88E is Moving East to Chase Success

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 11,785,000 88E shares at the time of publishing this article. The Company has been engaged by 88E to share our commentary on the progress of our Investment in 88E over time.

Energy security is high on the agenda for the US.

As Western governments stop purchasing Russian crude oil, the US is looking locally to shore up energy supply.

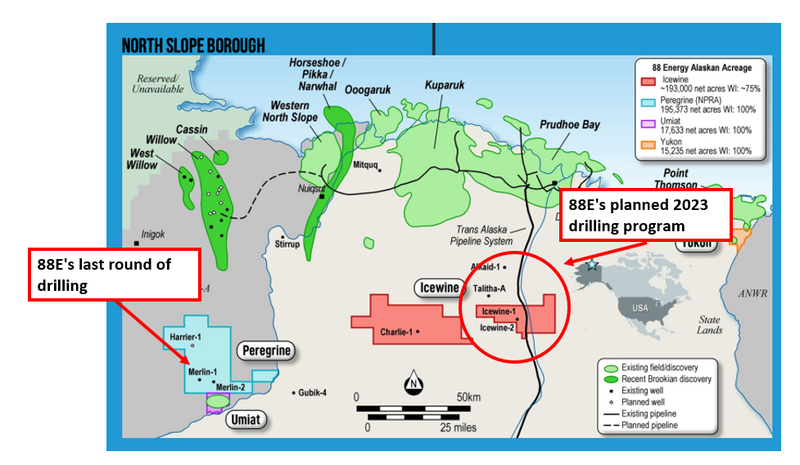

On the North Slope in the US state of Alaska, 88 Energy (ASX:88E | OTC: EEENF) has been actively exploring for oil for many years now, regularly drilling every year in the hope of making a large oil discovery.

But what’s different this time is what its direct neighbour is up to...

For the last 18 months, 88E had been busy drilling “Project Peregrine” on the western side of the North Slope.

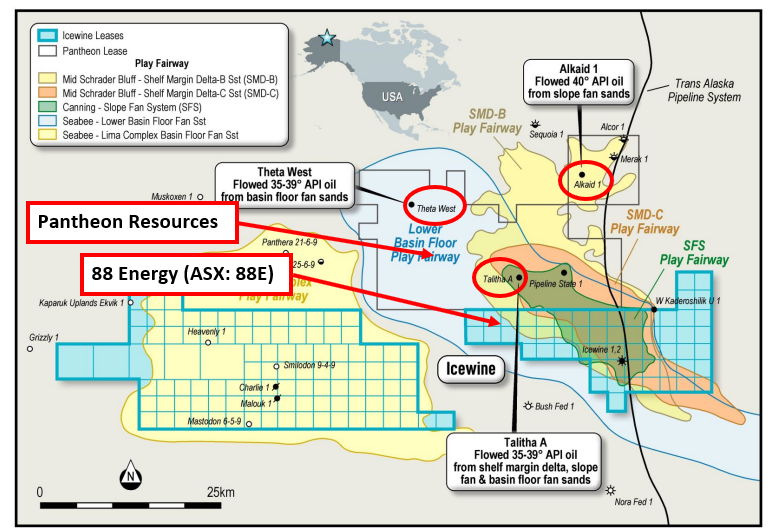

That whole time to the east of the North Slope, 88E's neighbour UK listed Pantheon Resources has been busy drilling next door to 88E's original "Project Icewine".

Pantheon has now drilled three out of three successful wells next door to 88E’s Icewine.

