IVZ basin opening drill at 593m out of planned 3,500m - over half way to first target at 850m

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 4,987,102 IVZ shares and 1,217,101 options and the Company’s staff own 60,000 shares and 10,845 options at the time of publishing this article. The Company has been engaged by IVZ to share our commentary on the progress of our Investment in IVZ over time.

Invictus Energy (ASX:IVZ) is the biggest pre-result exploration bet we have in our Portfolio right now.

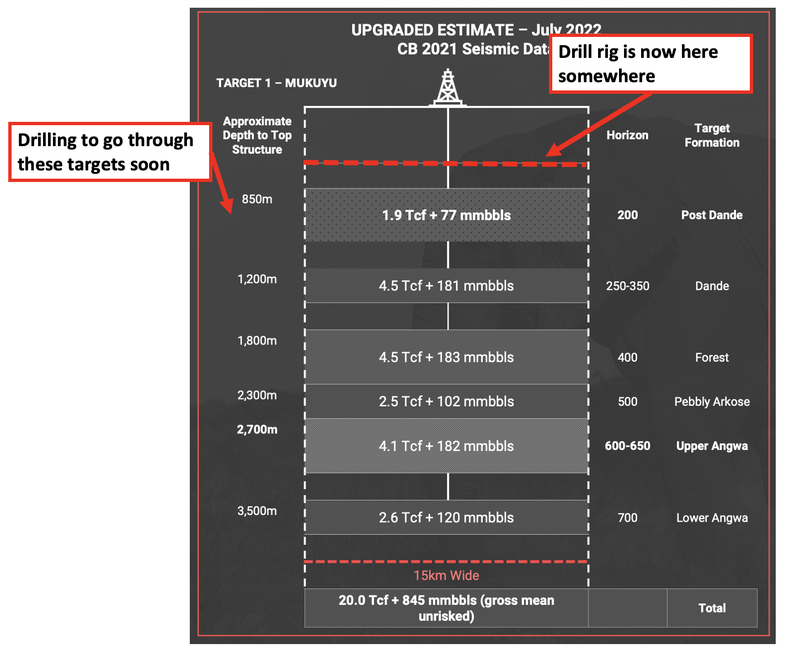

IVZ is drilling the largest conventional onshore prospect in Africa, with a prospective resource that now sits at >5.5 billion barrels of oil equivalent across a number of targets.

IVZ is drilling two wells in the coming months to test this prospectivity - and the first well is being drilled right now.

Eleven years in the making, and two years since we first Invested, IVZ’s long awaited drilling of its first well started 13 days ago, and is expected to take 50 to 60 days to reach target depth.

As of yesterday, IVZ was 593m into its planned 3,500m well depth, meaning it is potentially days away from piercing the first of the seven targets.

Today, IVZ upgraded its prospective resource, adding an extra 1.2 billion barrels of oil equivalent across its basin margin targets (a “String of Pearls” play), the first of which it will drill after the current well - giving IVZ a “second chance” on a string of basin margin targets if this first well doesn’t come in.

Importantly, these target areas are separate from one another, meaning IVZ gets two shots at making a basin opening discovery.

We are holding 4,987,102 IVZ shares and 1,217,101 IVZ options - a very large position for us (relative to our Portfolio size) to be holding into an oil & gas exploration result.

This larger position is due to our success 10 years ago investing in a similar basin opening drill in the East African Rift System with Africa Oil Corp. If we are being intellectually honest with ourselves, the success with Africa Oil Corp has probably inflated our risk appetite in the hope it might repeat with IVZ (yes, while we try not to, we also sometimes find it hard to keep emotions out of our investing).

Here is our detailed summary of the similarities we see between IVZ and Africa Oil Corp, and what we are watching for IVZ to announce over the next few weeks based on what caused Africa Oil’s share price rise.

Remember that the past performance of one stock is not an indicator of future performance of another stock. Yes there are similarities - but IVZ making its own material discovery is the only critical event that matters here.

Past oil & gas exploration results we have invested in or watched often fail, and the share price plunges. However that rare and coveted oil & gas discovery can cause the share price to spike up hundreds of percent.

Very soon, we will find out with IVZ.

In terms of our Portfolio, where we hold many resource exploration Investments, we hope that one or two will deliver an outsized result.

GAL currently looks like it will claim our best exploration result this year after it went from 20c to a high of $2 (now at ~$1.40) after announcing a platinum group elements discovery.

But with IVZ close to hitting its first target we would love to see it challenge for our best exploration result of the year - which is certainly possible when drilling a basin opening oil & gas well (risk caution: possible... NOT probable).

