Data shows EMD’s PTSD program is working, Australia leading the US

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 5,866,667 EMD Shares and 2,500,000 EMD Options at the time of publishing this article. The Company has been engaged by EMD to share our commentary on the progress of our Investment in EMD over time.

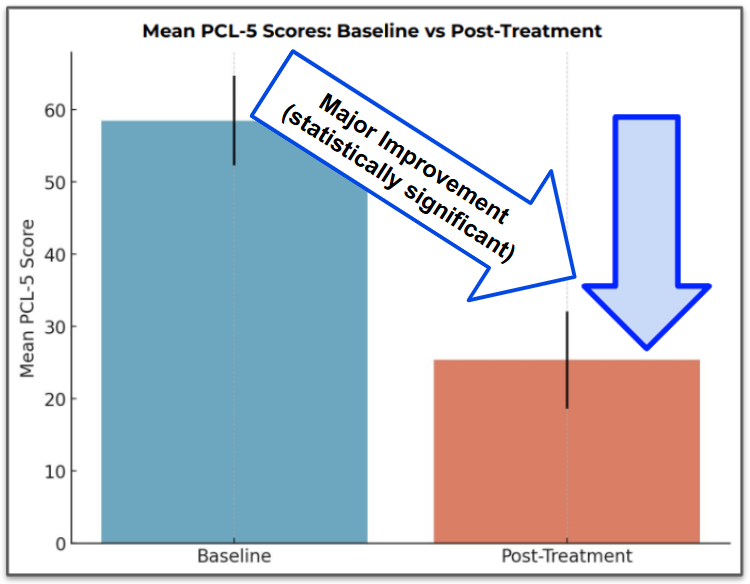

A dramatic reduction in PTSD symptoms.

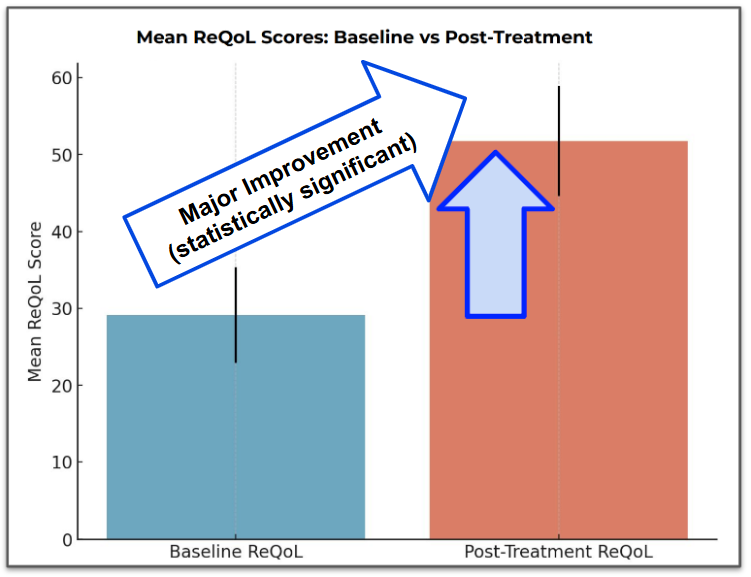

Big quality of life improvements.

Emyria (ASX:EMD) delivers and develops new treatments to improve mental health.

EMD is currently delivering psychedelic assisted therapies, in particular MDMA-assisted therapy for Post Traumatic Stress Disorder (PTSD).

Yesterday, the company gave investors a look at interim results for its first 8 patients.

EMD has its own clinics where it is administering these therapies, and is generating revenue from these patients at the same time.

EMD has developed into one of the only services globally with the legal approvals, skilled clinical team and critical infrastructure in place to provide and evaluate medication-assisted therapies for PTSD and other major unmet mental health challenges.

We like the EMD business model of being able to generate revenue from patients while collecting valuable clinical trial data in parallel.

So far the interim results for EMD’s first 8 PTSD patients undergoing MDMA assisted therapy are looking very promising.

All patients improved by more than 12 points on the PCL-5 scale (the metric used to measure PTSD severity).

However, overall the improvement was by an average of 33 points, which is both clinically and statistically significant.

This meant an average 33% reduction in PTSD symptoms.

The big upshot here is that EMD is building powerful evidence that their treatments are highly effective.

This data can then be shown to “payers” which have the ability to cover the cost of treatment.

