SGA produces 99.99% pure graphite - now suitable for batteries

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 4,354,500 SGA shares and 1,466,250 SGA options, the Company’s staff own 30,000 SGA shares and 7,500 options at the time of publishing this article. The Company has been engaged by SGA to share our commentary on the progress of our Investment in SGA over time.

We have 99.99%.

Our 2022 Small Cap pick of the Year, Sarytogan Graphite (ASX:SGA) is developing one of the biggest and highest grade graphite deposits on the ASX.

Graphite is a key ingredient in batteries...

IF it can be purified to at least 99.95%.

Today SGA announced it has successfully produced a sample of graphite with purity levels of 99.99%.

This significantly exceeds the battery grade requirement of 99.95% that SGA had been chasing.

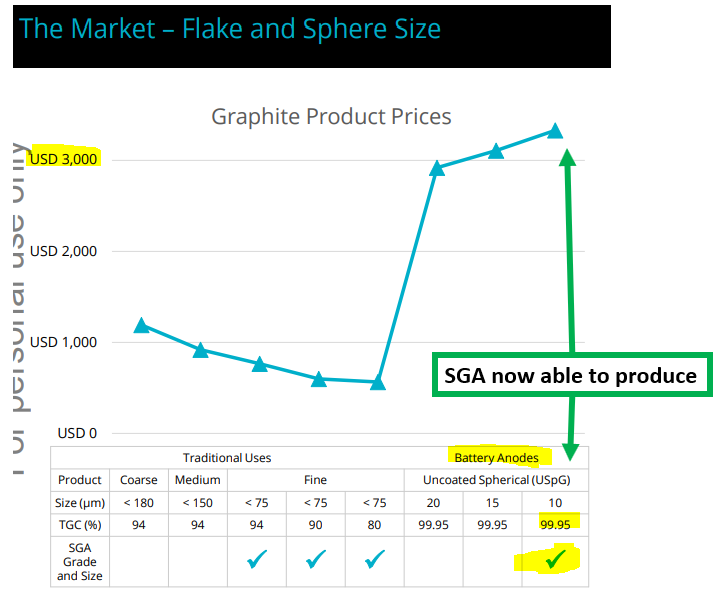

Graphite this pure can be sold for up to US$3,000 per tonne into the battery anode market.

(Compared to ~US $600 per tonne for lesser purity graphite sold in traditional graphite markets.)

Before today, SGA already had the highest grade graphite resource on the ASX. Given SGA’s $27M market cap, we think the market has been waiting to see if SGA could actually process graphite from its deposit into battery grade purity.

Previously, SGA had been steadily refining its processes, and got to a point where it was able to produce graphite with purity levels of 99.87% (very pure, but just short of battery grade).

After today, SGA has demonstrated to the market it can produce battery-grade anode graphite with purity levels of 99.99%.

SGA has now addressed a key technical risk for its project, and can now be in a position - to sell its product into the high value battery anode markets.

We think today’s metwork result could deliver a re-rate to SGA share price, given it is a major de-risking event.

SGA managing director Sean Gregory’s comment sums up the importance of today’s announcement:

(source)

High purity graphite sold into the battery anode markets can fetch prices over US$3,000, whereas lower purity fine flake graphite on its own for traditional uses can be <US$600.

(Source)

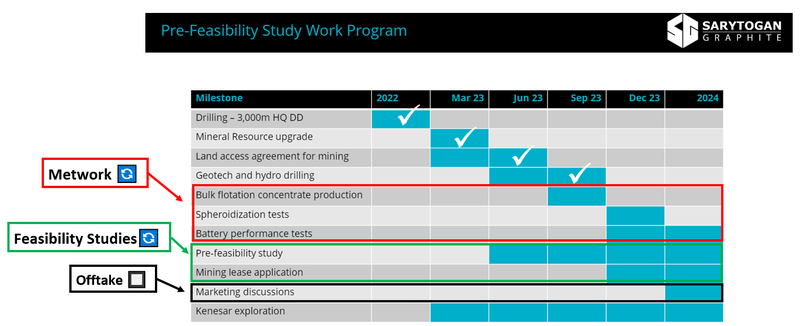

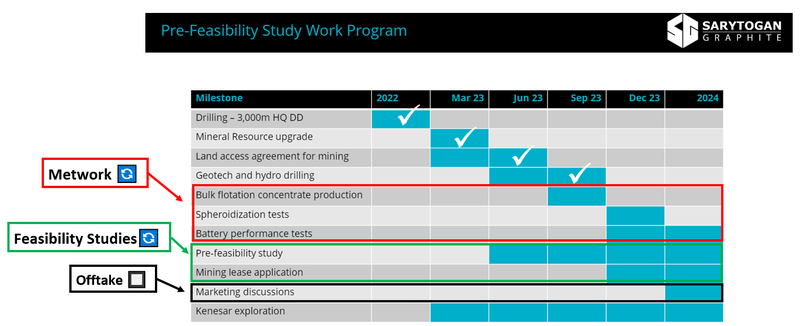

Armed with this data, SGA can feed the higher value products into its Pre Feasibility Study (PFS) economic models.

