EMN signs offtake term sheet with French battery maker to supply Renault

Disclosure: S3 Consortium Pty Ltd (The Company) and Associated Entities own 1,490,000 EMN shares at the time of publishing this article. The Company has been engaged by EMN to share our commentary on the progress of our Investment in EMN over time.

It’s the news we wanted for this Investment.

An offtake term sheet - and hopefully the first of many.

Today our European battery metals Investment Euro Manganese (ASX:EMN) signed an offtake term sheet with French battery manufacturer Verkor.

Verkor is a French battery manufacturing company founded in 2020, with some serious backers.

Among those involved with Verkor are Renault Group (big French automaker), Schneider Electric (massive €83BN capped French multinational) and none other than EIT InnoEnergy.

EIT InnoEnergy invested in EMN and helps facilitate these types of deals.

It's the same EIT InnoEnergy that backed Vulcan Energy Resources at 51c in May 2020.

Today’s offtake term sheet is for EMN to deliver its high purity manganese products into Verkor’s next-gen EV batteries in Europe.

Verkor is currently busy making its first gigafactory a reality. It is seeking a reliable, local EU supply of manganese - one that's traceable, has excellent ESG credentials and a low carbon footprint.

EMN can deliver this.

Pricing for the product with rise and fall based on an index-adjusted western benchmark price (with a floor price) - this is for a manganese product that ticks all the boxes from an ESG perspective outlined above.

This is EU made manganese, with a low carbon footprint, and EU automakers are prepared to pay a premium.

Offtake tonnages are equivalent to a percentage of EMN’s annual High Purity Manganese Sulphate Monohydrate (HPMSM) on a take or pay basis.

Deliveries will commence from first production, expected in 2027. The deal is initially for eight years of production, with potential for renewal.

Whilst the deal at this stage is ‘non-binding’ and there are some conditions, it's an excellent start as EMN goes about sourcing funding for construction - proving you have clear customer demand to construction financiers makes getting that finance significantly easier.

Why else do we think today’s news is so important?

Long time readers will know of Vulcan Energy Resources - another European battery metals focused Investment of ours - one of our best ever Investments.

We tend to mention it a lot.

Vulcan went down a similar pathway to EMN, looking to deliver a low carbon emission battery material product to the battery metals hungry European market.

We first Invested in EMN shortly after Vulcan - while Vulcan delivered constant progress and announcements over 2020 and 2021 resulting in a sustained and significant share price re-rate, EMN was a bit slow with news and progress during that time.

While EMN’s share price has performed well, we feel it is yet to live up to its full potential in the current battery metals boom.

As an example, Vulcan signed its first binding offtake agreement with electric vehicle (EV) battery maker LG in July 2021 and then backed it up with four more offtake agreements shortly after.

Over that period VUL’s share price went from ~$6 per share to reach its all time high of just under $17 in September 2021.

VUL’s market cap got as high as ~$1.8BN. It’s currently capped at $1BN.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

And whilst we can't predict what will happen on the market - EMN says it is now on the cusp of announcing a similar series of important offtake deals - but this time in the manganese space.

For those who are not familiar with manganese, it is a critical raw material used in nickel-manganese-cobalt batteries. These batteries are typically used in high performance cars.

While manganese hasn't been in the headlines as much as lithium or cobalt, it is still a critical raw material for battery materials supply chains.

Commodities market research firm, CPM Group, forecasts a 30-fold increase in the use of manganese in EV batteries in the 15 years from 2021 to 2036.

This will mean the battery materials market needs more and more manganese.

EMN also confirmed that today’s announcement is the “company’s first term sheet for a long-term offtake” and that “the Company anticipates more term sheets or agreements will follow in the near term as a result of the offtake tender process, which is currently underway”.

To us thats a big clue there could be more offtake deals on the horizon for patient EMN holders.

Just like the jostling to secure European lithium supply that happened over Vulcan, we think that EMN could also deliver offtake after offtake agreement.

Once the first domino falls, the rest generally follow.

We think the company’s location in Europe will be the key demand driver for EMN’s manganese.

EMN stands to become the only significant primary producer of battery grade manganese products in Europe, helping to improve the security of Europe’s battery raw material supply.

For context, Europe currently imports 100% of its manganese requirements from China supplying over 90% of the global high purity manganese market.

