VN8 announces buyout offer

Earlier this week VN8 announced a buyout offer for 100% of its shares for $0.0375/share from MaxoTel.

This deal will go to a shareholder vote on the 26th of September 2024, with the board unanimously recommending to accept the deal.

The offer price of $0.0375 is at a 108% premium to the price of the previous close day, however well down from our Initial Entry Price.

VN8 was one of the original stocks in our Next Investors Portfolio and we moved it to our “bottom drawer” in January this year.

We still hold on to a small portion of our VN8 holdings.

Whilst not at the price we were hoping for, our “Big Bet” exit for VN8 is playing out as we expected through a takeover offer.

At the end of the day, VN8 was not able to grow and integrate its acquisitions quick enough to deliver major returns.

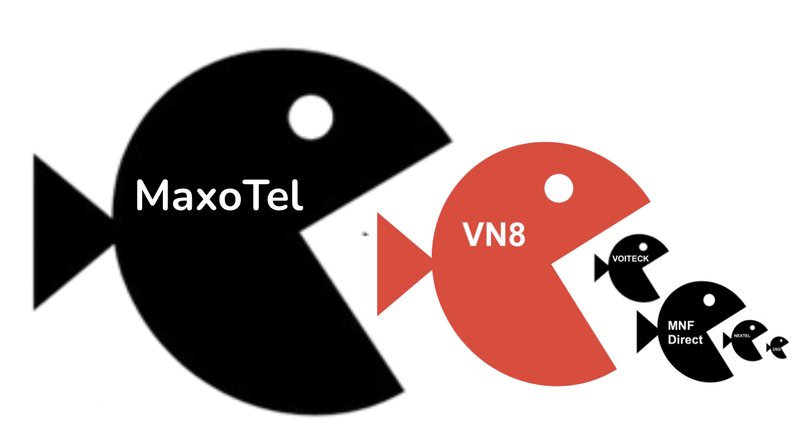

VN8’s strategy was to grow through acquisitions and debt, making four acquisitions in under two years to grow its top-line revenue.

This strategy worked well for Unity Group who was taken over for $3.6BN in 2022.

However, VN8 was too slow to integrate the new businesses and it could not grow fast enough before interest rate hikes put a strain on its heavily debt leveraged strategy.

A writedown of $19M last year was a tough re-set of the balance sheet, and the company has not made meaningful progress since.

If this deal closes as we expect it should, it will close the book on one of our original Next Investors Portfolio companies.

Key things we learned from the VN8 Investment

- Telcos are not our forte. This was our only ever telco investment and we generally have stuck to resources, biotechs and large-contract tech stocks since.

- The “growth through consolidation” bet requires a lot of momentum. As seen with Unity Group, it was able to grow through acquisition and capitalise on the zero interest rate environment. Whereas VN8 was too slow to grow and eventually was negatively impacted by higher interest rates on its substantial debt.

- Stick to the top slicing strategy. In February 2021 VN8 hit 32.5 cents off the back of the success of Uniti Group and a deal with Orange. This would have been the best time to top slice the Investment. We didn't do this, but of course, it’s very hard to pick the top for any investment.

Overall, VN8 was not one of our best Investments, however we did learn a lot of valuable lessons that will hold us in good stead for the future.