Modern exploration methods lead to additional drilling targets

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 2,661,667 KNI shares on the day of publishing. S3 Consortium Pty Ltd has been engaged by KNI to share our commentary on the progress of our investment in KNI over time.

Our investment Kuniko (ASX:KNI) is exploring for battery metals in Norway, specifically targeting copper (Cu), nickel (Ni), and cobalt (Co) as well as lithium (Li).

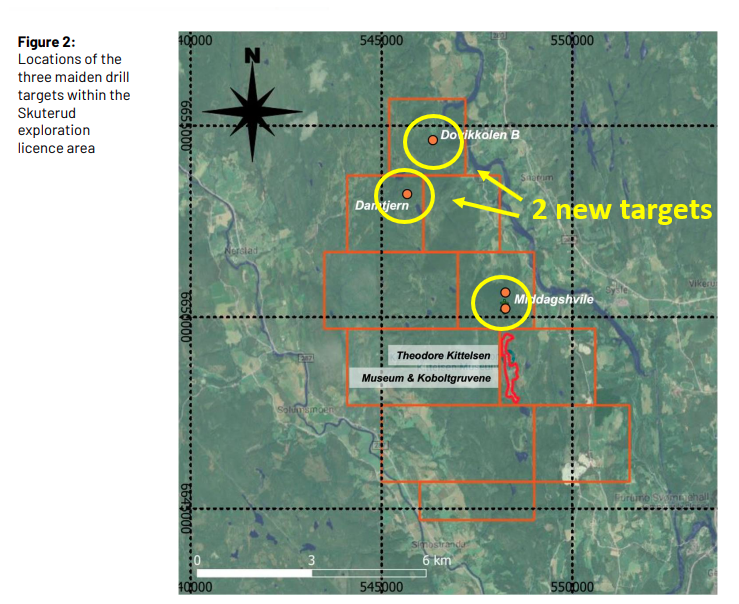

Yesterday KNI announced that ‘advanced interpretive analytical’ geophysical work has brought about 2 new high priority drilling targets which KNI are aiming to drill in Q2-2022.

2021 was a standout year for battery metals stocks with commitments by the world's largest automakers to electrify their car fleets and by governments around the world to facilitate a transition to cleaner energy sources.

After a brief pause in December, markets seem to have picked up where they left off and we hope 2022 will be another bumper year for our investments in the battery metals space, particularly those with a commitment to Zero Carbon projects.

KNI which was spun-out from our 2021 portfolio favourite, Vulcan Energy Resources, is similarly committed to delivering battery metals projects via zero-carbon exploration methods locally in the European Union.

We first invested in KNI in the IPO with the hope that modern exploration technologies could reveal discoveries that historical exploration may have missed.

KNI’s projects sit on grounds with a long history of production where we hope older and now outdated exploration technologies may have missed extensions to these old deposits and/or new discoveries completely.

Our theory is that with the guidance & backing from the team behind Vulcan Energy Resources, any new discoveries could be turned into company making projects.

KNI’s Norwegian cobalt project sits on grounds in a part of the world which was previously the largest cobalt mining region in the world. Any new discoveries here could put the whole region on the map again.

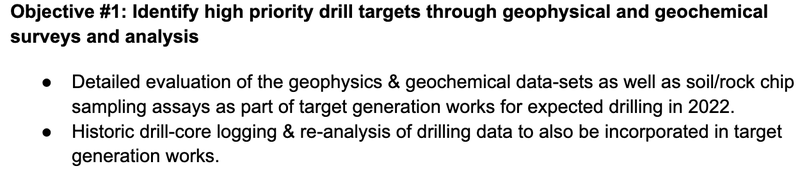

In our 2022 Investment memo for KNI we set 3 key objectives for KNI against which we plan to use to track the company's progress this year.

The first of these was to Identify high priority drill targets through geophysical and geochemical surveys and analysis which is exactly what yesterday’s announcement is all about:

Read our 2022 KNI investment memo here.

ASX:KNI

Yesterday’s announcement comes as a sequel to our last note on KNI where we did a deep-dive into the massive EM target that the previous owners of KNI’s cobalt project (Berkut Minerals) missed.

With two additional high priority drill-targets added to the planned 7-hole drilling program in Q2-2022 we thought we should do a deep-dive on these two new targets:

Now, ‘advanced interpretive analytical’ work or in simpler language, high-tech desktop studies, have opened up 2 new geophysics targets.

