Wireline logging program unsuccessful at the Merlin-2 well

88E put out an update with respect to its wireline logging program which is now nearing completion.

The wireline program was designed to test reservoir quality and ultimately would be the final step of testing before a production test could be done over the Merlin-2 appraisal well.

Unfortunately this morning 88E confirmed that provisional analysis of the wireline logging program showed that the reservoir quality was insufficient and would not be enough to warrant a production testing program.

… so we don’t even reach the starting line where the company runs a production test to assess the oil flow rates.

88E has now confirmed that the Merlin-2 well would be plugged and abandoned before a detailed evaluation of all the drilling data can be obtained.

As further analysis is released by the company we will reset our investment plan for 88E for the next 12 months, also taking into account today’s news.

The announcement went live on the London exchange overnight (Aus time), with the share down ~65% from £0.02 (3.5c AUD) to now trade around the £0.007 (1.2c AUD) mark.

At the time of writing this, the ASX has reacted in a similar fashion with the share price touching 1.3c at the open before settling around ~1.6c where it is trading now.

After big binary drilling events which lead to a disappointing result, we often see a market sell off that assumes the company has no other projects or assets…

This is not the position 88E is in, as it also has the recently acquired portfolio of production assets in Texas, USA, multiple other projects in Alaska (Project Icewine and the Yukon assets), plus other drilling prospects over its Project Peregrine acreage.

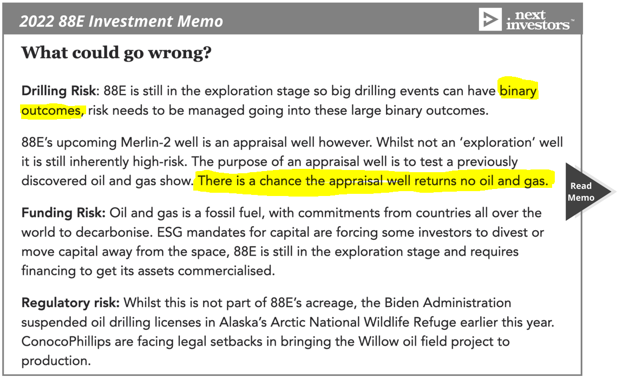

We have a well documented investment strategy when it comes to big binary drilling events with our oil & gas exploration investments. In our 2022 88E Investment Memo we set out and followed a clear investment strategy for 88E, like we do for all our investments.

We also recorded in the risks section of our 2022 Investment Memo that there was a scenario where the Merlin-2 well returned no commercial oil discovery.

We always like to record the risks to an investment so that announcements like today don’t come as a surprise. Of course we hope our portfolio companies are successful but with high risk investing it is important to cut out the emotion and focus on facts.

Below is a screenshot of the risks section from our 2022 Investment Memo for 88E, unfortunately in this drill campaign one of the key risks materialised:

Although 88E did in fact find oil and gas in the Merlin-2 appraisal well, it was not of high enough quality to warrant a production test which is still a failure in terms of the overall outcome.

As recorded in our investment plan for 88E (in our memo here) we held a de-risked position into the drill result (in case it WAS a success) and now expect the company to detail its forward plan for the rest of the year across its exploration assets in Alaska, as well as its newly acquired production assets in Texas, USA, at which point we will reassess our investment plan.