What happened to EXR's this week?

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 2,795,000 EXR shares at the time of publishing this article. The Company has been engaged by EXR to share our commentary on the progress of our Investment in EXR over time.

It’s been a wild week for Elixir Energy (ASX:EXR) so far... and it’s only Wednesday.

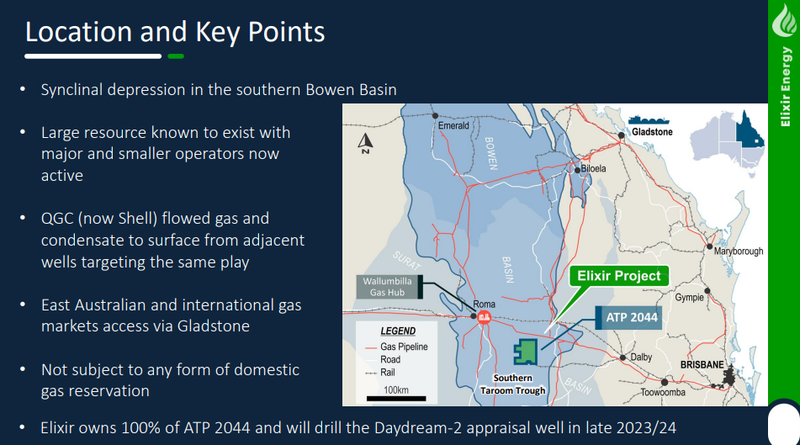

EXR is an early stage energy company with a coal bed methane gas project and a green hydrogen project in Mongolia, plus EXR is also planning to drill its Queensland gas project in the Taroom Trough later this year.

Here’s what’s happened this week (so far...):

