Small caps are back on & Silver Price is Surging

Published 18-MAY-2024 10:27 A.M.

|

22 minute read

Small caps are ripping.

Beaten up stocks are rising off their lows.

Multi-baggers are back.

Brokers are in a buoyant mood and more people are coming back to small cap investing.

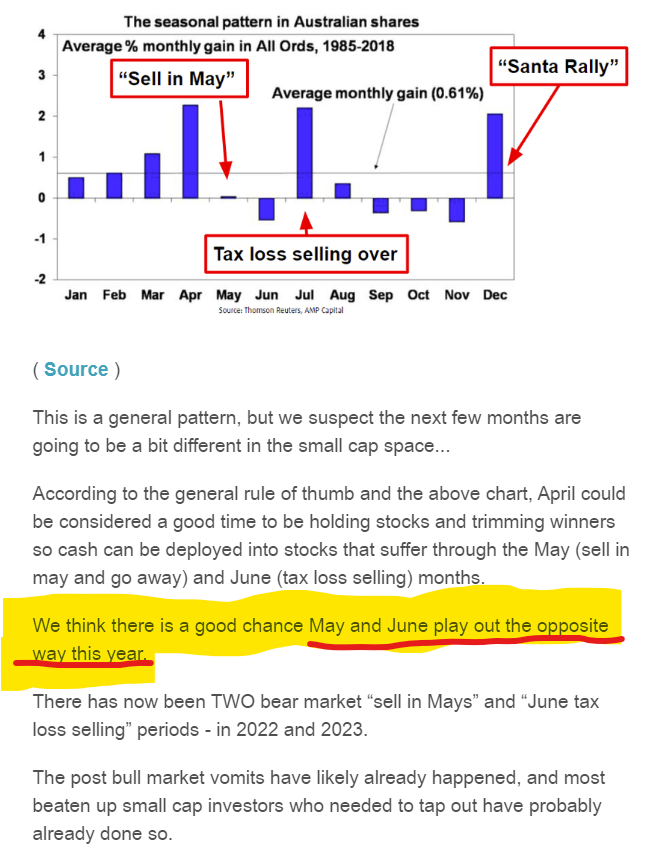

But isn’t it “sell in May”?

What about “tax loss selling June”?

Well the small cap market seems to be ignoring these traditions this year and is instead delivering a big, positive run.

That’s fine with us.

Back in March we predicted the small cap market would probably be unexpectedly bullish during the 2024 May/June season:

( Read the full commentary here )

Speaking of things we got right...

In the same article we also talk about why we thought silver was going to have a run...

Two months later it certainly has.

Especially last night:

And here’s what the media had to say this morning about silver’s overnight surge:

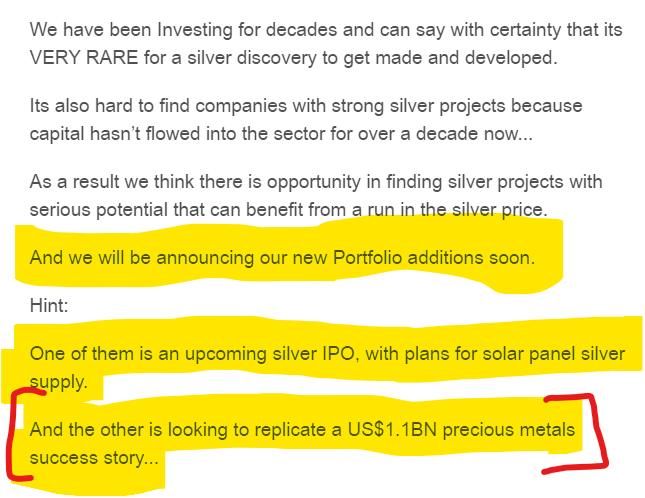

Anyway, shortly after our March silver price run price prediction, we wrote about adding two new silver companies to our Portfolio:

(Read the full commentary here)

Sun Silver (ASX:SS1) is the first.

And we have chosen SS1 as our Small Cap Pick of the Year for 2024.

SS1 commenced trading this week.

SS1 has a 292,000,000 ounce silver equivalent JORC resource in the middle of the USA.