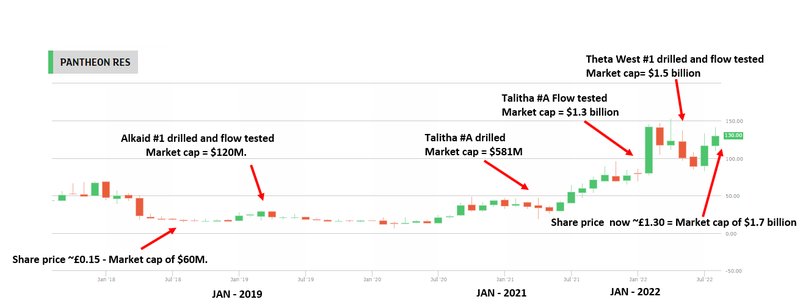

Since it drilled its first well in 2019, Pantheon’s market cap has gone from ~$60M to now sit at $1.7BN.

This is the kind of result we originally Invested in 88E to achieve, but 88E just didn’t have the critical “exploration luck” over the last few years.

So now it’s time for 88E to try and “manufacture some luck” based on the success of Pantheon.

Pantheon is in the middle of drilling its first ever horizontal well, where it is looking to conduct a long term production test.

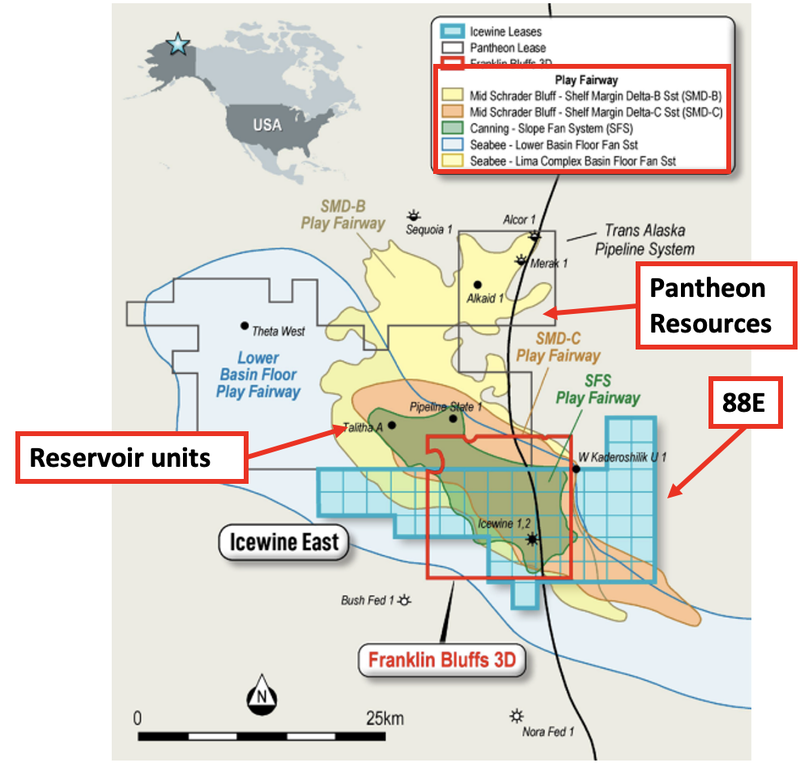

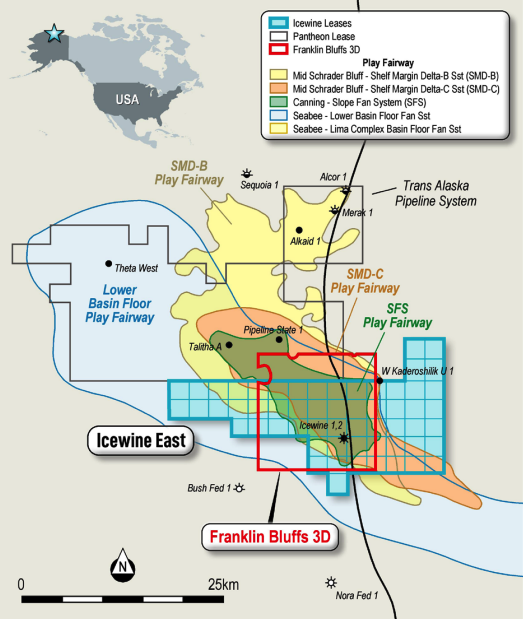

What’s really interesting is that Pantheon’s drilling is targeting the same reservoir units that have been independently assessed to extend south into 88E’s ground.