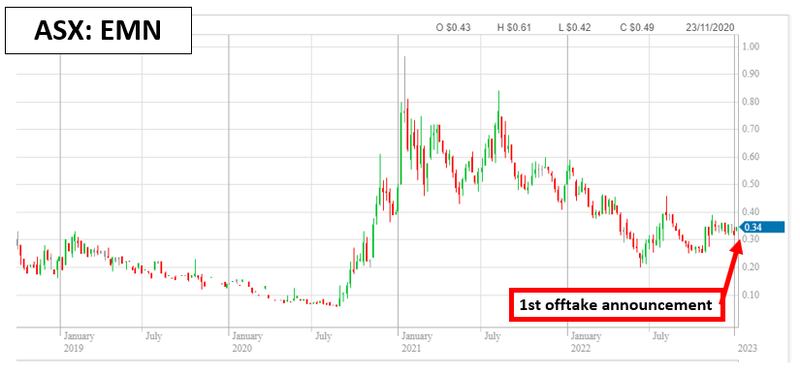

Here is how EMN’s share price chart looks like now:

And here’s where VUL signed its first offtake deal:

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

This brings us to our “Big Bet” for EMN which is as follows:

Our EMN Big Bet:

“EMN significantly re-rates to a $1BN+ market cap on becoming a High Purity Manganese producer.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved, and it will require a significant amount of luck. There is no guarantee that it will ever come true. Some of these risks we list in our EMN Investment Memo.

To visualise what EMN has done since we Invested, check out our Progress Tracker:

More on why EMN offtake matters, and who is Verkor?

As we mentioned above, we think EMN’s offtake deal with Verkor could be the start of a series of offtakes that hopefully together re-rate the EMN share price as competitive tension around its high purity manganese product increases.

With the growing importance of manganese in next-gen battery chemistries - we think EMN has a key role to play in ensuring Europe has access to sustainable, low carbon manganese.

In short, we think today’s offtake deal shows that EMN’s project is an important source of critical minerals for Europe AND this should help EMN further advance project financing.

Here’s a little more on EMN’s new offtake partner...

Verkor is a French battery manufacturing company founded in 2020, with some serious backers. Verkor has quickly raised €370M to build out French/European gigafactory battery capacity.

Among those involved with Verkor are Renault Group (big French automaker), Schneider Electric (massive €83BN capped French multinational) and none other than EIT InnoEnergy (source):

EIT InnoEnergy is the exact same EU backed group that invested in Vulcan Energy Resources at 51c in May 2020.

It’s an arm of the European Battery Alliance, which leads the organisation's industrial stream.

Most importantly - it is also a shareholder in EMN and facilitates these types of deals.

So it appears that EMN’s relationship with EIT InnoEnergy has borne fruit as they may have facilitated the introduction to Verkor.

Verkor has big plans.

The company plans to raise a further €1.6BN to build out its first gigafactory, a 16 gigawatt-hour (GWh) factory in Dunkirk that should start production in 2025 to supply high-performance batteries for Renault EVs.

That 16GWh metric is enough for around 300,000 EVs a year and the ultimate goal is to increase its production capacity to reach 50 GWh by 2030.

Starting early this year, Verkor plans to build a “megafactory” - a factory producing 100 to 150 MWh of batteries - that will produce thousands of cells per day for Renault to test and use in its EVs.

We suspect that EMN’s demonstration plant products could be involved in this testing.

As a final note on today’s deal, we see this as validation of our view that EMN’s CEO Matthew James is a highly proficient dealmaker and capable of delivering key objectives for the company and our EMN Investment.

A big tick mark for EMN and our Investment Thesis...

All up, we see the Verkor deal as a watershed moment for EMN, and we’re enthused about the company’s project after delivering on this key objective from our EMN Investment Memo.

EMN said the company was targeting offtake deals - and yes whilst not ‘binding’ yet - EMN has delivered.

What’s next for EMN?

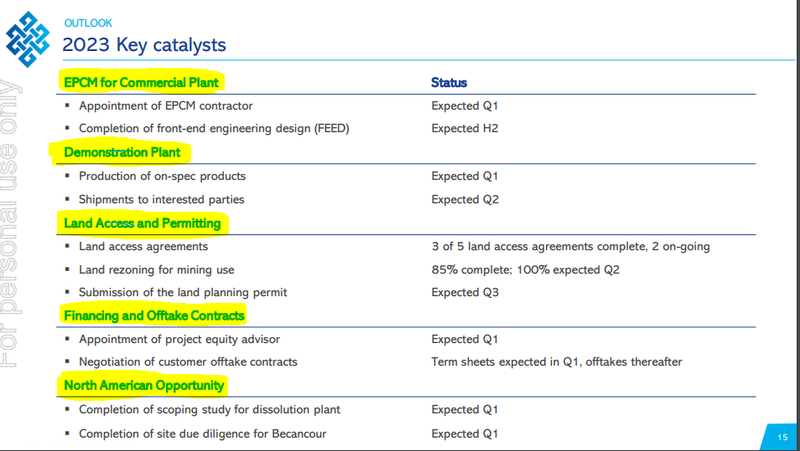

Here is what we will be watching for from EMN over the next 12 months:

Demo plant and Commercial plant progress 🔄

See our Quick Take on the latest for the construction of EMN’s demo plant: Demonstration plant to start producing offtake samples.