When we say “payers”, it means insurance companies or organisations like the Department of Veteran Affairs that may want to cover the costs of treatments like this.

If patients are able to access funded treatments, we expect demand for EMD’s services to materially increase.

We’re hoping this evidence also continues to solidify the value of EMD’s treatments in the eyes of the TGA (the Australian regulator) in this new frontier for mental health therapy.

Australia has proven a far better place for companies to pursue these novel therapies compared to the US.

Over there, a US company called Lykos Therapeutics was recently knocked back by the FDA on its Phase 3 clinical trials on MDMA-based psychedelic assisted therapies.

The FDA was clear in statements that it encourages continued research and development in the psychedelic space to address medical needs.

But ultimately, the FDA had too many questions about data, safety and efficacy of the trials that were run by Lykos.

While seemingly a setback for the sector, we think it actually leaves EMD in a much better spot as it rolls out its treatments here in Australia, in a much better regulatory environment than the USA.

But for now, here’s what we will cover in this note:

- EMD’s current position in the market

- This week’s EMD PTSD program results

- Regulators & the market: recent events in psychedelic assisted therapy

- What’s next for EMD

- How this week’s results impact our EMD Investment Memo

- Risks

- Our EMD Investment Memo

Before we dive back into this week’s interim trial results, first lets go over EMD’s current position in the market.

EMD is currently capped at ~$14M, and had $1.5M in the bank at June 30th. The company still has a further $300k to come in from EMD Chairman Greg Hutchinson’s participation in the most recent $2.3M placement, which was done at 5c in April.

After the quarter ended it also picked up ~ $500k with the University of WA from an innovation grant to advance its proprietary MDMA analogue program.

This funding will be used to advance a “world leading” Parkinson’s treatment program that we are very interested in seeing the results of.

But, EMD is not purely an R&D company - EMD is generating revenue from its clinics.

Last quarter, EMD collected clinical billings of over $1M, of which recognised revenues comprised $575k. This was a 36% growth compared to the corresponding quarter of the previous financial year.

However, like a lot of small cap early stage companies, it's not quite profitable yet.

We do note in the last quarterly report some streamlining of clinic services are happening this quarter and they are bringing on more practitioners (more practitioners = more revenue), so will be on the lookout for a reduction in net cash burn next quarter.

EMD Chairman Greg Hutchinson is also the CEO of Sonic Healthcare (ASX: SHL) - a $13.4BN capped clinic juggernaut.

So if anyone knows how to scale up a clinic business it's him.

As EMD Investors we are glad he is on the EMD team helping in its growth plans (and putting his own money into the company)...

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Back to this week’s interim PTSD program results

Although the results EMD published this week are only with the first 8 patients of a planned 70 in the study, it is a very promising result for EMD.

Below are the PCL-5 scores for this cohort of patients:

The second measurement that EMD was testing was quality of life (ReQOL).

Ultimately there was an improvement of 22 points on the quality of life score which again is a “clinically meaningful” amount.

In terms of safety, there were only mild side effects in two of the eight patients (which we think is a good result).

These results are a good start, but there is still much more to come with at least five more patients in the program, and EMD aims to get up to 70 patients.

The goal for the program is to provide enough data to show to “payers” which have the ability to cover the cost of treatment.

When we say “payers”, it means insurance companies or organisations like the Department of Veteran Affairs, that may want to cover the costs of treatments like this.

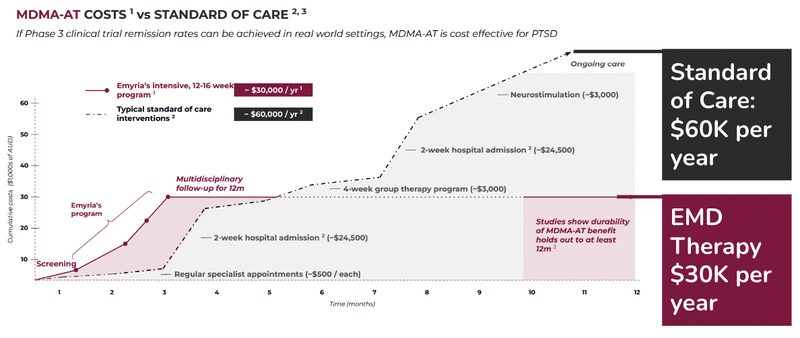

These companies and organisations are already funding the cost of treatment for PTSD - but MDMA-assisted therapy may lead to better outcomes and be more cost effective over time.