88E is now planning a 2023 drilling program of its own to see if it can replicate Patheon’s exploration success.

With Pantheon’s technical director Bob Rosenthal’s saying that the company is “now on the path to unlocking an enormous basin play”, our big bet for 88E is to successfully drill its own well and position itself as part of this emerging “basin play”.

If 88E can prove that the same reservoir units that Pantheon is hitting extend into its ground and then replicate Pantheon's drilling success, we would hope to see its market cap move closer to that of its $1.7BN neighbour.

88E is currently capped at $164M.

Whilst 88E is in a “quiet period’, we expect increased investor interest in the company as it gets closer to drilling which it is targeting in the first six months of 2023.

To help us track the history and progress of 88E’s next drilling campaign and the significance of Pantheon’s activities, we are maintaining the below project tracking document for the upcoming 88E drilling program.

We will be updating this slide deck as 88E and its neighbour makes progress in and around the Icewine East project.

View our 88E Icewine East tracking document here

While 88E was busy drilling its Merlin wells over at its Project Peregrine near ConocoPhillips’ Willow Oil Project, its direct next door neighbour at Project Icewine, UK-listed Pantheon Resources, drilled three wells and went from a ~$60M to a $1.7BN market cap.

Pantheon has now repeatedly proven the deliverability of high quality light oils over its project area and is now focused on proving that the project can produce oil at commercially viable flow rates.

Over the years, ~US$300M was spent on Pantheon’s project to get it to where it is today — 17 billion barrels of oil in place and a 2.2 billion barrel of recoverable resource.

Now, Pantheon is in the middle of drilling its first ever horizontal well and has already hit four separate reservoir units ahead of a long term production testing program.

Off the back of just the preliminary results from that well, Pantheon’s market cap increased by more than $300M.

Interestingly, all four of the reservoirs that Pantheon intercepted are interpreted to be extending into 88E’s ground to the south.

In 2023, 88E plans to drill its own well to see if the reservoirs do in fact extend onto 88E’s ground.

Pantheon’s plan is to conduct a long term production test with its latest well, with a view of becoming an oil producer by October 2023.

This means 88E can just sit back and watch its neighbour de-risk the ground as it plans its own exploration drilling.

However, 88E hasn't been entirely quiet and waiting around.

Whilst watching Pantheon’s successful drilling programs, 88E acquired some 3D seismic data over its acreage and commissioned the first ever independent prospective resource estimate for Icewine East.

That prospective resource came in at 1.03 billion barrels on a gross mean unrisked basis.

Given 88E’s 75% working interest in the project, this gives the company a net entitlement to the prospective resource of 647 million barrels of oil.

Regular readers know that we like to Invest in oil and gas explorers when they are temporarily out of favour, with the market looking elsewhere, and when it is very far away from a big drilling event.

Readers will also know that we like to Invest in explorers that are taking a big “swing for the fence” style approach to exploration - chasing a mammoth discovery.

A mammoth discovery in a small cap explorer like 88E is a binary drilling event - where 88E either makes a company making discovery that re-rates the share price many times over, or it finds nothing and the share price goes down.

We think 88E is currently in that sweet spot where it fits all of these criteria:

- 88E is currently in a quiet period - The market sold down 88E post the Merlin-2 well, with the share price down ~80% from before the drilling event.

- 88E is preparing to drill a big oil and gas target - The company has started planning for a 2023 flow test at its Icewine East project bordering its multi billion dollar neighbour Pantheon Resources.

- 88E’s big drilling event is not until next year - The proposed 2023 drilling program over the Icewine East project is still in the planning stage.

This is why we increased our Investment in the recent placement at 0.9c per share and plan to follow our tried and tested oil and gas Investment strategy.

