PFE Hit Manganese Mineralisation in Maiden Drilling

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 2,410,000 PFE shares and 227,500 options; the Company’s staff own 25,000 PFE shares at the time of publishing this article. The Company has been engaged by PFE to share our commentary on the progress of our Investment in PFE over time.

Good. Manganese has been confirmed in assay results.

Today our exploration Investment Pantera Minerals (ASX:PFE) announced results from its maiden drilling campaign at its WA manganese project.

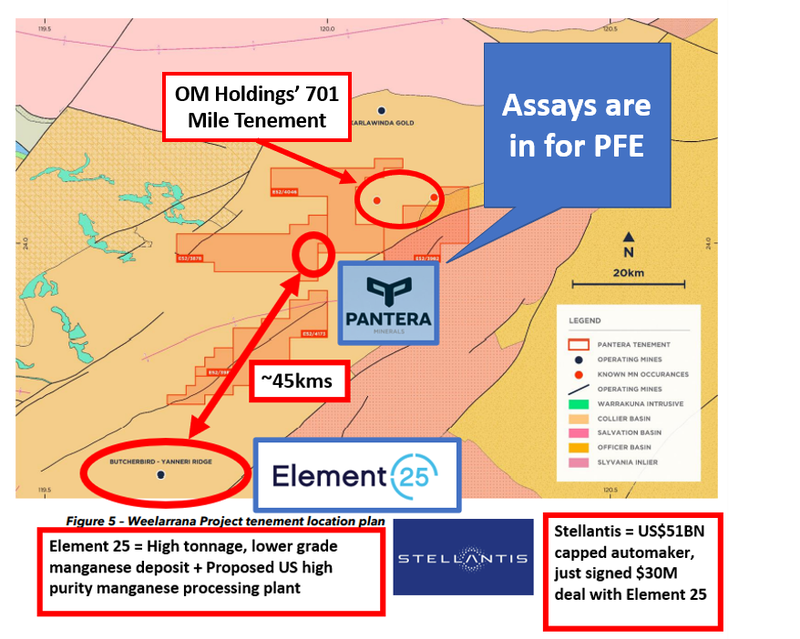

PFE’s project is roughly 45km south of producer Element 25’s resource of 263Mt of manganese ore grading ~10% Mn.

Element 25 recently secured an investment from EU auto giant Stellantis - more on that below.

Making a new manganese discovery on par with the $191M capped Element 25 would be an excellent success case for PFE.

While the $11M capped PFE is not quite there yet, PFE’s initial results have revealed that there’s plenty to look forward to in future drilling campaigns.

At this stage the manganese grades are not significantly higher than a much larger deposit like Element 25's - however we are hoping both grades and the size of the intercepts can grow in PFE's next rounds of drilling.

Typically it takes multiple drill campaigns before striking it ‘lucky’.

Broadly speaking, there are four key takeaways from today's maiden drilling program results:

- Manganese mineralisation confirmed - manganese mineralisation in Area 1 continues along 600m of strike.

- Mineralisation is open in two directions - this suggests mineralisation could extend further.

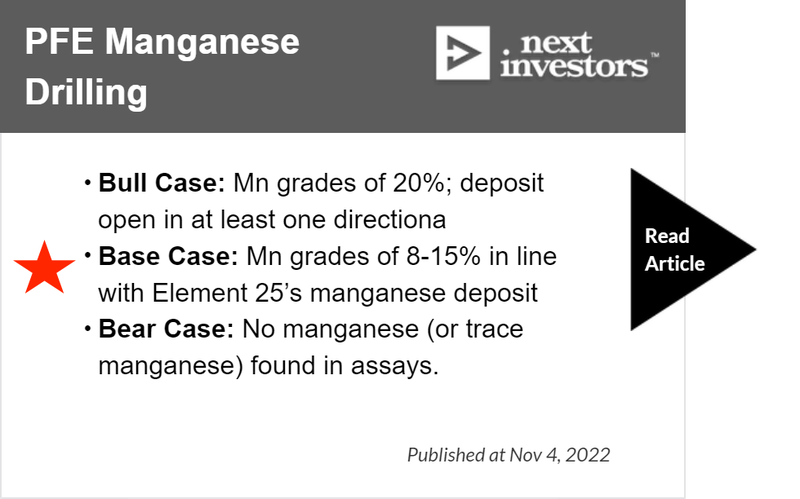

- Strong grades - the grade for the semi-massive to massive manganese area fell within our “Base Case” scenario of 8-15%.

- Shallow mineralisation - manganese was found near the surface - this makes it cheaper and easier to mine if PFE moves into production.

Given High Purity Manganese is increasingly going into EV batteries, we think that in the coming years we could see the manganese market really start to heat up.