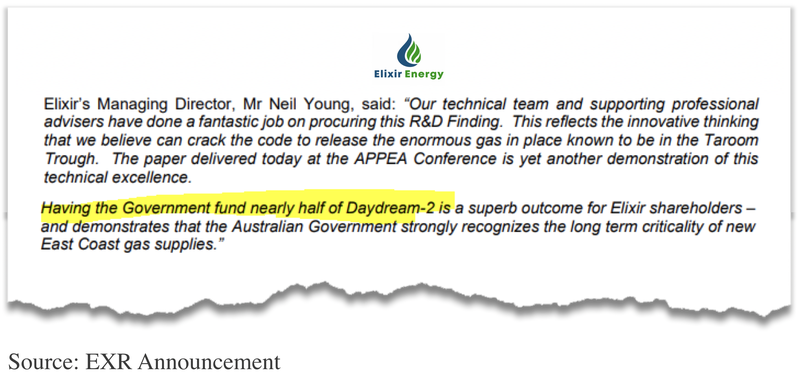

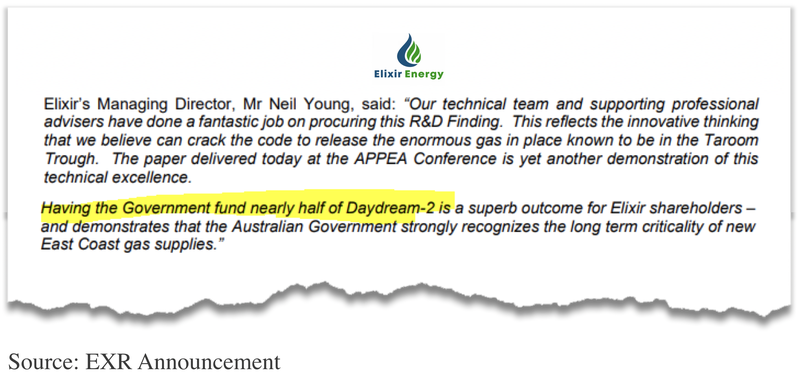

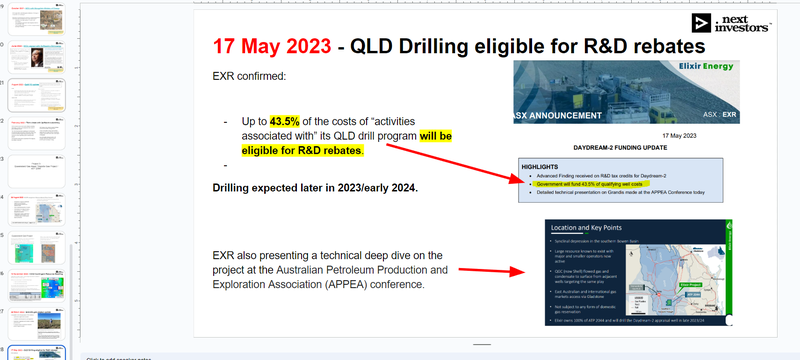

This morning EXR announced that it has a non-dilutive pathway to funding nearly half the well costs on its main drilling event for 2023, the Daydream-2 well in the Taroom Trough, QLD.

This will dramatically reduce the total costs of the appraisal well that EXR will need to pay, and it reduces the perceived funding risk that we think has been hanging over the EXR share price recently.

Two days ago on Monday, EXR released a fairly standard update on flow tests and a new drilling campaign on its CBM project in Mongolia.

For some reason the market didn’t like Monday’s announcement. EXR’s share price dropped from 13.5c to as low as 7.7c - before snapping back up to ~9c yesterday afternoon.

We speculate that a small drop on Monday's news may have been exacerbated to a big drop by some early tax loss selling from some of EXR’s large cohort of retail holders combined with perceived funding risk on the extra spend required in Mongolia.

Other than that, Monday’s actual announcement seemed pretty vanilla to us, certainly not worthy of such a reaction in our opinion.

Fast forward to today, and on a much brighter note, EXR just announced that funding has been secured for nearly half the well costs on its main event for 2023 - drilling in Taroom Trough QLD scheduled for later this year.

This removes some of the funding risk associated with a big looming drilling event that can weigh on a share price. It will be interesting to see how the EXR share price reacts today, especially coming off the beatdown it took on Monday and Tuesday.

EXR today confirmed that the Australian government would be funding “43.5% of qualifying well costs” under the government's R&D rebate programs.

EXR is planning to drill its unrisked 3.3 trillion cubic feet (TCF) prospect later this year.

For some context on the size... since 1965 the Bass Strait gas fields have produced <10 Tcf of gas and were a primary source of supply for the east coast of Australia.

Obviously, there is no guarantee that EXR is able to convert all of its 3.3 Tcf prospective resources into actual reserves, that is where drilling comes into play and drilling always carries with it risks.

EXR already has 395 billion cubic feet (BCF) contingent resources booked inside that 3.3 Tcf prospective resource.

Contingent resources are basically the last confidence level before reserves can be booked.

EXR is drilling an “appraisal” well - and will be less about making a new discovery and more about converting those contingent resources into the reserves category.

Also today, EXR put out a technical deep dive into the project that EXR’s Chief Geoscientist Greg Channon will present today at the ‘Australian Petroleum Production and Exploration Association’ (APPEA) Conference.

Check out the full presentation here.

So EXR has seen some wild share price fluctuation over the last two days on large volumes - and this morning has released an announcement about securing nearly half the funding for its main drilling event this year - so it will be interesting to see how the share price reacts today.

But why is today’s news material for EXR?

In short - because the news sees up to ~43.5% of the funding of drilling its Queensland gas asset derisked.

We have talked about it time and time again, the approach we take to Investing in large oil & gas drilling events is to Invest early, well before drilling starts and to wait for the share price to rise closer to the drilling program.

The biggest risk to our strategy is the timing of when a company completes its final capital raise and releases the standard “drilling is fully funded” announcement.

Experienced investors know that the company needs to raise capital to finance drilling, so the market waits for this - instead of buying on market to get exposure to the company and its drill result.

This inevitably weighs down on the company's share price and can even lead to selling on the market - the sellers are typically exiting with a view of re-entering at the capital raise.

We think that with only 6 months left in the year and EXR planning to drill later this year, the markets are doing what they do and this week started selling the company down in anticipation of a funding event.

Today’s announcement will go a long way to alleviate some of that pressure with the market now being forced to understand that EXR will not need anywhere near as much funding as the market may have previously thought.

Especially now that the government has approved the drilling events R&D rebate eligibility (up to 43.5% of costs).

The funding risk leads directly to what happened a few days ago for EXR.

What happened a few days ago and why is EXR’s share price down?

