88 Energy banks on North Alaska

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Promising Australian oil and gas explorer, 88 Energy (ASX:88E), has banked $6.75 million from a successful capital raising.

Together with existing cash reserves, proceeds of the placement will fund the company’s ongoing evaluation of its extensive acreage in the resurgent North Slope region of Alaska, where it rubs shoulders with a number of energy giants, including ASX-listed Oil Search (ASX:OSH).

The company has also hinted at further resource acquisitions, saying the capital raising will provide the company with enough cash to fund ‘new venture opportunities’.

Managed by broker Hartleys, the capital raising was finalised through a placement priced at 1.25 cents per share (£0.007), an 11% discount to 88 Energy’s last closing price of 1.4 cents. A total of 540 million ordinary shares will be issued, bringing the number of ordinary shares in issue to 6,871,540,324.

At the end of the June quarter, the company’s cash reserves stood at $6.7 million.

Commenting on the Placement, Dave Wall, Managing Director of 88 Energy, stated: “Completion of this placement positions the Company strongly as preparations continue for the drilling of the Charlie-1 (Malguk-1 appraisal) well, which will test multiple stacked conventional targets, as well as the HRZ shale, in Q1 CY2020.

“Drilling the Charlie-1 well will be a pivotal moment for the Company as it seeks to unlock the large potential of the conventional plays on the acreage.”

88 Energy’s prospects in the region haven’t gone unnoticed by the bigger players, with London-based Premier Oil Plc (LON:PMO) recently agreeing to bankroll 88 Energy’s conventional Icewine Project.

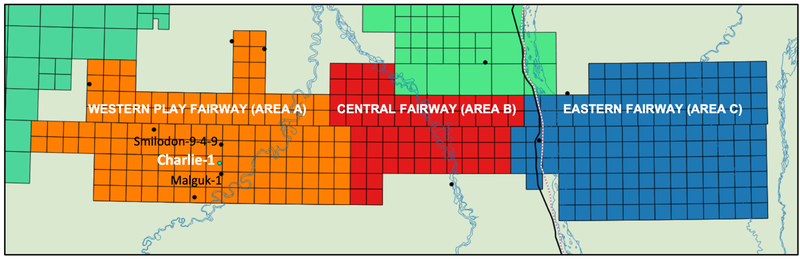

Terms of the farmout agreement were signed in late August, giving Premier a 60% interest in the precinct known as Area A, with 88 Energy retaining a 30% holding. The remaining 10% will be held by 88 Energy’s joint-venture partner, Houston-based Burgundy Xploration.

Drilling at the Charlie-1 well in Area A is on target to commence within 6 months, with Premier Oil contributing up to US$23 million. 88 Energy will retain operational rights to the project.

88 Energy has earmarked some of the funds raised as a contingency for the Charlie-1 well should costs exceed Premier Oil’s US$23 million commitment, in addition to chasing new exploration opportunities in the region.

Broker Hartleys says while drilling success at the Charlie-1 well would represent 88 Energy’s most likely catalyst for a rerating, the company has other irons in the fire.

Other conventional targets – including in the adjacent Area B and Area C – provide future exploration opportunities, with Premier Oil already lining up for a piece of the pie.

Should Charlie-1 be successful, Premier has the option to take a 50% interest in Area B or C by spending US$15 million.

And while not everything has gone to plan for the company – the Winx-1 well was abandoned earlier this year – Hartleys remains positive, saying there is significant value yet to be unlocked through the farmout of conventional acreage at 88 Energy’s recently acquired Yukon leases.

The Yukon leases, which were drilled by BP in the 1990s, could hold prospective resources of 90 million barrels of oil.

There’s further upside potential from HRZ shale resources at the 475,000 acre Project Icewine, with 88 Energy hoping to sign a deal with a farmout partner before the end of the year.

Unconventional resources such as HRZ shale are those requiring specialised extraction techniques, such as hydraulic fracturing.

Those HRZ shales resources could be as significant as 2,000 million barrels of oil – twice 88 Energy’s share of the likely conventional resources available from the Project Icewine acreage.

But there’s still work to be done, including horizontal appraisal drilling. 88 Energy hopes to collect more data when the Charlie-1 well is drilled early next year. For now, the focus remains on securing a farmout partner for the non-conventional resources.

And of course the introduction of a farmout partner inevitably reduces 88 Energy’s share of that 2 billion barrel potential resource.

Hartleys maintains a ‘speculative buy’ rating on 88 Energy, saying the most likely trigger to move the share price upwards will come from developments in the company’s conventional resources. The broker has recently lifted its valuation from 2.4 cents to 2.8 cents per share.

Given that potential upside, 88 Energy should be rated as one of the more interesting small energy plays listed on the ASX – but it’s a small company operating in a foreign jurisdiction, and investors need to understand (and be comfortable) with the risks of the junior oil and gas sector.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.