SS1 is already up to 62c from the 20c IPO price.

This Monday should be very interesting for SS1 given the silver price surged nearly 7% last night to new 13 year highs... and could keep going.

... plus most IPO flippers (day one sellers) should be gone by now.

The SECOND silver company we said we would add in anticipation of a silver price run is re-listing very soon... (more on this below).

It's simply great luck to time a new Investment when a macro thematic is just turning positive.

Usually it's pretty hard to pick up good quality companies at good prices when the macro theme is too hot (think lithium in the middle of 2021).

We think the timing for SS1’s IPO was excellent with the silver price roaring just as it listed on Wednesday, and again overnight.

(Good luck on timing is not in anyone’s control, and while it’s all looking good right now, remember that things can and do go wrong in small cap investing, it’s high risk and good luck can be fleeting...)

It does look like the macro planets are aligning on this one, and we hope the macro momentum just gets stronger and stronger.

SS1 launched its IPO on the 19th of April, closed it in a few days due to “overwhelming demand" and then listed early on Wednesday May 15th (initially it was targeting a June listing).

Here are events leading up to SS1’s IPO overlaid on the silver price chart:

...and overnight the silver price smashed through $30, hit $31, and finished at $31.5.

(The image above is from our launch note on Wednesday when silver was at $28.6... $31 doesn’t even show on the chart)

Now all we need is the silver price to continue on its tear and we get the recipe for a nice, sustained rerate in SS1 as project economics improve with a higher silver price.

So far so good, and we hope that as the company delivers catalysts over the coming months, the share price continues to appreciate.

See our launch note and the 11 key reasons why we Invested in SS1 here:

Another Silver Portfolio Addition Coming Very Soon

Speaking of silver running...

... and of companies that should start trading very well if the silver price is running.

We spoke about adding two silver companies to our portfolio back in April .

We are very close to announcing the second silver company...

It has an existing JORC resource (40,000,000 ounces of silver)

The company traded at above $110M back in 2021 when it hit one of the highest grade silver intercepts in the world.

The company had a tough 2022-2023 and ended up needing to do a recapitalisation raise which we participated in (this company is the next addition to our Emerge Portfolio)

It’s recommencing trading soon, coming back on at a restructured $8.4M market cap with ~$4M in the bank.

With only a small number of silver companies on the ASX it's pretty easy to figure out which one it is.

The company is Mithril Resources (ASX:MTH) - We will release our full commentary and Investment Memo after it recommences trading.

In the meantime, here is the most recent MTH investor presentation .

Why we think the silver price could go even higher

For a long time we believed the price of silver was trading unsustainably low.

We have been Investing in commodities companies for decades now and one way to gauge IF a commodity is likely to rally hard is to try and plot what is called “incentive prices” against the chart for that particular commodity.

Incentive prices refer to the price for a commodity where companies see it as worthwhile to either explore for OR develop advanced assets.

I.e if the cost to produce a commodity is say $10, then the incentive price would need to be way above that number for it to be worth building a huge mine and taking on all the risks associated with that.

And for explorers the incentive price is usually even higher - where the price needs to be high enough to make it worthwhile spending money on high risk/high reward exploration.

When it comes to silver, we think the market traded well below incentive pricing for far too long.

That period of low prices resulted in mines being shut down or new mines not being built AND a complete lack of exploration looking for new discoveries.

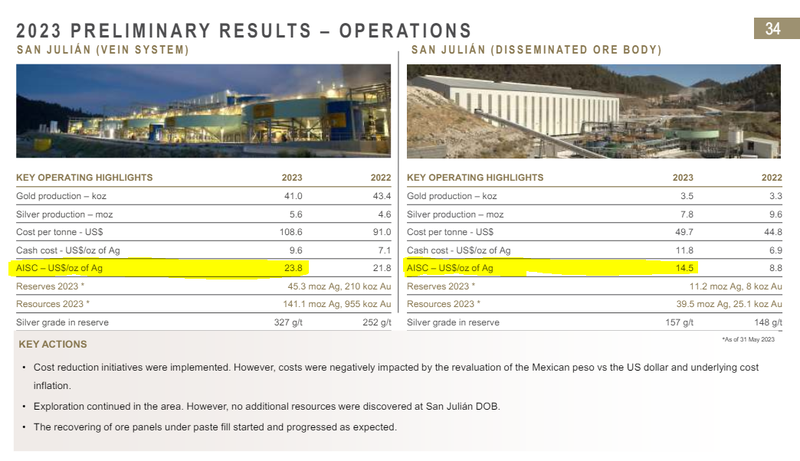

Fresnillo plc is the world’s biggest silver producer.