You can see how these look below:

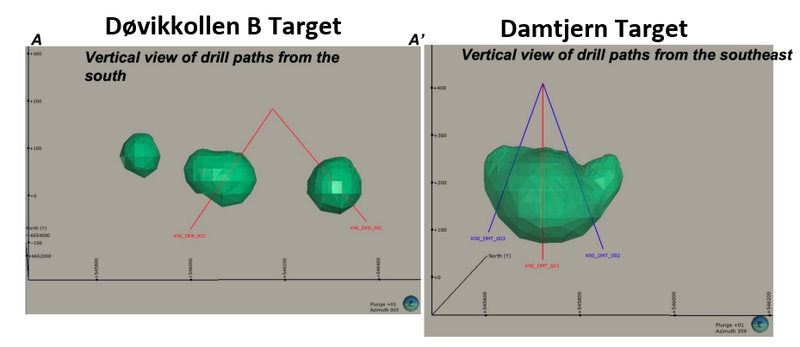

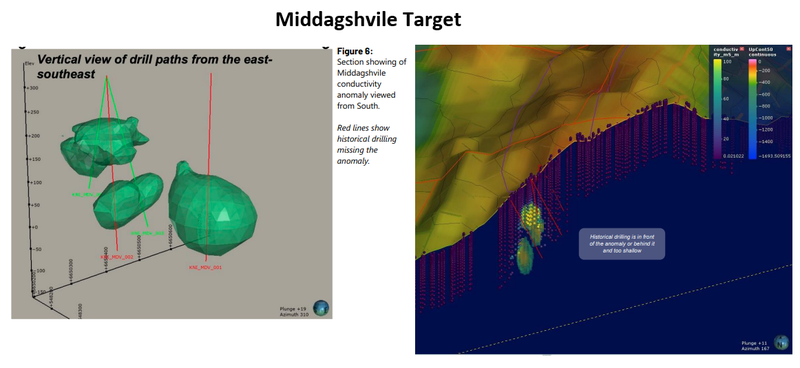

The green blobs in the images above are the conductive anomalies that the modern geophysical surveys have mapped out for KNI. This shows where the rock structures beneath the ground have different magnetic properties from the areas that surround it.

Thinking of people with metal detectors walking along beaches looking for things in the sand, these blobs are 3D images that more advanced radars have managed to map out.

Geophysical surveys are used when defining targets for a reason, these green blobs could be indicating all kinds of different mineralisation. They could represent massive cobalt targets which KNI goes on to make new discoveries from, or it could return nothing.

This is part and parcel of high-risk exploration and the truth will ultimately be in the upcoming drilling program KNI is planning.

As for that drilling, the images also show how KNI plans on testing these targets.

The red lines running through the anomalies represents the planned drilling in the upcoming drilling program where KNI have aimed these straight through the guts of the geophysical anomaly.

Should the initial drilling results turn out to be positive and indicative of a new discovery then the blue-lines are what represent the potential follow-up drill-holes.

Lets not forget the big target we spoke about last year...

In our last note on KNI we did a deep-dive on the massive EM anomaly found right next to where the previous owners of the project (Berkut Minerals) had done some drilling.

The same ‘advanced interpretive analytical’ was done on this target and now we have a slightly better understanding of what KNI are chasing at that prospect.

Below is a side-by-side comparison with the initial results from the Geophysical surveying and the new advanced interpretive analytical works done.

Whereas the initial imaging looks more 2D and less defined, the modern exploration methods applied in the latest round of analysis is defining the targeted anomalies a lot more clearly.

Again in the image on the left, the green blobs in the image on the left are the conductive anomalies that KNI will be targeting.

As we mentioned for the 2 new targets, the red lines represent the primary drill-plan, the first of those drill-holes will go straight down the guts of the anomaly on the right and the other drill-hole will test both of the EM targets on the left.

The green lines are also expected to be drilled but we think it will most likely depend on the early indications from the first two drill-holes (In red).

For our deep-dive on the early geophysical works results see the note we put out late-last year here.

Key Objectives we want KNI to achieve in 2022

We’ve been highlighting our Investment Memos as a great way to familiarise yourself with companies quickly, from a high-level perspective.

Here are the 3 key objectives drawn from our KNI Investment Memo and some commentary from us about how today’s announcement relates to them:

Today’s announcement directly contribute towards objective #1 with KNI has managed to identify 2 new high priority drill-targets through the modern geophysical analysis.

This however is just the beginning for KNI as we wait for them to announce more drilling targets across their other projects (copper, nickel and lithium).

Yesterday’s announcement is less of a direct achievement of objective #2 but it does mean there are more high-priority targets that can be tested in the upcoming drilling program.

The announcement did at least provide us with an expected time for when drilling will start.

Although there was no mention of new assets being acquired in yesterday’s announcement, we are still hopeful that KNI can make some progress on this front through the course of this year.

ASX:KNI

After today’s announcement you can see KNI is making progress across Objectives #1 and #2.

Geophysical interpretation has yielded two new targets and we now have a firmer timeline on when drilling will commence.

We’ll be using these Investment Memos as a way to assess the company’s progress over 2022 and also examine how our investment thesis played out at the end of the year. We will also update our investment strategy as things progress.

You can catch a quick rundown on KNI, why we continue to hold a position in KNI during 2022 as well as key risks to the investment right here.

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 2,661,667 KNI shares on the day of publishing. S3 Consortium Pty Ltd has been engaged by KNI to share our commentary on the progress of our investment in KNI over time.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.