Roots taps into growing meat replacement industry

Published 19-AUG-2019 12:17 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Roots Sustainable Agricultural Technologies Limited (ASX:ROO) has initiated a planting program specifically aimed at examining the effects of its RZTO and IBC technologies on several protein-laden crops to increase the content of leghemoglobin.

The crops will be planted at Roots’ research and development hub in central Israel where the protein content of the beans and peas will be measured in a two-part program.

During this process the company will employ its root zone temperature optimisation (RZTO) and Irrigation by Condensation technologies.

Initially root zone cooling will be measured, then in the autumn and winter a second round of crops will be tested using root zone heating.

Roots’ Irrigation by Condensation (IBC) technology will then be used to examine the effect on protein content of the ‘deficit irrigation’ concept using irrigation from just humidity in the air.

The results from each plot will be compared with a control plot planted under the same ambient conditions enabling Roots compare the results.

Leghaemoglobin is a form of protein in plants and contains Heme, the key ingredient in plant-based meats, similar in look, preparation style and flavour as beef, but without the environmental impact and negative health effects of real beef.

Increasing demand meat replacement crops

Beans and peas are examples of crops from which Heme can be extracted.

Growing interest in meat replacement crops has accelerated the search for high protein vegetables and technologies that can increase the protein content in any given crop.

Reasons include health benefits of plant-based proteins over meat sources, ethics around livestock management, and environmental issues.

Management highlighted that one kilogram of beef requires 15,415 litres of water.

By comparison, the production of one kilogram of pulses has a water footprint of 4,055 litres of water, 74% lower.

Peer stocks perform well in global markets

From a broader perspective, the Israeli-based Roots is developing and commercialising disruptive, modular, cutting-edge technologies to address critical problems being faced by agriculture today, including plant climate management and the shortage of water for irrigation.

Roots has developed proprietary know-how and patents to optimise performance, lower installation costs, and reduce energy consumption to bring maximum benefit to farmers through their two-in-one root zone heating and cooling technology and off the grid irrigation by condensation technology.

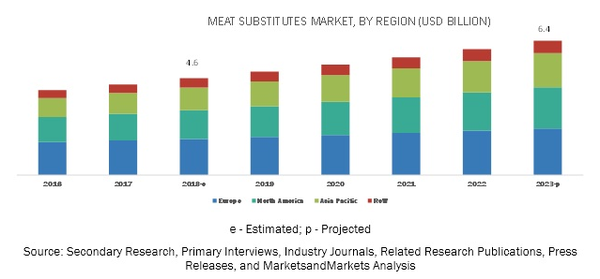

Looking specifically at the planting program announced today and the group’s associated goals, global markets suggest that it could be targeting a growth industry.

Companies such as Beyond Meat (NASDAQ: BYND) and Impossible Foods have developed versions of plant-based substitutes for meat which are now sold commercially.

Beyond Meat’s market capitalisation has increased by over 500% since its May 2019 IPO to US$10 billion.

Summing up her take on this emerging industry and the role Roots is likely to play, chief executive Sharon Devir said, “Roots is aiming to enter the meat replacement market with this research initiative.

‘’We plan to address a major market that is surging due to the changing way we eat.

‘’Growing concerns about sustainable consumption of animal protein has urged consumers to elect for alternative protein sources, furthering demand for plant-based meat products.’’

Citing research from https://www.marketsandmarkets.com/ResearchInsight/plant-based-meat-market.asp, Devir highlighted that the global demand for plant-based meat is estimated to reach US$27.9 million by 2025.

Devir also explained that according to reports, bean and pea protein is becoming more accepted in communities and is rapidly gaining popularity among plant-based meat manufacturers at a global level thanks to its high protein content and health benefits.

On this note, leading manufacturers in the global plant-based protein industry have shifted resources to developing common meat products, using pea protein as a base for future product development.

Given this backdrop, roots is continuing to look for value add opportunities in the plant-based meat sector, an initiative that could potentially provide new income streams and revenue diversification, as well as exposure to a growth industry.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.