Making Investments in the Bear Market

Published 03-JUN-2023 10:00 A.M.

|

15 minute read

We are announcing a new Portfolio addition this Monday 5th June at ~10AM AEST.

It’s in early stage battery metals.

Another one so soon?

Yes.

Here’s why:

As mentioned in our weekend edition last month, we are planning to add a few new Investments to our Portfolios during the May and June weakness we expect in the market, which we think could be the market low point.

Last week we added SLM to our Portfolio.

Our best performing Investments to date were made in the months after the COVID crash, when every small cap share price had been smashed by broader market sentiment.

In our opinion, there are some very high potential companies out there right now that are trading at very low valuations after a rough 12 to 18 months in the market.

We think the final low point could be this year's June tax loss selling season (just our opinion, we might be wrong).

Our view is that there are some attractive entry points for long term Investors like us who believe in a longer term battery metals and energy boom AND are patient enough to wait for a bull market to roll around again, which it eventually always does.

So we will aim to add a couple of new Investments during June - More on this later in today’s note.

(All the above is just our opinion and corresponding strategy, we might be wrong, the strategy may require lots of patience and may not be right for everyone’s situation.)

Our new Portfolio addition will be announced at around 10AM AEST on Monday 5th June.

Last week's Portfolio addition: SLM out of the blocks fast - up nearly 200% for the week.

On Wednesday we added Solis Minerals (ASX:SLM) to our portfolio - read our SLM Portfolio launch note here.

SLM is the first new addition to the Next Investors Portfolio in almost 12 months.

It’s also the first in our current cohort of what we think (...hope) will be ”bottom of the market” Investments that we are currently making... and plan to hold for a couple of years.

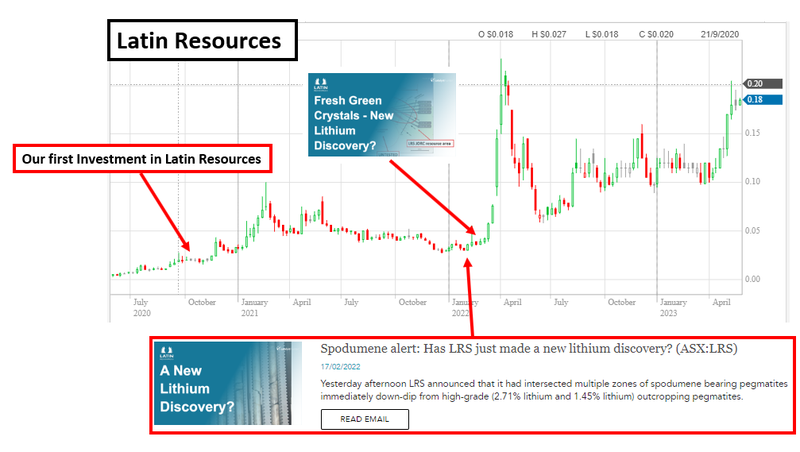

SLM is exploring for lithium in Brazil and has the same team behind it as Latin Resources (ASX:LRS), our Investment that delivered us a 10x over 2 years. Latin holds 14% of SLM.

By battery metal explorer standards, SLM started the week from a pretty low base with a sub $10M market cap at 14c - SLM finished the week at 42.5c on big volumes traded.

SLM is now sitting at around a $25M market cap.

