CONFIRMED: SGA has produced battery grade product.

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 4,354,500 SGA shares and 1,466,250 SGA options, the Company’s staff own 28,000 SGA shares and 7,500 options at the time of publishing this article. The Company has been engaged by SGA to share our commentary on the progress of our Investment in SGA over time.

Graphite is a key ingredient in electric vehicle battery anodes.

Sarytogan Graphite (ASX:SGA) has a giant graphite deposit

(it’s huge - we’ve seen it).

This is great, but can SGA’s graphite be used in electric vehicle batteries?

(one of the biggest new markets we have seen emerge in decades)

This is what the market has been waiting to find out since SGA’s IPO in 2022...

Today SGA has announced that tests have confirmed that YES its graphite can be used in electric vehicle batteries.

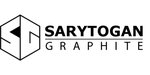

SGA just confirmed it has produced the first spheroidized graphite from its graphite deposit (the kind needed in battery anodes):

So YES this spherical graphite produced from SGA’s giant graphite deposit CAN be used in batteries.

The next step is to test the performance of batteries that are made using SGA’s graphite - to confirm that these batteries perform to a certain standard.

All very good timing for SGA with the graphite macro theme starting to come alive again after the Chinese government announced a graphite export ban.

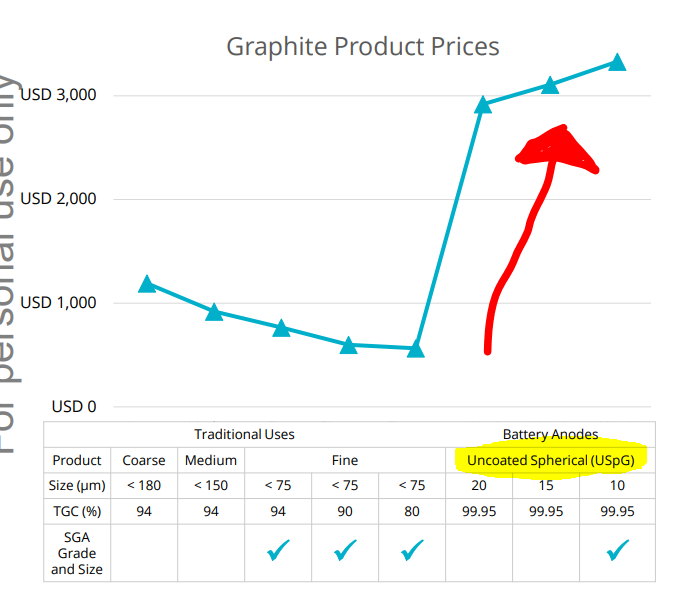

SGA’s uncoated spherical purified graphite could fetch US $3,000/t.

We expect the ultra high purity fines produced in the process to also command a higher price.

SGA can now plug these higher sale prices into their Pre-Feasibility Study (PFS) that is expected to be released in Q3 next year.

The PFS is where we find out what SGA’s project could be valued at if they build a mine, how much it will cost to build and operate, and how much profit it could make.

SGA can also start offtake discussions now that it has confirmed battery grade graphite CAN be produced from its giant deposit.

Before today’s announcement, SGA already had:

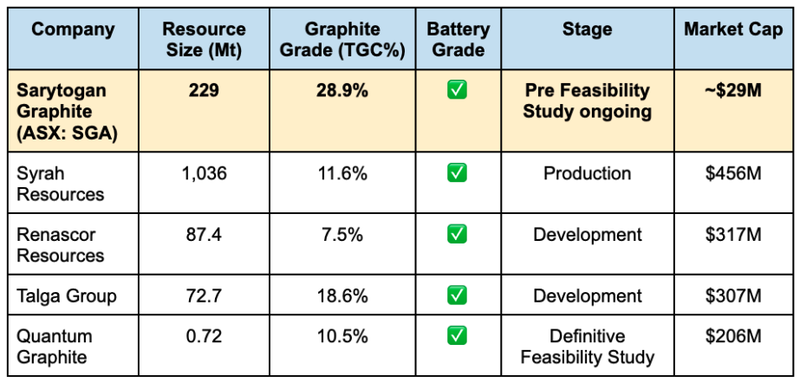

- The highest grade graphite resource on the ASX - Higher grades typically lead to lower costs of processing a resource into a final saleable product.

- The second largest graphite resource on the ASX in terms of contained graphite. Second only to Syrah Resources, which is capped at $456M.

This deposit is enormous, we have been to Kazakhstan and seen it with our own eyes...

We are very happy to see SGA confirm that its graphite can be processed to a level that can be sold into the giant battery market.

We believe the many potential investors in the market had been waiting for this confirmation too.

SGA Managing Director Sean Gregory certainly sounds excited by today’s new development:

And with this we hope $29M capped SGA can start to bridge the gap to its listed peers which are valued at between 200M and $400M.

Not all graphite is equal.

Some graphite is not able to be mined and processed into a product that eventually makes it into a battery.

No matter how big or small a project - when it comes to developing a graphite resource into a mine, a key aspect is demonstrating that the graphite can be mined, processed and refined into a battery suitable product.

