LCL Drilling PNG Copper-Gold Targets Next Month

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 8,055,814 LCL shares and staff own 133,250 LCL shares at the time of publishing this article. The Company has been engaged by LCL to share our commentary on the progress of our Investment in LCL over time. Share holdings correct on 28th Feb 2023.

Welcome to elephant country — mineral rich Papua New Guinea (PNG).

Largely the domain of Tier 1 mining giants, our $21.6M capped Investment Los Cerros Ltd (ASX:LCL) is set to embark on its maiden drilling campaign in PNG in a matter of weeks.

LCL is focussing on high impact exploration drilling and has planned a 3,000m /18 hole diamond drilling program at the Kusi target.

Ahead of this drill program, LCL is conducting a 3.0 cent Rights Issue, offering investors that hold LCL shares as of next Wednesday 1st March the option to buy 1 LCL share for every 5 shares held.

To participate in the rights issue, investors must have purchased LCL shares before the 1st of March - meaning today and tomorrow are the final days to participate (27-28 February).

As LCL shareholders, we intend to take up our full allocation.

LCL had already had $8.4M cash at 31 December 2022 and this rights issue, if fully subscribed, will bring in a further $4.3M.

This will take LCL’s cash balance to around $12.7M.

Assuming a full take up of the rights issue, LCL’s implied current market cap is $26M at 3c per share. This equates to an Enterprise Value of $13.3M going into the March drilling campaign.

At these levels, we like the leverage here to a new discovery.

Late last year, LCL acquired five copper-gold and nickel projects in PNG ... and they boast some of the highest grades we have ever come across.

Samples include gold grading above 60g/t, copper of more than 20%, as well as nickel sulphides assaying up to 45%.

Further, we like that these projects provide exposure to battery metals (copper, nickel) and gold, two Investment Themes that we think are poised for a strong 2023.

For a company trading with such a small market valuation, these PNG projects add real potential for significant upside.

PNG can be considered a high risk jurisdiction but we have seen small caps with projects in this part of the world re-rate into billion dollar companies before.

Consider Canada’s K92 Mining which entered PNG in 2014 - at the time its market cap was sub-CAD$100M.

The company restarted production at the Kainantu gold mine and made multiple high grade gold discoveries — sending its share price rise from CAD$0.80c to CAD$7.20 per share today to trade with a CAD$1.7BN market cap.

Given its multitude of prospects across 3,867km2 of exploration claims, this is the type of success we hope to see for LCL.

The company has now narrowed in on three key targets for the first half of the year:

- Drilling the Kusi copper-gold prospect at the Ono Project,

- Drill the Veri Veri prospect, at the Liamu Project (nickel, copper-gold),

- Attracting joint venture partners to advance multiple targets concurrently.

These targets are particularly compelling for high impact exploration, having new discovery potential that provide opportunity for early success.

Of those prospects, the Kusi copper-gold target at the Ono Project is the standout target. Here, LCL is due to run 3,000m of diamond drilling in March.

This drilling will test high grade copper-gold mineralisation established from previous drilling, trenching and surface sampling.

But this is just a slither of what LCL may have at Kusi. A wider Kusi exploration program will gauge the potential regional scale and help LCL gain a better understanding of the central copper porphyry.

The Veri Veri nickel prospect at the Liamu Project is a second focus area during the first half of this year.

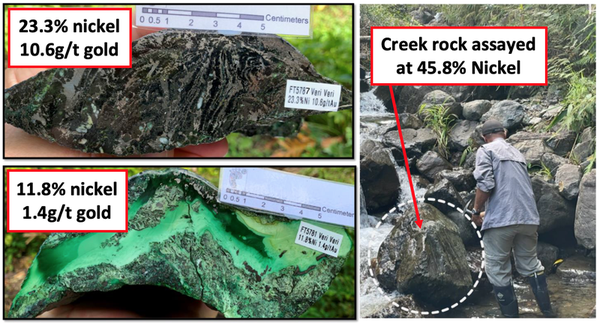

LCL also says it will also be prioritising work at the Imou copper-gold project in H1-2023 and wants to secure a joint venture partner to progress this and other targets, including the Ubei Project which displays mineralisation similar to that of K92 Mining.

New Investment Memo

These project areas are where we want to see LCL focus its efforts over the coming 12 months and are central to our latest LCL Investment Memo in which we cover:

- The macro theme for LCL

- Why we continue to hold LCL

- Our long term bet - what we think the upside Investment case for LCL is

- The key objectives we want to see LCL achieve over the next 12 months

- The key risks to our Investment Thesis

- Our Investment Plan

What is the macro theme?