Below is a slide taken from the Fresnillo 2023 results presentation which shows the All in sustaining cost (AISC) for two of its silver mines.

One is at US$21 per ounce and the other at US$14.5 per ounce.

(they must be a lot happier with silver at US$31.5)

Naturally their assets are in the lowest cost quartile for silver producers.

So US$14.50 to US$21 is as good as it gets when it comes to the cost of mining silver.

( Source )

Now looking at the silver price...

So the above numbers show us roughly how much it costs to mine silver.

The next thing to think about is how much a miner can sell its silver for.

For over a decade the silver price traded in a range between ~US$13 per ounce and ~US$22 per ounce.

We think that those prices were nowhere near high enough to justify bringing new silver mines online AND especially not high enough to incentivise new exploration.

Taking into consideration the time it takes to bring new projects online, the forward outlook for silver supply is relatively grim.

New mines can take up to ~17 years to come online following a discovery. Obviously projects at a more advanced stage in terms of development can come online quicker.

All in all, we think the silver market currently finds itself in a position where there is no new supply coming online and demand could be about to go exponential...

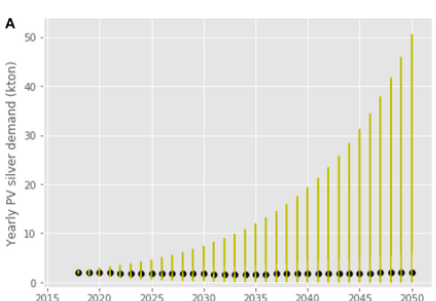

Exponential silver demand growth projected to 2050

By 2050 - 50% of silver demand is expected to come from the solar panel manufacturing market. This is a relatively recent development in the silver market.

The chart below shows how demand for silver is expected to rise by over 250% by 2050 due to solar alone .

( Source )

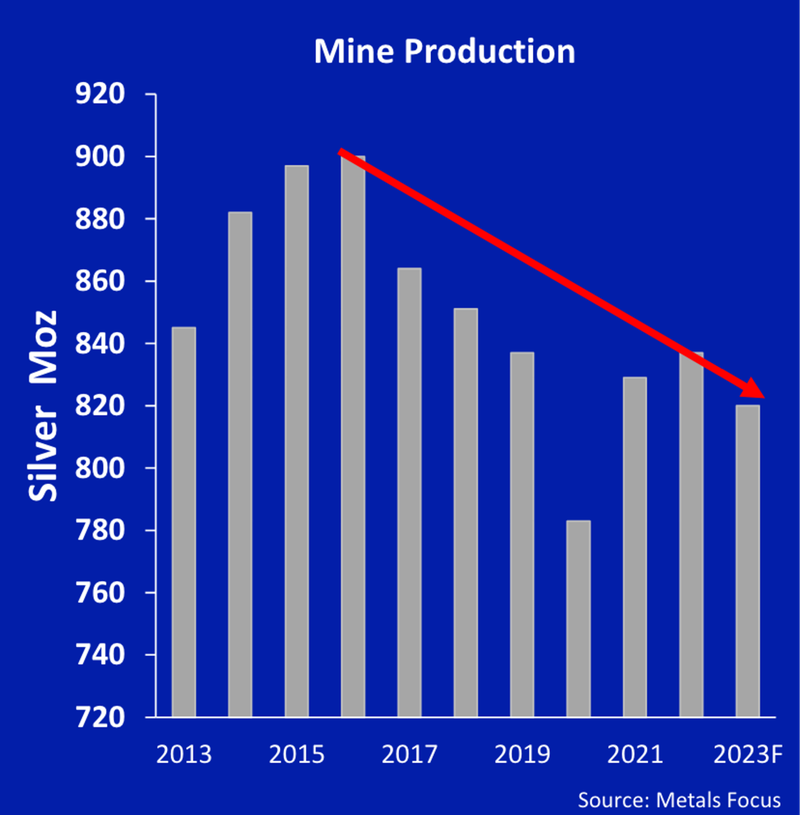

Demand is growing, BUT global silver production is declining...