Here is some data that EMD have sourced in relation to financial costs of treating PTSD:

(Source)

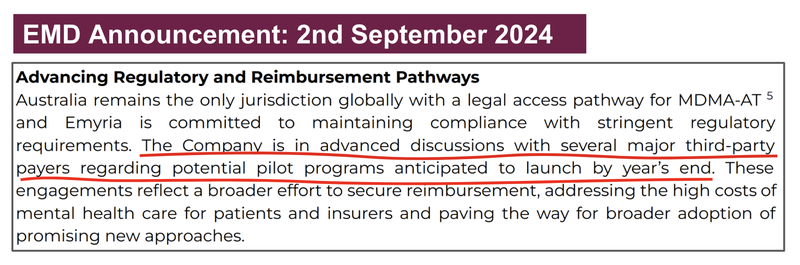

EMD have said that it is in “advanced discussions” with potential payers regarding a pilot program.

Anticipated launch... year’s end.

(Source)

If EMD is able to secure a payer deal it is effectively a commercialisation deal for the company and will allow it to scale up services of its MDMA-Assisted therapy.

The cost of therapy is generally prohibitive to the majority of people ($30k per year).

However, insurance companies or industry bodies can be the ones to foot the bill for most patients.

If EMD can prove that it is safer, more effective and cheaper to the current standard of care, then it will be able to secure a Payer Agreement and potentially more funding for its programs.

EMD already has a deal with Reach Wellness for first responders, which is a great start but we want to see more organisations partner with EMD and provide a pathway to commercialisation.

We covered that news here: EMD up 37% on no news yesterday... MDMA Therapy for First Responders.

Regulators & the market: recent events in psychedelic assisted therapy

It has been a tumultuous six weeks for the psychedelics assisted therapy industry.

Last month, US industry leader Lykos Therapeutics had its MDMA-Assisted Therapy program rejected by the FDA in the US.

(Source)

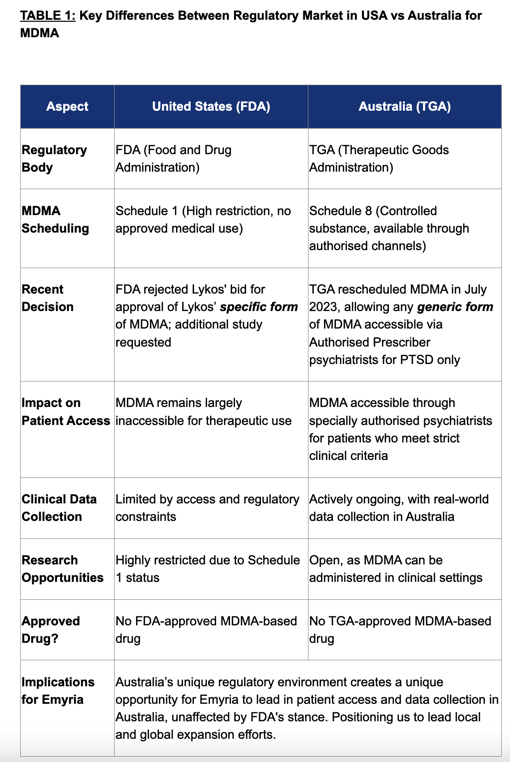

But we think the US is currently lagging behind Australia when it comes to psychedelic assisted therapy.

In the US MDMA is a Schedule 1 drug (high restriction, no approved medical use).

In Australia, the TGA re-scheduled MDMA last year to allow any generic form of MDMA to be accessible via Authorised Prescriber (AP) psychiatrists for PTSD only.

EMD has a unique status as one of the few organisations in Australia approved by the Therapeutic Goods Administration (TGA) to use MDMA for therapeutic purposes.

(yes, before we Invested in EMD, we couldn’t believe it too that Australia is actually leading the innovation in this space).

This FDA ruling on the Lykos trial was a big setback for the industry, but when one door closes, another one opens, and we think this could be an opportunity for EMD.

Here is our take...

The FDA ruling suggested that Lykos Therapeutics needed another clinical trial to get more data on safety and efficacy of MDMA-Assisted therapy.

We think a lot of the FDA rejection of the Lykos trial data comes down to data validity - it's hard to do a double blind trial with placebo when anyone will immediately know that they are having a powerful psychological experience.