While in the meantime running further tweaks to optimise the efficiency of its purification process.

SGA expects to release its PFS in 2024, and will be the first look at the economics of developing SGA’s graphite project.

Other news we are watching out for from SGA over the coming 12-18 months include:

- Battery performance tests,

- Commericalisation progress e.g. offtakes,

- Additional metwork and processing refinement, and;

- Exploration progress on its new project.

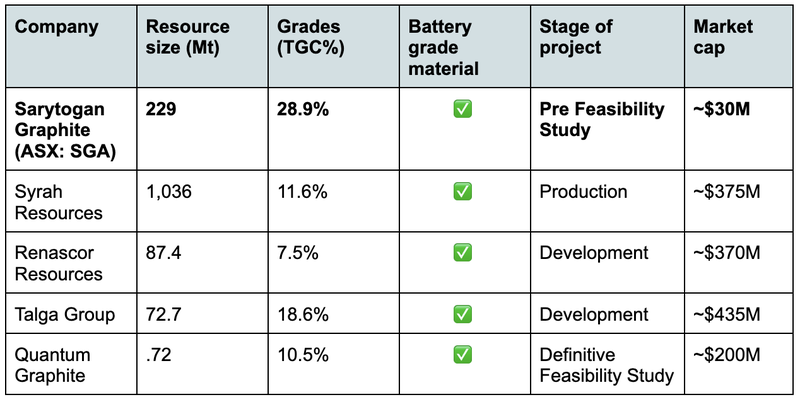

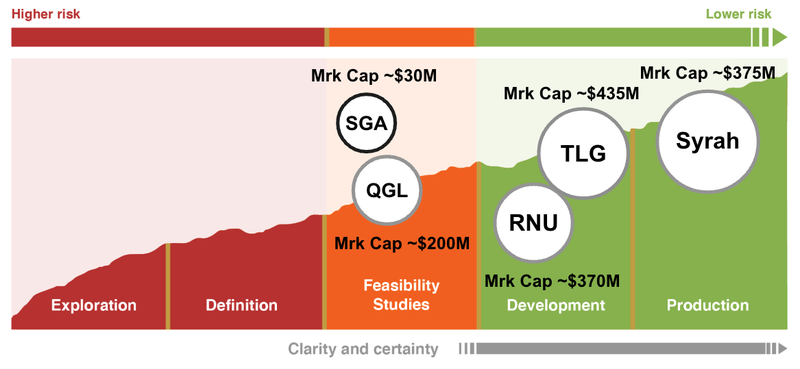

How does SGA compare? A quick look at what other ASX graphite stocks are up to

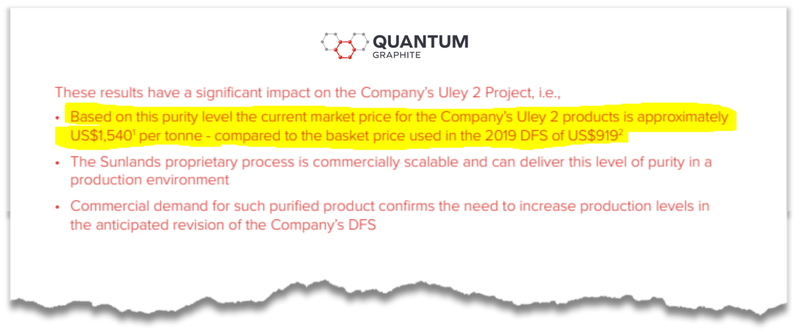

Another ASX graphite developer, Quantum Graphite is currently valued at ~ $200M - much higher than SGA’s ~$30M market cap.

Quantum Graphite is more advanced than SGA, having finalised its DFS in 2019. In that DFS, Quantum used graphite prices of US$919 per tonne.

Two months ago, just like SGA has done today, Quantum Graphite produced graphite with purity levels of 99.99%.