Globally, silver production declined by 0.7% in 2023. ( Source )

Decreasing production isn't just a “2023 thing” either.

Global silver production has been trending lower since 2016...( Source )

( Source )

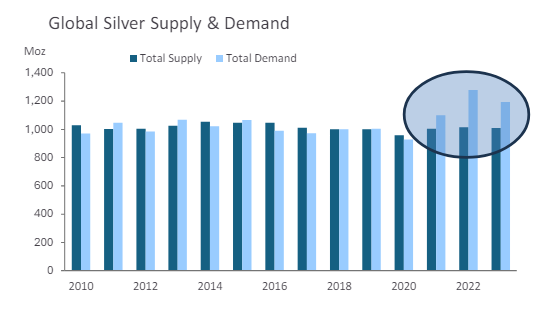

Production falls have led to deficits for 3 years straight...

While the last three years have seen a significant large supply deficit emerge. ( Source )

( Source )

We think the silver price is running largely as a result of the supply/demand imbalances the market is starting to price into the silver market.

Our view is that over the next 5-10 years, the silver price will need to go a lot higher then where it is today, to incentivise new exploration and new mine supply.

For the lithium market to incentivise new supply to come online, prices rallied over 10x in 2021...

The silver market is a lot more mature than lithium - but even if we got a 2-3x move in the silver price, we think it will bode extremely well for our silver Investments.

121 Mining Investment conference in London

This week one of our analysts attended the 121 Mining Investment conference in London.

As small cap investors, first and foremost, speaking to management is a key part of our Investment Strategy.

There were five companies in our Portfolio presenting at the event: GAL, MNB, HAR, TYX and KNI.

Each company had a slightly different goal for the conference, but the unifying theme was to meet institutional and high net worth investors that could provide support for the projects.

Galileo Mining (ASX:GAL)

First, we spoke to GAL Chairman Brad Underwood and Non-Executive Director Noel O’Brian.

The key takeaway was that GAL is first and foremost, an exploration play.

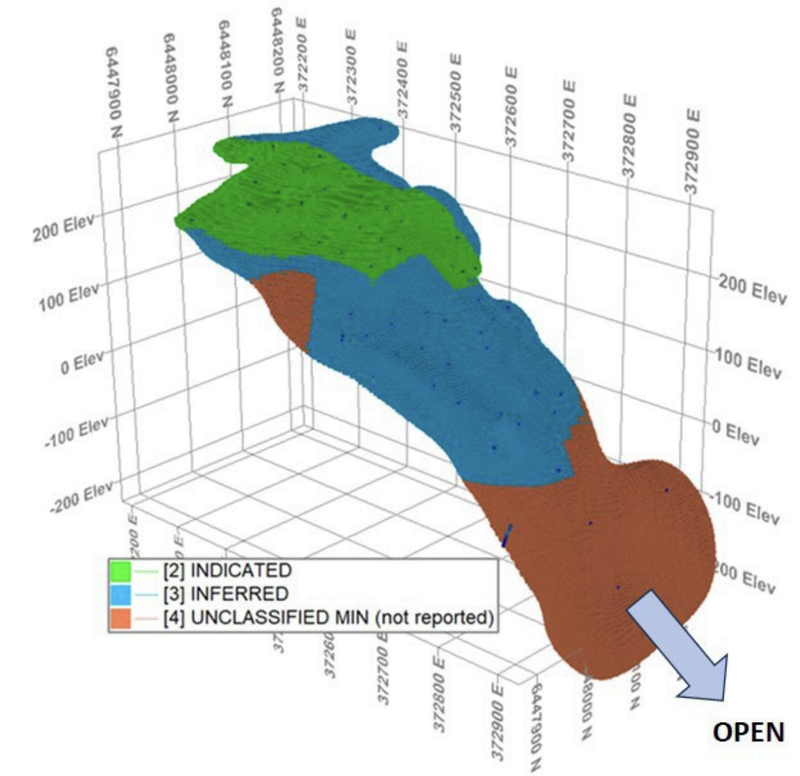

Last year the company published a 17.5Mt polymetallic Mineral Resource Estimate (MRE), with further unclassified mineralisation at depth (the brown section):

GAL made its nickel-palladium discovery in 2022 and continued to drill out the deposit until it published its mineral resource estimate.