We have Invested early, we will now patiently hold onto our 88E position hoping to see the share price re-rate ahead of drilling, after which we can Free Carry and potentially Take Profit on our Investment, while holding a material position into the result.

There are many months left to go before the 2023 drilling, so there is plenty of time for what we hope will be the usual 88E “pre-drill re-rate”.

To get the project drill ready and shore up the balance sheet, 88E recently raised $14.9M at 0.9c per share.

This adds to the company’s existing cash reserves of $6.1M (as of 31 July 2022), which should see the bank balance sit at ~$21M post raise.

We expect to see 88E systematically de-risk its project over the coming months by reviewing all available data and selecting the best location to drill its 2023 well.

We obviously want to see the company drill where it thinks it will have the highest probability of success.

The prospective resource estimate from a few weeks ago marks the first key data with respect to 88E’s forward exploration program at Project Icewine since we launched our latest 88E Investment Memo in June of 2022.

Our memo details everything else we want to see 88E achieve, the reasons why we hold 88E in our portfolio, and the key risks to our Investment thesis. To see the memo, click on the image below.

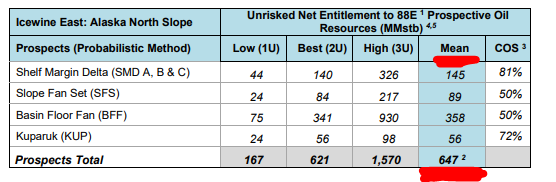

88E’s 1.03 billion barrel prospective resource over its Icewine East Project

Together with its recent capital raise, 88E put out a maiden prospective resource estimate over its Icewine East project.

The independent prospective resource came in at 1.03 billion barrels on a gross mean unrisked basis.

88E has a ~75% working interest in the project meaning its net unrisked prospective resource is ~647 million barrels of oil.

Importantly the prospective resource estimate has been mapped across the same reservoir units Pantheon Resources drilled its Alkaid-1, Talitha-A and Theta West-1 and confirmed light oil with successful flow rates.

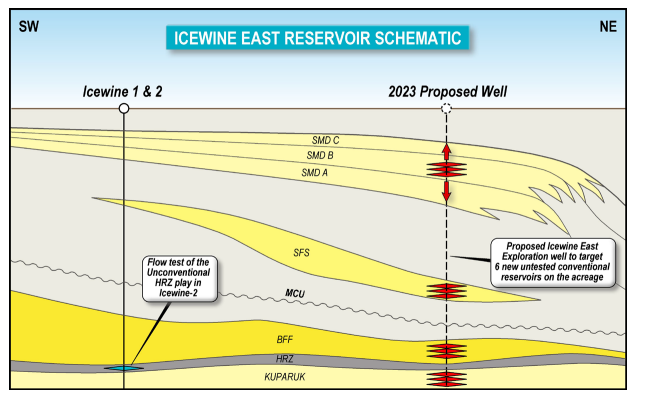

In addition, in terms of play targets, it's worth noting that Icewine East is completely independent of the Icewine West acreage where 88E previously drilled the Charlie-1 well.

With the recently released, independent prospective resource estimate outlining the potential scale of 88E’s project, let's take another closer look at what its much larger neighbour has been up to a stone's throw away.

What has 88E’s $1.7BN neighbour been up to?

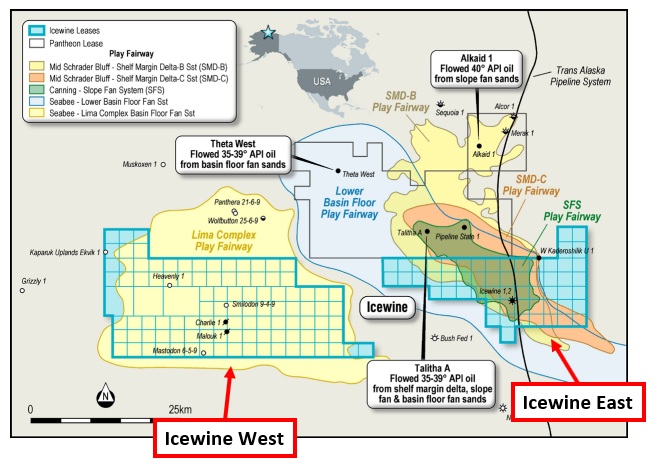

88E’s “Icewine East” project is directly next door to UK listed Pantheon Resources.