It then flagged that it could plug in higher sale figures of US$1,540 per tonne into its feasibility studies going forward.

(Source)

After today’s news, SGA can also plug a higher, natural graphite “battery market” price directly into its own feasibility studies.

It's worth noting that while Quantum Graphite is more advanced in its development, SGA’s resource is a lot bigger and higher grade than Quantum Graphite.

Remember, SGA is capped at ~$30M, whereas Quantum Graphite is capped at ~$200M.

SGA now has:

- The highest grade resource on the ASX. In mining grade is king. Higher grades typically lead to lower costs of processing a resource into a final saleable product.

- The second largest graphite resource on the ASX in terms of contained graphite. Second only to Syrah Resources, which is capped at $375M.

- AFTER TODAY - Proof that it can process its graphite to a high enough purity to be sold into high value battery anode markets.

Here is how SGA now stacks up on a valuation basis versus some of its ASX graphite peers:

This is where SGA sits when compared to its graphite peers in the project lifecycle:

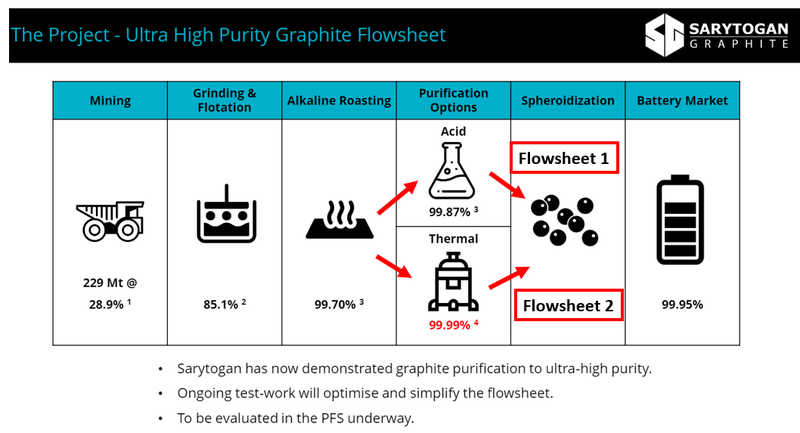

SGA taking a “two pronged” flowsheet approach

We also noticed today that SGA is now concurrently testing two different flowsheets for its graphite.

The first is the conventional route, where it is alkaline roasting, purifying, and then going through the spheroidization process to produce battery grade anode material.

The NEW approach adds a “thermal purification” step.

The thermal purification route looks interesting as it could help simplify SGA’s flowsheet (reduce the number of steps during the processing stage).

Now that SGA has proven one particular processing flowsheet can reach 99.99%, they can start tweaking/optimising the steps to lower costs and complexity.

A general rule of thumb is that a more simplified flowsheet leads to lower cost production.

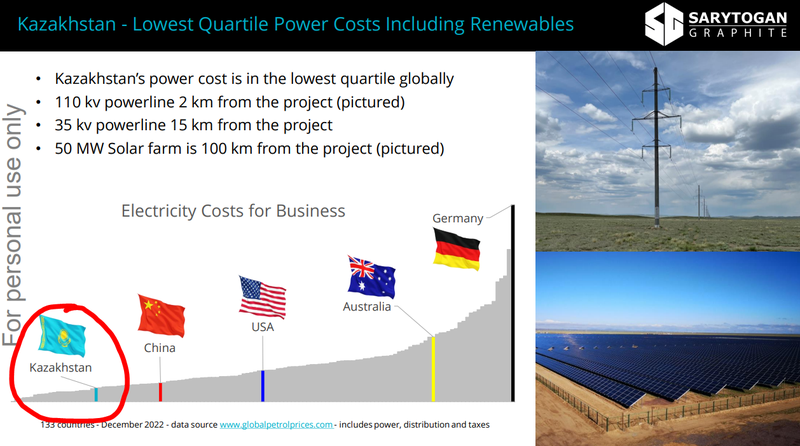

That said, the thermal purification process can be energy intensive, which may impact long-term operating costs of this process.

In relation to processing costs, working in SGA’s favour is the low cost of power in Kazakhstan relative to the rest of the world:

At this stage, we would like to see SGA test both process routes so that when it comes time to develop its project, it can pick the more efficient/cost-effective solution out of the two.