We saw what happened when GAL made its first discovery, the share price went from ~$0.20 to ~$1.90 (in a notably hot market for small cap stocks), and then GAL managed to raise ~$20M at $1.20 (we participated in the raise).

The share price has come off a lot since then.

This was because of a mixture of a poor market for small caps, the nickel and palladium sector suffering and GAL’s discovery not growing further than investors expected.

However, with the Mineral Resource Estimate now published, underpinning the value of the company, GAL is returning to exploration drilling to look for a second discovery.

GAL has $10M in the bank, and is funded for its drill programs.

GAL’s next set of drill results are expected in June. Any mineralisation discovered may form the basis of a completely new discovery.

We also spoke to Brad about the nickel and palladium markets.

Although the palladium price is in the doldrums, we think that it could be one of the next commodities to run in the next 12 months.

The signs are there.

Last week, Johnson Matthey published a paper highlighting the big deficit in the PGM markets:

( Source )

The primary use for palladium is in internal combustion engines used for traditional petrol vehicles and also hybrids.

Hybrids are looking more and more likely to be a low-carbon alternative to EVs preferred by car manufacturers :

(Source)

Our thesis is that IF hybrids are chosen as the preferred to EVs, then the palladium price will turn, in particular given the significant supply deficit of the last two years.

A telling sign of how tight the supply market is when the London Metals Exchange banned nickel/aluminium from Russia, they didn’t ban palladium.

If palladium turns, we think it could be the right place, right time, right commodity for GAL if it is able to make a second discovery at its project.

Minbos Resources (ASX:MNB)

It was good to see MNB CEO Lindsay Reed and get an update on the MNB story.

MNB’s focus for the conference was on both the final funding for the near-production Phosphate project and the longer-term investment for Green Ammonia.

...and Lindsay’s schedule was packed.

Before the conference Lindsay outlined the strategy in a video interview with Crux Investor, which provides a very good update for shareholders on the company:

( Source )

Our key takeaways from the interview, and the conference is:

MNB’s Phosphate Plant

- “Plan is to start construction in July”. The construction contract has not yet been signed but is with a local Portuguese company who can mobilise within two weeks.

- MNB first needs around ~US$24M more to construct the phosphate plant.

- Of that, US$14M will come from the IDC Project Facility and the company is looking to secure the remaining ~US$10M from strategic investors in and outside of Africa.

- There is lots of scope to grow the project. In particular it will cost just US$4M to double the scale of the plant and there are interested parties within Africa to do that and secure phosphate supply.

- Angola is set to heavily invest in the agricultural sector to diversify the country's revenue away from oil and gas.

- Angola needs MNB to succeed with a strong return on investment as a templar of foreign investment success in the country

MNB’s Green Ammonia Project

MNB is planning to build a green ammonia plant in Angola using some of the cheapest energy in the world from an under-utilised hydroelectricity dam. It’s still at the early development stages, and MNB is looking for a funding / financing partner.

- Lots of parties are interested in the project, but it's about finding the right one for MNB.

- Also, the structure of the deal matters and the scope of the project

- The project is not relying on a “green premium”. The cheap access to renewable energy is a feature of the project and should stand on its own economically.

- I am told that one interested party was “shocked” at MNB’s ability to secure less than 1c per kilowatt hour power prices... and that it could be the cheapest power supply contract secured in the world for this type of project.

MNB is currently capped at ~$50M, and is churning through a recent capital raise at $0.07c that we participated in.

We think that this presents value given the phosphate plant’s project economics being US$24M CAPEX (remaining) for a base-case NPV of ~US$200M.

