88 Energy Edge Closer to Spud Date on One of the Biggest Oil Wells of 2020

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

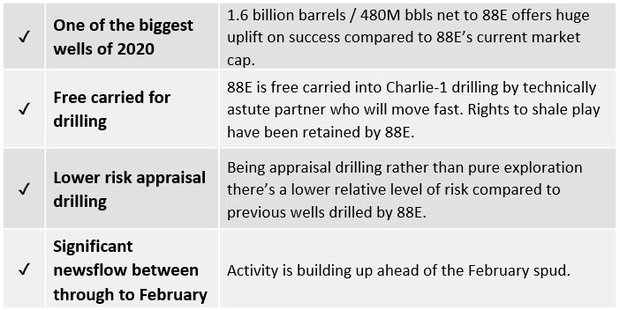

The countdown is on to the spud of 88 Energy’s (ASX:88E | AIM:88E) fully funded appraisal well on the Alaskan North Slope.

The Charlie-1 appraisal well at the company’s Project Icewine is on track for February 2020 drilling and it’s set to be one of the biggest oil wells in the world in terms of game changing, company making potential.

In one single well no less than seven stacked horizons across three plays will be targeted, with a gross mean prospective resource of 1.6 billion barrels of oil — 480M bbls net to 88E at its 30% working interest.

Now that we are edging closer to the February spud date, we are keeping a close eye over the coming weeks for announcements from the company confirming that the permitting and contracting process is on track.

Based on standard procedures in the lead up to drilling an oil well in Alaska, before Christmas we expect to see:

- Confirmation that the company’s US$23M farm out with Premier Oil is complete;

- Approval of the Plan of Operations for drilling;

- Construction of an Ice Road to get the drill rig to the exact location.

Each event is likely to spark new attention and already, since my last update on 88 Energy, the share price has climbed over 30% with no signs of slowing down.

As we welcome in 2020 things are only expected to gather pace, with the drill rig set to be mobilised in early February and the well spudding just a week or two after.

Drilling of Charlie-1 is expected to take just 30 days and given that conventional targets are being tested, the results will arrive almost immediately.

Note that this is not a pure exploration drill — it is appraisal drilling so has a much lower relative risk compared to previous wells the company has drilled.

Plus, 88E will be fully carried with the Charlie-1 well being fully funded up to US$23 million up by 88E’s farm-in partner Premier Oil Plc (LON:PMO).

The following video provides a comprehensive look at the project and the targets:

Share Price: $0.015 / 0.85p

Market Capitalisation: A$103 million / £51.92 million

Cash position: $10.1 million (3Q19 end)

Here’s why I like 88 Energy:

Alaska North Slope Basin

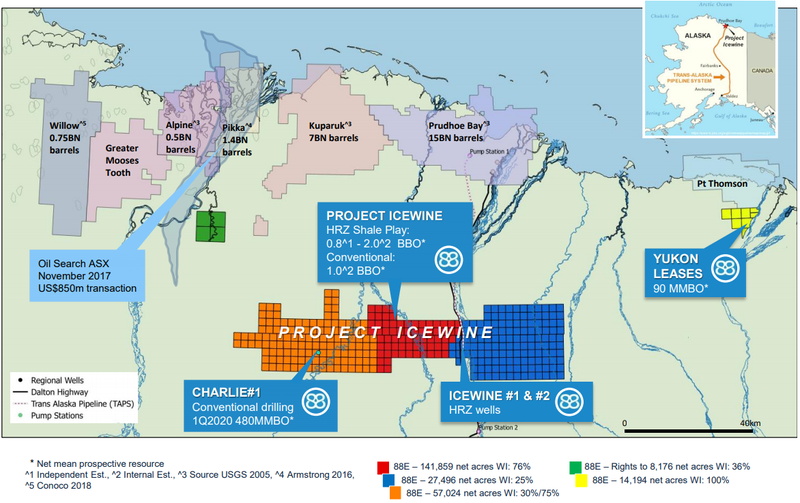

Alaska’s North Slope basin has a long history of successful oil discoveries and is now seeing renewed industry interest.