The short answer - we think the announcement from EXR a few days ago just added to the funding risk the markets were already starting to price in.

On Monday, EXR put out an update on its Mongolian Coal Bed Methane Gas (CBM) project.

Our key takeaway from the program was that EXR would be looking to expand the Pilot Plant program by:

- Extending the flow (production testing) period and;

- Drilling of an extra well

EXR also confirmed that after running workover programs on the first two production testing wells the company had brought one of them back online for further testing.

All of that sounds like a typical production testing program, the company is learning from its first two wells and deciding to drill another.

The market didn't seem to take the news lightly... EXR’s share price since the announcement is down from ~13.5c per share to now trade at ~9c per share.

But why did the market react to what was a regular update on a production test so negatively?

Aside from our speculation that the initial small drop may have triggered some retail tax loss selling pushing a bigger drop, we think it might come down to the following reasons (most specifically funding risk, which we hope has been partially alleviated with today's announcement)

1) Delayed timelines

As we’ve experienced many times over our Investment journey - delayed timelines for small caps can hurt a share price, sometimes badly when guidance indicates a shorter time frame to the completion of important milestones or objectives for a company.

Put simply, the market hates when expectations are not met.

The extension of the flow period is one such example of this.

2) Shareholder demographics

Companies with multiple projects also have their own “shareholder demographics” - as in, some holders may be strongly attached to one project over another.

It is possible that EXR’s stated intention of drilling an extra well was interpreted as indicating that the results received from existing wells to date were not sufficiently successful to make the project economically viable on its own.

Investors who have been around for a long time waiting for EXR to commercialise its Mongolian CBM project may be looking to exit based on these assumptions.

More often than not commercialising projects can take several years so we see the news yesterday as a positive step rather than a negative one.

EXR’s team have been there and done it all before when it comes to CBM gas projects -

- Managing Director Neil Young is ex-Santos management.

- Director Stephen Kelemen ran Santos’ Coal Seam gas portfolio, AND

- EXR’s chairman Richard Cottee is seen as “the Godfather” of Coal Seam gas in QLD - he famously took Queensland Gas Company from a $20M junior into a $5.8B takeover target.

We also note that EXR has two other projects in its portfolio - the Gobi hydrogen project and its Queensland gas project which has a drilling event that is set to take place in +6 months.

3) Tax loss selling

Price action in markets during May and June are typically the worst times of the year anyway.

May is notorious for the saying “sell in May and go away” & June is notorious for being the month where “tax loss selling” accelerates.

During these months investors are typically scanning their portfolios for companies where they can book tax losses before the end of the financial year and will typically sell something that is going down (thinking it will continue going down further).

After the initial drop on Monday, most new EXR shareholders from the last 2 years would have suddenly been showing a paper tax loss, some may have moved to crystallise it by selling.

It becomes a rush for the exit during a period when there aren't many buyers in the market anyway.

This is completely unrelated to what the company is doing, and while it wasn't the major contributor to EXR’s share price falling over the last few days we think it made the selling worse than it otherwise would have been.

4) Compounding factor (funding risk)

We think this has had the biggest impact on the market's reaction.

The extra CBM well will likely incur additional costs (likely smaller than in other geographies, EXR has indicated this) as part of EXR’s 2023 exploration program in Mongolia.

EXR ended the March quarter with a cash balance of ~$11M.

With interest rates rising and capital markets becoming harder to tap, investors likely took the news as a signal to sell now and wait for a capital raise.

With the stretched timeline for the flow period, and the need to drill another well, it's entirely possible the market took this as a sure-fire sign the company will need to raise more capital to finance the QLD drill program.

As we have seen many times, the perception that a raise is imminent or coming soon often see small cap share prices slide.

We’ve seen many times that risks do not exist in isolation for companies and frequently they can interact with each other in novel ways.

After Monday’s news, perceived production and funding risk may be materialising at the same time in the opinion of some investors.

BUT - we think today’s announcement that funding has been secured for nearly half the QLD drilling should remove some of that perceived risk.

Also, we did like to hear from EXR that the Mongolian gas project remains on the “on the path to commerciality” - a view we share, particularly after EXR delivered early promising results from the Mongolian Pilot Plant.