Volkswagen, Mercedes, Tesla, and GM have all recently announced intentions to use High Purity Manganese in their cars.

Plus we’ve seen two deals in recent weeks from battery makers jostling to secure a manganese supply.

European auto giant Stellantis just signed a $30M deal to get its hands on high purity manganese from PFE’s regional peer, the ~$191M capped Element 25.

Meanwhile, our own Investment Euro Manganese signed an offtake agreement with French battery company Verkor.

You can read more about our 2023 outlook for manganese here.

PFE is aiming to make a new discovery of manganese in WA, and it's on its way based on today’s first drill results.

PFE’s drill results demonstrated manganese mineralisation to be open in two directions and strong enough results to plan a second drilling campaign in the area.

Manganese was intercepted in 16 holes of the 30 holes drilled. Of those, the three best intercepts were:

- 5m at 12.3% manganese from surface

- 3m at 19.7% manganese from a depth of 3m

- 2m at 17.1% manganese from a depth of 3m

The completed program consisted of 965m of RC drilling for 30 holes, focused on the first of 4 areas of interest.

Ahead of the drilling program we set some expectations for the company’s drill results, primarily based on manganese grades.

Today’s results fit into our “base case” scenario for the drilling campaign. We will update these results when the infill drilling is complete and the other three manganese areas are drill tested next quarter.

Our drilling results benchmark is primarily tied to manganese grades, considering PFE's proximity to existing manganese producer Element 25.

Our thinking is that a small but high grade discovery, which may on its own not be economically viable to build a mine, would be valuable to someone like the Stellantis backed Element 25 who could potentially put smaller, higher grade ore through its nearby processing infrastructure.

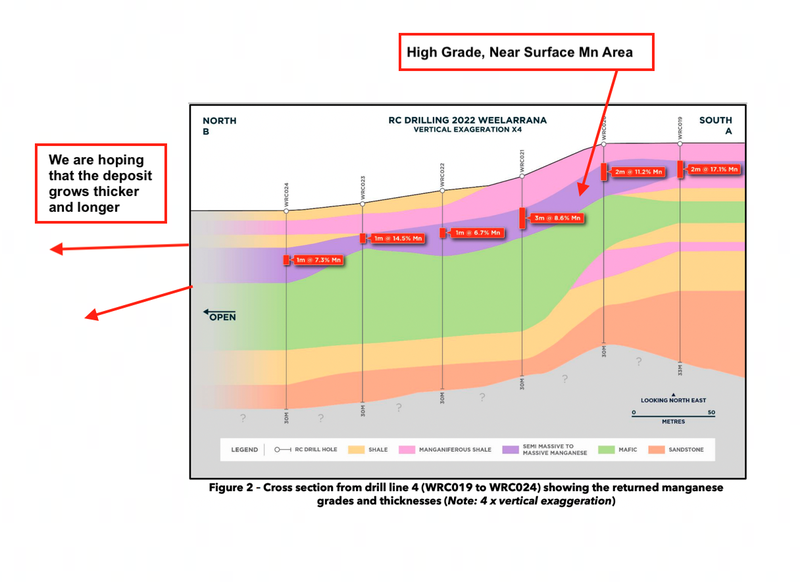

The manganese mineralisation PFE found extends over a strike length of 600m and the deposit remains open in two directions.

We hope that with more drilling, the high-grade manganese shale will extend thicker and longer.

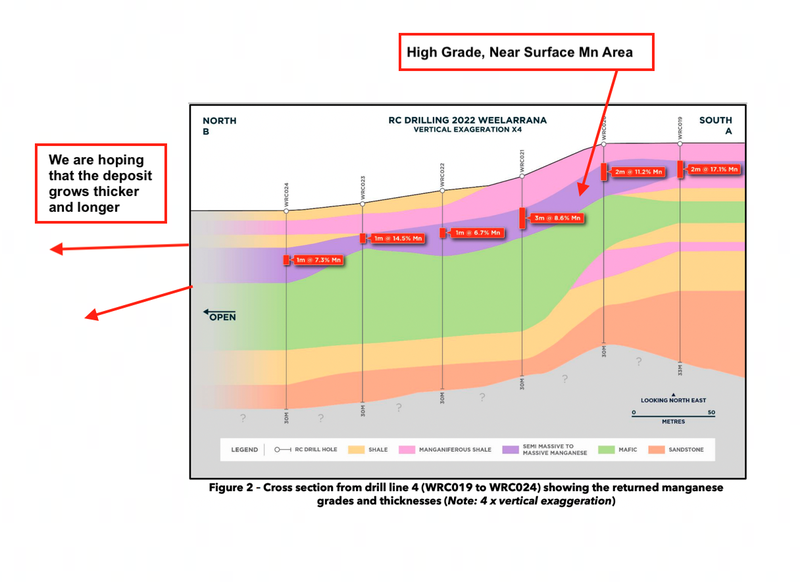

You can see the highest grade manganese as the darker purple shade in the below cross section:

As Investors, we always want to see our small cap exploration juniors drill, learn from the drilling program, and drill again with better information to hopefully one day make a commercial discovery.