In fact, major podcaster Joe Rogan and PayPal/Palantir billionaire Peter Thiel discuss this drawback or limitation with double blind trials as it relates to Lykos’ FDA knockback below:

It’s an interesting little snippet that explains the difficulties Lykos faced, check it out:

There’s a connection to EMD here too:

Michael Winlo, the CEO of EMD, previously worked at Peter Thiel’s Palantir's Health division.

Palantir is a ~$100BN capped software company founded by Thiel that provides data analytics platforms like Foundry... which EMD uses to derive insights from patient data collected through its clinics.

It’s a high tech approach to dealing with complex mental health problems - and we think EMD has a significant edge on other companies operating without this powerful tech stack.

Deeper dive: What actually happened to Lykos Therapeutics and what it means for EMD

Three weeks ago the US FDA knocked back approval for Lykos Therapeutics’ MDMA-assisted therapy to treat PTSD.

A successful application would have marked the first FDA approved therapy for MDMA - and its rejection is a setback for this emerging industry.

The FDA didn’t reject the trial, but instead requested the company undertake another, larger Phase 3 trial.

This will likely set Lykos Therapeutics back years too, Lykos needs to do additional work and data collection.

With the potential for funding drying up, in response it had to lay off 75% of its staff. (Source)

Meanwhile, other smaller players in the US will likely also be hurt by the decision as the regulatory risk may be seen as too high to continue to fund US-based startups treating patients in the US in the psychedelic therapy space.

Since the rejection, it has also come out the journal Psychopharmacology removed three articles that were published about Lykos’ midstage clinical trial data citing “unethical conduct”. (Source)

All of this bad news for Lykos opens up the door for another company to step in as the industry leader in the space...

Enter EMD.

Australia has a friendlier regulatory environment, so EMD can develop its treatment in Australia without much competition from the US.

Ultimately, we think this gives EMD a leg up on potential US startups in the industry hoping to use the Lykos decision to ride a macro wave up.

In an email to shareholders EMD addressed the FDA filings, here are our key takeaways:

- The FDA decision will inevitably delay MDMA-assisted therapy in the US.

- The US is not Australia, and Australia currently has a much friendlier regulatory environment for MDMA-assisted therapies (with stringent controls and regulations which EMD rigorously adheres to).

- This decision provides EMD will an opportunity to break ground and set a benchmark in the industry within a jurisdiction with an easier pathway towards commercialisation.

- The decision doesn’t affect any payer (commercialisation) discussions for EMD for use of its therapy within Australia.

- EMD has the chance to “set the benchmark” for this kind of therapy, positioning it as one of the most advanced opportunities for investors looking to be leveraged to the thematic.

We think that EMD can build up an advantage by being one of the only companies that can easily run trials on other psychedelic assisted therapy programs as well.

So, while Lykos goes back to the drawing board and the US revisits the decision later down the track, EMD is free to develop its treatment in Australia under a friendlier regulatory environment.

Below is a quick summary of the “Key Differences Between Regulatory Market in USA vs Australia”:

(Source: EMD Shareholder Email)

(Subscribe to EMD’s Investor Updates here)

For those new to EMD, this all might be a lot to take in, so lets give a quick recap on EMD...

Summary: What does EMD do?

EMD is an “integrated clinical drug development and care delivery” company in Australia.

EMD’s primary area of focus is on psychedelics such MDMA, psilocybin and ketamine.

The company is looking to use these drugs to support treatments for mental health problems - first targeting PTSD, and then expanding into other areas.

EMD has an integrated business strategy because it has:

- Treatment centres - places where treatments can be administered with wrap-around care, i.e. providing a full suite of practitioners such as psychiatrists, mental health nurses, psychologists, counsellors, OTs, social workers, physical therapists.

- Treatments - EMD can legally source the drugs, which include psilocybin, ketamine, MDMA and an ongoing drug development program into analogues, aiming to make the treatment work better for a range of conditions.

- Data - EMD collects and owns valuable patient data to help improve its drug treatments and therapy programs.

We’ve seen these aspects of EMD’s business in-person too...

Last month we made a trip to the Empax centre which is the clinic that EMD recently acquired.

It’s a state of the art facility and EMD CEO Michael Winlo was kind enough to give us a tour.