New technology and exploration incentives have led to an exploration renaissance and once stranded resources are being commercialised.

Recent discoveries have included the two largest conventional oil discoveries onshore North America in over 40 years.

It is the location of North America's largest current oil field, Prudhoe Bay, which originally contained over 25 billion barrels of oil. Furthermore, the basin is surrounded by several other large oilfields, having together produced over 17 billion barrels of oil since 1977 through the Trans Alaska Pipeline System.

These discoveries have been made in a new play called the Brookian Sequence, where over the last six years, massive amounts of oil — over 4.0 billion barrels — have been discovered.

Here are some of those discoveries along with 88E’s Project Icewine location:

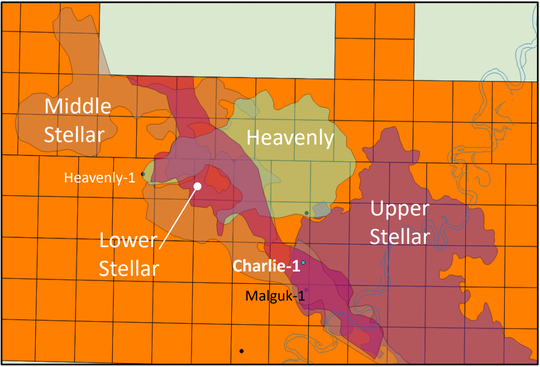

88 Energy’s extensive position on the Alaskan North Slope

88 Energy (ASX:88E | AIM:88E) is pursuing both conventional and unconventional oil opportunities in the Brookian play.

It’s not just about the upcoming well – the Company has an extensive position on the North Slope with four active exploration projects across 486,000 contiguous acres, totalling 250,000 net acres each with access to the transportation corridor / TransAlaska Pipeline. These projects are:

- Project Icewine (Conventional)

- Project Icewine (Unconventional HRZ shale)

- Yukon Acreage

- Western Blocks

Project Icewine – Conventional

We are soon going to know a whole lot more about the conventional potential of Project Icewine.

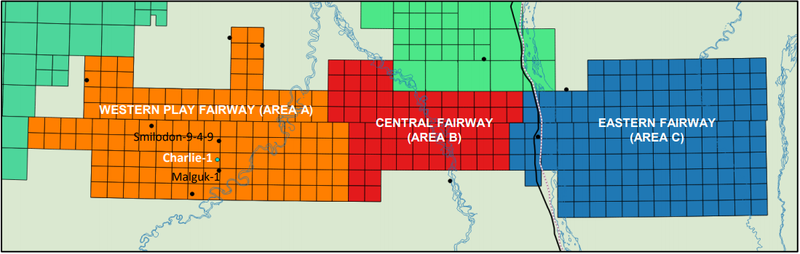

The company is now fast approaching the February spud of the Charlie-1 (Malguk-1 appraisal) well — a pivotal moment for the company as it seeks to unlock the large potential of the acreage’s conventional plays.