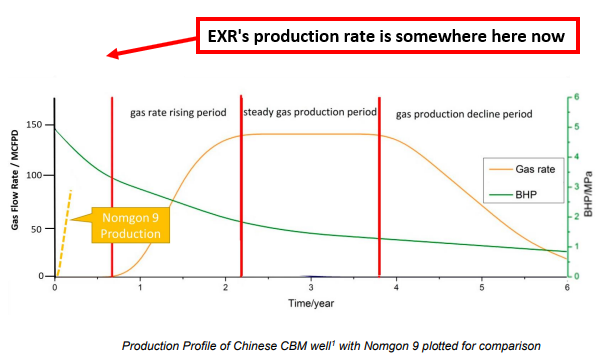

Below is an image showing where EXR’s production rates were compared to flow tests run on CBM projects in China:

So what does this all mean?

All this being said, this is the small cap markets and share prices often don’t behave in line with what the company is delivering.

We have speculated above on what we think has caused the price swings of the last couple of days but ultimately there are thousands of EXR shareholders who have different opinions, world views and financial circumstances, and each of them can press the buy or sell button accordingly.

We are hoping for a good reaction to today’s news and a return to upward share price movement as the company approaches its big drilling event over the next 6 months.

Our EXR Big Bet:

“EXR to achieve a $1BN market cap through successfully advancing one or more of its three projects: its Mongolia gas project, Mongolia green hydrogen project, and/or its Queensland gas project.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our EXR Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

What’s next - EXR’s QLD gas project:

Contractor selection 🔄

EXR is looking to lock in a drilling contractor for the drill program later this year.

We note that EXR’s QLD neighbour Omega Oil and Gas used a SLB (formerly ‘Schlumberger’) rig to drill its two recent wells (one still underway).

we wouldn’t be surprised if EXR uses the same SLB rig. Given the success of Omega’s first well, EXR would surely be keen to replicate that performance.

Financing 🔄

EXR ended the March quarter with $11.8M cash in the bank.

Today’s news derisks the financing of the well significantly with the drilling costs now eligible for R&D rebates of up to 43.5% - most importantly this is all non-dilutive funding for EXR.

Now EXR can turn its focus to finding a debt financier who is willing to lend against the future R&D grants.

We have seen these types of deals get done plenty of times before.

What’s next - EXR’s Mongolian Coal Bed Methane (CBM) gas project:

Extended production testing 🔄

EXR is now looking to drill a third production testing well & has extended the testing period for the program.

We are looking forward to the results from the new well and hope that based on the learnings from the first two wells, EXR will be able to demonstrate stronger flow rates.

Ultimately, the production testing program is something that will be happening in the background of EXR’s Mongolian project even while the company continues with its exploration programs.

Just as we have seen with other CBM projects across the world, commercialising the projects can take time.

2023 exploration program 🔄

EXR has already locked in its exploration contractor and expects drilling to start soon.

What’s next - Mongolian green hydrogen project:

Financing for a pilot plant 🔄

EXR confirmed that discussions with potential financiers were ongoing for a pilot plant.

The company specifically mentioned the Asian Development Bank (ADB) as well as other “International finance” organisations.

Offtake agreement for the pilot plant 🔄

EXR also confirmed in its recent quarterly for potential offtake agreements on its pilot project.

50/50 Joint Development Agreement (JDA) 🔄

EXR is progressing discussions with its Japanese Partner SB Energy Corp (now 85% owned by Toyota Tsusho Corporation).

We are hoping to see news on this front by the end of the year.

What are the risks?

The two risks we think are most relevant to EXR right now is the production & commercialisation risk at the company’s Mongolian CBM gas project.

As for the QLD gas project, the company has partially addressed funding risk with today’s announcement BUT we are still conscious of EXR needing to secure some sort of debt financing to bridge the gap between having to pay for drilling and the R&D rebates coming in.

To see all of the risks to our EXR Investment thesis check out our EXR Investment Memo here:

EXR Investment Memo

Below is our newest EXR Investment Memo, where you can find a short, high level summary of our reasons for Investing including the following:

- Key objectives for EXR for the coming year

- Why we are Invested in EXR

- The key risks to our Investment thesis

- Our Investment plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.