Today, SGA did just that... and next year the company will be able to measure the battery performance of anodes containing SGA’s graphite.

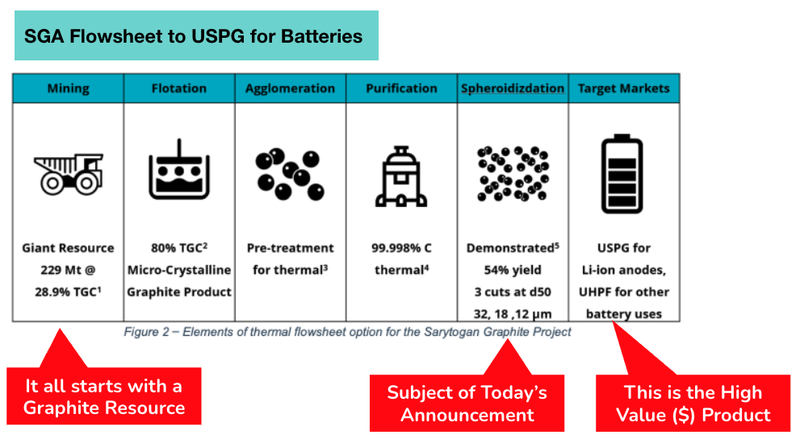

After today’s news, SGA has shown its graphite can produce two different products:

- 54% Uncoated Spherical Graphite - One of the most important components that make up a lithium-ion battery anode.

- 46% Ultra High Purity Fines - Another key value add material used in lithium-ion battery anodes.

The next step for SGA is to test its product in batteries to see how well they perform.

After that, SGA can wrap up all of that technical info and plug it into a Pre Feasibility Study (PFS) which is scheduled to be ready by Q3 2024.

Ultimately, the PFS is one of the key catalysts that we think will give the market a sense of the economics of the project.

🎓 To learn more about feasibility studies check out our educational article here: Feasibility Studies Explained: Evaluating Project Viability

What does today’s news mean for SGA’s PFS?

The significance of today’s news ultimately comes down to one key point.

The sale prices SGA can plug in for its graphite into its Pre-Feasibility Study (PFS).

When it comes to graphite, a lot of the value in the product is derived downstream, meaning a company’s product becomes more and more valuable as it gets processed.

It's a lot different to commodities like iron ore where companies mine, concentrate and then sell the product.

With graphite, it's a bit more of a process, but eventually, the company ends up selling a higher value-add product.

After today’s news, SGA has shown that its product can be processed down into two of those high value add products.

For context - graphite concentrates can sell for up to ~US$900 per tonne.

Whereas USPG which sells for ~US$3,000 per tonne - SGA just produced that product today.

Obviously, getting the products to that step is more costly, but for the lucky few companies that can manage to get their graphite into that state, the financial returns are generally strong.

The significance of today’s news is that when it comes time to run the financial modelling for its project, SGA will be in a position where it is able to plug in the much higher sale prices that the two products are capable of getting.

(Source)

Catalysts we think can bridge SGA’s valuation gap with its peers

Ultimately, we are Invested in SGA to see its market cap get bigger as its project gets closer to being development ready.

We made SGA our 2022 Small Cap Pick Of The Year because its project had a size/scale comparable to the likes of Syrah Resources, which is capped at $456M.

AND because of the project's unique location nestled in between China and Europe.

Our Investment Thesis was that once the company de-risked its project and got it closer to production, the market would catch on to the potential of the project and re-rate the company’s market into a range that is in line with its peers.

Right now, SGA is capped at ~$29M, whereas most of its peers trade in the $200M to $456M range - many multiples higher than SGA.

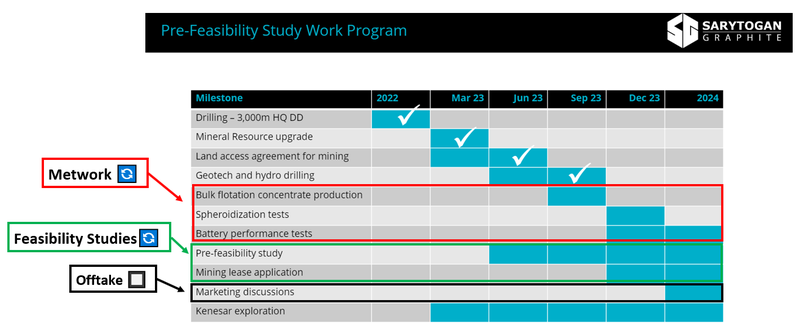

We think that in 2024, SGA can deliver on three major catalysts, which we hope would be the trigger for a re-rate in the company’s market cap in line with its peers:

- Battery performance testing results - SGA’s graphite could perform well above expectations here. In this case, its project could start to pop up on the radar of both European/Chinese battery manufacturers looking to source graphite.

- Feasibility studies (expected news BUT numbers unknown) - This is a catalyst expected in Q3 2024, but SGA could surprise the market by delivering it sooner. The numbers from this are largely unknown, too. If the Net Present Value (NPV) numbers are big, then the market could be wrong footed, depending on where SGA’s market cap is at the time.

