GTR’s regional neighbour buying up USA uranium projects

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 16,662,000 GTR shares at the time of publishing this article. The Company has been engaged by GTR to share our commentary on the progress of our Investment in GTR over time.

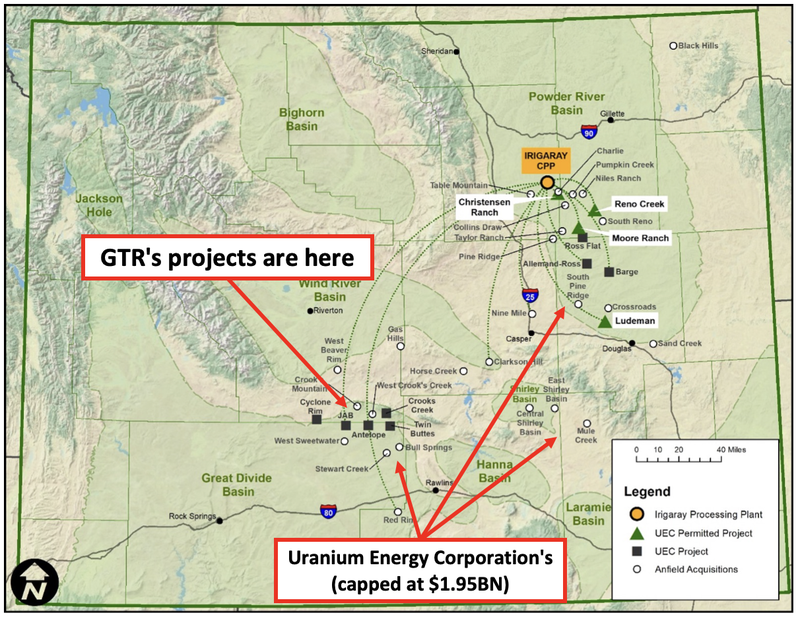

In Wyoming’s Great Divide Basin, the US capital of uranium, $1.95BN capped Uranium Energy Corporation is busy buying up its neighbours.

The billion dollar giant of the region has a “hub and spoke” strategy - bringing together projects with established uranium resources to eventually process them through its central processing infrastructure.

Its most recent transaction, completed only a few months ago, was a deal worth US$134M.

As the US works to shore up domestic energy supply, US uranium assets — particularly those in Wyoming, are becoming hot property.

That all bodes well for our uranium exploration Investment GTi Energy (ASX: GTR), which is actively drilling its US uranium projects with the ultimate aim of proving out a maiden JORC resource estimate.

Today, the $24M capped GTR announced a batch of assay results from a drilling program at the first of its projects, Thor.

Key takeaways:

- GTR hit its best intercept to date, ~22m with a uranium grade of 0.034%, giving the hole a grade thickness (GT) measure of 2.55 - over 10x the cut-off of 0.2GT.

- ~1,400m of new roll front trends (host structures for ISR uranium) found to date - total strike length of uranium mineralisation now sits at ~6.8km .

- 20 of the first 40 holes have delivered an average grade thickness of 0.73.

For some context on these results, the cut-off ‘grade x thickness’ (GT) for the typical large scale in-situ recovery (ISR) uranium project in this part of Wyoming is 0.2GT and the cut-off grade is 0.02%.

This means half of GTR’s drillholes to date have delivered results that exceed that of a typical economically viable uranium system amenable to ISR mining methods.

Importantly, GTR’s best intercept to date is almost 13x higher than the cut-off measure.

GTR is still only 6,209 metres through its planned 30,480 metre drilling program, which means we should see a whole lot more assay results over the coming months.

And looking over the results released today, we hope to see more like them to provide GTR with enough strong data to declare a maiden JORC resource for the project.

Our theory is that if GTR can prove up a resource it might just get on the radar of a major like Uranium Energy Corp as a takeover target.

