SGA on the Road to 99.95% Graphite Purity

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 4,354,500 SGA shares and 1,466,250 SGA options, the Company’s staff own 30,000 SGA shares and 7,500 options at the time of publishing this article. The Company has been engaged by SGA to share our commentary on the progress of our Investment in SGA over time.

We are betting that key battery material graphite is going to “do a lithium” in the medium term.

Our 2022 Next Investors Small Cap Pick of the Year, the $42M capped Sarytogan Graphite (ASX:SGA) already has the second largest graphite resource on the ASX in terms of contained graphite.

It’s second only to $606M Syrah Resources - AND SGA has the highest grade graphite resource on the ASX.

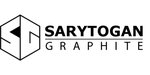

A giant, high grade resource is great, but the key news the market is waiting to see from SGA is whether they can achieve the 99.95% carbon purity required for battery anodes.

This purity level is required for “spheroidization” - milling and heating 99.95%+ purity graphite into tiny, microscopic balls with better packing and energy density required for battery anodes.

Today SGA announced a clear timeline to achieving 99.95% carbon purity - all they need to do is remove traces of titanium.

We will know by the end of this year.

This level of 99.95% pure graphite is the type that goes into battery anodes and commands a high price from buyers.

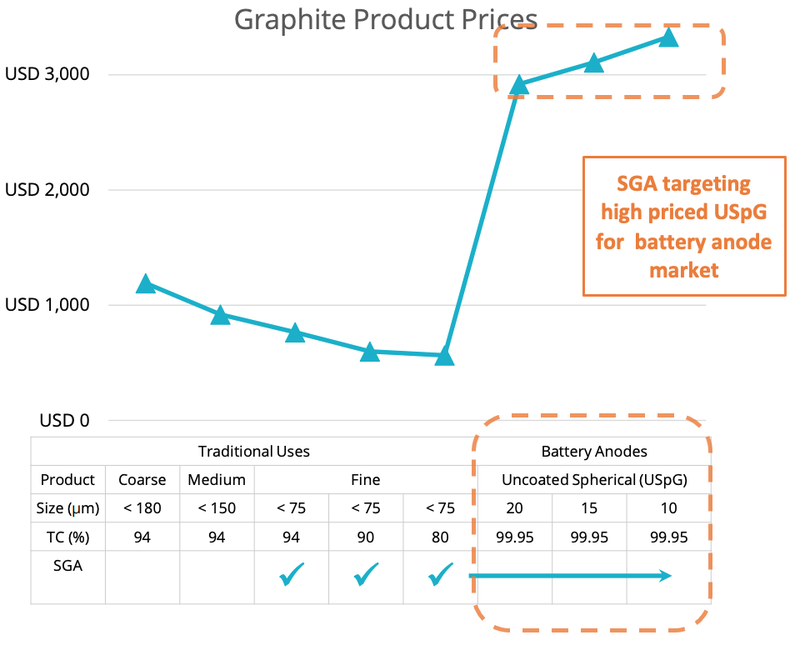

After further metallurgical work, today SGA announced that they expect to achieve 99.95% graphite using simple gravity separation to get rid of the final traces of titanium in its product.

Gravity separation uses, you guessed it - gravity. A heavier material (in this case titanium) settles lower than graphite, which is lighter.

As of today’s news, SGA has shown that it can REPEATEDLY produce graphite with purity levels of 99.87%, across different testing laboratories.

But the next big step is graphite with 99.95% carbon purity so it can be sold to high value battery anode markets - and SGA now has a simple and inexpensive plan to get there.

Graphite sold into the battery anode markets can fetch prices >US$3,000, whereas fine flake graphite on its own for traditional uses can be <US$600.

The price being received for SGA’s product is important because it will form the basis for the company’s Pre-Feasibility Study. SGA’s PFS is currently ongoing and expected to be delivered sometime in 2024.

If SGA can demonstrate a reliable process to get 99.95% purity graphite, it will then have:

- The second largest graphite resource in terms of contained graphite

- The highest grade resource on the ASX,

- Graphite that can be sold into the high value battery anode markets.

In Perth today? Want to hear from SGA?