Of particular note to us, was the demonstration of EMD’s AI generated music which provides patients with the right music at the right time to elicit the right assisted therapy experience.

The data, the regulatory approvals, the physical presence and of course the treatment - we think EMD is doing important work in addressing major mental health problems.

There are over 1 million people with PTSD in Australia (Source) and we think that any product that makes people’s lives better is worth paying attention to.

This brings us to our Big Bet.

Our EMD Big Bet

“EMD re-rates to a +$300M market cap by making a breakthrough with one or more of its clinical trial programs (MDMA, psilocybin, ketamine, CBD) while rapidly growing the footprint of its mental health treatment clinics”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our EMD Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

What’s next for EMD?

Payer Agreement

EMD forecast that a “payer pilot program” could be started before the end of the year.

We are very interested to see what this program would look like and if it is with one of the big players (with a big balance sheet).

This could be a big catalyst for EMD if it can secure a favourable deal.

More patients, more results, more revenue

We also want to see EMD continue to recruit patients into its trial. The goal is to get 70 patients and we want to see if the promising results published from today continue in a larger sample size.

Along the way, EMD will be generating revenue as it conducts its trial.

How has our EMD Investment Memo been impacted?

PTSD program Interim Results

Yesterday EMD published interim results for its first 8 PTSD patients undergoing MDMA assisted therapy.

All patients improved by more than 12 points on the PCL-5 scale (the metric used to measure PTSD severity).

Overall the improvement was by an average of 33 points, which is both clinically and statistically significant.

5 more patients are currently undergoing therapy, and the goal is to get to 70 patients for this trial.

This news directly advances our Objective #1 for EMD.

Objective #1: Gather important data from MDMA mental health trial

We want to see EMD deliver its MDMA assisted therapy. EMD has already recruited its first patient and secured key approvals from the Office of Drug Control and Therapeutic Goods Administration.

Milestones

✅ First patient recruited

✅ First interim results published (🔲 ➡ ✅)

🔲 Second interim results published

🔲 Third interim results published

🔲 Complete patient recruitment

🔲 Publish final results

Source: Objectives, EMD Investment Memo 4th September 2023.

Lykos Therapeutics FDA rejection

The news about Lykos Therapeutic affects two key risks, US “regulatory risk” has increased while “competition risk” has decreased.

This decision by the FDA affects the regulatory environment in the US but not in Australia.

EMD does have plans to grow into the US at some point in the future, but this decision may put those on pause for now.

Regulatory risk [Increased]

The regulatory changes that allow EMD to operate in the field of psychedelic therapies are new and could be reversed. A regulator could step in and intervene either across the industry or specifically in relation to EMD. A change of government could also bring about a regulatory reversal.

Source: What could go wrong? EMD Investment Memo 4th September 2023.

On the other hand, this FDA decision opens up the opportunity for EMD to move into pole position as a global leader in the psychedelic therapy space.

Investors that are looking to advance MDMA and psychedelic assisted therapy products may turn to EMD as an alternative (or in addition to) Lykos Therapeutics, given that EMD is based in Australia which has a friendlier regulatory environment.

Competition Risk [Reduced]

EMD will need to move quickly to establish its presence in the market. If progress is slow, another care provider or alternative treatments could emerge hurting EMD’s prospects.

Source: What could go wrong? EMD Investment Memo 4th September 2023.

Balance sheet

Aside from regulatory risk, the other key risk hanging over EMD at the moment is related to its finances.

At the end of the last quarter EMD had $1.5M in the bank, and while it is generating revenue, it's still spending more than it makes.

Depending on how fast EMD wants to grow the company, it may need to raise additional capital at some point in the future. Any capital raising is dilutive to existing shareholders.

Funding Risk

Small caps often need to raise cash to fund their growth. Whilst EMD is generating revenue now, it is still making a loss - i.e. it spends more cash than it brings in. If EMD is unable to develop a self-sustaining business model with positive operating cash flow, this could force EMD to raise capital in the future, likely at a discount to market prices to secure funds.

Source: What could go wrong? EMD Investment Memo 4th September 2023.

Our EMD Investment Memo

In our EMD Investment Memo, you can find:

- EMD’s macro thematic

- Why we Invested in EMD

- Our EMD “Big Bet” - what we think the upside Investment case for EMD is

- The key objectives we want to see EMD achieve

- The key risks to our Investment thesis

- Our Investment Plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.