We think the outlook for battery metals, including copper and nickel, is positive in 2023 and are pleased to see that LCL has added some battery metals exploration exposure to its advanced gold project in Colombia.

Additionally, we expect gold to perform well over the coming year as it remains a safe haven investment and hedge against inflation that has historically outperformed in times of volatility.

Our LCL “Big Bet”:

“LCL to re-rate 1,000% off exploration success on its new PNG gold, copper, nickel projects or from developing its advanced gold project in Colombia.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our LCL Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

Why do we continue to hold LCL?

LCL acquired multiple high-grade copper, gold and nickel targets across five project areas in PNG in late-2022. This adds to its 2.6Moz Quinchia Gold Project in Colombia.

The PNG acquisition creates new areas for exploration focus as LCL transitions towards development scenarios for its Colombian gold project.

Management team: We are confident in backing LCL’s Managing Director Jason Stirbinskis, who we have been following for over 3 years. With the acquisition of the PNG assets, LCL gained its in-country geologists — Glenn Twomey and John Dobe — who bring a combined 60 years’ mineral exploration (8 years in PNG in senior roles for Barrick Gold) to LCL as executives.

High potential new projects: Work to date shows some of the highest grade assays we’ve seen. This region of PNG is elephant country — there are a lot of existing discoveries, producing mines, and majors operating. The new projects have multiple drill ready targets with near term drilling planned.

Adds battery metals exposure: Adding to the existing gold project in Colombia, for which LCL is now considering development options, the PNG projects add exposure to two of our favourite investment thematics for 2023: battery metals (copper and nickel) and more gold.

What do we expect LCL to deliver in the coming 12 months?

Objective #1: Drill the Kusi copper-gold prospect at the Ono Project

LCL has an extensive drilling program planned at the standout target of the PNG assets — the Kusi copper-gold prospect at the Ono Project.

The maiden 3,000m drilling program over ~18 diamond holes is due to commence on schedule next month. This upcoming drilling program is part of a larger Kusi exploration program.

There are three things we want to see from exploration at Kusi:

- The initial drilling will further test the gold-copper oxide skarn mineralisation within an upper limestone unit that was established from previous drilling, trenching and surface sampling. This will provide confidence in what LCL has on its hands in its target drilling areas.

- Gauge the potential regional scale. The wider Kusi exploration program will include trenching and mapping to define the extent of the mineralised skarn horizon which occurs within the upper limestone unit and over a total area of approximately 3km x 1.5km. This will help answer the question of just how big is the skarn unit?

- Gain a better understanding of the central copper porphyry. Drilling and surface work is instrumental in locating the porphyry source.

(We dig into the details of the Kusi exploration program later in this note.)

Objective #2: Drill the Veri Veri prospect, at the Liamu Project (nickel, copper-gold)

The Veri Veri target is prospective for high grade nickel sulphide. LCL says that relatively quick and inexpensive exploration could transform Veri Veri to a target of significance in the battery metals space.

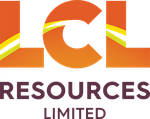

LCL intends to kick off exploration at Veri Veri early this year after the maiden drilling program at Kusi. It will focus on the source of creek float boulders of massive nickel sulphides assaying up to 45.8% nickel with some samples also reporting high gold grades such as 23.4% Ni with 10.6g/t gold.

- We want to see LCL commence field work at Veri Veri in H1 2023.

While the specifics haven’t been provided yet, we do know that LCL wants to locate the source of massive nickel sulphide creek float boulders. These boulders are assaying up to 45.8% nickel with some samples also reporting high gold grades — such as 23.37% nickel plus 10.6g/t gold.

Objective #3: Secure JV/alliances to test other PNG targets

LCL has an abundance of targets at its PNG projects. While its primary near term focus remains on drill testing the high-grade gold-copper Kusi oxide skarn at the Ono Project, LCL is eager to see advances across multiple targets concurrently. It has specifically acknowledged the significant copper/gold targets across the Liamu, Ubei, Imou and Tauya projects.

In order to advance multiple targets concurrently while its own capital is largely being directed to Kusi, LCL is seeking joint venture partners.

As part of LCL’s strategy to seek joint venture partners, it has a field program planned at the Imou Project for Q2 2023, aiming to enhance the project’s prospectivity and broad appeal.

- We want LCL to commence its planned field program at Imou in Q2 2023.

- We want to see LCL attract a partner to help with additional exploration at Imou, Ubei, or at another of its PNG projects.