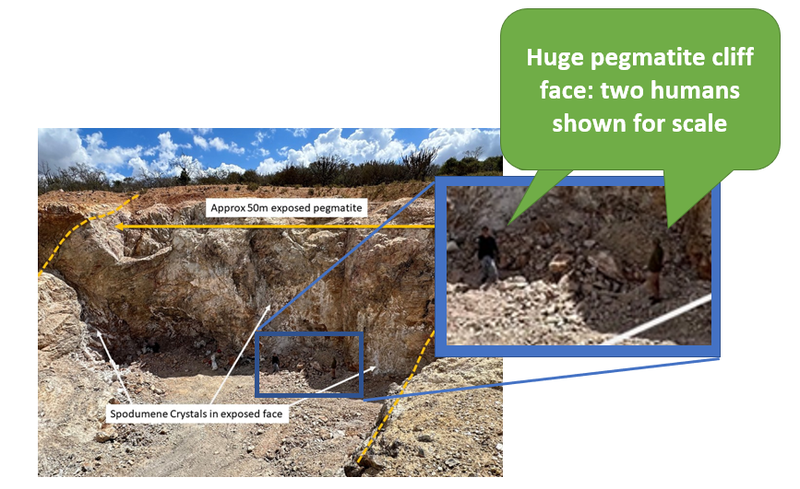

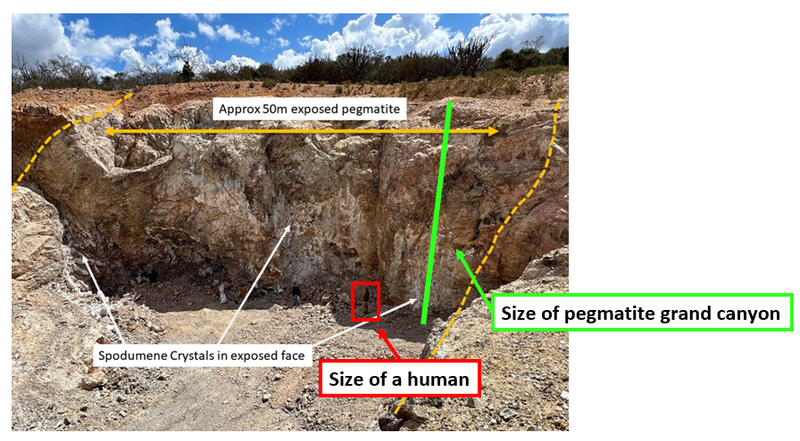

The market seemed to like SLM’s newly acquired option on the “Jaguar” lithium exploration project in Brazil - given the 4.95% lithium rock chips and the 50m exposed pegmatite outcrop you can see in the photo below:

Later in the week, SLM Managing Director Matt Boyes was featured in what we think is one of the strongest video interviews from a micro cap explorer we have seen in a while.

Check out the video here:

Matt gave details on what to expect from SLM in the coming weeks including

- SLM will be drilling within 14 days.

- SLM is planning ~2,500m of diamond drilling across 4-5 holes.

- The project sits on a granted Mining Lease.

- By the end of the 90 day due diligence period, SLM will know just how big the potential of its project will be.

Like Matt in the video, and apparently the rest of the market, we are also excited to see what SLM can deliver when it puts the first drill into the exposed spodumene crystals in less than two weeks time.

The market loves a nice photo of a long, glistening spodumene drill core - hopefully we see one from SLM later this month.

More about adding new Investments in what we think could be the low point of small cap markets.

The small cap market has been terrible for what seems like forever (it’s only actually been about 18 months).

Why on earth would we want to Invest now when small cap stocks are mostly going down?

Well, many small cap stocks are trading at all time lows.

Not because anything is wrong with the actual companies, simply because there have been more sellers than buyers during the last 12 months.

Sometimes investors who entered a small cap stock in the bull market and are sitting on a paper loss get impatient, bored, or simply have life expenses they need to pay for - and they sell their position regardless of the company’s progress.

In a bad market like we have been in for 12-18 months, there are simply not enough new buyers to absorb all the sellers and share prices go down, and down, and down some more - even if the company is delivering good progress.

For example, battery metals explorers that may have been trading at a $30M to $40M valuation in the bull market, might currently be trading for less than $10M. Some even under $5M.

Ours is a pretty simple strategy - find companies we really like, Invest during the current market weakness (which we think will be the rest of June), and then patiently wait for the bull market to return (it eventually always does).

Maybe in a few months... or maybe over a year, no one knows.

A few weeks ago we explained why we think the markets may start to look rough in May and June and

In this note we also said that we would use this period to make NEW Investments and ADD to our existing holdings.

SLM was the first of these new Portfolio additions.

The last time we were in the depths of a really bad market was in early-mid 2020, after that horrifying COVID market crash in March.

Some of our best Investments were made during this period, like EMN, MNB, GAL and IVZ.

Right now we have entered the second June tax loss selling season after the end of the roaring post-COVID crash bull market, and we think the market might be in for one final vomit in this year's “tax loss selling June” before things get better again.

Or has it already happened and been priced in? We just don’t know.

So what do we do when we think the market is at its worst?

Add beaten down companies we really like to our Portfolio... and wait.

Like we did after the COVID crash.

There are a lot of different macro forces at play here, many of which are very familiar to regular readers.

We won’t rehash those here.

(You can read our in depth June Tax loss selling explanation for 2023)

Point is, the market has been rough for a long, long time.

Over a year now.

And as as we suggested before, at some stage, it’s possible there just won’t be any sellers left in the market.