Pantheon’s ground has had over US$300M spent on exploration over a decade.

Over the last ~18-24 months, Pantheon drilled and flow tested three different wells with all of them confirming reservoir deliverability of light, sweet oil (the type of oil that is easiest to produce and generally makes the most money).

Below is our quick recap of these three wells and a map showing where they sit with respect to 88E’s ground:

We also cover each well in detail in our tracking document:

View our 88E Icewine East tracking document here

Here's a quick summary of Pantheon’s trifecta of successful wells:

Talitha-A:

- Vertical well completed

- The well flowed high quality light oils.

- Flow test showed a production rate of ~73 barrels of oil over a three day test period.

Theta West-1:

- Vertical well completed

- Confirmed deliverability of high quality light oil.

- Flow test showed a production rate that averaged ~57 barrels of oil per day with peak rates exceeding 100 barrels of oil per day over 2.5 days.

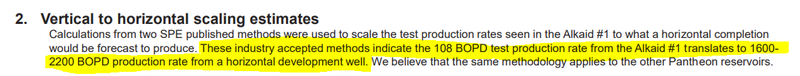

Alkaid-1:

- Vertical well completed

- Confirmed deliverability of light, sweet oil.

- Flow test showed a production rate of ~108 barrels of oil per day.

That’s three wells from three delivering high quality, light flowing oil.

The results have proven Pantheon’s theory that there is a potentially commercially viable, working petroleum system on its acreage.

We think the following comment from Pantheon’s technical director Bob Rosenthal’s summarised Pantheon’s results perfectly:

Pantheon almost immediately followed up these wells with a plan to go back to drill a horizontal well so as to target a bigger section of the reservoir units identified.

Near the Alkaid #1 well, Pantheon confirmed its plans to drill a horizontal well that will target more of the reservoir unit with the aim of obtaining a 1,600 to 2,200 barrels of oil per day production rate.

And so Alkaid #2 was born - Pantheon’s latest and greatest horizontal well.

07 July 2022 - Drilling at the Alkaid #2 well started.

29 July 2022 - Pantheon completes drilling to a total VERTICAL depth of 8,950 feet hitting oil across all three of the reservoir units being targeted.

- The Shelf Margin Deltaic - Net ~83m oil bearing reservoir encountered which was thicker and of better reservoir quality than pre-drill estimates.

- The Alkaid anomaly - Net ~47m oil bearing reservoir encountered with the interception exceeding pre-drill expectations of reservoir thickness and quality.

- The Alkaid Deep anomaly - Reservoir quality encountered was better than pre-drill expectations. Analysis is currently underway to determine net reservoir thickness.

Importantly these are all the same reservoir units that are interpreted to extend into 88E’s ground to the south.

We also noted that the UK markets re-rated Pantheon by ~20% adding ~$300M to Pantheon’s market cap after this bit of news.

18 August 2022 - HORIZONTAL drilling section of the Alkaid #2 well completed.

Pantheon’s preliminary analysis is showing that reservoir characteristics are remaining strong over the entire horizontal section.

Pantheon said in its press release that “initial analysis indicates significant improvements in reservoir quality which has the potential to lead to upgrades of the current resource estimates for all targeted horizons”

The NEXT step for Pantheon is to stimulate the well and do a long term production test.

The flow test from the long term production test will ultimately determine whether or not the well can become an economically viable producer.

This is where we think Pantheon’s work relates to 88E.

If Pantheon puts out commercially viable flow rates, we suspect the market will start to show an interest in 88E, speculating on the probability of the reservoirs extending into 88E’s ground.

