VUL release Pre Feasibility Study - A$3.5BN Net Present Value

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Vulcan Energy’s (ASX:VUL) Zero Carbon Lithium® Project’s first Pre-Feasibility Study (PFS) has demonstrated strong potential to develop a cutting edge, combined renewable energy and lithium hydroxide project, in the centre of Europe, with net zero carbon footprint.

The PFS, which was released today, shows an after tax Net Present Value of €2.25 Billion (AU$3.55BN). This is much bigger than expectations, especially given that at around $5/share, VUL is valued under $400M.

This is compared to the world’s top lithium producers.

Ganfeng Lithium Co Ltd is capped at $32BN, Albemarle - $24BN, Tianqi Lithium - $17.4BN, while SQM is capped at $9BN (figures are all in $AUD).

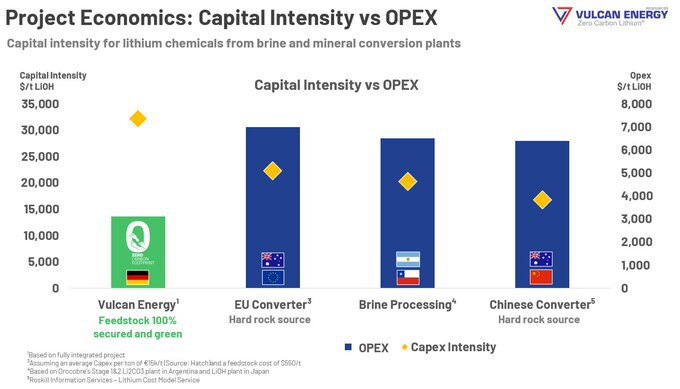

VUL will have a higher CAPEX, but much lower OPEX operation relative to industry peers.

The company will also uniquely produce geothermal energy, providing stable revenue with the high fixed feed in tariff in Germany, a key industry differentiator.

While there will be dilution for VUL shareholders to raise the cash needed to develop their project over time, if VUL continues on its current trajectory it could reach a multi-billion dollar valuation like other producers in the long-term.

Earlier this week, influential German investment analysts Der Aktionär set a share price target on VUL of €6 (AU$9.50).

Highlights of VUL’s PFS include:

- Project value of €2.25 billion (post-tax, NPV), which equates to A$3.54 billion.

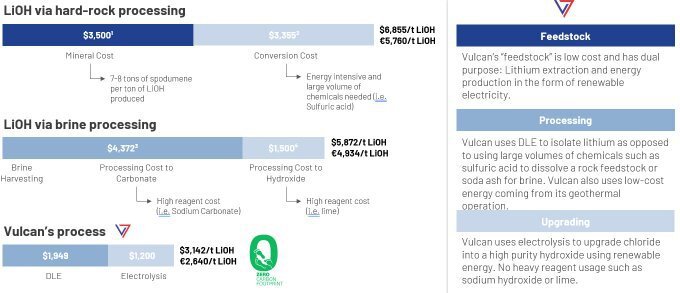

- Lowest operating expenses (OPEX) of any lithium hydroxide (LHM) project globally at €2,640/t LHM.

- Combined renewable energy-lithium project pre-tax IRR of 26% and post-tax IRR of 21%. (Lithium as a separate entity from energy shows pre-tax IRR of 31% and post-tax IRR of 26%.)

- Dual operation producing: 74 MW of renewable energy generation and approximately 40ktpa LHM production.

- Starting capital cost of €226m for geothermal wells and plant, and €474m for Direct Lithium Extraction (DLE) plants and Central Lithium Plant (CLP).

PFS details

VUL’s project hosts Europe’s largest lithium resource, dwarfing all other EU lithium Resources.

It is more than twice the size of the next largest Resource and could satisfy Europe’s lithium needs for the electric vehicle transition, from a zero-carbon source, for many years to come.

The PFS demonstrates strong potential to develop a cutting edge, combined renewable energy and lithium hydroxide project, with net zero carbon footprint.

Conducted with world-leading experts in lithium extraction, chemistry, chemical engineering, geothermal plant engineering and geology, the study focused solely on Indicated Resources, from the Ortenau and Taro licenses.

The PFS also demonstrates robust economics for both the lithium hydroxide and renewable energy parts of the project, both independently and combined.