Objective #4: Explore development options at Quinchia Gold Project, Colombia

At the 2.6 million oz Quinchia Gold Project in Colombia, LCL has transitioned to focus on investigating potential development scenarios, while reducing greenfield exploration activities.

- While not the primary focus for LCL over the coming 12 months, we do want to see progress on works that would feed into a Preliminary Economic Assessment (PEA), which would help provide clarity around potential investment returns that development of the Colombian project could deliver.

What could go wrong?

Exploration risk

LCL is years away from production of its assets, and hence its value is derived from exploration success, which can not be guaranteed.

Capital requirements

LCL is an explorer, not a producer, and so requires continuous funding while it determines the value of its prospects. Upon completion of the up to $4.3M rights issue, LCL will have a decent cash balance of ~$12M. That balance will be predominantly directed to drilling of Kusi high grade copper-gold target so in order to progress exploration at its other targets, the company is open to joint venture partners. As LCL is not generating any revenue, at some point it will likely need to again raise capital when its cash at bank drains. There is no guarantee that capital markets will be conducive at that time.

Underlying commodity risk

LCL is exposed to commodity price risk (in this case nickel, copper, lead, zinc, gold and silver), which depends on macroeconomic factors and demand and supply dynamics of the underlying commodities. Market sentiment closely correlates with commodity prices, and hence LCL’s valuation will be impacted by commodity prices as well.

Sovereign risk

LCL’s projects are located in the developing nations of Papua New Guinea and Colombia. There is no guarantee that local authorities and/or communities will favour development of LCL’s prospects, and so could hinder advancement. LCL says it intends to instil its Colombian-style ESG approach to its PNG presence with modifications sensitive to local dynamics and culture. However, it remains a jurisdiction with a high level of sovereign risk.

What is our investment plan?

We intend to take up our full entitlement in the LCL March 2023 Rights Issue.

Our strategy is to treat LCL like an exploration company, using the 3.0 cent raise price as a baseline.

If the share price materially increases from 3.0 cents in the lead up to a key drilling event, or on the back of a successful drilling result, we will look to Top Slice our Investment, and Free Carry our position.

With our revised Investment Memo as a framework to measure the company’s progress against, let’s take a closer look at LCL’s upcoming Kusi exploration plans.

A month ago, LCL said site preparations were underway ahead of its maiden drilling program in PNG that’s scheduled for March.

This aligns with our Objective #1: Drill the Kusi copper-gold prospect at the Ono Project.

LCL has laid out plans for a 3,000m, 18 hole exploration drill program targeting gold-copper oxide skarn at its standout Kusi target, which is within the Ono copper-gold Project.

LCL has three specific goals here and we’ll get into the details shortly, but before we do, here’s a reminder of what we already know about the Ono Project and its Kusi target.

Ono Copper-Gold Project (Objective #1)

The 1,630km2 Ono Project is prospective for gold/copper in skarns and porphyry plus epithermal gold/silver mineralisation.

But what does that mean?

Simply put...

- Skarns units consist of hard, coarse-grained metamorphic rocks, formed when magma intruded a nearby rock mass. Some of the world’s best copper and gold (and many other minerals) deposits have been in skarn material.

- Porphyries host the largest known exploitable concentrations of copper on the planet. They typically come with gold as well. These are typically low grade, but extremely large metals deposits - big miners love these types of resources, as they generate substantial cashflow for decades of mine life.

- Epithermal quartz gold-silver mineralisation typically forms close to volcanic and geothermal hot spring activity, such as hot springs or geysers and is characterised by coarse free gold.

Notably, Ono is within the same structural belt as the Hidden Valley gold mine (an operating open pit gold and silver mine owned by Harmony Gold Mine) and the Wafi-Golpu copper/gold project (an advanced exploration project in 50/50 JV between Harmony and Newcrest Mining).

Much of the Ono Project area, of which Kusi is a part, has never been prospected or assessed with modern techniques and understanding.

As such, LCL says the Ono Project has the potential to deliver multiple compelling exploration targets in the coming programs.

Here’s LCL Managing Director Jason Stirbinskis on site with a brief field overview of the Ono Project:

As mentioned above, the focus of much of LCL’s 3,000m of near term diamond drilling will be to further test the oxidised skarn mineralisation within an upper limestone unit established from previous drilling, trenching and surface sampling.

This will provide confidence in what LCL has on its hands in its target drilling areas.

