VN8 Quarterly: So close to being cash flow positive. Completes giant acquisition, cap raise. We topped up.

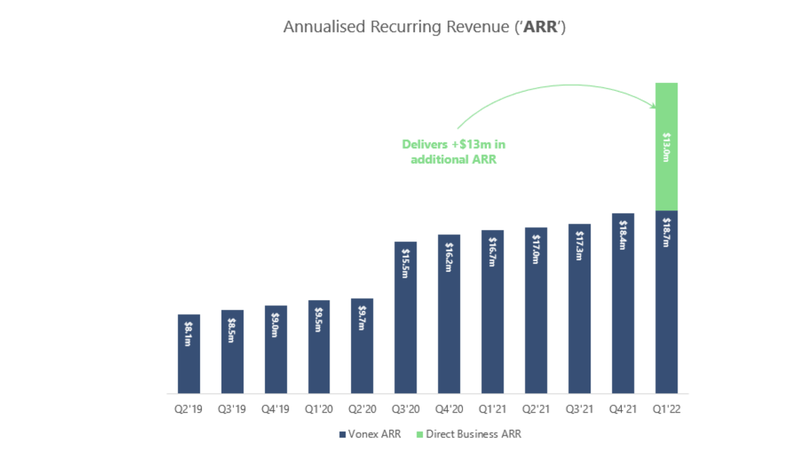

Our telco investment Vonex Ltd (ASX:VN8) reported yet another robust quarterly result today, with unaudited sales revenue of $4.8 million for the quarter, leading to annualised recurring revenue (ARR) of $18.7 million.

This comes off the back of VN8’s recently announced biggest ever acquisition and corresponding cap raise (and debt finance).

VN8 is a telco that services small to medium enterprises. It also has a wholesale business that allows companies to white label its communications technology.

We first invested in VN8 at 14c in September last year and increased our position in the recent placement at 11c- we continue to hold as VN8 executes its growth by acquisition strategy. Our average entry is now ~12.5c.

While VN8 has just missed the mark on being cashflow positive this quarter, we expect they will hit that milestone for 2H21. As long term investors, we view this as a key milestone for any company aspiring to pay dividends down the line or use the cash for growth.

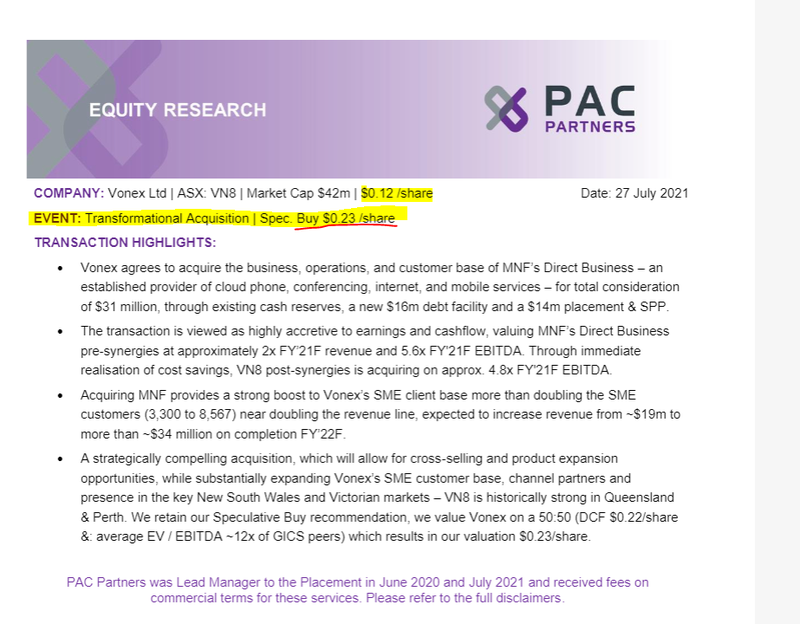

We’ve also seen a research note earlier this week from PAC partners describing VN8’s “Transformational Acquisition” with a subsequent $0.23/ share price target (vs $0.125/ share at close yesterday).

Further to the 11c placement VN8 will also be offering an 11c Share Purchase Plan (SPP) to existing eligible shareholders - closing on August 13th.

While not as “exotic” as some of our early stage exploration investments, we see significant long term growth for VN8 but with reduced risk and volatility, as it is generating recurring revenue - providing a good balance to some of the higher risk positions in our portfolio.