The PFS considered both the geothermal and lithium businesses and modelled the project under different possible structures:

- The Full Project developed at the same time and involving no phasing, or

- Phase 1 developed first, followed by Phase 2 — each as separate geothermal and DLE integrated businesses.

Under the scenario in which the full project is developed at once, using a Net Present Value calculation, the PFS indicates a project value of €2.25 billion (post-tax), which equates to A$3.54 billion.

Under the second scenario, where the project is developed in two phases, the project has post-tax NPV of €703 million (A$1.1B) in Phase 1, and a post-tax NPV of €1.4 billion (A$2.2B), in Phase 2.

VUL’s Opex (operating expenses) to pull out one tonne of Zero Carbon LithiumR Hydroxide is €2,640 per tonne.

This means VUL has Opex per tonne lower than any current operation globally.

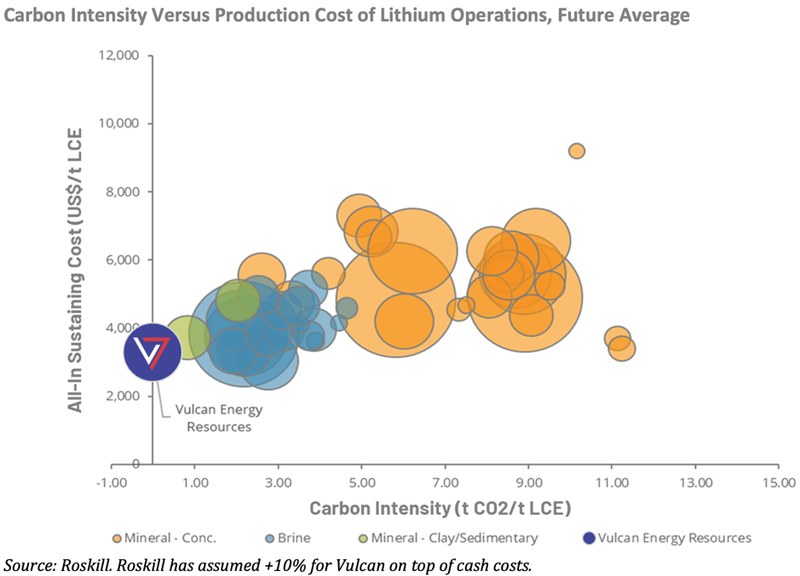

VUL will also have the lowest CO2 footprint of any lithium operation globally and sits at the very lowest of carbon intensity and production costs on this curve:

Good metrics at the right time

The EU is ramping up its commitment to the roll out of electric vehicles and is the fastest growing market in the world for lithium.

In fact, Europe’s lithium consumption is forecast to continue to grow sharply, with demand ramping up by 2024. \

EU commissioner Thierry Breton highlighted that Europe is “100% dependent on lithium imports.

However, that is set to change.

"The EU, if finding the right environmental approach, will be self-sufficient in a few years, using its resources,” Breton said.

In fact, Europe is the fastest growing market in the world for lithium following strong investments in battery and cathode plants and with more investment in electric vehicles in Europe than in China, Europe’s lithium consumption is forecast to continue to grow sharply.

Demand is anticipated to spike in 2024 — right as VUL anticipates its first production.

In the medium to long term, fundamentals remain strong for electric vehicles and energy storage. Growth rates are expected to average 25% per year over the next 10 years, while supply is growing at a slower rate, leading to a deficit from 2024 onwards.

Furthermore, thanks to changes in cathode technologies, by the mid 2020s, lithium hydroxide (LHM) is forecast to take over lithium carbonate as a battery material, which works to VUL’s advantage.

Further to this, over the next few years lithium-ion batteries will come under strict regulations that must comply with maximum carbon footprint thresholds.

Batteries not meeting the new regulation will be banned and manufacturers will have to demonstrate that they are sourcing raw materials responsibly.

With regard to this, Vulcan is the only lithium project globally that is being developed to have a zero-carbon footprint, and its trademark Zero Carbon Lithium® can be licenced to battery manufacturers and OEMs using the product.

A big year ahead

Multiple potential share price catalysts are flagged for 2021, as VUL conducts Definitive Feasibility Study (DFS) work, project permitting, lithium extraction test-work scale up, and advances discussions with European lithium off-takers.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.