Maiden drilling campaigns are a first look into what might be discovered. PFE’s initial results have revealed that there’s plenty to look forward to in future drilling campaigns at the prospect.

PFE still has three other prospective areas for manganese to drill in Q2 this year and we hope that this will help the company on the path to a commercial discovery.

On that note, let’s take a look at the Big Bet for PFE.

PFE’s Big Bet

“PFE will return 10x by making a discovery and defining a deposit significant enough to move into development studies.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved, and it will require a significant amount of luck. There is no guarantee that it will ever come true. Some of these risks we list in our PFE Investment Memo.

To help visualise what PFE has done since we Invested, check out our Progress Tracker:

More on today’s results

PFE’s Weelarrana manganese project is located near Newman in Western Australia, and covers 958km2.

Weelarrana is roughly 45km south of $191M-capped Element 25’s Butcherbird Project, which hosts 263Mt of manganese ore grading ~10% Mn.

Element 25 recently attracted an investment from giant EU automaker Stellantis, who is looking to strengthen its critical minerals supply chain, in particular manganese, for the electric vehicle transition.

Also close by and immediately along strike to PFE is $550M-capped OM Holding's 701 Mile manganese project, which has shown grades of between 8-15% manganese.

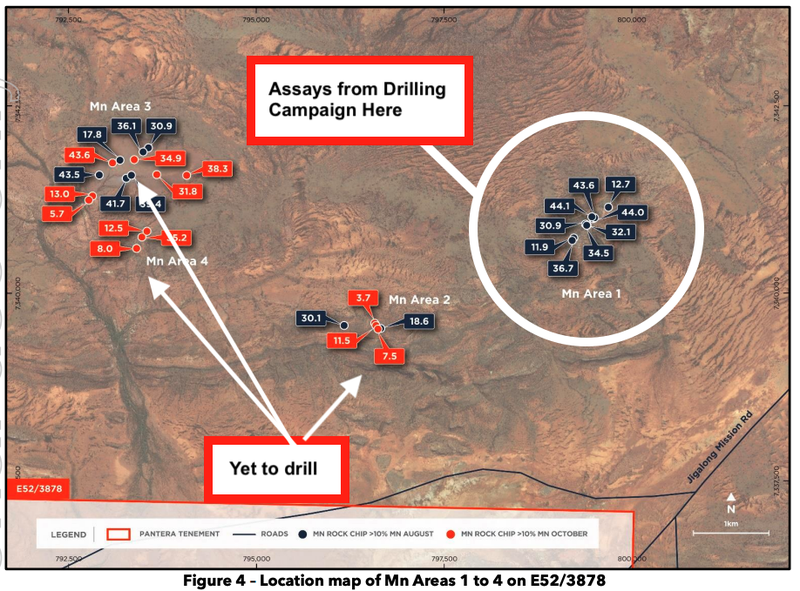

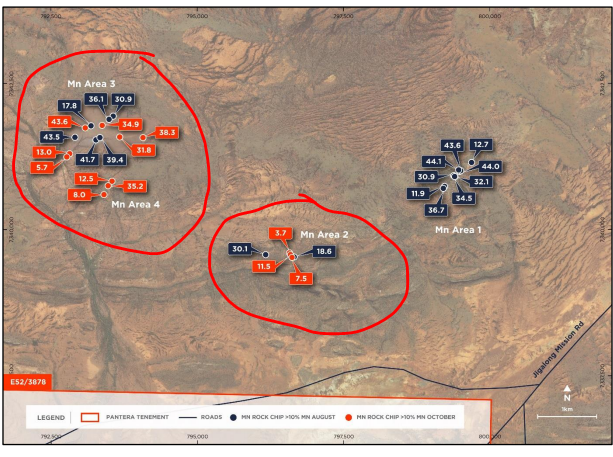

To date, PFE have identified four areas prospective for manganese at Weelarrana where high grade rock chip samples were found at surface.

PFE received permitting to drill at Area 1 first, and so launched the maiden drilling campaign here last November.

Broadly speaking, as we pointed out above, there are four key takeaways from today's maiden drilling program results:

- Manganese mineralisation confirmed - manganese mineralisation in Area 1 continues along 600m of strike.

- Mineralisation is open in two directions - this suggests mineralisation could extend further.

- Strong grades - the grade for the semi-massive to massive manganese area fell within our “Base Case” scenario of 8-15%.

- Shallow mineralisation - manganese was found near the surface - this makes it cheaper and easier to mine if PFE moves into production.