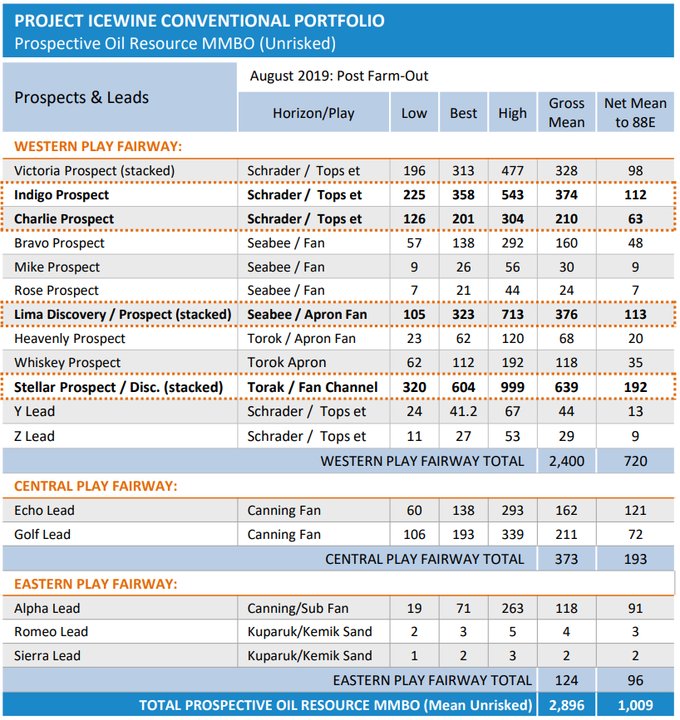

Project Icewine has a 2.9 billion barrels unrisked gross mean conventional prospective resource which is based on modern 3D/2D seismic. Of this, 1.0 billion barrels is net to 88E.

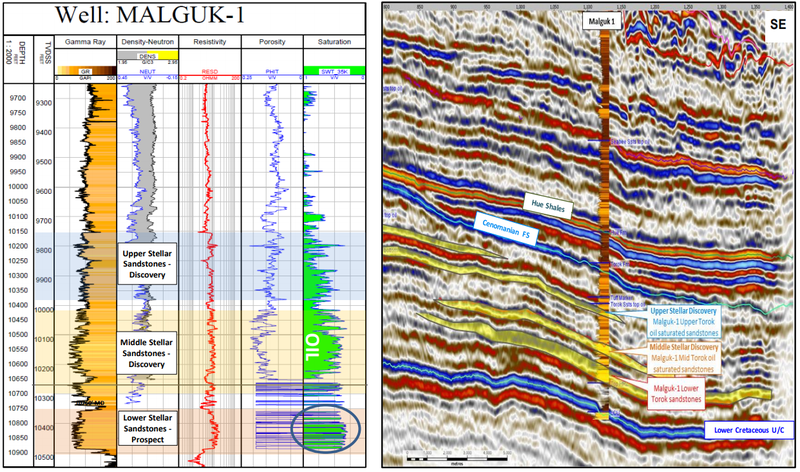

This is no wildcat well – the Charlie-1 appraisal well has been designed as a step out appraisal of a well drilled in 1991 by BP Exploration (Alaska) Inc called Malguk-1.

Malguk-1 encountered oil shows with elevated resistivity and mud gas readings over multiple horizons during drilling but was not tested at that time. This was due to complications towards the end of operations, which resulted in lack of time before the close of the winter drilling season.

That well was also drilled using vintage 2D seismic, which was insufficient to adequately determine the extent of any of the prospective targets encountered.

88 Energy subsequently undertook revised petrophysical analysis, which identified what is interpreted as bypassed pay in the Malguk-1 well. 88E also completed acquisition of modern 3D seismic in 2018, in order to determine the extent of the discovered oil accumulations.

Premier Oil funding Charlie-1

88 Energy will operate Charlie-1 via its 100% owned subsidiary Accumulate Energy Alaska Inc, with the cost funded by Premier Oil Plc (LON:PMO) under a farm-out agreement of up to US$23 million.

In addition, a recent share placement saw the company raise $6.75 million at A$0.0125 (equivalent to £0.007), significantly strengthening the balance sheet in preparation of the Charlie-1 spud.

At the end of third quarter the company reported cash reserves of $10.1 million, while its expenditure during the current quarter is expected to be $1.6 million.

Partnering with Premier Oil, rather than going with an industry major, was a strategic decision by 88E. It suits 88 Energy as Premier is only interested in the conventional oil, so 88E retain the rights to the unconventional HRZ shale.

Premier Oil will pay the full costs of this well (up to a total of US$23M) in exchange for 60% of the conventional potential in the precinct known as Area A — just one portion of the larger Project Icewine acreage.