- Offtake discussions (unexpected before the PFS) - SGA could deliver an offtake announcement at any point. Even though SGA has conveyed that it is working on this in presentations, depending on how good the deal is, the market may be caught off guard again.

In the short term, the focus will be on the battery performance testing results.

Our view is that as SGA delivers as many of these catalysts as possible, the more likely it is its market cap re-rates in line with its ASX peers.

Ultimately, we are long term SGA holders and want to see the company take its project through the feasibility study stage and into a position where the company achieves our “Big Bet”.

Our SGA “Big Bet”

“Given this graphite project’s strategic location in between China and Europe, we hope that if SGA proves out the size and economic extractability of the resource, it will generate interest from major mining companies, leading to a takeover of SGA for $1 billion+.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our SGA Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

The graphite macro thematic is starting to improve again... slowly

We touched on the graphite macro environment in detail in our last SGA note where we wrote about:

- China's dominance on the graphite supply chain - China is the world’s biggest graphite producer and processes ~90% of all the graphite that ends up in battery anodes.

- Graphite's importance for lithium-ion batteries - Graphite is the largest component of lithium-ion batteries, comprising over 50% of every lithium-ion battery and over 95% of a battery’s anode.

- Potential for bifurcated market pricing in battery materials - this is where graphite that is sourced from “friendly countries” to the EU/US sells for premiums in separate markets to graphite produced in other countries. Kazakhstan has previously signed an MOU with the EU to co-operate on battery materials supply chains, which could bode well for SGA.

AND - The export restrictions China announced on graphite - China recently announced a potential export ban on graphite products, putting ~90% of the market at risk. The announcement made ex-China supply instantly more valuable.

Check out our graphite macro deep dive here: Our take on the Graphite macro thematic.

What’s Next for SGA?

Battery performance testing & more metwork 🔄

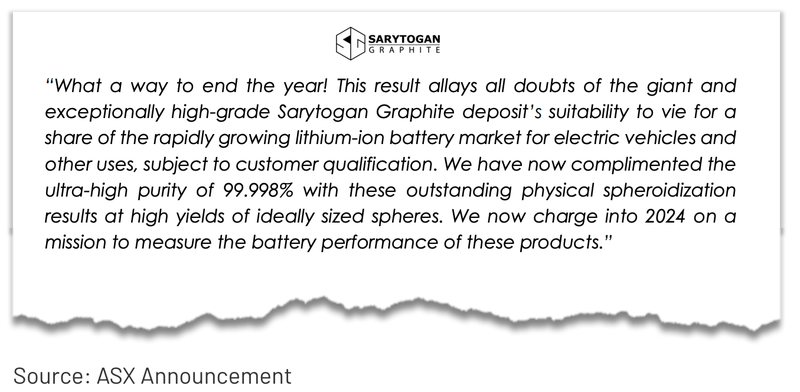

After today’s news, SGA has run through a full cycle of its processing flowsheet managing to:

- Produce graphite with purity levels up to 99.998% - well above the required battery grade of 99.95%.

- Scale up the process and produce bulk samples - producing bigger quantities to show its flowsheet works at scale.

- Spherodisation - to make precursor battery anode materials Uncoated Spherical Graphite and Ultra high purity fines.

The final step as part of SGA’s metwork testing will be to see how SGA’s graphite performs inside a battery.

Depending on the results, SGA could always go back and make adjustments to its flowsheet if it needs to find efficiency improvements.

The metwork refinement process never comes to an end for mining projects and is constantly tweaked to find small improvements in each processing step.

As a result, we could still see more news on this front in the future.

Feasibility Studies 🔄

SGA expects to deliver the Pre-Feasibility Study (PFS) in Q3 of 2024.

What are the risks?

Like all small cap stocks, an investment in SGA carries risk.

As a graphite developer, a key risk to SGA’s share price is the graphite price.

While sentiment has started changing after the China news about restricting exports, graphite prices are yet to rally hard off the back of the news.

There is always a risk that prices lag and that companies like SGA are impacted by not being able to raise f when they need it at a favourable price.

SGA had $6.5M cash in the bank at 30 September 2023, which is relatively strong considering SGA’s market cap at ~$29M.

However, SGA is still pre-revenue and, therefore, needs to tap capital markets or find offtake or JV partners to continue to fund the development of its project.

With the December quarterlies coming up in late January, its possible that SGA’s cash balance may start to get to a level where the company needs to consider doing a top-up raise at some stage in 2024.

We don't think funding should be a problem in the short term, though.

Another risk is the performance of SGA’s product in batteries - if the performance is not to the level battery manufacturers require, SGA may need to do more testing work.

To see more risks listed as part of our SGA Investment memo click here.

Our SGA Investment Memo

Below is our Investment Memo for SGA, where you can find a short, high level summary of our reasons for Investing.

In our SGA Investment Memo, you’ll find:

- Our SGA Big Bet

- Key objectives went want to see SGA achieve

- Why we are Invested in SGA

- What the key risks to our Investment Thesis are

- Our Investment plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.