88E neighbour Pantheon's drilling exceeds expectations

Pantheon Resources (capped at $1.35BN), neighbour of our US based oil and gas exploration Investment 88 Energy (ASX: 88E), is weeks away from flow testing its project immediately to the north of 88E’s ground.

Pantheon drilled its Alkaid #2 well earlier this year, hitting oil across all three of the formations it was targeting.

The company then completed the horizontal section of the drilling, completed all of the necessary stimulation works, and is now preparing to conduct a long term production test.

The ultimate purpose of the long-term pilot production test would be to test the “potential commerciality of the project” and to “optimize design of production facilities for long-term production”. As at 26 September, Pantheon expected the production test to begin at the end of October.

What does this mean for 88E?

The reservoirs that Pantheon is about to flow test are interpreted to extend to the south into 88E’s ground.

If Pantheon puts out commercially viable flow rates we suspect the market will start to show an interest in 88E speculating on the probability of the reservoirs extending into 88E’s ground.

We will be watching Pantheon’s news carefully over the coming weeks/months.

We also note that 88E released an updated investor presentation which provides a lot of the context on what’s going on around 88E’s projects in Alaska.

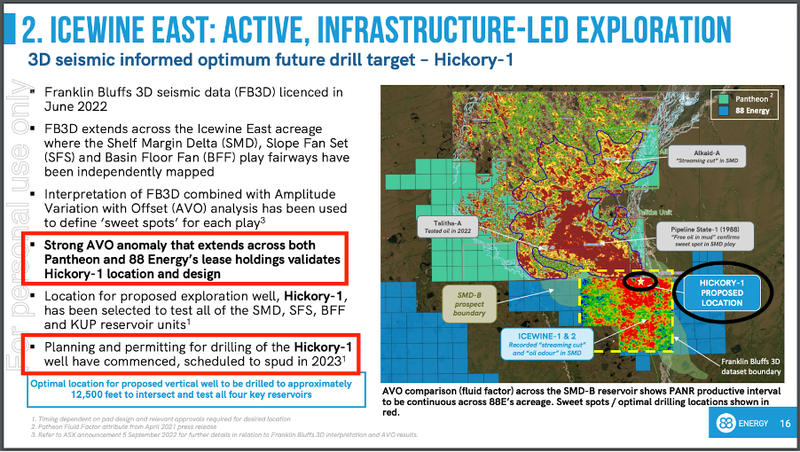

The following slide on Icewine East, next door to Pantheon, was particularly interesting to us. To view the full presentation click on the image below.