88 Energy will retain a 30% holding and the remaining 10% will be held by 88 Energy’s joint-venture partner, Houston-based Burgundy Xploration.

While drilling at Charlie-1 well is the immediate focus, the other conventional targets, including those in the adjacent Area B and Area C, provide future exploration opportunities, with Premier Oil already lining up for a stake.

Should Charlie-1 be successful, Premier has the option to take a 50% interest in Area B or C by spending US$15 million.

Here are the prospective oil resources at Project Icewine conventional portfolio across the Western Play Fairway, Central Play Fairway, and Eastern Play Fairway (Areas A, B, and C):

As can be seen above, multiple stacked drillable prospects have been identified on Icewine 3D interpretation. All up, there’s 1.009 billion barrels of prospective oil resource net to 88E (mean, unrisked).

The Nordic-Callista Rig-3 was secured for the upcoming drilling of the Charlie1 appraisal well. Rig-3 was used for the drilling of the Winx-1 well in March 2019 and 88 Energy was extremely pleased with its safe and efficient performance throughout the course of operations.

Once drilling at Charlie-1 is completed, there will be wire-line logging, then a frack and flow test in the best of the primary Torok targets. Being a vertical well and future development would be via horizontal wells, the flow rate required to give confidence of commerciality is only around 100 barrels of oil per day.

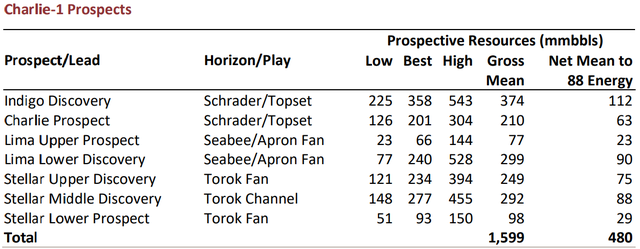

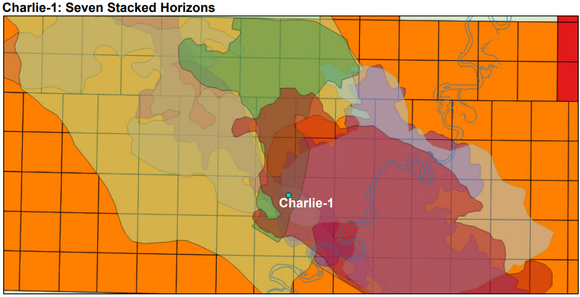

Seven stacked targets – 1.6 billion barrels gross prospective resource

Drilling of the Charlie-1 (Malguk-1 appraisal) well will test multiple stacked conventional targets totalling 480MMBO net to 88E, as well as the HRZ shale in February.

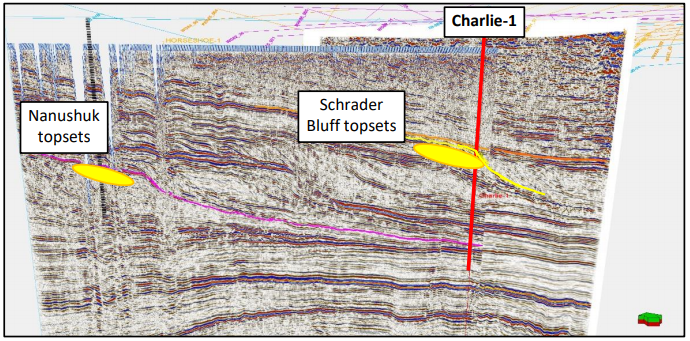

These seven stacked targets that will be intersected by the Charlie-1 well have all been identified using the same modern technology used to make the most recent Brookian discoveries.

Each of these targets could be a potential standalone development in its own right and, when combined, the aggregate gross mean prospective resource potential is 1.6 billion barrels of oil, 480 million barrels of which is net to 88E's retained 30% interest.