On top of this, MNB has access to some of the cheapest power in the world to build its blue sky Green Ammonia project. We look forward to seeing which direction the company takes to develop it.

MNB published an investor presentation along side the conference that you can see here: Mining 121 Investor Presentation MNB

Tyranna Resources (ASX:TYX)

TYX is exploring for lithium in Angola, and the company has partnered with major Chinese company Sinomine to fund exploration of its project.

Sinomine is one of the big Chinese mining companies that works across commodities, particularly lithium.

Last year, Sinomine made a big investment in TYX, providing funding for the company’s project through this exploration phase.

The lithium markets have had a bumpy ride since TYX started its drilling in November last year so we made sure to meet with CEO Joe Gratziano.

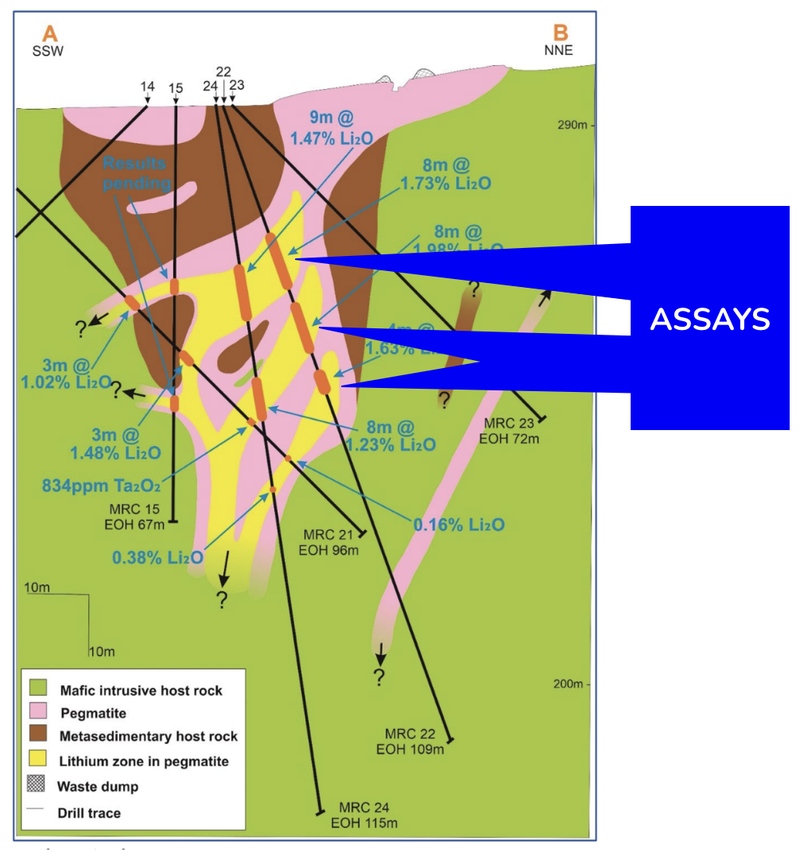

The company recently published its first assays from the drill program, with promising results of 8m @ 1.73% and 8m @ 1.93% and 4m @ 1.63% LiO.

Assays can take a bit longer to publish when obtained from a remote location, particularly if there is a backlog of assays to process at the labs.

The company is still doing more drilling, and more results will come out soon, but as Joe explained, the reality of this project is that there is plenty of room to grow.

There are still thousands of pegmatites to map and TYX is well funded to undertake this exploration.

Joe mentioned that Sinomine has been a very good partner, sending over exploration experts from other projects around Africa to support exploration activities.

We look forward to the next 12 months for TYX as it drills out its lithium project in Angola.

Mining 121 conference presentation here: TYX Mining 121 conference presentation

Haranga Resources (ASX:HAR)

As one of our newer Investments, it was great to see HAR’s Managing Director Peter Batten and get the project update from the company.

Peter is the former Managing Director of Bannerman Resources, and we always enjoy listening to his old war stories from the ASX-listed former uranium giant.

He mentioned to keep an eye out for HAR’s assay results from its RC drilling campaign as well as progress on the MRE upgrade and update.