This is a good start, but PFE will still need to continue to hit high-grade mineralisation to justify a small but high-grade discovery OR thicker intercepts with a greater volume of manganese mineralisation.

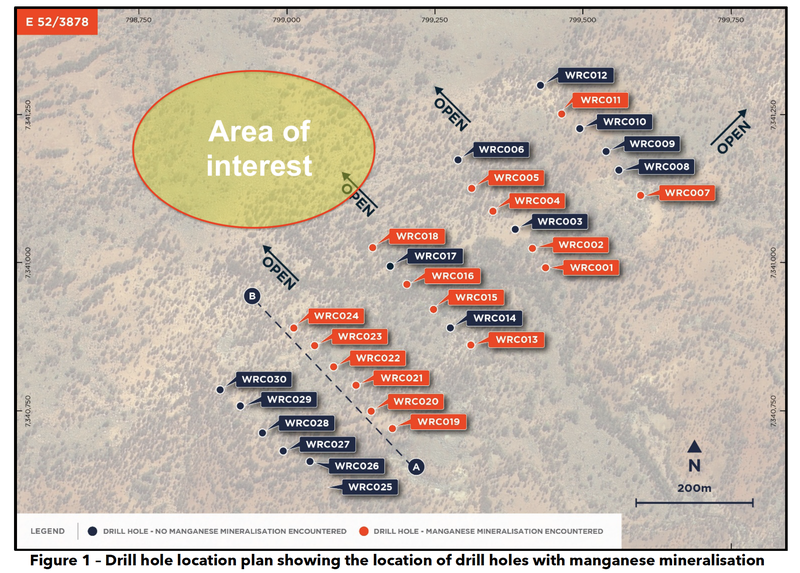

Here is the map of PFE’s drilling campaign and all of the holes drilled. Manganese mineralisation was encountered in the orange holes.

Based on the holes that intercepted manganese mineralisation, the area of interest for us and likely for PFE, is to the north and north-west, particularly along the drill line featuring holes WRC019 to WRC024.

As the cross section image below of that line of holes shows, it hit manganese mineralisation with a consistent 1m to 5m horizon of semi-massive to massive manganese shale, returning grades between 6.7% - 17.1% manganese over 250m.

This is also where a 1m interval in drill hole WRC019 returned a maximum grade of 24.1% manganese.

We are hoping that with more drilling the known deposit extends can be further extended to the north and the north west, with the potential for more high grade manganese to be defined.

Overall we’d consider this first maiden drill program to be a success as it provides us with some interesting things to look forward to in future drilling campaigns.

With some more exploration luck, we hope the market will re-rate PFE off the back of news that it has made a NEW and potentially economic discovery.

This is even more pronounced due to the fact that Stellantis has partnered with regional neighbour Element 25, shining a spotlight on the manganese industry.

You can read our earlier coverage of the Stellantis deal and what it means for PFE here:

What’s next for PFE?

More drilling at Weelarrana 🔄

PFE has planned infill RC drilling to better understand the manganese grade and thickness variability through the centre of the Mn Area 1. PFE will also look to extend manganese mineralisation to the north and east along strike in future drilling.

Drill permitting for areas 2, 3, and 4 continues to progress and going by today’s ASX announcement, we expect PFE to be drilling these areas in the next quarter.

These are areas where PFE has previously found manganese rock chips grading up to 43.6%.

Mapping of new tenements 🔄

PFE has also commenced a new round of mapping and soil and rock chip sampling to firm up more drilling targets for 2023.

Of particular interest is the newly granted tenements that sit adjacent to land held by neighbours OM Holdings and Element 25.

Another look at PFE’s polymetallic Hellcat project?

With Galena (ASX: G1A) producing first concentrate at its Abra base metals mine in WA last week, PFE may look to do a second round of drilling at its Hellcat polymetallic project.

Despite first pass diamond drilling not finding anything of material grade, the project is geologically close by to Abra so the production news may reinvigorate interest in PFE’s project.

PFE has yet to announce a drill campaign, so we will need to wait for the company to confirm its plans.

Drilling at base metals project - Frederick

We also think that a drilling campaign at the Frederick base metals project isn’t too far off, with PFE securing an Exploration Incentive Scheme grant of up to $100k last quarter for drilling. This would mark the fourth WA project that PFE has drilled.

Our PFE Investment Memo

Below is our Investment Memo for PFE where you can find a short, high level summary of our reasons for Investing.

The ultimate purpose of the memo is to record our Investment thesis in order to benchmark the company's performance against our expectations.

In our PFE Investment Memo you’ll find:

- Key objectives we want to see PFE achieve

- Why we Invested in PFE

- What the key risks to our Investment thesis are

- Our Investment plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.