So why should 88E care?

We think that there is a good chance that 88E’s ground forms part of this “enormous basin play”.

Having recently acquired some 3D seismic data over its Icewine East acreage and then calibrating it with all of the public data available from Pantheon/previous exploration campaigns in the region, 88E thinks Pantheon’s reservoir units could extend south into its ground.

In fact, the consultants brought in to review the 3D seismic data also reached the conclusion that ALL of Pantheon’s reservoir units extend onto 88E’s Icewine East acreage.

88E has already started planning for its own exploration program right near this border and will be targeting its net mean unrisked prospective resource of 647 million barrels of oil.

The image below really helps us understand how an exploration well would look targeting these reservoir units - as you can see, these are different reservoir targets to the previous Icewine 1 and 2 wells drilled a few years back.

We want to see 88E plan and optimise the highest priority drilling location over its Icewine East acreage and to test it with the ultimate aim of replicating its UK neighbour's success.

More on the capital raise

Together with the independent prospective resource estimate over Icewine East, 88E also raised $14.9M at a share price of 0.9c in recent weeks.

This adds to 88E’s existing cash reserves of $6.1M (as of 31 July 2022), meaning the company should have ~$21M to finance its current and upcoming exploration work.

We note that 88E will likely need to raise again closer to any drilling event - but hopefully, by that time, the share price is significantly higher - and this might also depend on whether 88E can seal a farm in deal.

88E specifically mentioned that it plans to use the new funds for the following:

- Exploration program at the Icewine East project (where 88E just put out a gross unrisked mean prospective resource of 1.03 billion barrels of oil)

- New ventures and portfolio expansion opportunities (this looks interesting - we will keep an eye out here to see if any new project gets added to 88E’s portfolio).

The shares from this placement were issued yesterday, which means ~1.6 billion shares were issued to investors who participated in the raise.

We expect to see 88E’s share price trade sideways for a while whilst these shares are churned through on market.

What’s next for 88E

Exploration program over Icewine East acreage 🔄

In its post capital raise announcement, 88E confirmed that the company is advancing planning works over the Icewine East project.

As part of this work, we expect to see an update from 88E outlining its highest priority drill targets. The ultimate aim of which is to conduct at least one flow test across all four of the key reservoir targets inside its acreage in 2023.

Funding agreement for a drilling program at Icewine East 🔄

Even having just raised capital, we still think 88E will need to bring in a funding partner to fully finance a future drilling program.

88E has managed to sign a farm-in agreement before for its Icewine West project, with Premier Oil in 2019.

We now want to see 88E replicate that previous farm-in success for Icewine East.

Things working in 88E’s favour to attract a farm-in partner in the near term are:

- The much higher oil price environment - offering higher rewards for successful high risk oil exploration.

- 88E’s neighbour drilled successful wells directly to the north and is valued much higher - making it an easier investment case for 88E.

- Independent consultants have confirmed that all Pantheon’s reservoir units run directly onto 88E’s ground.

- 88E’s ground now has an independent prospective resource net of 647 million barrels of oil to 88E.

- Demand for domestic discoveries in safe OECD jurisdictions is much higher compared to other regions of the planet. 88E’s ground is in Alaska, USA.

88E hinted at a funding deal being worked on in the background in its recent investor presentation, so it wouldn't surprise us if the company was already fielding discussions with interested parties.

What could go wrong?

Our 88E Investment Memo

Below is our June 2022 88E Investment Memo where you can find a short, high level summary of our reasons for investing.

The ultimate purpose of the memo is to record our current thinking as a benchmark to assess the company's performance against our expectations 12 months from now.

In our 88E Investment Memo you’ll find:

- Key objectives for 88E in 2022/2023

- Why we invested in 88E

- What the key risks to our investment thesis are

- Our investment plan

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 11,785,000 88E shares at the time of publishing this article. The Company has been engaged by 88E to share our commentary on the progress of our Investment in 88E over time.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.