We’ve also noticed persistent low volumes - and small volumes mean sharper moves both ways. The question is - will the small cap market rip again like it did in the middle of 2020?

If it does, it may be tentative at first - but from experience when it changes it changes quickly.

This is the ASX Emerging Companies Index (XEC) which is often used as a proxy for small cap sentiment:

The chart doesn’t make for pretty reading for small cap investors.

But while the share prices of small caps flounder - we’ve seen a boom in M&A activity with major mining companies swooping on smaller companies.

We see this as indicative of our thesis that we are still in the middle of a commodities supercycle.

We believe that this, combined with the effects of the previously outlined tax loss selling, makes for a fertile environment to make (and hold) new Investments.

And so with SLM now added to our Portfolio, we’ve got another new Portfolio addition we will be announcing this Monday at around 10AM AEST.

SLM is hoping to follow in the footsteps of one of best Investments in Latin Resources - here’s how SLM got to where it is today.

How Solis Minerals (ASX:SLM) came about:

We are hoping SLM and its Brazil lithium project can become “Latin Resources 2.0”

Latin Resources delivered us a 10x over two years from its own lithium project in Brazil.

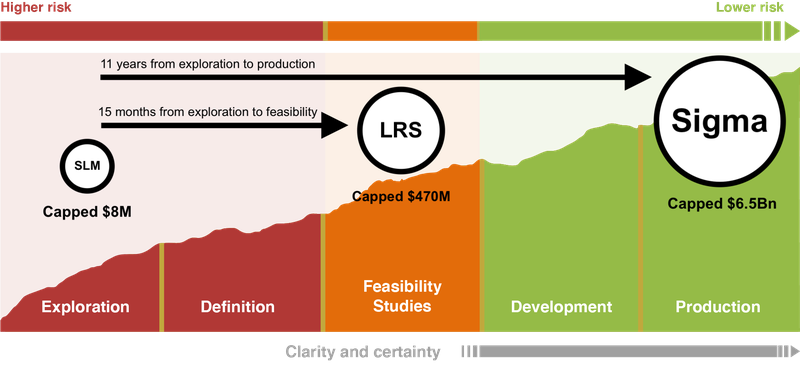

$470M capped Latin Resources is trying to become “Sigma 2.0” - Sigma is capped at an $8BN and is Brazil's first lithium producer as of a few weeks ago.

But let’s go back to the beginning and how this trio of companies all came about.

In December 2017 TSX listed company Margaux Red Capital acquired Sigma.

The deal was similar to the Reverse Takeover Offers (RTOs) we are used to seeing on the ASX - where companies with no direction bring in new projects and go again.

Sigma, at the time, was focused on developing its “Sigma Lithium Project”.

The project sat on ~15,000 hectares of ground in the State of Minas of Gerais.

Between August and December 2017, Sigma had done ~9,000m of drilling, which would be the basis for the company’s initial foreign 43-101 resource estimate.

In 2018 Sigma put out its initial resource estimate of 13Mt with a lithium oxide grade of 1.56% and the company was capped at under $200M.

At the time our Catalyst Hunter Investment Latin Resources (ASX:LRS) was looking to build a portfolio of lithium projects in Argentina.

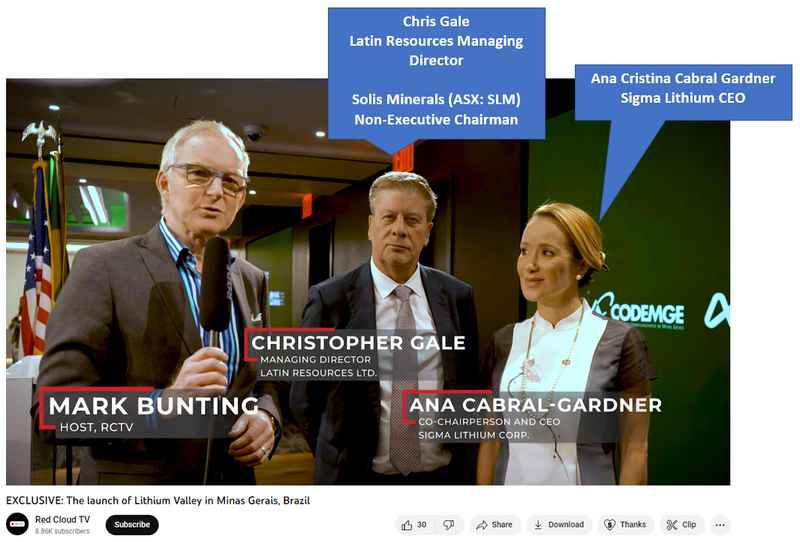

In 2017-18, Chris Gale, LRS’s Managing Director (and SLM’s Chairman) picked up the Sigma investor deck and decided to send his team of geologists out into Brazil to see what all the fuss was about.