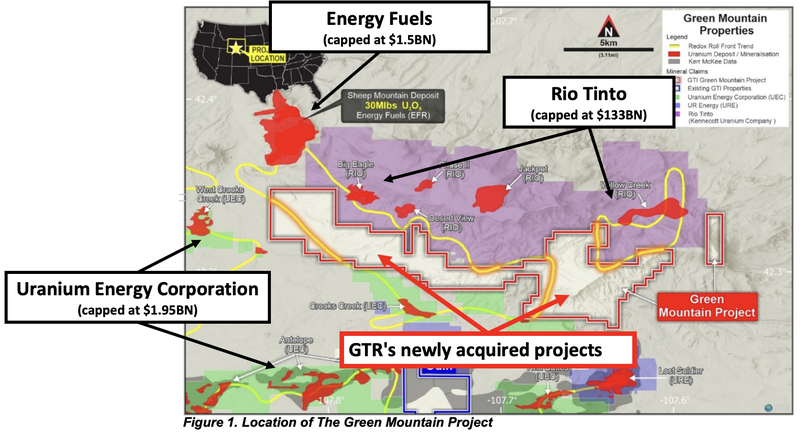

Below is an image showing GTR’s projects relative to Uranium Energy Corporation’s projects (where Uranium Energy Corp holds uranium resources of almost 100M lbs).

This brings us to our “Big Bet” for GTR which is as follows:

Our ‘Big Bet’

Prove out a large resource base in the “uranium capital” of the USA and generate offtake or acquisition interest as the USA moves to secure local uranium supply.

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our GTR Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

For our summary of GTR’s progress over time and how today’s announcement contributes to our Big Bet see our GTR Progress Tracker.

More on GTR’s news today

Before taking a closer look at GTR’s latest announcement, let’s first consider what good drilling results look like for in-situ recovery (ISR) uranium projects in Wyoming.

Ur-Energy’s Lost Creek ISR uranium deposit, which is next to GTR’s projects, has a 13M lb uranium resource at an average grade of 0.048% with an average grade x thickness (GT) of 0.2.

🎓 To see our deep dive on uranium ISR “grade thickness”, check out our previous article here: GTR uranium drilling now - to confirm previous mineralisation.

In the current drilling program, GTR hoped to encounter mineralisation of similar to that encountered at the Lost Creek deposit, which we set as an objective in our GTR Investment Memo:

Today GTR confirmed:

1. A peak intercept of 22m with a uranium grade of 0.034%, giving the hole a grade x thickness (GT) measure of 2.55.

The significance of this is that the intercept on its own is almost ~13x the typical economic cut-off for grade thickness on ISR projects in Wyoming.

2. ~1,400m of new roll front trends (host structures for ISR uranium) found to date - total strike length of uranium mineralisation now sits at ~6.8km.

This is important because drilling has now extended the known strike length of uranium mineralisation by ~1,400m across GTR’s projects.

Better yet, all of this sits outside of the areas GTR has already mapped — this is the equivalent of step out drilling which has returned mineralisation.

GTR’s mapped roll fronts now extend over a total of ~6.8km.

Think of this as the total strike length of uranium mineralisation across the areas that GTR has already mapped at its Thor Project.

3. 20 of the first 40 holes have delivered an average grade x thickness (GT) of 0.73.

We think this is a good start to GTR’s drilling program with 50% of all holes completed returning intercepts well above the required grade thickness cut off of 0.2.

GTR has now completed the first 6,209m of drilling — just a fraction of the planned total of 30,480m.

Drilling is expected to continue through to the end of the year, so we expect to see a steady stream of newsflow over the coming months.

Consolidation by US uranium majors in Wyoming - could GTR be a target one day?

One of the key reasons we first Invested in GTR was because of the company's projects being located in Wyoming — the uranium capital of the USA.

The region’s dominance in the domestic US uranium industry is highlighted by investments from billionaires like Warren Buffet and Bill Gates who are fronting US$4BN for a new nuclear reactor in the region.

The US government has also pledged to throw more than US$10BN at the domestic nuclear energy sector, so with uranium being the fuel source for nuclear power, companies with local US uranium resources stand to benefit and attract interest from the uranium producers.

