88 Energy seals Alaskan farmout agreement with Premier Oil

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

88 Energy (ASX:88E, AIM: 88E) has secured a farmout for its conventional prospect portfolio at Project Icewine.

The company has negotiated an agreement which will provide financial backing, exploration funding and technical expertise, while allowing the company to maintain a material interest in the project.

The parties to the Sales and Purchase Agreement (SPA) are Premier Oil Plc (LON:PMO) — a £630 million (A$1B) capped mid cap oil company with 80,000 BOE per day in production — and 88 Energy and its Joint Venture partner, Burgundy Xploration LLC.

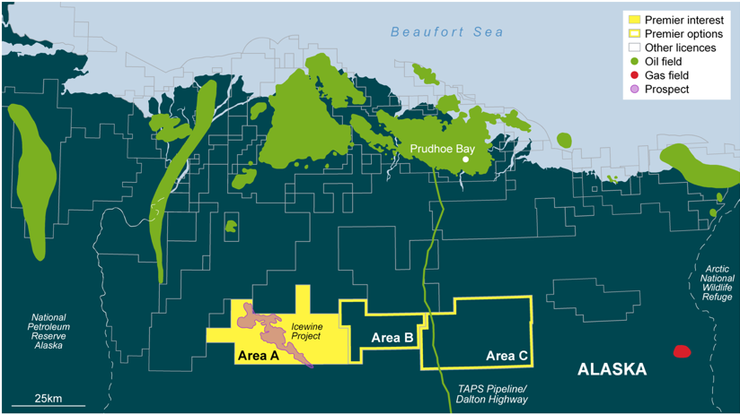

Under the terms of the SPA, Premier will farm-in for a 60% interest in Area A (also referred to as the Western Play Fairway) of the conventional Project Icewine acreage in the proven Alaska North Slope basin.

From 88 Energy’s perspective, it will retain a 30% working interest in Area A, with the remaining 10% working interest held by Burgundy. It also retains the HRZ unconventional play.

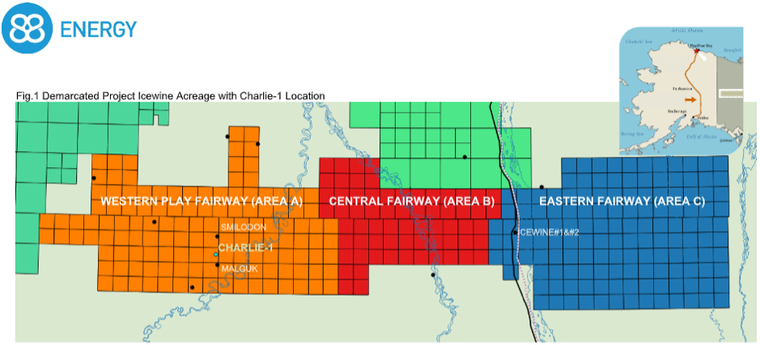

As you can see on the map below, Area A only makes up approximately 40% of Project Icewine.

Premier will pay the full costs of an appraisal well up to a total of $23 million to test the reservoir deliverability of the Malguk-1 discovery. So essentially, Premier is taking a 24% of the acreage (HRZ excluded) for a full carry on a US$23 million well.

Premier has an option to earn a 50% working interest in Area B or C (35% of the acreage) by spending US$15 million, if the Charlie-1 appraisal well in Area A is successful.

The Charlie-1 appraisal well — which will be operated by 88E — has been designed to test all of the prospective horizons identified in the Western Play Fairway, giving benefits usually only derived from an expensive multi-well program.

The Charlie-1 well location conveniently intersects seven stacked targets, including all the primary targets – 1.6bbl gross and ~500mmbbl net to 88E on the reduced Working Interest.

The well will be drilled and tested in the March quarter of 2020 with rig options having already been identified and contracting negotiations underway.

On successful completion of the work programme, Premier will earn a 60% paying interest and assume operatorship. In the meantime, 88E will retain operatorship so can keep a lid on costs and make sure the objectives are me.

