Is this the rate decision we had to have? Part 2: Stocks for all seasons

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

At a time when there is limited wage growth, consumer confidence is low and plenty of retailers are doing it tough, it is difficult to find stocks in the consumer discretionary sector that are likely to prosper.

In such an environment, investors tend to target non-discretionary spending areas such as health services, pharmaceuticals, food and liquor retailing.

Following on from yesterday's article, Is this the interest rate decision we had to have? Part 1, we now look at six stocks that could be worthy of your attention in this current economic climate.

Vonex

One stock worth considering that sits outside the square is telecommunications group Vonex Ltd (ASX:VN8), which also aligns with the essential services theme.

The company is a full service, award-winning telecommunications service provider selling mobile, internet, traditional fixed lines and hosted PBX and VoIP services.

Vonex primarily targets the small to medium enterprise (SME) sector under the Vonex brand.

The company provides wholesale customers, such as internet service providers, access to its core PBX and call termination services at wholesale rates via a white label model, whilst developing new technologies in the telecommunications industry, including a feature-rich cloud-hosted PBX system.

Vonex is also developing the Oper8tor App, a multi-platform real-time voice, messaging and social media app that allows users to connect with all social media friends, followers and contacts across different social media, all consolidated into one app.

Management provided a trading update last week which featured outstanding growth in retail clients, resulting in its shares hitting a high of 17 cents, representing an increase of nearly 40% compared with Monday’s closing price of 12.5 cents.

Vonex also benefits from its small to medium enterprise (SME) product offerings, and revenues from recent orders are expected to provide sustained growth throughout 2019.

With regard to this market segment,Vonex expects to continue to grow its PBX user base as the company accelerates its targeted marketing to SME customers.

From a broader perspective, management will target the NBN rollout in Australia’s capital cities as its campaign develops, delivering sustained website traffic growth, resulting in new customer leads online and through channel partners across the country.

One of the key factors that should enhance Vonex’s resilience at a time when spending is constrained at both consumer and business levels is its ability to offer competitively priced telecommunications solutions.

Simble Solutions

Another company that should benefit from a product offering that assists both small and large clients in saving on essential services is Simble Solutions (ASX:SIS),a software company focused on energy management and Internet of Things solutions.

The Simble Energy Platform or ‘SimbleSense’ is an integrated hardware and real-time software solution that enables businesses to visualise, control and monetise their energy systems.

The company’s Software as a Service (SaaS) platform has Internet of Things (IoT) capabilities and empowers enterprises and consumers to remotely automate energy savings opportunities to reduce their energy bill.

Simble operates in the SME and residential market and like Vonex targets the distribution of its platform through channel partners.

Management reported year-on-year sales growth of 67% last week, also noting significant cost improvements.

One of Simble’s key attractions is its increasing level of recurring income which provides revenue predictability.

Alcidion Group

The healthcare sector is often viewed as a safe haven during challenging economic times which brings Alcidion Group Ltd (ASX:ALC) under the spotlight.

The company’s strategy is to deliver healthcare products which feature smart, intuitive solutions that meet the needs of hospitals and allied healthcare service providers on a worldwide scale.

Alcidion’s combined 25 years of experience in the healthcare industry has assisted it in developing unique products and expanding into complementary markets.

The company consists of three healthcare software companies in Alcidion Corporation, Patientrack and Smartpage, as well as MKM Health, a tech solutions and services provider.

Each company brings a complementary set of products and skills that create a unique offering in the global healthcare market, including solutions that support interoperability, allow communication and task management, and deliver clinical decision support at the point of care to improve patient outcomes.

With over 25 years of combined healthcare experience, the Alcidion Group of companies brings together the very best in technology and market knowledge to deliver solutions that make healthcare better for everyone.

The company is positioned to deliver a strong result in fiscal 2019, having had success in the six months to 31 December, 2018 and backed that up with an impressive March quarter.

During the quarter, the group signed or renewed a total of 24 contracts for Alcidion’s products (Miya, Patientrack and Smartpage) and specialist IT services, with a Total Contract Value (TCV) of $5.3 million.

The Dartford and Gravesham NHS Trust (UK) contract in particular marked the achievement of a major strategic objective for fiscal 2019.