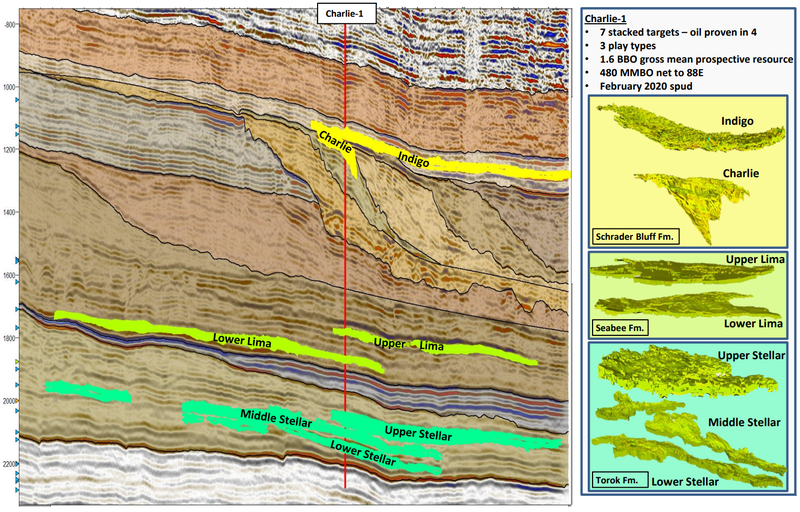

Here you can see the stacked targets at depth, with Charlie-1 piercing through all seven of them:

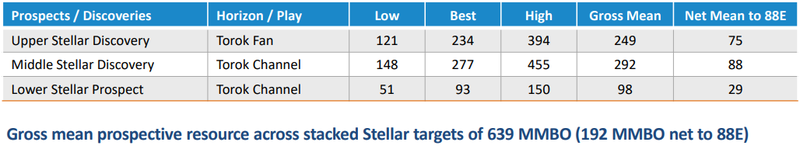

Charlie-1: Primary Target – 3 Horizons Torok Formation

The primary targets of Charlie-1 are three stacked objectives in the Torok formation — Upper, Middle and Lower Stellar — all of which are interpreted as oil bearing, based on the analysis of Malguk-1.

The Upper Stellar, Middle Stellar and Heavenly prospects are considered discoveries for appraisal, while Lower Stellar is also highly likely to be oil bearing based on elevated resistivity log.

Petrophysical analysis indicates thick oil bearing section with multiple sand packages in the Torok – Upper, Middle and Lower Stellar.

A 700ft gross oil bearing interval has been interpreted with porosity of up to 18%.

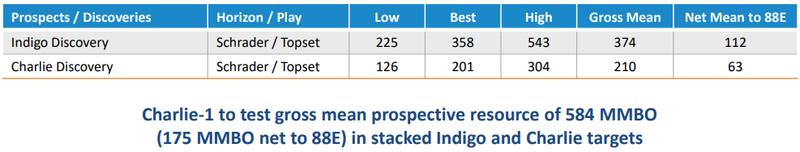

Charlie-1: Primary Target – 2 Horizons Schrader Bluffs Formation

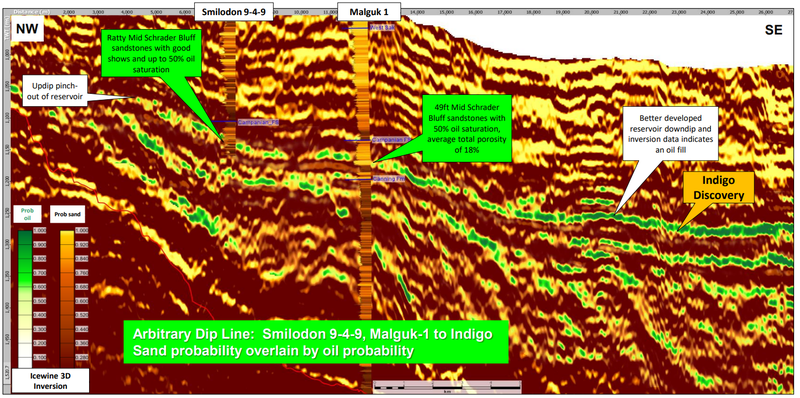

Multiple prospects have also been identified in Schrader Bluff Topsets with shallow, large stacked objectives. This is an analogous play type, on younger clinothem to recently successful Nanushuk discoveries.

