IVZ raises $12.7M in an oversubscribed Share Purchase Plan.

Our 2020 Energy Pick of the Year, Invictus Energy (ASX: IVZ) just raised another $12.7M through its oversubscribed Share Purchase Plan (SPP).

The SPP was over 100% oversubscribed with the initial target being only $5M.

IVZ has now raised a total of $22.7M across its placement and SPP at 12c per share.

Both capital raises also came with one-for-two basis, with an exercise price of $0.20 and expiry date of 7 June 2026.

The shares from the SPP are expected to be issued on 2 June 2023.

How we expect IVZ to trade over the coming weeks -

IVZ is currently trading at 14.5c per share well above the 12c capital raise price.

In the short term we expect to see some churn in IVZ shares and for the share price to trade sideways for a few weeks as some of the investors who took part in the capital raise look to sell some of there position.

What’s next for IVZ?

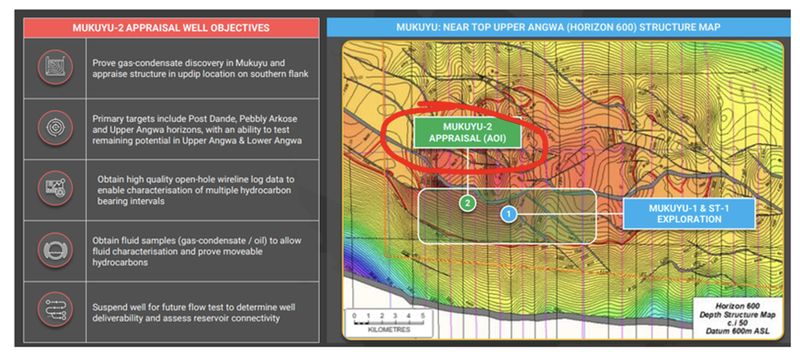

1) Preparation for drilling Mukuyu-2 in Q3 this year.

IVZ has the Exalo 202 rig warm stacked meaning it can mobilise the rig to site relatively quickly.

At the moment the drilling contractor is completing maintenance and upgrade works, preparing the drill rig for Mukuyu-2.

Upgrades started in April and IVZ expects the rig move to start soon after.

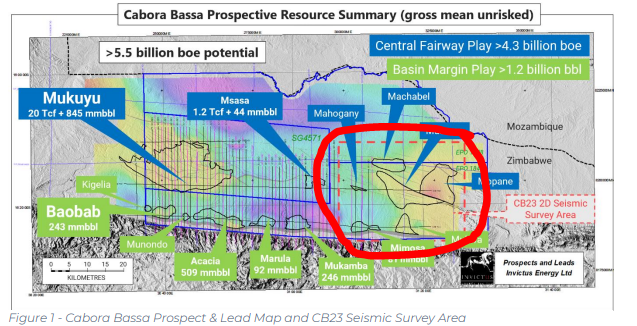

2) 2D Seismic programs across eastern part of project.

IVZ now has the 2D seismic contractor locked in for a ~400km^2 program.

IIVZ has already started mobilising seismic equipment and personnel so we shouldn't have to wait for this program to start.

We expect the program to be run in the background while IVZ drills its Mukuyu-2 well.