Winning this major procurement against established UK competitors provided a strong market endorsement of the value proposition of Alcidion’s combined product suite, as well as proof of its market potential in the UK.

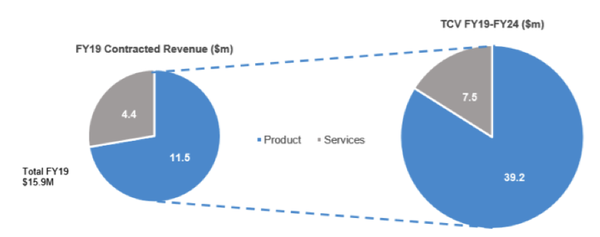

As at March 31, 2019, the contracted revenue to be recognised in fiscal 2019 had increased to $15.9 million, up from $14.8 million at the end of December quarter.

Importantly, this contracted revenue includes service and product related fees, with $7.3 million being recurring revenue and $8.6 million non-recurring revenue with the former providing income predictability in future years.

Recurring revenue includes income derived from Alcidion’s SaaS subscription revenue, annual product licence fees, product support and maintenance fees (payable annually) and recurring multi-year service contracts.

Non-recurring revenues include revenues from upfront product licence fees and non-recurring services such as product implementation and commissioning services, as well as fixed term professional services projects.

A further $30.8 million of contracted revenue will be recognised over the next five years from these contracts.

The graph below shows contracted revenue as at March 31, 2019 expected to be recognised in fiscal 2019, as well as the Total Contract Value (TCV) of customer contracts through to 2024, broken down by product revenue and service revenue.

Alexium International Group

Health and safety are closely intertwined, and on that note Alexium International Group Ltd (ASX:AJX, NASDAQ Designation: AXXIY) comes into the frame.

The company holds proprietary patent applications for novel technologies developed to provide flame retardancy for a wide range of materials.

These environmentally friendly flame retardants have applications for several industries and can be customised.

Further, Alexium develops proprietary products for advanced thermoregulation utilising phase change materials.

The company also holds patents for a process developed initially by the US Department of Defence, which allows for the surface modification and attachment of nanoparticles or multiple chemical functional groups to surfaces or substrates to provide fire retardancy and various additional functionalities.

Applications under development include, but are not limited to textiles, packaging, electronics, and building materials.

Alexium’s chemical treatments are currently marketed as Alexicool® and Alexiflam®.

The company had a major breakthrough in late April as it received approval from the US Environmental Protection Agency (EPA) for the manufacture and sale of Alexiflam® NF in the US.

Alexiflam® NF is a patent-pending flame retardant developed by Alexium for the treatment of cotton and cellulose-based textiles, possessing enhanced flame-retardant properties over incumbent products.

The EPA approval provides Alexium with access to the largest market region for flame retardant cotton and follows the recent announcement of the company’s Memorandum of Understanding with ICL (TASE/NYSE:ICL) for the future manufacture, marketing and sales of Alexiflam® NF.

Commenting on the commercial importance of the EPA approval of Alexiflam NF®, Alexium chief executive Bob Brookins said, “EPA approval of Alexiflam® NF marks a significant milestone for the company.

“This approval supports Alexium’s manufacture and sales into the US, which represents the largest global market for flame retardant cotton products.

“The EPA approval builds on our recent Memorandum of Understanding ( MoU) with ICL for them to act as the future manufacturer and distributor of Alexiflam® NF.

“Having delivered on these milestones, Alexium is well placed to drive the commercialisation of Alexiflam® NF and deliver on the global opportunities we see for our unique textile technology.”

CropLogic Limited

Another company that is benefiting from its proprietary technology is CropLogic Limited (ASX:CLI), an award-winning global agricultural technology company with operations in Australia and the US.

The other factor which should provide the group with a reasonable degree of resilience in difficult market conditions is its exposure to an essential service, being the growing of crops.

As we mentioned, food and grocery retailers generally handle difficult economic conditions well because of the significant degree of revenues generated from the sale of essential items.

Consequently, companies such as Woolworths Group (ASX:WOW) tend to come into favour, and not surprisingly in the last three months its share price has increased from about $28.00 to hit a four-year high of $32.89.