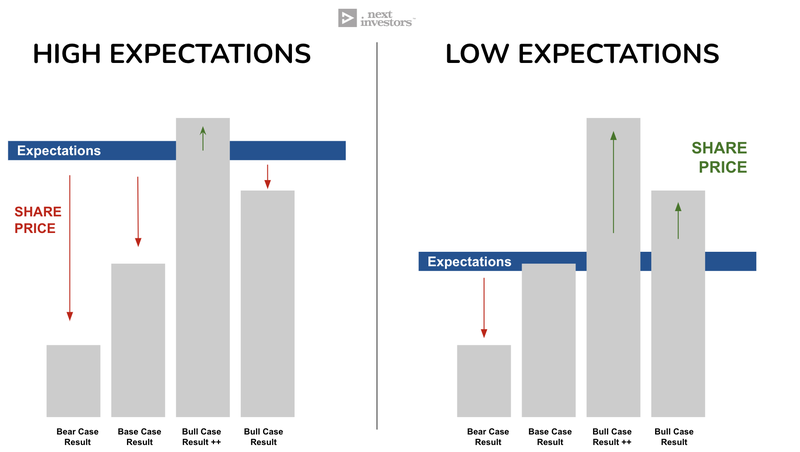

So - SGA just delivered unexpected good news in a tough market

In markets like the one we are in now, where investors are selling out of stocks for all sorts of reasons - unexpected good news can mean there is very little expectation built into company share prices.

The graphite space is perhaps one of the hardest hit where there could be selling due to recent weakness in the graphite price AND general macro factors.

All of the selling in between newsflow can mean a reshuffle of a company's register from impatient short term shareholders to shareholders with a longer term outlook.

We think SGA has no doubt suffered from this, with its share price trading below the initial IPO price of 20c per share for the second time since listing in mid-2022.

Given general market expectations are low, we are hoping that today’s unexpected good news leads to a re-rate in the SGA share price that is sustained over the coming months.

Beyond today’s news, over the next 6-9 months, SGA could produce additional unexpected positive catalysts:

- Pre-Feasibility Study results (PFS) - This is expected newsflow, but the market doesn't know what to expect for the economics and Net Present Value (NPV) of the project. Given the size/scale of the project, SGA could surprise to the upside here if it can demonstrate the potential for a low CAPEX, profitable future mining operation.

- Battery performance testing - After today’s results, SGA now knows its graphite can be used in battery anodes. Next, SGA will be testing to see how well the material performs in battery life cycle tests. Again the results of this is unknown and could surprise to the upside.

- Potential offtake discussions - This is completely unexpected but one thing that we think could really surprise the market if delivered. With its project now de-risked from a technical point of view and graphite prices relatively low, off takers might start discussions on this front now.

Ultimately, we are long term SGA holders and want to see the company take its project through the feasibility study stage and into a position where the company achieves our “Big Bet”.

Our SGA “Big Bet”

“Given this graphite project’s strategic location in between China and Europe, we hope that if SGA proves out the size and economic extractability of the resource, it will generate interest from major mining companies, leading to a takeover of SGA for $1 billion+.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our SGA Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

For a quick summary of SGA’s progress over time see our SGA Progress Tracker:

What has happened to the graphite market in 2023?

At the start of 2023, we tipped graphite to have a big year.

Our thesis was that demand for graphite would grow due to its abundant use in lithium ion batteries.

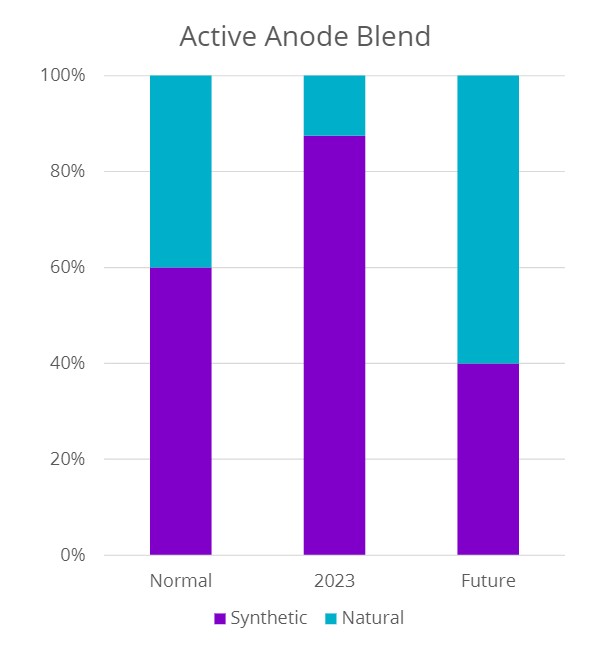

However, over the past six months, the prices of graphite have fallen - primarily because synthetic graphite production out of China has been ramped up.