The entire telco space is in a consolidation phase and VN8 is running an acquisition strategy snapping up smaller players.

In the last 18 months, VN8 has acquired 2SG and Nextel and last week announced the acquisition of MNF Group’s Direct Business for $31M.

Whilst $31M appears large when compared to VN8’s market capitalisation (~$24M), we view the deal as genuinely transformative as it essentially doubles VN8’s small medium enterprise (SME) customer base and revenue line going forward.

Ultimately we are invested and holding long term because we think VN8’s acquisition strategy will come full circle and eventually a bigger fish will come along and swallow VN8.

VN8 is aspiring to attain a similar valuation to its ASX listed telco peers:

- Spirit Telecom (ASX: ST1): $202M

- Over The Wire Holdings (ASX: OTW): $271M

- Uniti Group (ASX: UWL): $2.3BN

All are trading at many multiples of VN8, currently capped at $24M.

We are invested for the long term as we want to see how VN8’s growth strategy plays out and hoping VN8 can start catching up to its other much bigger ASX telco peers.

Today’s quarterly results come on the back of successful integration of VN8’s previous two acquisitions: 2SG and Nextel have both contributed to VN8’s growing bottom line.

Highlights of the quarterly include:

- Unaudited sales revenue of $4.8 million, with annualised recurring revenue of $18.7 million as at 30 June 2021 (rising to $31.7 million on completion of acquisition of the Direct Business)

- Cash receipts for the quarter totalled $4.5 million

- As at 30 June 2021, VN8 had approximately $3.7 million of cash, with the 4C financials showing as at June 30th VN8 says they have cash left for 30 quarters at the current burn rate (however this doesn’t take into account the recently announced transaction).

- Active subscribers of Vonex’s cloud-based PBX phone service surpasses 45,000, with growth over the year to June 30 reaching 26%

- Cash balance of $3.7M as at 30 June 2021.

- Funding secured for the Direct Business acquisition as well as other growth initiatives, including a $16M credit facility from Longreach Credit Investors and a share placement raising up to $12M in equity, with a Share Purchase Plan (SPP) offered to existing eligible shareholders to raise up to an additional $2M, all at 11c per share.

VN8’s latest acquisition

Last week VN8 made its biggest acquisition to date, acquiring MNF Group’s Direct Business for $31M.

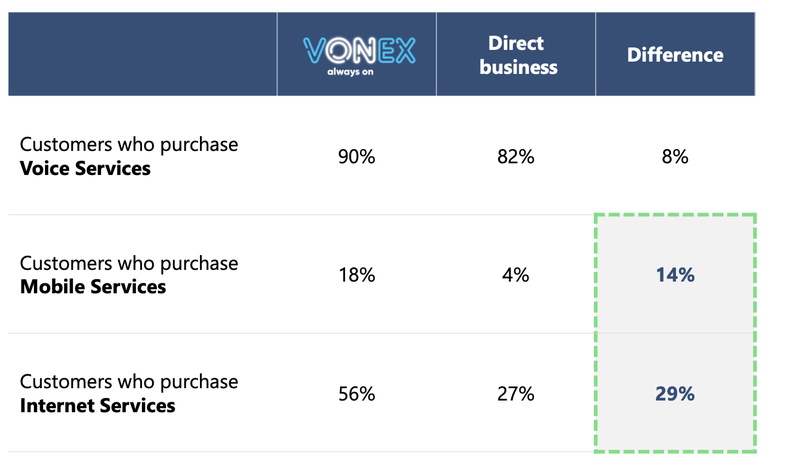

The Direct Business sells cloud phone, internet and mobile services to small-to-medium enterprise (SMEs) and residential customers in Australia, as well as dedicated audio and video conferencing services - which perfectly complements the VN8 business model.

The Direct Business acquisition is a key part of VN8’s ongoing acquisition strategy.

This latest acquisition is binding and will increase VN8’s annualised recurring revenue by approximately 70%, delivering more than 5,250 new SME customers and more than 180 new channel partners in the process.