We hope that by now the construction is largely complete and product samples have started being produced.

At the same time we are looking forward to the front end engineering design (FEED) for the commercial plant due in H2 this year.

Progress on offtake front 🔄

We note that today’s announcement with Verkor is a non-binding term sheet and still needs to be formalised into an official offtake agreement.

EMN mentioned that this is the “company’s first term sheet for a long-term offtake” and that “the Company anticipates more term sheets or agreements will follow in the near term”.

As mentioned earlier in today’s note we are hoping today’s news is the first offtake announcement of many this year.

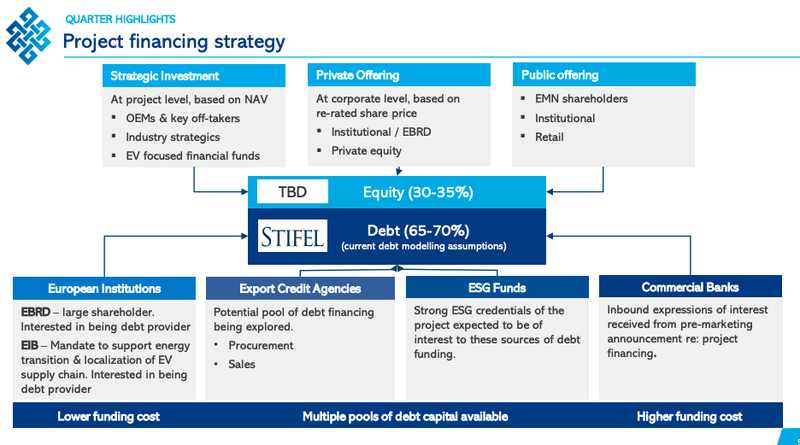

Progress with project financing and Final Investment Decision (FID) 🔄

EMN’s previous guidance was for a Final Investment Decision (FID) to be made by the second half of this year.

To get to a FID, EMN will need to lock in project financing and on this front we expect EMN to lean on:

- Its finance advisor, US financial services company Stifel (market cap ~US$6BN).

- EMN’s existing large shareholder - the European Bank for Reconstruction and Development (EBRD)

- European debt provider - European Investment Bank (EIB) which is mandated to support energy transition projects to help build out a local European battery metals supply chain.

This is the key slide from the latest EMN presentation:

Delivery of North American Scoping Study 🔄

By 2031, North America is expected to require over 200kt of High Purity Manganese annually. So it makes sense that EMN is pursuing opportunities in North America (more specifically Quebec).

In addition to the expected demand from a quickly growing US EV market, the US recently passed the Inflation Reduction Act which builds in specific incentives for localisation of the battery supply chain.

Earlier this week we saw global automaker Stellantis (capped at $73BN) throw up to $30M at ASX listed Element 25 for a partnership on a high purity manganese facility in the USA.

Clearly there is an interest in these North America based battery metals processing facilities and we think EMN could start to get a lot more interest based on this after its scoping study is completed.

Permitting 🔄

We’re looking for EMN to secure a “Final Mining Permit” the last bit of the puzzle for EMN to conduct any commercial extraction and processing activities at the Project.

We expect this to be largely a formality given EMN is rehabilitating an old mining deposit and cleaning it up is desirable - but European regulatory bodies can move slowly and this is an important step, especially for financiers.

Risks

While we see this as a de-risking event for EMN across the “product risk” and “financing risk” aspects of our EMN Investment Memo, EMN still has significant work to do in developing its project and completing its permitting process.

We note that EMN recently submitted its final Environmental & Social Impact Assessment to the Ministry of Environment in the Czech Republic and the environmental approval process is expected to take six months.

Beyond that, there’s a risk that the market for high purity manganese products enters a downturn, either due to a supply glut or demand impacts if EV battery manufacturers opt for alternative battery chemistries.

Our EMN Investment Memo

Click here for our EMN Investment Memo which includes:

- Key objectives for EMN

- Why we Invested in EMN

- What the key risks to our Investment thesis for EMN

- Our Investment plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.