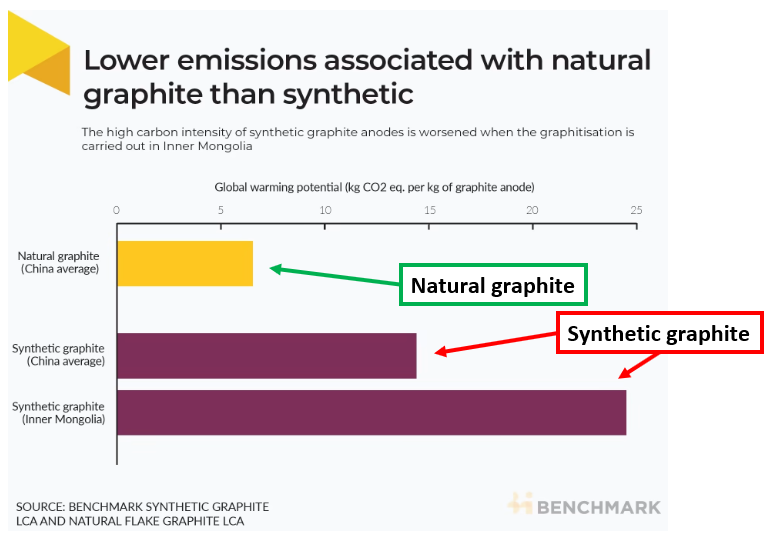

In 2023, ~90% of graphite used in battery anodes came from synthetic sources out of China. Synthetic graphite is basically made in a lab in an energy intensive environment in a process that is both environmentally damaging and expensive.

Natural graphite anodes are cheaper to produce, have higher capacity and lower energy consumption when compared to synthetics.

In the future, natural graphite like what SGA has on its hands, is expected to make up over 60% of the market as the synthetics are phased out of the market.

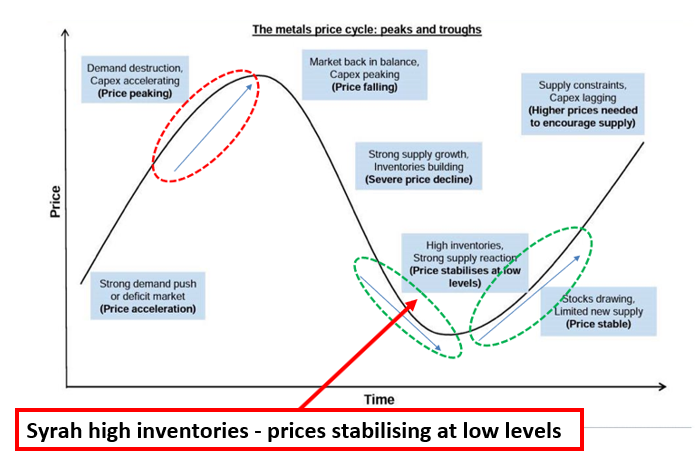

For now though, the flooding of synthetic graphite into the market has brought prices low enough to push the ASX’s biggest graphite producer, Syrah Resources, into pausing graphite production due to ‘unsustainably low’ graphite prices.

(Source)

Mining companies only do this when the costs of mining new supplies far exceed the price that can be achieved when selling them.

This has had a trickle down effect on smaller graphite players on the ASX, with broader sell-offs in ASX graphite companies as a whole.

Price volatility is to be expected with a commodity in its infancy like graphite compared to other metals with a more established market like gold, nickel and copper.

We find that with emerging commodities it is best to ignore the short term price slump and make investments counter-cyclically - meaning to invest when prices are down and hold them until commodity prices recover.

Short term moves in commodity prices discourage investment into new supply, and in a high growth market like battery anodes - when the demand comes, the supply shortfalls mean prices go exponentially higher.

The graphite market today reminds us of the lithium market in 2019-2020.

In October 2019, lithium miner Pilbara Minerals put its Pilgangoora project in WA on care and maintenance for two years due to unsustainably low lithium prices.

The company then re-started operations in June 2021.

(Source)

Fast forward to today, and driven by the real demand for lithium, Pilbara Minerals has a market cap of ~$14.5BN and has built up a $3.3BN cash war chest from that single mine.

Any newly developing market takes time for real demand to materialise.

But when it does, the mine supply is often too slow to catch up, and commodity prices go exponentially.

Of course, no one can be certain that graphite will have its lithium moment - commodity prices are extremely hard to predict, and higher prices in commodities can often lead to substitutions being found for that particular commodity.