The significance of a discovery in a basin opening well (where there are many similar, other targets in the same basin) is that investors will likely infer that all the other drill targets in the basin will likely be successful too, and that “blue sky” potential of the entire basin will be priced into the share price after the first discovery - and yes, of course the opposite will happen on a failed result, where the chance of the other targets being successful falls in the eyes of investors, and gets priced in to the share price.

So with that in mind, here is our big bet for our Investment in IVZ:

Our ‘Big Bet’

To see IVZ make a basin opening oil/gas discovery in Zimbabwe and re-rate by over 1,000% - similar to the move Africa Oil experienced after making its basin opening discovery in Kenya.

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our IVZ Investment memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

For our summary of IVZ’s progress over time and how today’s announcement contributes to our Big Bet see our IVZ Progress Tracker.

Today IVZ upgraded its prospective resource - in the middle of its maiden drilling program.

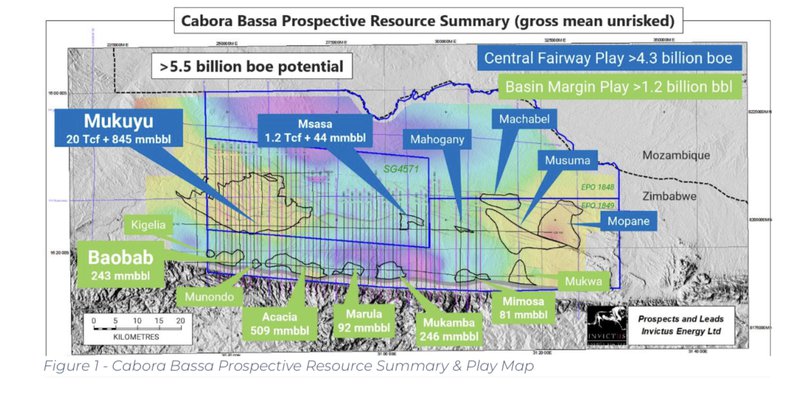

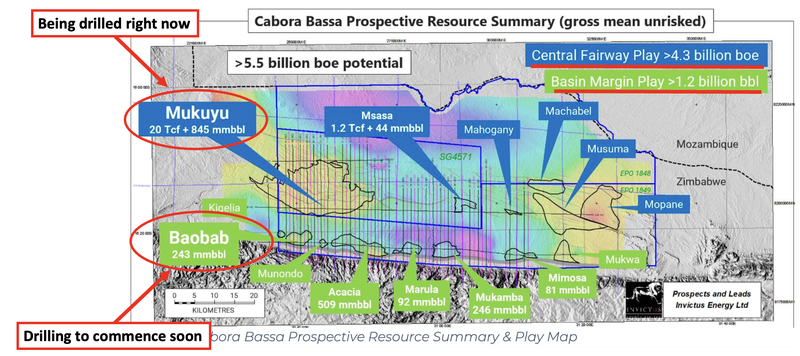

IVZ’s total prospective resource number now sits at over 5.5 billion barrels of oil equivalent across two plays:

- IVZ’s “Central Fairway Play” - Currently being drilled at the Mukuyu-1 well - targeting >4.3 billion barrels of oil equivalent.

- IVZ’s “Basin Margin Play” - A potential “String of Pearls” to be drilled with the Baobab-1 well - targeting >1.2 billion barrels of oil equivalent.

This is really a two part series, with IVZ drill testing both plays in the coming months - the second well to be drilled right after the first.

Almost 10 years to the day, IVZ is looking to repeat the success of Africa Oil Corp - our first oil and gas explorer that 10 bagged after making a basin opening discovery, also in the East African Rift System.

To see our deep dive into the story behind our Africa Oil Investment in the context of IVZ check out our most recent write up here.

For some context, IVZ’s prospective resource is now almost 2.5x that of Africa Oil Corp’s back in 2012 when it made its basin opening discovery in Kenya.

Of course a “prospective resource” is a high level estimate of the potential for IVZ’s project - the oil and gas simply may not be there - it’s entirely a speculative number.

Even in a success scenario we expect IVZ’s in ground resource to be lower than this number (but still commercially significant)

IVZ is currently drilling the first of its planned two well drilling program, and both are due to be completed before the end of the year.

On that note, IVZ put out an update on its first well yesterday with drilling currently at a depth of 593m of a total planned ~3,500m.

The drill rig now sits just above the first of the seven stacked targets IVZ is drilling into which starts at 850m.