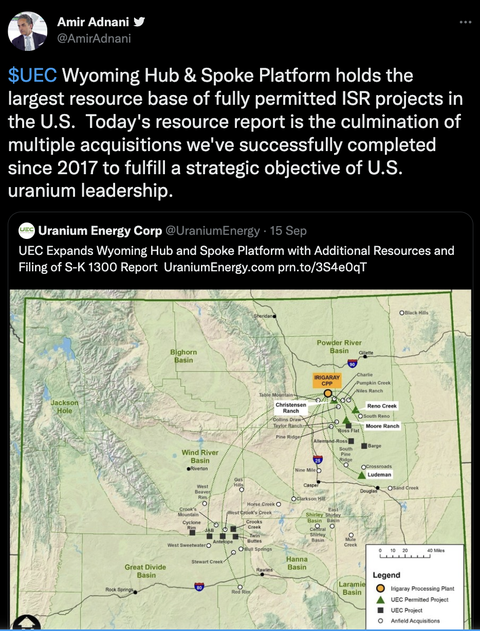

We have already seen $1.95BN capped Uranium Energy Corporation pop up as a player looking to establish some level of regional dominance with its acquisition of its neighbour Uranium One.

That deal was worth ~US$134M and took the company’s resource base to almost 100M lbs of uranium.

The deal and accompanying tweets from Uranium Energy Corporation’s CEO clarified a number of points, as follows:

1. The majors have an appetite for ISR uranium projects that come with JORC resources.

2. This region in Wyoming provides a significant domestic base for uranium production.

3. Low-cost domestic ISR uranium projects are critical to US energy independence in a world where security of supply is an issue.

Click here, or on any of the images above, to read the full twitter thread.

We hope that this year's drilling can take GTR a step closer to putting together an achievable exploration target, or better yet (our bullish case expectation), a maiden JORC resource estimate.

Given the location of GTR’s projects, this would surely bring it to the centre of the majors’ minds.

What’s next for GTR?

Drilling results from the 100,000 ft exploration program 🔄

GTR is just over one-fifth of the way through its planned ~30,480m drilling program, meaning GTR still has plenty of drilling newsflow to come.

Looking ahead to the assay results, we will be watching to see if GTR reports similar intercepts to those at the nearby Lost Creek Project.

The Lost Creek ISR uranium deposit has a 13Mlb (measured/indicated resource) at an average grade of 0.048% uranium with an average grade x thickness (GT) of 0.2.

We want to see GTR discover and confirm enough uranium mineralisation to put together a maiden JORC resource estimate and have set bull/base/bear case expectations as follows:

Target generation works at newly acquired ground 🔄

GTR only recently acquired ground along a border shared with Rio Tinto and within close proximity to Energy Fuel’s (capped at $1.5BN) 30Mlb Sheep Mountain deposit.

It is still early days for this project but we want to see GTR detail a forward exploration program and start putting together high priority drilling targets.

Below you can see where GTR’s newly acquired ground sits relative to its neighbours.

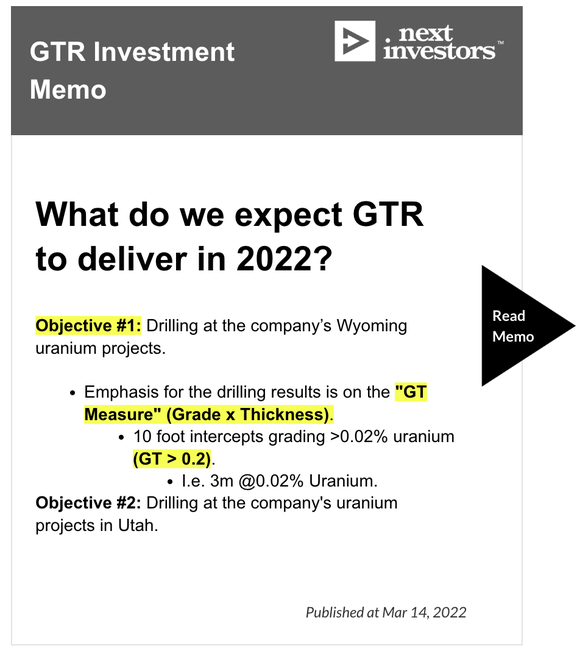

Our 2022 GTR Investment Memo

Today’s news contributes to key objective #1 of our GTR Investment Memo.

Below is our GTR Investment Memo, where you can find a short, high level summary of our reasons for Investing.

The ultimate purpose of the memo is to record our current thinking as a benchmark to assess the company's performance against our expectations for the following 12 months.

In our GTR Investment Memo, you’ll find:

- Key objectives for GTR for the coming year - starting from March 2022

- Why we are Invested in GTR

- What the key risks to our Investment thesis are

- Our Investment plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.