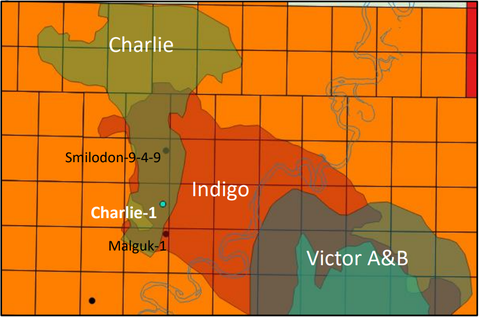

The two prospective secondary targets, Indigo and Charlie, are higher up in the well in the Schrader Bluffs formation.

Indigo discovery

Indigo was intersected sub optimally by Malguk-1 but had good oil shows and indications of potentially commercial oil saturation.

The Mid Schrader Bluff sandstones at Malguk-1 are 49 feet thick with 50% oil saturation and average total porosity of 18%, based on revised independent petrophysical analysis. The key risk is related to water salinity used for petrophysics, which impacts oil saturation.

Gross mean prospective resource 374 MMBO (112 MMBO net to 88E).

Charlie discovery

The Charlie prospect has never been drilled through so was not intersected by the historic Malguk or Smilodon wells, yet 3D seismic inversion predicts good quality, oil filled sands. The key risks here are typical of exploration prospect: trap, oil saturation and reservoir quality.

Gross mean prospective resource 210 MMBO (63 MMBO net to 88E).

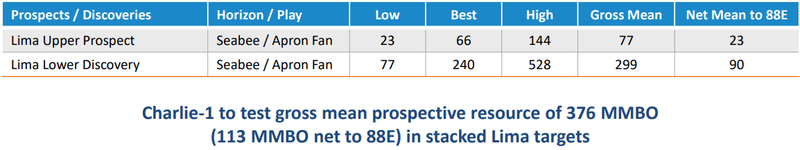

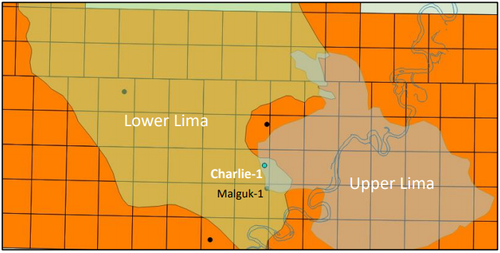

Charlie-1: Secondary Target – 2 Horizons Seabee Formation

The last of the conventional targets is Upper and Lower Lima in the Seabee formation. Charlie-1 has not been designed with these targets in mind, yet crucial data in these prospects will be collected as an added bonus.

Good oil saturation was interpreted in Seabee formation on Icewine acreage but the Lima targets are considered secondary due to the higher risk associated with reservoir quality.

Analysts say ‘Buy’

In my last update on 88 Energy in mid-October, I mentioned that Hartley’s maintained its ‘speculative buy’ rating on 88 Energy while lifting its share price target to 2.8 cents per share pending upcoming developments in the company’s conventional resources.

