Battery materials demand will need more than 300 new mine

Published 16-SEP-2022 14:38 P.M.

|

2 min read

Macro: Lithium

The battery materials thematic is a major part of our Portfolio.

After a nasty down day for the market two days ago driven by inflation fears emanating from the US, we remain confident that this theme will be part of a decade long trend.

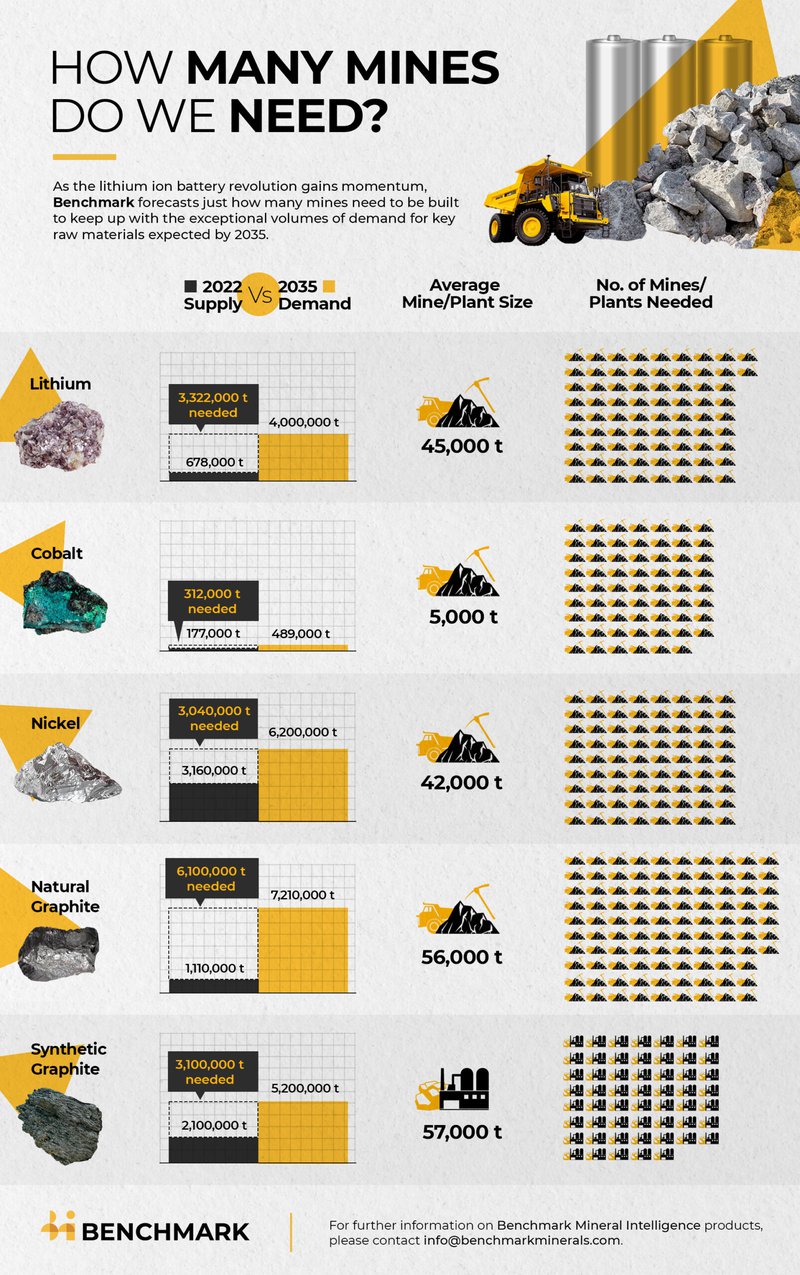

A recent Benchmark Mineral Intelligence report highlights just how much battery materials are needed for the world to reach its ambitious decarbonisation goals.

The report notes that, “At least 384 new mines for graphite, lithium, nickel and cobalt are required to meet demand by 2035.”

Here are the companies in our Portfolio that we hold as exposure to each of the four battery materials referred to in the report (click the company name to see our Investment Memo):

Graphite:

Sarytogan Graphite (ASX:SGA) - early stage development, Kazakhstan

Evolution Energy Minerals (ASX:EV1) - late stage development, Tanzania

Lithium:

Tyranna Resources (ASX:TYX) - exploration, Angola

Latin Resources (ASX:LRS) - resource definition, Brazil

Vulcan Energy Resources (ASX:VUL) - development, Europe

Ragusa Minerals (ASX:RAS) - exploration, Northern Territory (recently acquired)

European Metals Holdings (ASX:EMH) - development, Europe

Nickel:

Galileo Mining (ASX:GAL) - exploration, Western Australia (currently in resource definition mode on PGE project)

Cobalt:

Kuniko (ASX:KNI) - exploration, Europe (KNI also has a nickel project)

The report also had a great infographic outlining the required tonnages of the various materials which can be found below:

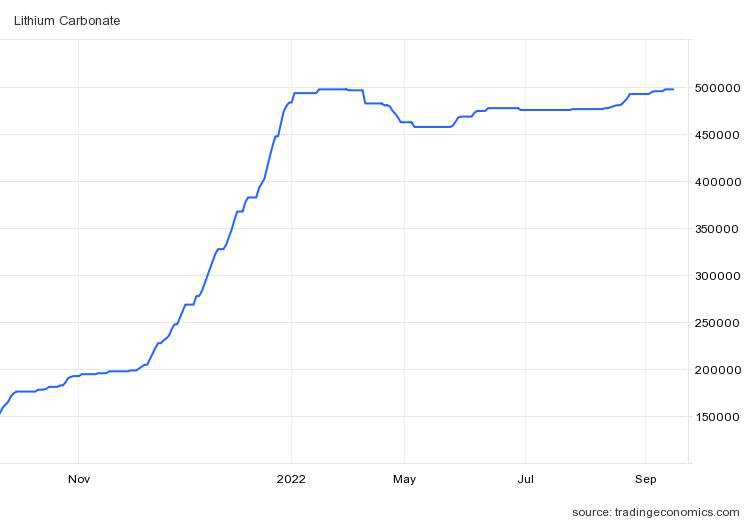

We note that one Barrenjoey analyst recently upgraded their forecasts for the lithium prices for 2023 and 2024 by 36% to and 86% respectively.

As a bellwether of the battery materials space, the lithium price remains strong:

We remain confident in our battery materials Investments now, as well as over a long term +3 year timeframe.