catch up with its larger peers.

6. Promising results from animal trials

ALA is at the start of a long journey to take a therapy from the conceptual scientific stage, all the way through to commercialisation:

At phase 0, also known as pre-clinical trials or animal trials, investors are looking for whether there is something that shows that the therapy is both safe and effective in animals.

Animal trials for ALA’s treatment indicate both of these things.

The results of the animal trials for ALA’s CAR19-iNKT treatment shows the fast acting way in which the treatment kills the cancer cells (coloured blobs):

You can see from the image that ALA’s treatment, on the far right, destroyed the cancer cells faster (removed the coloured blobs) than any other treatment.

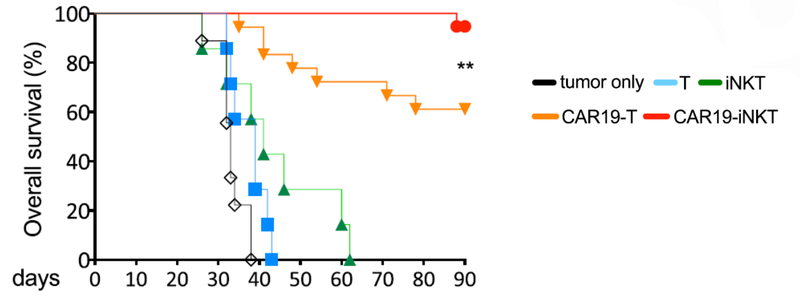

Not only did the treatment prove to be fast acting, but it also had a higher overall survival rate compared to T cell therapies.

This graph shows that at 90 days ALA’s treatment had >90% survival rate, compared to 60% survival rate for T cell therapy.

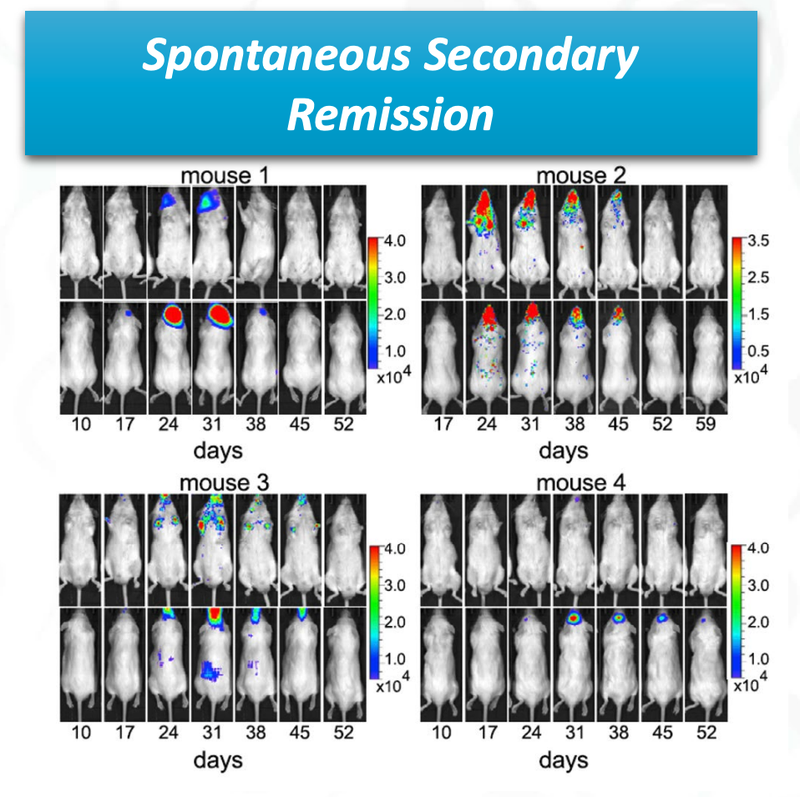

The last promising thing for ALA, is that there was spontaneous secondary remission from a number of mice in the clinical trial, indicating that even if the cancer does come back, the treatment is effective at reducing the secondary onset of cancer cells.

You can see from the image that over time the cancer cells (coloured blobs) come back, but then are soon after destroyed.

This is a significant benefit of the treatment if it can be translated to humans.

Testing on animals is a good early indicator for investors, but the science will need to be proven out when ALA conducts clinical trials on humans.

In order to prepare for clinical trials anticipated for the first half of 2023 ALA will need to:

- Secure and complete manufacturing of CAR19-iNKT cell therapy

- Complete the trial design

- Secure ethics approval

- During this time, ALA will continue to confirm safety and specificity of its additional technology that combines the DKK1-CAR/mAB and the iNKT technology

These are the key things that we will be watching out for ALA to progress throughout the year.

7. Legacy tech could reduce cash burn

Prior to its rebranding as Arovella, ALA was called Suda Pharmaceuticals. We’re conscious that when ALA was Suda, the old business plan did not work out for the company and shareholders as expected.

When Suda became ALA, this marked a dramatic pivot in strategy. This pivot made cancer cell therapy the primary focus, and as result, a far more compelling investment in our eyes.

While we are invested in ALA primarily for its cancer cell therapy treatment, ALA has legacy tech from its previous iteration which is revenue generating.

ALA is about to commercialise an oral mist treatment for insomnia which could reduce ALA’s cash burn as it pushes towards Phase I trials of its main cancer tech.

You can see the other oral mist treatments in ALA’s tech portfolio below:

We don’t think these will be a priority for ALA but last financial year, ALA pulled in ~$257K in revenue from their commercial arrangements regarding their oral mist treatment for insomnia.

In the six months through to December 31 2021 they pulled in an additional $307k in receipts from customers.

ALA will need all the cash it can get to commercialise its cancer therapy, so we think this additional revenue will help reduce their cash burn, in turn reducing the frequency and size of dilutive capital raises.

Bookmark our ALA Investment memo

We’ll be using this ALA Investment Memos as a way to assess the company’s progress over 2022 and also examine how our investment thesis plays out throughout the year.

In our ALA Investment Memo you’ll find:

- Key objectives for ALA in 2022

- Why do we continue to hold ALA

- The key risks our investment thesis

- Our investment plan.

View the memo by clicking the button below, Bookmark this page if you want to follow our investment journey with ALA and how they track against our 2022 objectives

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.