We Just Tripled Our Holding in TMR

Next Investors has been having a great run of results since we introduced our investment portfolio model in 2019 to only cover a small number of carefully researched companies we are invested in. Most of them are currently up hundreds of percent.

Long term positions in quality companies + wide investor awareness + successful execution of the company business plan is our formula for investment success.

Investing in small caps is not a perfect science, and a few of our picks haven’t performed as well as we hoped (yet), even though the original reason we invested has not fundamentally changed.

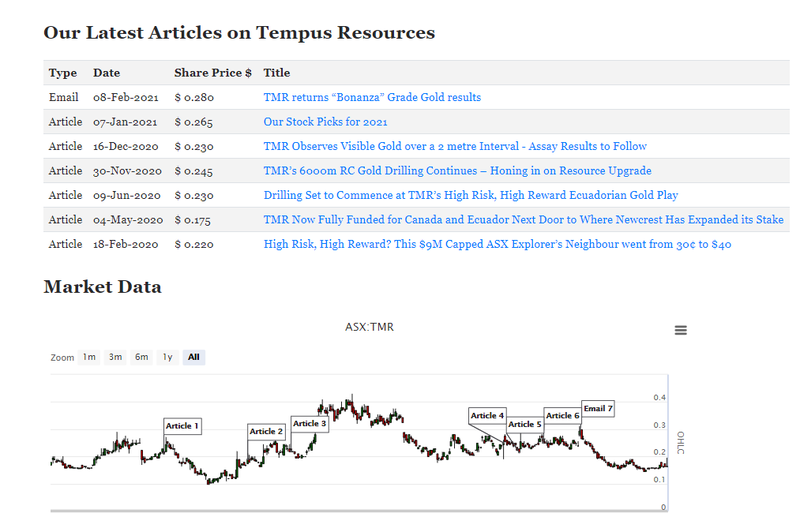

We originally took a position in Canadian Gold explorer Tempus Resources (ASX: TMR) at 21c back in February 2020 because we liked its Canada and Ecuador Gold projects, active drilling campaign plans and sub 100 million shares on issue. We increased our position in November 2020 at 34c.

For a number of reasons, (which we cover below) the TMR share price has only moved sideways since we invested 12 months ago. However, with the next drilling campaign starting in around 6 weeks after a few months’ pause due to winter weather, and the gold price looking like it wants to make a comeback, we tripled our holdings in TMR by participating in TMR’s placement last week at 14.5c.

After last weeks placement, our new average entry price on TMR is now 18.2c. We haven’t sold a single TMR share since we first invested last year. We are pleased that our first batch of TMR shares has now hit the 50% capital gains tax discount because we have held for 12 months.

(We are launching a more informative portfolio page soon which will have much clearer info on our entry prices and exit strategies - thanks for all the feedback please keep it coming.)

Our goal with all our portfolio companies is a long term hold for hopefully a 1,000% plus gain - assuming the company executes on its plan (and has some exploration luck in TMR's case). We hope 2021 is TMR’s year and we get some positive drilling results over the next few months.

Investors should also remember that investing in explorers is risky and you can lose most of your investment if results don’t come in. See our ebook to learn about how we invest in small cap stocks here.

So why did TMR’s share price go sideways the last 12 months?

Even though we carefully choose each investment we make, sometimes things don’t go to plan with execution and other factors the company can’t control (like global pandemics). This is small cap investing.

Here is our take on why TMR’s share price didn’t rise over the last 12 months:

Permit delays reduced drilling campaign size

TMR’s last drilling campaign was reduced in size due to COVID related permit delays. TMR only managed 2,000m out of 6,000m originally planned drilling at Elizabeth - we assume some investors were not happy with this and switched out to other explorers that were not delayed.

UPDATE: All permits now secured for next 5 years - 7,500m drilling campaign planned for next few months.

Impatient holders left during drilling pause for Canadian winter

TMR announced visible gold from drill cores in December 2020, followed by bonanza gold results in February this year. TMR’s share price reacted well on the day, but then entered a down trend for the next few weeks - we assume due to impatient sellers leaving because of the pause in drilling that would continue through March and April due to the Canadian winter - hence no results or catalysts during that time. They may also have been frustrated with the reduced size in the previous drilling campaign.

UPDATE: Winter is over, drilling is starting again in 6 weeks - 7,500m campaign.

Ecuador Drilling on hold due to COVID

We also assume there was pressure on the share price from some investors becoming impatient with delays to the drilling campaign in Ecuador. We must admit we were frustrated by this delay too, but decided to hang in as we really like the Ecuador project and are hoping it will kick off this year.

UPDATE: Still doing geochemical sampling program in Ecuador - waiting for further update from the company.

Sellers

There seemed to be a few sellers in the stock last year, but hopefully they are all done now and TMR will have fresh air to rise into if they can deliver some positive drill results - and in the excitement leading up to results.

UPDATE: Unfortunately we don’t have enough visibility on this to form an opinion.

Gold price came off from Sept to March.

Gold had a huge run in 2020 from $1,500 to over $2,000 per ounce - obviously this was great for gold stocks, but not so good when the price pulled back a bit to the $1,700’s.

UPDATE: Gold price looks like it’s making a comeback now - if it keeps going back to above $2,000 this will be positive for all Gold stocks. (Please excuse my horrific charting attempt but you get the point.)

So what is going to make TMR interesting over the next 16 weeks?

Here is what we are looking out for over the next few months:

- Canadian winter ending and first drilling commences - probably about 6 weeks away so plenty of time for excitement to build pre drill.

- Gold price to continue to rise - c’mon $2,000 per ounce!

- A positive update on TMR’s Ecuador project.

Other reasons we like TMR in general:

- Only 100 million shares on issue - means share price can move fast up (or down) on results.

- Funded for this drilling campaign.

- Canadian listing - TSX.V: TMR lets Canadians invest in TMR.

- US listing on OTCQB coming very soon, there is a huge pool of investors in the USA.

Here is all our previous commentary on TMR

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.