VN8 will effectively grow in all key metrics, in particular earnings and cashflow:

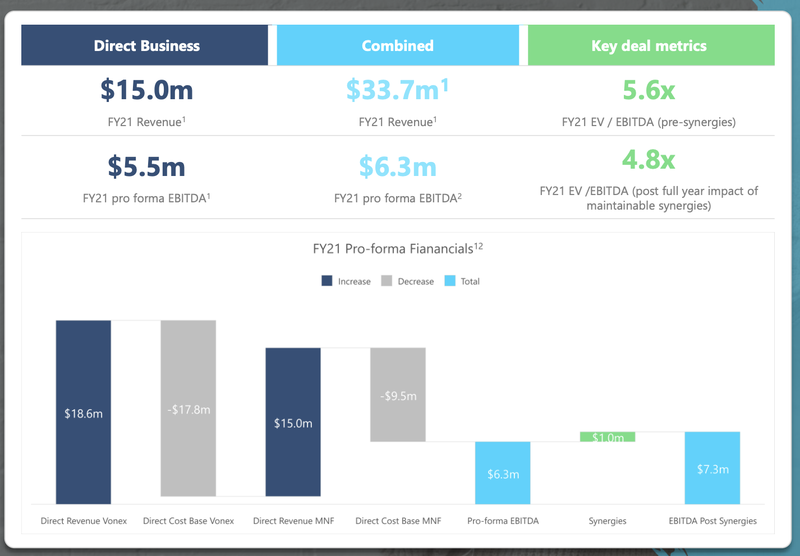

In FY21, the Direct Business delivered revenue (unaudited) of $15.0M of which 89% was derived from its SME segment and 11% derived from the retail segment.

Close to $9 in every $10 of this revenue was recurring, with divisional EBITDA of $5.5 million (unaudited) reported in FY21.

Besides the boost to VN8’s customer and revenue bases (essentially doubling both), we like the synergistic benefits of this acquisition, which provides for cross-selling and product expansion across several markets.

We’re not the only fans of this transaction, with PAC Partners releasing a research note earlier this week describing the MNF Direct Business as a “Transformational Acquisition” for VN8, with a subsequent $0.23/ share price target (vs $0.125/ share at close yesterday).

VN8 will pay $20M in cash upfront, plus $11M in deferred monthly cash payments to acquire MNF Group’s Direct Business. We think this structure is a good outcome for VN8 as monthly payments will help it manage its cash flow over the coming year.

To pay for the acquisition, VN8 has secured a $16M debt facility from Longreach Credit Investors which will be fully drawn down to partially fund the upfront $20M.

VN8 is also raising up to $12M via a well supported two-tranche placement, through the issue of 109 million shares at 11c per share and will offer a Share Purchase Plan (SPP) to existing eligible Shareholders to raise up to an additional $2M. The SPP will close on 13 August.

VN8’s largest shareholder 2SG Investments and director Jason Gomersall says they will subscribe for approximately $570k and $374k worth of Tranche 2 placement shares respectively, illustrating the confidence they have in VN8’s growth strategy.

Here’s why we like VN8’s latest acquisition.

- Through this acquisition, VN8 is forecast to deliver $33.7M (almost double) its current revenue. The Direct Business delivered FY21 pro forma revenue of $15M and pro forma EBITDA of $5.5M. This gives VN8 high quality earnings and a strong platform for future organic growth through cross selling internet and mobility products to Direct Business customers.

- 12 month payment plan. The ability to pay a third of the acquisition cost over a 12 month period will help with cash flow during this period and shouldn't put too much strain on VN8’s bottom line.

- The acquisition will materially expand VN8's footprint. VN8 will significantly expand its reach to SME and residential customers across Australia. The acquisition will give VN8 5,250 new business customers.

- Delivers $13M in additional Annual Recurring Revenue (ARR). A picture tells a thousand words. The following graph shows how VN8’s ARR will increase with the addition of Direct Business’ ARR. It’s an increase of over 70%:

- Increase average revenue per user. Monthly subscriptions and high levels of customer retention will no doubt strengthen VN8’s bottom line.

6. Attract further institutional investment. We expect this capital raise to introduce a number of new funds, and the combined entity’s larger size will position Vonex on the radars of other institutional investors going forward.

- Increased EBITDA. Acquisition represents an implied FY21 EV / EBITDA of 5.6x (before synergies) and 4.8x (post synergies) on a FY21 pro forma basis vs several peers trading at near double this.

- Geographic expansion: VN8 can further expand its reach into the major Melbourne and Sydney telco markets.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.