Trading halt for Brazilian lithium project assays

LRS entered a trading halt today “pending the release of an announcement in relation to assay results from the Salinas lithium project in Brazil”.

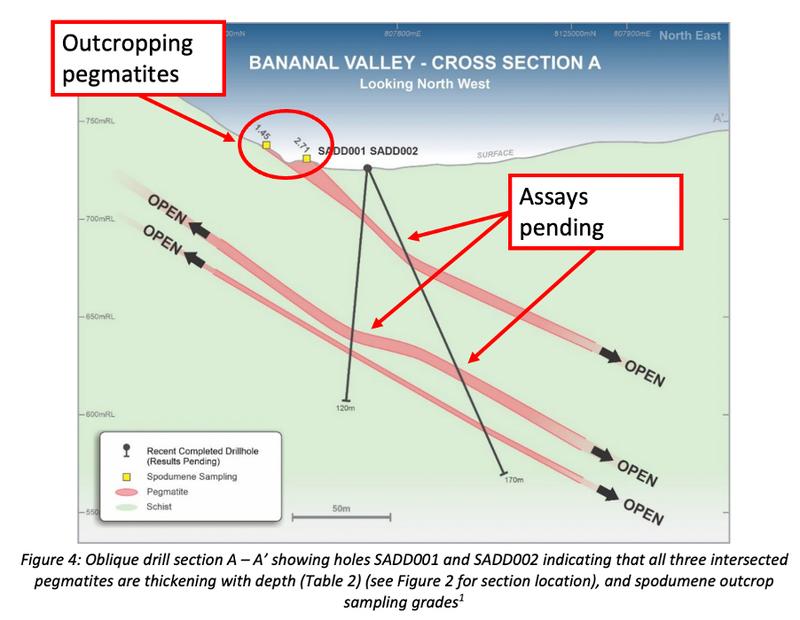

We have been covering the drilling program over LRS’s lithium project in Brazil ever since the first two drillholes intersected multiple zones of spodumene bearing pegmatites immediately down-dip from high-grade (2.71% lithium and 1.45% lithium) outcropping pegmatites.

We looked at the first two drill holes in our first note on this drilling program, which can be read here. The assays will likely be from these two drillholes.

Since then LRS have continued to intercept spodumene bearing pegmatites along strike and down dip so any indication of lithium mineralisation could really mean LRS are onto something here.

Since drilling started the share price has gone from ~3c to now trade at ~7.6c a ~150% increase off spodumene intercepts. If the assays now come in and prove lithium mineralisation we suspect this could only be the start of a move higher.

LRS has now defined a ~500m spodumene bearing pegmatite structure in the southern part of the project. This could be the first sign of what we hope is a new lithium discovery.

As of the last drilling update, LRS released on the 16th March, LRS had completed 6 out of 14 of the planned drillholes.

With the remainder of the drilling program to focus on the northern section of LRS’s project, we expect to see if the strike length can be increased to the north and will be watching to see if LRS continue to drill out spodumene intercepts.

Of course the ultimate tell of whether or not LRS have made a new lithium discovery will depend on the assays from all those drillholes.