Over the next 4 years, through the entire lithium bear market of 2018-2020, Sigma kept drilling its project, and Latin Resources kept looking for the ground which could make it “Sigma 2.0”.

Most had moved on from the lithium space during those years but LRS kept its geologists in Brazil, scouring for ground to acquire/peg.

In 2019 LRS started picking up ground to the north of Sigma in the State of Minas Gerais.

In 2021 LRS started desktop work on the projects it managed to pick up.

Then in early 2022 after multiple years in Brazil, LRS finally drilled its project and made its hard rock lithium discovery.

Less than 18 months later, LRS put out its initial resource estimate, started a 65,000m drill program to expand the resource and has raised ~$72.1M in capital to develop the project.

Interestingly, LRS’s initial resource estimate came in at almost exactly the same size as Sigma’s - 13.3Mt grading 1.2% lithium oxide...

From discovery through to now, LRS’s share price is up from 3.5c per share to now trade at ~17c per share.

Now LRS is being touted as “Sigma 2.0”.

For more on Latin, you can watch MD (and SLM Chairman) Chris Gale run through a Latin Resource investor presentation yesterday here.

The Solis Minerals (ASX:SLM) story begins in late 2021...

Solis listed via an IPO in December 2021, backed by Latin Resources.

Latin Resources shareholders got priority access to the IPO, and LRS itself had a cornerstone shareholding from the Peruvian assets divested to SLM.

While LRS was preparing to shift all of its focus on its Brazilian lithium project in the State of Minas Gerais, SLM was a new, much earlier stage vehicle that could focus on earlier stage projects.

Latin Resources holds a 14% shareholding in SLM, and Managing Director Chris Gale is SLM’s Chairman.

Now, backed by LRS, and with a new asset its about to drill, SLM is looking to emulate some of what Sigma achieved back in 2017 and LRS in 2022.

NOTE: Image taken from our SLM initiation note, the SLM market cap was correct at time of publishing. The SLM market cap was around $25M at Friday’s close.

This time the focus is on North Eastern Brazil, an area hardly explored for lithium.

Just like Sigma and Latin Resources did in the State of Minas Gerais, SLM is moving into previously untouched ground looking to make its own hard rock lithium discovery.

The hard work has already been done on SLM’s ground.

The project has mapped outcropping pegmatites over strike lengths >1km, 50m of width and spodumene crystals the size of humans (up to 2m).

Spodumene crystals that size are rare... in the same interview we mentioned above, SLM’s Managing Director Matthew Boyes says he has never seen anything like that, not in WA or anywhere else in the world.

Matt knows his lithium too... he was the Managing Director for Red Dirt Metals, where he oversaw the early development of the Mt Ida lithium project - which took Red Dirt’s market cap from ~$15M to in excess of $200M.

For context, the image below shows just how big those crystals are... the prospecting hammer looks tiny in comparison...

For context on the size of the pegmatite, here is another image that is at the bottom of what we have named “Pegmatite Grand Canyon”:

We are long term Investors in SLM - we will be holding 100% of our Initial Investment for at least the next two years.

BUT we should get an idea of just how big SLM’s project is within the next month or so.

Once the drill plan is put out to the market we will be putting out our SLM Investment Memo so be on the lookout for this.

What we wrote about this week 🧬 🦉 🏹

Minbos Resources (ASX: MNB)

MNB expects to have its phosphate fertiliser project constructed and in production before the end of the year.

This week the company put out an announcement saying that an offtake partner to take up “most of” the entire Stage 1 phosphate production volume could be “a few weeks” away AND a funding agreement for the remaining project CAPEX was expected to come in August/September.

📰 See our full Note: Friday Stock: Production in sight for MNB, offtake "shortly"?

TechGen Metals (ASX: TG1)

TG1 is currently drilling its NSW gold project, following up on its discovery made last year. This time around, the company is drilling to see if the gold found last year is an extension of a larger Intrusion Related Gold System (IRGS).