With casing being run and a blowout preventer being installed (literally to stop the well blowing up in the event a discovery is made and highly pressurised gas rushes to the surface), IVZ expects to drill into these targets in the coming weeks.

Drilling is expected to be completed within 50-60 days of spudding - which happened on the 23rd September.

This means we could expect early results anytime between now and the end of October/November.

We are hoping for news early and over a longer period, for our IVZ Big Bet (see above) to be realised.

Deeper dive on today’s news

With today’s announcement, IVZ has given investors a first look at the potential value of its basin margin prospects.

Our key takeaways are as follows:

- Prospective resource upgraded - IVZ’s basin margin holds a prospective resource of 1.2 billion barrels of oil across five different drill ready targets. This has increased IVZ’s total prospective resource to over 5.5 billion barrels of oil equivalent across its project.

- Basin Margin well prospectivity firmed up - IVZ’s first basin margin well (Baobab-1) will target 243 million barrels of that total prospective resource.

First, the prospective resource upgrade.

IVZ has increased its total prospective resource to >5.5 billion barrels of oil equivalent.

For some context, Africa Oil, which we have spoken about multiple times before (including multiple times in this note alone), went into its drilling program back in 2011 with a total prospective resource number 1.8 billion barrels of oil equivalent.

This puts into perspective the size and scale of IVZ’s potential should it have exploration success either at Mukuyu-1 OR at Baobab-1 wells.

The entirety of IVZ’s prospective resource sits across the “Central Fairway Play” and the “Basin Margin Play”.

IVZ is now drilling the Mukuyu-1 well, which is targeting the >4.3 billion barrels of oil equivalent “Central Fairway Play”.

Once this is done, IVZ will move on to drill the Baobab-1 well, targeting the remaining >1.2 billion barrels of oil equivalent “Basin Margin Play”.

Importantly, these target areas are separate from one another, meaning IVZ gets two shots at making a basin opening discovery.

Secondly, we now have a firm prospective resource number for the second well that IVZ plans to drill this year, Baobab-1.

Here, IVZ will target a gross prospective resource of 243 million barrels of oil equivalent.

Again for some context, Africa Oil’s first successful Basin Margin well (Ngamia-1) was going after a similar sized prospective resource at ~231 million barrels of oil equivalent.

The key here will be that any successful discovery would unlock a “String of Pearls” which would increase the probability of the remaining prospects being filled with oil.

So IVZ’s drilling program this year will be a two shot approach to a company making discovery at its project, with each well targeting entirely different plays.

This brings us to the drilling update IVZ put out just yesterday.

Where is IVZ at with its Mukuyu-1 well:

A drilling update yesterday confirmed that IVZ’s Mukuyu-1 well has reached a depth of 593m of a total planned ~3,500m.

This means that the rig is just above the first of the seven stacked targets that IVZ is drilling into.

IVZ confirmed that the company would be running some cement casing and installing a blow out preventer.

The next stage of drilling will see IVZ drill through the first FOUR stacked targets with drilling expected to continue up to a depth of 2,200m and then again through THREE of the primary targets at the prospect down to the planned total depth of ~3,500m.

IVZ expects the whole drilling process to take between 50 to 60 days to complete but we are hoping to see some newsflow before then with IVZ commenting on whether or not gas/oil columns have been hit.

What’s next for IVZ?

Drilling results from the Mukuyu-1 well 🔄

Drilling is now at a depth of ~593m and IVZ is now running cement casing and installing a blow out preventer.

IVZ will then start drilling into the first of the seven stacked targets it is drilling into with the Mukuyu-1 well.

The first of IVZ’s seven stacked targets starts from ~850m so we are hoping we get some good news from IVZ in the coming days/weeks.

Drilling of the Baobab-1 (Basin Margin) well 🔄

IVZ has confirmed that the Baobab-1 well pad construction is underway and is scheduled to be completed before the Mukuyu-1 well is finished drilling.

IVZ expects to move its drill rig straight to the Baobab-1 target as soon as the Mukuyu-1 well is completed.

This should be in around ~50 to 60 days (from 23 September) but the timeline could change significantly if IVZ hits any large gas columns as any major hits would disrupt drilling.

Our 2022 IVZ Investment Memo

Below is our IVZ Investment Memo, where you can find a short, high level summary of our reasons for Investing.

The ultimate purpose of the memo is to record our current thinking as a benchmark to assess the company's performance against our expectations for the following 12 months.

In our IVZ Investment Memo, you’ll find:

- Key objectives for IVZ for the coming year - starting from March 2022

- Why we are Invested in IVZ

- What the key risks to our Investment thesis are

- Our Investment plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.