SGA MD Sean Gregory will be presenting at the Association of Mining and Exploration Companies (AMEC) Investor Briefing in the Perth CBD this Tuesday afternoon/evening. Investors are invited to register for a free pass to attend the event.

Venue: The Melbourne Hotel, 33 Milligan Street, Perth

Date: Tuesday 6 June

Time: 3.30pm - 5.30pm, refreshments to follow

Click here to register to attend event

How does SGA compare to ASX graphite peers?

To complete its Pre-Feasibility Study and show project economics, the company needs to show how its graphite can be mined and then processed into a product suitable for sale into high value markets.

Metallurgical work (metwork) has always been a key risk for the SGA’s project, and we think, the primary reason for the company trading at a significant discount to its ASX-listed graphite peers.

SGA is capped at $42M, whereas its graphite peers are capped at multiples higher:

- Talga Resources - capped at $444M.

- Renascor Resources - capped at $495M.

- Syrah Resources - capped at $606M.

Ultimately we are hoping that once SGA cracks the metwork code for its project, the company re-rates to a market cap in line with its peers.

How and when SGA plans to get to that 99.95% purity level

SGA laid out the plan relatively concisely in today’s announcement.

The companies plan is to:

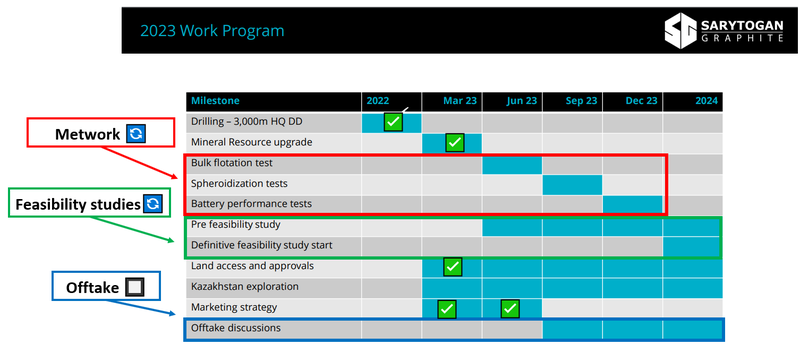

- Between now and the end of Q3 2023 - SGA plans to run another batch of its graphite through a “bulk flotation concentrate production circuit”. The bulk concentrate will then be used for further purification and spheroidization (processing 99.95%+ purity graphite into tiny, microscopic balls required for battery Anode).

- Between Q3 and the end of Q4 2023 - SGA will run the bulk concentrate product it receives through a gravity separation circuit and look to remove the final contaminants (titanium). Hopefully at this stage SGA hits that 99.95% purity level.

- Inside Q4 2023 - SGA expects to run chemical purification, spheroidization, and battery testing. At this stage SGA expects to be putting out results on how its graphite performs in a battery anode.

So by the end of 2024 we should know whether SGA’s product is suitable for use in the battery supply chain.

Ultimately, positive results from the metwork should translate into improved project economics in SGA’s feasibility studies.

SGA now well funded to deliver upcoming material newsflow:

SGA recently topped up its coffers by raising $5M at 33c per share.

Before the raise, SGA ended the March quarter with $4.2M in cash (31 March 2023).

Post capital raise, the company should have close to ~$9M (not including any spending done during the June quarter to date).

Based on that cash balance, SGA now has a market cap of $42M and an enterprise value of ~$33M.

We think this amount of cash should be enough to see the company through to its Pre-Feasibility Study, which it expects to deliver in 2024.

Our take on the recent SGA capital raise

The SGA cap raise was an interesting one, in that the company still had a decent amount of cash in the bank and wasn't in a position where it necessarily had to raise capital.

Typically we prefer our Portfolio Companies try and buy themselves as much time as possible to deliver good news, see their share prices re-rate off the back of that news and then raise at higher share prices.

That strategy works in a market where sentiment is positive - it works less when the environment for capital raisings is tough.

In markets like the ones we have now, the best outcomes come from when companies raise capital well ahead of the market pricing in an impending cap raise. This is exactly what SGA did with its raise in April.