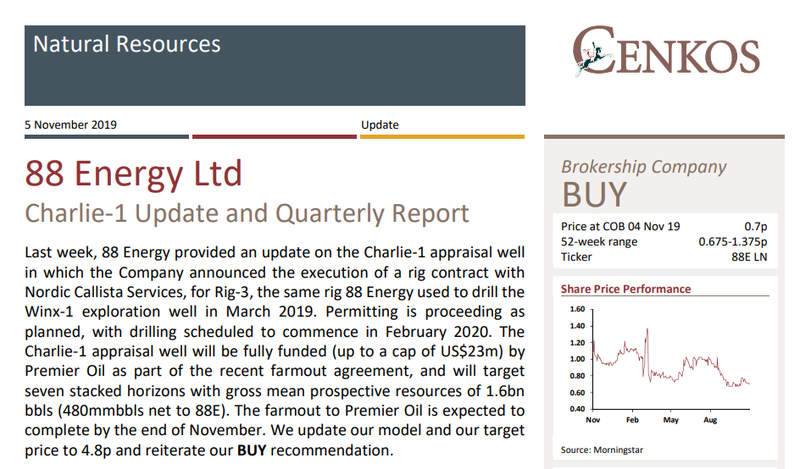

Then, after 88 Energy’s late-October update on the Charlie-1 appraisal well, London based broker Cenkos Securities also said in a research report that the stock is a ‘Buy’.

Cenkos say the drilling of the Charlie-1 well will be a defining moment for 88E as it seeks to prove the conventional potential of the Project Icewine acreage. The broker updated its model for both the HRZ Shale and the Yukon Leases, whilst updating a full DCF model for the Icewine Conventional acreage.

“The result is an increase in our valuation and our price target to 4.8p and reiterate our BUY recommendation,” said analyst James Mccormack.

At the current share price this represents an almost 450% premium to the last close on London’s AIM market of 0.88p.

Mccormack added, “Whilst the early stage nature of 88 Energy’s portfolio makes our valuation speculative, the upside potential is huge, unrisked, we value the 88 Energy portfolio at 47.8p per share or US$4.8bn.”

The report can be downloaded here.

Project Icewine Unconventional

88 Energy has so far drilled two unconventional exploration wells that have de-risked and improved understanding of the large shale potential at the project. Additional analysis is progressing and will be complemented by results from Charlie-1 which will also drill through the HRZ shale.

A farm-out process is planned to fund further appraisal, while the JV continues to field unsolicited third party interest in the HRZ shale play and an informal farm-out process is underway.

Yukon Leases

Discussions are ongoing with nearby lease owners to optimise the monetisation strategy for existing discovered resources located in the vicinity of the Yukon Leases.

The Yukon Leases contain the 86 million barrel Cascade Prospect, which was intersected peripherally by Yukon Gold-1, drilled in 1994, and classified as an historic oil discovery.

88 Energy recently acquired 3D seismic (2018) over Cascade and, on final processing and interpretation, high-graded it from a lead to a drillable prospect. The Yukon Leases are located adjacent to ANWR and in close proximity to recently commissioned infrastructure.

Western Blocks

Additional regional 3D purchased during the last quarter will aid 88E in the evaluation process for the Western Blocks.

The forward program will be to continue to assess this data and potentially reprocess and reinterpret the 3D seismic. The company anticipate that the evaluation work will be completed towards the end of 2019.

All eyes on Charlie in the lead up to February 2020

It’s all happening with in the next few months, with the Charlie-1 well on schedule for a February 2020 spud.

All is going to plan with a rig contracted, funding secured, and major permits approved.

Construction of an ice road is scheduled for next month, then the drill rig will be mobilised to site by early February.

Drilling is scheduled to commence mid-February and is anticipated to take around 30 days, after which the well will be stimulated and flow tested in the best of the primary Torok targets. This flow testing is anticipated to then be completed in April 2020.

That’s not to say that this opportunity doesn’t come without risk - 88 Energy is a small company and this is highly speculative oil exploration, with no guarantee of success.

But if the Charlie-1 well is successful, it will likely be a company making event for 88 Energy.

So far, Charlie-1 is shaping up to be one of the largest onshore targets to be drilled around the world in 2020 and given 88 Energy's large net resource potential this could prove to be a turning point for the company and its shareholders.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.