With regards to CropLogic, after launching its product into Washington State in 2017, the company is servicing a significant proportion of horticultural growers in that region, with a market share as high as 30% in some crops.

Following significant growth in 2017/2018 in Washington State and North Oregon, in 2018, CropLogic expanded into the Idaho market.

CropLogic offers growers of irrigated crops digital agricultural technology expertise based upon scientific research and delivered with cutting-edge technology – science, agronomy and technology interwoven into an expert system for decision support.

One of the company’s key technologies is CropLogic realTime which monitors and tracks key crop metrics, such as soil moisture and irrigation, and converts observations into data which is accessible at any time.

This information is then collated in a concise and accurate format, providing actionable insights for users to make cost-saving decisions.

Crop managers can view this data in a user-friendly application called CropLogic GrowerView, which can be accessed via desktop, as well as on both Android and Apple iOS devices.

However, there is more to the CropLogic story as it has recently received approval to establish a 500 acre trial hemp farm in Oregon.

Not only will this allow the company to generate potential near-term profits, but it will provide CropLogic with an opportunity to showcase the benefits of its technology as it manages the crop from planting in May/June through to harvest in September/October.

Secos Group

SECOS Group Ltd (ASX:SES) is worth watching for a number of reasons.

As a prominent developer and manufacturer of sustainable packaging materials the company is in a position to distribute products that can provide cost benefits to its clients.

The other factor working in the company’s favour is the increasing shift to sustainable packaging, which is receiving added momentum as a result of regulatory changes.

The company also has resilient end markets as packaging products are often used in relation to the distribution of food from the manufacturer to retail outlets.

Once again, it isn’t surprising to see a company such as Amcor, Australia’s largest packaging group with a market capitalisation of nearly $19 billion trading close to its all-time high.

Consequently, there are concrete reasons why the company’s products will enjoy strong demand.

SECOS supplies its proprietary biodegradable resins, packaging products and high-quality cast films to a blue-chip global customer base.

The company holds a strong patent portfolio and the global trend toward sustainable packaging is fueling its growth.

SECOS has a Product Development Centre and manufacturing plant for resins and finished products in Nanjing, China, with manufacturing plants for high quality cast films in Port Klang, Malaysia.

As a global player in a thriving industry, SECOS has sales offices in Australia, Malaysia, China and the US, with a network of leading distributors across the Americas, Europe, Asia, the Middle East, Africa and India.

Fiscal 2019 has been a year of transformation and consolidation with the company having closed its unprofitable Australian traditional polymer manufacturing operations.

Production of traditional polymer film continues at the company’s Malaysian facility and SECOS is working to develop new customers for its hygiene and medical films within the Australasian markets, leveraging its substantial experience in this area.

In the medium to longer term SECOS aims to convert its traditional plastic hygiene products to incorporate bioplastics and anticipates introducing breathable films using its unique and exclusive MiniFabTM licensed technology.

Closure of the Australian operations has helped reduce cash outflows, evidenced by a 16% decline in year on year expenses in the March quarter.

Furthermore, the company has targeted new applications within the Compostable and BioHybridTM product space which yield higher margins, and as a consequence operating cash outflows are trending to positive in line with forward planning.

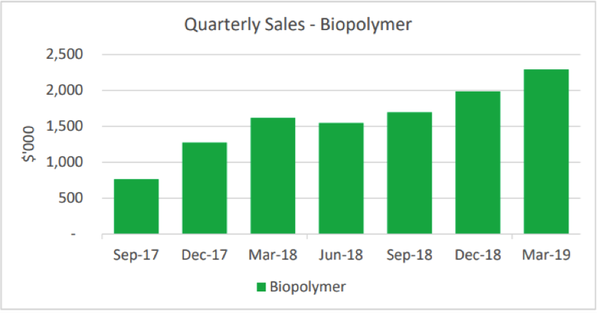

Management provided a positive outlook statement in late-April, saying that it expects further growth in biopolymer resin and film sales in view of significant opportunities and the company’s available manufacturing capacity.

SECOS also expects further margin improvement in its resin and film business as applications move to biopolymers.

The following quarterly sales figures underline the strong growth in its biopolymer operations.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.