Unfortunately, due to delays in the elections in Senegal, some of the newsflow was delayed - however this now means we should expect a flurry of updates soon on backlogged news flow.

HAR's project already has a JORC resource of 16 million pounds of uranium, and the company is exploring multiple large radiometric anomalies with the aim of significantly expanding the resource base.

The main pitch for potential HAR investors is that its 16 million pound resource underpins the value of the company, and compared to its tiny market cap of just ~$8.8M means that the company is leveraged to exploration success.

HAR published an investor presentation alongside the conference which you can see here: HAR Investor Presentation

Kuniko (ASX:KNI)

Finally, we spoke to the KNI Managing Director Antony Beckmand about KNI’s EU critical minerals projects and its strategy.

KNI is full steam ahead to grow its mineral resource estimate on the Ringerike Nickel-Copper project.

Last month, KNI announced a maiden Mineral Resource Estimate of 49.7kt of nickel, 37.3kt of copper and 3.3kt of cobalt.

Further to this, an 8-hole 4,000m extensional drilling campaign has been initiated to extend the resource.

This will be the main focus for the company as it looks to develop its European-based critical minerals projects.

Last year, major car maker Stellantis took a strategic cornerstone investment in KNI of $7.8M for ~20% of the company.

I asked about the Stellantis relationship with KNI and the strategy from Stellantis to invest in early stage critical minerals projects.

Stellantis has been one of the most active OEMs in the downstream mining and metals space.

Its goal is to secure a local supply of critical minerals.

Investment in companies like KNI is about protecting the downstream risk to their EV supply chains, MORE than a financial return for the investment. So it was interesting to understand the speed at which Stellantis is hoping for KNI to move through into production and the lengths that it may go to get there.

This is the same playbook that China runs with its EV supply chain management. In 2022 China was happy to pay US$80,000 per tonne of Lithium Carbonate, because it was seen as critical to the EV supply chain... despite the cost and economics.

This may become more apparent in the nickel market due to growing unrest in New Caledonia, where 10% of global nickel supply comes from.

( Source )

Security of supply is important for companies taking a long term outlook on EV demand, and we are hoping that KNI will be one of the main beneficiaries of this investment.

Another macro story could be brewing here, watch this space...

A big thank you to the team at 121 Group for another great event.

What we wrote about this week 🧬 🦉 🏹

TechGen Metals (ASX:TG1)

TechGen Metals (ASX:TG1) has acquired two copper exploration projects in Western Australia's Halls Creek region as copper prices surge nearly 30% in three months.

TG1 is also awaiting lithium assay results from its Ida Valley project, expected in four weeks.

The new copper projects show promising samples, with the Blue Devil project having up to 50.5% copper. TG1 plans geophysical surveys to identify drill targets.

Read more: ⛏️ Double Copper with Squeeze

Sun Silver (ASX:SS1)

Sun Silver (ASX:SS1) is our 2024 Small Cap Pick of the Year.

SS1 has a 292M ounce silver equivalent JORC resource in Nevada. With silver prices at an 11-year high, demand for silver in solar panels is strong.

The $25M capped SS1 plans to expand its resources and develop silver paste for solar panels. The US push for domestic solar manufacturing and new tariffs on Chinese products support SS1's prospects.

Read more: ⛏️ Our Next Investors 2024 Small Cap Pick of the Year: Sun Silver

Condor Energy (ASX:CND) - formerly known as GLV

Condor Energy (ASX:CND), formerly known as GLV, is exploring for oil and gas offshore Peru.

This week, French oil giant TotalEnergies signed agreements with the state owned PeruPetro to explore next door to CND.

Total’s entry into the region means CND is just one of three companies with TEAs on offshore blocks in Peru.

The move by TotalEnergies is a strong validation of the quality of CND’s exploration assets, and evidence they are hunting for a large oil discovery in the right place.

TotalEnergies has a vast balance sheet to spend on exploration, so we are hoping they see enough to drill test some targets as well - which would bring more interest into CND’s assets.

Read more: 🛢️ Oil & Gas Supermajor TotalEnergies picks up ground next to CND

Pantera Minerals (ASX:PFE)

Equinor has joined ExxonMobil and our investment Pantera Minerals (ASX:PFE) in the Smackover Basin to explore lithium, investing up to $160 million in two projects owned by Standard Lithium.