We were on site last week and put out a site visit note on Monday.

📰 See our full Note: Last weeks site visit - drill results expected in weeks...

🟢 NEW INVESTMENT 🟢 Solis Minerals (ASX:SLM)

As we covered extensively above, this week we added the first company in over 12 months to the Next Investors portfolio - Solis Minerals (ASX:SLM).

SLM is following in the footsteps of its biggest shareholder Latin Resources (which owns 14% of SLM), looking to make a hard rock lithium discovery in Brazil.

Latin Resources went from a share price of ~3.5c per share to now trade at 18.5c per share off the back of its discovery and is now being labelled “Sigma 2.0”.

Could SLM be Latin Resources 2.0?

To see the 11 reasons why we Invested in SLM check out our launch note:

📰 See our full Note: Introducing our new Investment: Solis Minerals (ASX: SLM)

Quick Takes 🗣️

GAL: Resource modelling underway while drilling continues

GTR: GTR’s second US uranium JORC resource on track for end of Q2

RAS:Maiden Rare earths & kaolin/halloysite resource estimate

IVZ: IVZ raises $12.7M in an oversubscribed Share Purchase Plan.

KNI: Kuniko’s cobalt assays are in, more to come

TEE: TEE to kick off 2D seismic program in QLD this month.

MAN: Washington based advisor appointed to chase commercial opportunity

MEG: MEG in the field in James Bay, Canada in mid-June

TYX: TYX finds more lithium to its east - drilling later this year

Educational 🎓

This week we published a new biotech-focused educational piece: Orphan Drugs Explained.

Orphan drugs are rare diseases, but have certain advantages like orphan drug pricing and periods of marketing exclusivity that make them lucrative opportunities for early stage biotechs.

Macro News - What we are reading 📰

Commodities

Mine prospecting boom ends amid economic gloom (AFR)

Lithium

Leo Lithium bags $106m investment from China’s Ganfeng (AFR)

Biotech

Elon Musk’s Neuralink wins approval for human study of brain implants (AFR)

Cannabis

Zelira shares nearly triple after study pits its CBD pain drug against Pfizer’s $7.7b Lyrica (Business News Australia)

Oil & Gas

The world’s oil-price benchmark is being radically reformed (Economist)

Uranium

Uranium stocks melt down on new ‘resources nationalism’ push (AFR)

Namibia Considers Taking Stakes in Mining and Petroleum Companies (Bloomberg)

US-Based Minerals

Hyundai and LG will build a new $4.3 billion EV battery plant in Georgia (Fortune)

⏲️ Upcoming potential share price catalysts

Updates this week:

- IVZ: Drilling oil & gas target in Zimbabwe, Myuku-2 (Q3, 2023).

- IVZ raised another $12.7M at 12c per share through its Share Purchase Plan. See our Quick Take on the news here. It’s since gone into another trading halt as of Friday for another capital raise.

- GAL: Drilling at its Callisto PGE discovery in WA.

- GAL put out another batch of assay results this week. The company also confirmed it would be drilling its Jimberlana & Mission Sill prospects in the coming months. See our Quick Take on the news here.

- GTR: Maiden resource estimates across two of its uranium projects in Wyoming, USA.

- GTR confirmed that its second JORC resource would be ready before the end of Q2. See our Quick Take on the news here.

- KNI: Drilling 3/3 of its Norwegian battery metals projects in Europe.

- KNI put out some more high grade cobalt hits from its project in Norway. See our Quick Take on the news here.

- NHE: Scheduled to drill two targets at its helium project in Tanzania (Q3 2023).

- NHE went into a trading halt on Thursday for a capital raise. In the AFR’s coverage of the capital raise, it said that the company was raising funds to finance the drilling of its two wells next quarter. Click here to see the AFR article.

- TG1: Drilling at its NSW gold project in May.

- We had an analyst on-site at TG1’s NSW gold project last week. See our site visit note from the trip here.

- MNB: Offtake agreement for its phosphate fertiliser project.

- MNB put out an update saying that its offtake agreement was imminent. See our note on the news here.

No material news this week:

- DXB: Interim Analysis of Phase III Clinical Trial on FSGS (Q4 2023).

- LCL: Maiden drilling underway at primary PNG copper-gold target.

- TMR: Maiden JORC resource estimate for its Canadian gold project.

- LNR: >10,000m drill program at rare earth’s project in WA.

- BOD: Phase III clinical trial for CBD insomnia treatment.

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.