The wider Kusi exploration program has a further two broad objectives:

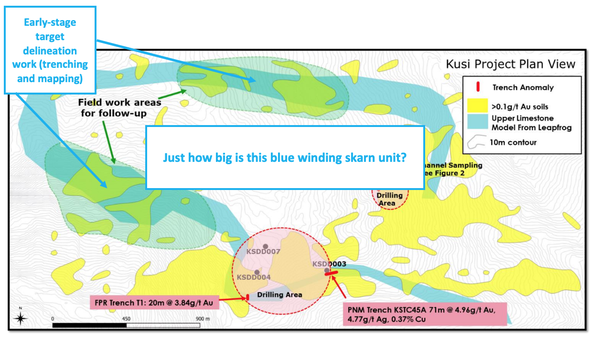

- To gauge the potential regional scale and gain an understanding of just how big the skarn unit is. The exploration program will include trenching and mapping to define the extent of the mineralised skarn horizon which occurs within the upper limestone unit and over a total area of approximately 3km x 1.5km.

- Gain a better understanding of the central copper porphyry. Drilling and surface work is instrumental in locating the porphyry source.

1. Testing the established mineralisation

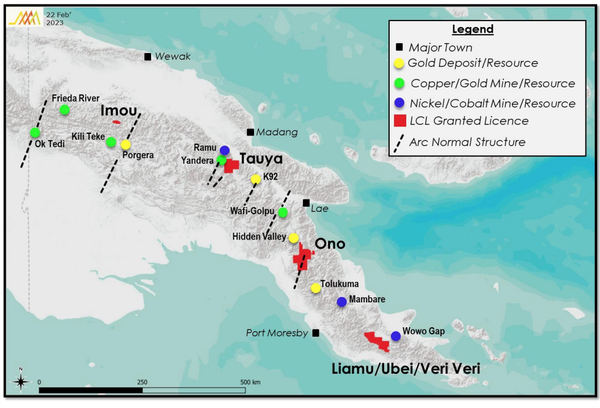

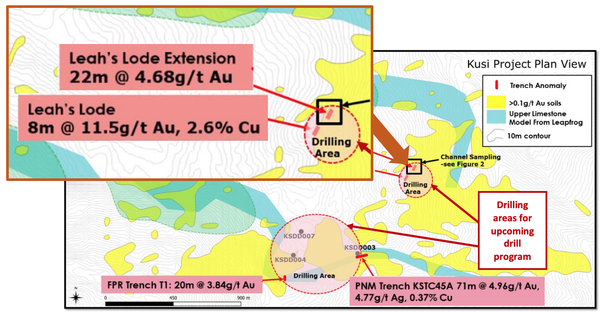

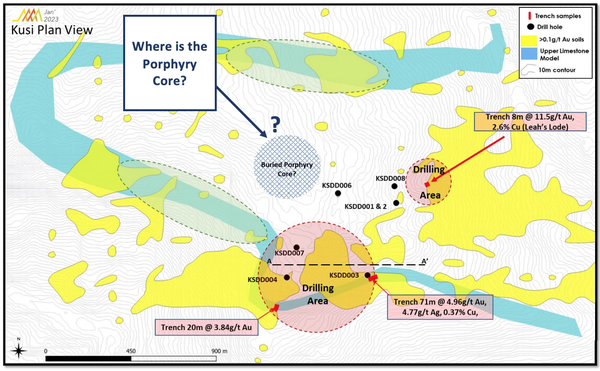

The Kusi drilling program will initially focus on areas of previous drilling and trenching at the main skarn unit and at Leah’s Lode (red circles on the plan view below).

Main skarn unit

As marked on the plan view above, trenching at the larger drilling area returned assays including:

- 20m grading 3.84g/t gold

- 71m grading 4.96g/t gold, 4.77g/t gold and 0.37% copper

Diamond drill results from this upper skarn unit of the main skarn unit/drilling area include:

- 10.1m grading 2.39g/t gold from 0m (KSDD003)

- 20m grading 2.89g/t gold from 107m (KSDD004)

- 35m grading 3.04g/t gold from 136m (KSDD007)

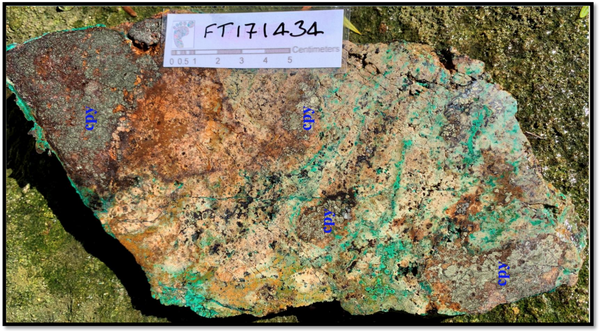

Here is an outcrop sample of upper skarn grading 40.4g/t gold, 11.65% copper and 116 g/t silver:

Here Stirbinskis provides an overview of the Kusi target, looking at past trenches results and drill holes:

Given the high grades here, we think that this deposit could support a profitable mining operation from just this upper skarn alone. Of course, more exploration work will be needed to determine if this is the case.