This follows a trend of oil majors entering the lithium market for clean energy. PFE secured land in the area before these giants, and stands to benefit from increased regional investment and rising lithium demand.

Read more: ⛏️ PFE: Another oil major enters US lithium in the Smackover - joins Exxon (...and PFE)

Quick Takes 🗣️

Norwegian energy giant now in PFE’s backyard

L1M hits anomalous lithium in WA

PFE to work with subsurface expert to find lithium

Bite sized summaries of the latest mainstream news in battery metals, biotechs, uranium etc: The Future Money: https://future-money.co/

Macro News - What we are reading 📰

Silver:

Biden’s Solar Factory Boom Slows as Cheap Imports Flood Market (Bloomberg)

- President Biden's climate law aimed to stimulate $16 billion in solar manufacturing investments across the US.

- However, due to high borrowing costs and low panel prices driven by cheap imports, at least four planned plants have been delayed or abandoned.

- The US government faces challenges in reshaping clean energy supply chains away from China, despite efforts to incentivize domestic manufacturing.

Miners appeal to Canada to declare silver a critical mineral (miningweekly.com)

- Silver mining executives call for government recognition of silver as a critical mineral, stressing its importance for Canada's economic security and clean energy transition.

- Silver's role in photovoltaics (PV) for solar power and its increasing demand are emphasised, highlighting supply limitations and disruptions.

- Despite past exclusions, the letter urges policy alignment with academic consensus on silver's critical mineral status.

Sprott Q3 Precious Metals Report: Central Banks Support Gold & Solar PV Demand Buoys Silver (Sprott)

- Gold experiences modest decline in Q3, while silver remains stable amid lacking catalysts in bullion markets.

- Investment demand for gold decreases, contrasting with solid demand from sovereigns and central banks.

- China leads global gold consumption, with Shanghai gold premium spikes indicating sustained demand; silver demand driven by green technologies, including solar panels and electric vehicles, contributing to expected market deficits.

New US Solar Tariffs Would Slow Clean Power Shift, Developer Warns (Bloomberg)

- Renewable developer criticises US solar manufacturers' push for tariffs on imported photovoltaic cells from Southeast Asia, alleging profit-driven motives.

- Dispute centres on crystalline silicon photovoltaic cells, with potential implications for the solar supply chain.

- Tariffs may impact US panel makers' competitiveness and introduce uncertainty in the industry.

Iron Ore:

Iron ore price: Citi calls time on iron ore rally (afr.com)

- Citi analysts lower iron ore price forecast from $US120 to $US105 per tonne due to weakening credit market in China.

- Treasury forecasts predict iron ore prices to fall to $US60 to $US70 per tonne by March next year, citing weak demand from China's property market.

- Despite bearish outlooks, some analysts believe prices will remain higher, with S&P Global and Commonwealth Bank offering more optimistic projections.

Hydrogen:

Budget 2024: ‘Back in the game’: Hydrogen sector celebrates from afar (afr.com)

- Australian CEOs celebrate clean-energy incentives in the federal budget, including subsidies for hydrogen projects.

- Positive reactions from industry leaders and executives anticipate project launches, especially in the SME space.

- Calls for streamlined implementation of hydrogen production tax credit for initiative's success.

Copper:

Copper Short Squeeze in NY Prompts Rush to Send Metal to US (Bloomberg)

- New York copper futures hit record highs amid a short squeeze, prompting metal diversion to US shores.

- July delivery copper on NY exchange traded at unprecedented premiums, spurring short position fulfilment.

- Comex saw its largest-ever backwardation as the July contract traded notably above September's.

Lithium:

2024 Could Be The Year For American Lithium (forbes.com)

- Silver Peak, Nevada, once rich in silver and gold, now hosts America's only lithium mine, supporting battery production.

- Despite its small scale, this mine highlights efforts to enhance US lithium supply chains for clean energy.

- With abundant lithium potential in the US, projects like the McDermitt Caldera and the Salton Sea, aided by federal investments, seek to transform the supply chain.

Have a great weekend,

Next Investors

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.