Here is what happened to the lithium price over that period from when Pilbara’s mine was shut in 2019 until today:

With the graphite market at a cyclical low right now, we think there are two key factors that will drive the long term demand for the sector.

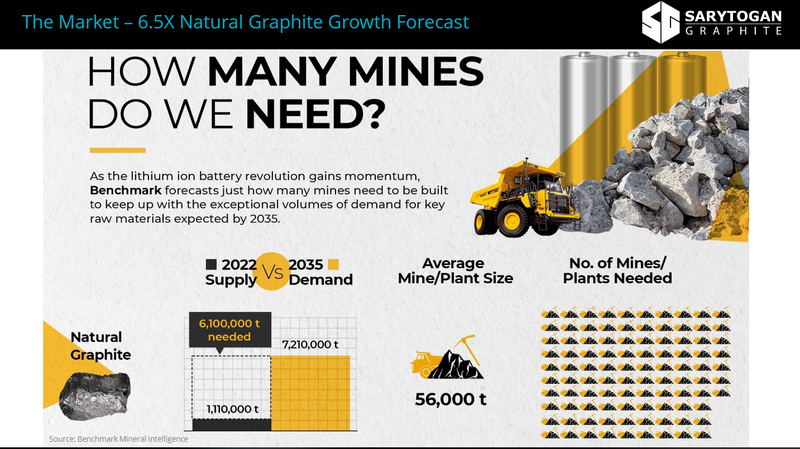

The world needs 6.5x more natural graphite by 2035

The world is looking to rapidly move away from fossil fuels and into a clean energy future.

This electrification theme won’t happen overnight, and we believe it will be a decade long thematic where demand for electric vehicles and lithium-ion battery storage will grow.

For context - it's estimated that by 2035, the world will need 6.5x more natural graphite.

Between now and then, price volatility and periods of lower prices are to be expected.

The graphite market is almost solely controlled by China

Unlike the copper or gold markets, where there is price discovery and trade happening all around the world, the graphite space is dominated by a single market.

At the moment, China mines ~80% of the world’s graphite and controls almost all of the world’s processing capacity.

In any industry where the supply chain is controlled by a single country/market, prices can be volatile.

When China’s not buying, prices suffer.

Domestic issues inside China are currently affecting the graphite prices, despite graphite's strong demand outlook for the future.

In the long run, as the graphite market matures, we expect to see supply/demand diversify and graphite prices stabilise at higher levels.

In the short term, we expect more periods of graphite pricing volatility.

Real substitution risk

As mentioned earlier, the environmental costs of producing synthetic graphite are significantly higher relative to producing natural graphite battery anode materials.

(Source)

We do note though that there is always a risk that technological innovations in synthetic graphite production improve and new ways of making cheaper, cleaner synthetic graphite anodes are found.

If this were to happen then prices could stay at levels where natural graphite supply doesn't make sense to bring onto the market.

As with any commodity - substitution risk is always something to keep in mind when investing.

What’s Next for SGA?

Ongoing metwork 🔄

Having now surpassed 99.95% TGC purity levels, the next phase of work will be about optimising and scaling up its flowsheet.

SGA mentioned in today’s announcement that bulk flotation tests were already underway, which would provide for larger samples to test across both flowsheets.

For context - today’s news was based on 50g sample sizes.

Read our quick take of the flotation news here: Higher Concentrate Graphite Grades Achieved

Feasibility Studies 🔄

SGA is on track to deliver the Pre-Feasibility Study (PFS) in 2024.

In today’s announcement, SGA confirmed that it would be running trade-off studies to see which of the two flowsheets works best for its project.

Basically, SGA will be looking to see which of the two is cheaper and more efficient before plugging it into the feasibility study.

What are the near term risks for SGA?

In the short term, a key risk to SGA’s share price is the graphite price.

We have seen Syrah put its project into care and maintenance which typically signals to the rest of the industry that there is no demand for new graphite supply in the short term.

This can slow down the development of projects like SGA’s which are still a while away from being put into production.

In the short-run this could impact SGA’s ability to raise capital.

To see the risks in detail, check out the Memo here, or click on the image below:

Our 2022 SGA Investment Memo

Below is our Investment Memo for SGA, where you can find a short, high level summary of our reasons for Investing.

In our SGA Investment Memo, you’ll find:

- Key objectives went want to see SGA achieve

- Why we are Invested in SGA

- What the key risks to our Investment Thesis are

- Our Investment plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.