Another good example from our portfolio is Latin Resources which raised $37.1M at 10.5c per share when the company already had $21M in cash in the bank.

No one was expecting the raise, and so the share price kept going up after the news - Latin Resources now trades at ~18c per share.

As a result, we think SGA made the right call to raise capital when the market least expected it.

SGA now has has plenty of time to deliver material news, which we hope will re-rate the share price and doesn't have to worry about having to raise new capital.

SGA key newsflow to watch for

On that front we think one of the three pieces of newsflow could be the key catalysts for a re-rate:

Metwork breakthroughs (unexpected good news)

If SGA can hit the 99.95% purity level its product will be deemed suitable for the high value battery anode materials markets.

This would be one of the company’s major risks mitigated and we would expect the market to re-rate SGA’s share price.

Feasibility studies (expected news BUT numbers unknown)

This will put some solid economics behind SGA’s project. SGA recently appointed its PFS contractor and expects the PFS to be delivered at some point in 2024.

Offtake discussions (unexpected before the PFS)

This will be important when it comes time to try and move SGA’s project from feasibility stage into the development stage.

The market won't be expecting this any time soon so any surprise news on this front could be a major catalyst for the company.

Ultimately, we are long term SGA holders and want to see the company incrementally progress its project into a position where the company achieves our “Big Bet” which is as follows:

Our SGA “Big Bet”

“Given this graphite project’s strategic location in between China and Europe, we hope that if SGA proves out the size and economic extractability of the resource, it will generate interest from major mining companies, leading to a takeover of SGA for $1 billion+.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our SGA Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

For a quick summary of SGA’s progress over time see our SGA Progress Tracker:

New graphite ground pegged in Kazakhstan

Just before the end of the March quarter, SGA picked up some new early stage graphite exploration ground in Kazakhstan.

SGA’s resource is already the second largest on the ASX (in terms of contained graphite), second only to $606M capped Syrah Resources, so the company doesn't need to add any additional resources.

We think that the new ground is less about trying to increase the size and scale of SGA’s graphite resources and more about diversifying the type of graphite SGA is able to produce.

SGA’s new project sits on the type of geology that is known to host flake graphite deposits.

If SGA is able to define a flake graphite resource, it would be complementary to its existing resource.

The project covers ~309km^2 of ground in the north of Kazakhstan, ~660km away from SGA’s main project.

This project is at an earlier stage and not our main focus, but we are interested to see what SGA can find here.

The project also brings to SGA an added exploration exposure while the company runs through the feasibility process for its existing project.

What’s Next for SGA?

As Managing Director Sean Gregory revealed in a recent presentation at the RIU Explorers Conference, SGA has a busy work program ahead of it.

Ongoing metwork 🔄

SGA continues to work with its processing partners to achieve the required Uncoated Spherical Graphite (USpG) specifications of 99.95% TGC purity in spherical graphite balls of 5-20 micron in size.

Achieving these specifications will be key to accessing the battery anode market with a high priced spherical graphite product.

However, there is no guarantee that SGA will be able to achieve these required specifications and/or it may not be able to scale the processing solution to a size/scale that is required for its project.

This is a key development that we are watching for.

Feasibility Studies 🔄

SGA recently appointed its Pre Feasibility Study (PFS) contractor and is on track to deliver the PFS in 2024.

What are the near term risks for SGA?

The key risk for SGA is related to the network the company is doing.

No matter how large a project's resource is, metallurgical test work is a major hurdle for determining whether or not a project gets developed.

Metwork determines how a deposit is processed and can make or break a project.

In SGA’s case, the all important hurdle is whether or not the company can produce 99.95%+ purity graphite that is suitable for sale into the battery anode markets.

At the moment, the company has managed to produce 99.87% purity levels. As a result, metwork risk is still a key factor for the company.

To see the risks in detail check out the Memo here, or click on the image below:

Our 2022 SGA Investment Memo

Below is our Investment Memo for SGA, where you can find a short, high level summary of our reasons for Investing.

In our SGA Investment Memo, you’ll find:

- Key objectives went want to see SGA achieve

- Why we are Invested in SGA

- What the key risks to our Investment Thesis are

- Our Investment plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.