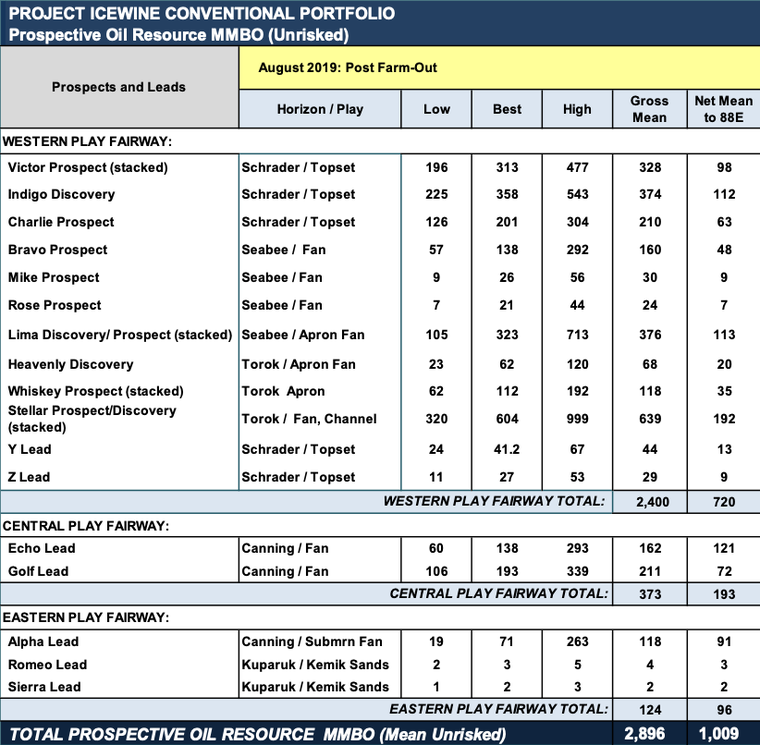

Prospective resource

88 Energy’s net Prospective Resource for Area A (the Western Play Fairway) has been adjusted in the table below for its post Farm-Out working interest.

Another Brookian play

The agreement will allow Premier Oil to farm into Area A of its Project Icewine acreage in the proven Alaska North Slope basin, close to the Trans-Alaska Pipeline and the Dalton Highway.

As highlighted below, Area A (in orange) is in the western section of Project Icewine, and it contains the Malguk-1 discovery, which was drilled by BP in 1991.

The discovery well encountered 251 feet of light oil pay in turbidite sands in the Torok formation, within the recently emerging Brookian play.

Premier estimates an accumulation of more than 1 billion barrels of oil in place, based on the original well data and its evaluation of the existing 3D dataset.

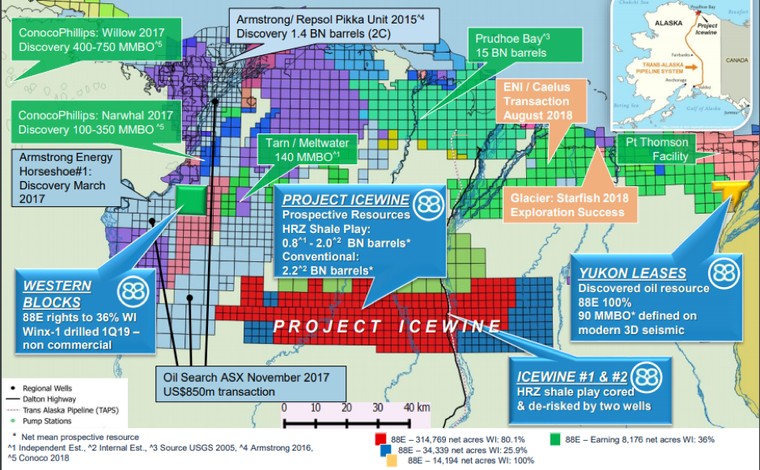

From a broader perspective there have been discoveries in excess of 4 billion barrels of oil in the Brookian play since 2013.

Consequently, the agreement provides Premier with a cost effective entry point into an emerging play following recent advances in drilling and completion techniques in a proven oil province.

Indeed, the broader area has been host to a number of large discoveries in recent years which have attracted some of the world’s largest energy companies to the region, resulting in sizeable acquisitions.

The following is a snapshot of the hive of activity that surrounds the Project Icewine territory, highlighting the presence of big players such as Conoco Phillips, Armstrong Energy and Australia’s Oil Search (ASX:OSH).

88 Energy maintained meaningful working interest

In discussing the strategic benefits of the agreement, 88 Energy managing director, Dave Wall, said, “We are delighted to be partnering with a company of the technical calibre of Premier. Premier has a strong track record of delivering projects through to production and is an excellent addition to the Joint Venture. The deal itself strikes a good balance between cultural fit, value and the meaningful working interest retained by 88E for its shareholders.

“The Charlie-1 well has been designed to test all of the prospective horizons identified in the Western Play Fairway, giving benefit usually only derived from a multi-well program.”

From Premier’s perspective, it also sees considerable upside in the shallower Schrader Bluff formation which has yet to be explored in a play similar to the Pikka/Horseshoe trend which lies to the north-east of Project Icewine.

88 Energy’s shareholders should benefit from accelerated newsflow given that Premier will be drilling its vertical appraisal well in the first quarter of 2020, and the group expects to be in a position to drill a lateral side track appraisal well towards the end of the year.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.