Leah’s Lode (within the Kusi area)

Leah’s Lode is a 2022 discovery defined by a single trench with strong copper and gold grades of 8m grading 11.5g/t gold, 2.6% copper, 24g/t silver.

Recent assay results from a trench sampling survey of mineralised skarn included 22m grading 4.68g/t gold — providing important confirmation of a gold discovery here.

Leah’s Lode is not the main skarn unit at Kusi (it’s at a different stratigraphic level to the upper limestone unit), so the result comes as a nice bonus, demonstrating potential >100m+ strike length.

While Leah’s Lode has demonstrated some impressive grades from trenching, it has never been drilled. Along with the primary Kusi drilling area in the south, LCL will drill Leah’s Lode in the upcoming drill program.

In the following clip, Stirbinskis explains the “spectacular” grades at Leah’s Lode:

Here you can see the prior trenching results at Leah’s Lode of 8m grading 11.5g/t gold, 2.6% copper and 24g/t silver, within which were individual 2m samples of:

- 27.74g/t gold with 3.6% copper and

- 43.3g/t gold with 12.1% copper.

You can also see the new extension trench - 22m grading 4.68g/t gold.

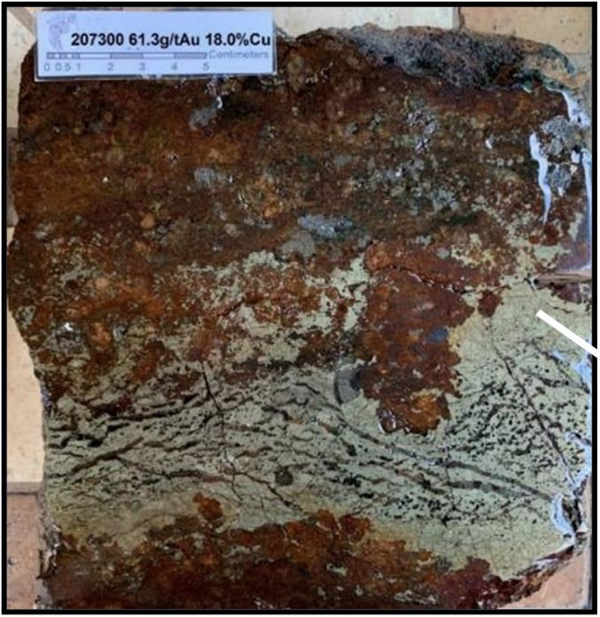

A sample of outcrop located within two metres of the original Leah’s Lode trench reported 61.3g/t gold with 18% copper - here is that sample:

And here is where it came from:

2. How big is the skarn unit?

LCL will undertake early-stage target delineation work - trenching and mapping along the limestone skarn unit, focusing on possible extensions to upper skarn mineralisation (the blue winding band on the image below).

This will help gauge the potential regional scale and is expected to generate additional 2023 drill targets.

3. Chasing the elephant

The third objective of the exploration program at Kusi is to gain a better understanding of where to drill to chase the elephant — the central copper porphyry.

Drilling and surface work is instrumental in locating the porphyry source. Porphyry deposits are one of the most attractive exploration targets due to their high tonnage and relatively easy open pit mining.

What’s Next?

In its just announced Rights Issue, LCL is seeking to raise up to $4.3M at $0.03 per share from investors that hold LCL shares on 1st March and has a closing date of 20 March.

The Rights Issue, which we intend to fully take up, allows investors to buy 1 new share for every 5 shares held.

We look forward to seeing the results of the raise on 27 March, before the new shares begin trading on Tuesday 28 March. (All dates are indicative).

We’re also looking forward to confirmation that drilling has commenced at Kusi, as well as the field program at Imou, and await further details around exploration plans at Veri Veri as well as any updates on joint venture partners.

For more details on each of the five PNG projects, be sure to check out our previous note - LCL acquires new gold and battery metals project - drill campaign incoming.

This longer video from MD Jason Stirbinskis at the time of the PNG acquisition also provides a good overview of the opportunity here:

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.